Medicaid eligibility and enrollment in California

Medi-Cal covers more than 15 million people; California has gradually expanded access to Medi-Cal for undocumented immigrants

Who is eligible for Medicaid in California?

Medicaid is a joint federal-state program. The federal government establishes broad guidelines, and each state develops specific rules and policies that shape how the program is administered for its residents.

In terms of who is eligible for coverage, the federal government requires states to cover certain populations. States must cover mandatory populations to receive federal funding. States can also cover optional populations and receive federal funding. The federal government establishes baseline levels for eligibility within each covered population. States can set higher levels if they wish, and the income limits vary significantly from state to state.

California has generous standards for covering various Medicaid populations. Children from birth through age 18 are covered with family income levels up to 266% of FPL (and this includes undocumented immigrant children). Pregnant women qualify with incomes up to 213% of FPL, and non-elderly adults — both those with and without dependent children — are covered up to 138% of FPL (note that all of these limits include a built-in 5% income disregard that’s used for MAGI-based Medicaid eligibility determinations).

As described above, California has gradually changed its rules to ensure that a person’s immigration status is not an obstacle to enrolling in Medi-Cal. This has been done incrementally, starting with children, then young adults and older adults. Immigration documentation requirements will be eliminated for the rest of the adult population by 2024. At that point, anyone in California who meets the income guidelines for Medi-Cal will be able to enroll, regardless of their immigration status.

During the pandemic, California suspended premiums and cost-sharing for Medicaid and CHIP, and has since made that permanent using a state plan amendment.

MCAP (Medi-Cal Access Program) is also available to pregnant women with household incomes between 213% and 322% of FPL (for Medi-Cal and MCAP eligibility, a pregnant woman counts as two people when determining household income relative to the poverty level). MCAP enrollment was integrated with Covered California in October 2015.

Apply for Medicaid in California

Online on the Covered California website. Fill out an application and mail it to P.O. Box 989725 West Sacramento, CA 95798-9725. Apply in person at a county social service office.

Eligibility: Children from birth through age 18 with family income levels up to 266% of FPL; pregnant women with incomes up to 213% of FPL; and nonelderly adults — with or without dependent children — with incomes up to 138% of FPL. Pregnant women with incomes up to 322% of FPL are eligible for MCAP.

ACA’s Medicaid eligibility expansion in California

California’s Medicaid program is called Medi-Cal. It covered nearly 15.3 million people as of October 2022. Over a third of Californians rely on the program to get health insurance coverage. (Note that the federal government puts the total quite a bit lower, at 13,901,970.)

As detailed below, California has taken steps to ensure that people can enroll in Medi-Cal regardless of immigration status, and is eliminating the asset limits for disabled and elderly applicants. The state has also established an auto-enrollment program to ensure that a person who loses Medi-Cal can transition to a private plan via Covered California (the state-run exchange/marketplace) without a gap in coverage. Medi-Cal disenrollments resume at the end of June 2023, after being paused for three years during the COVID pandemic, with the auto-enrollment program in use for the first time.

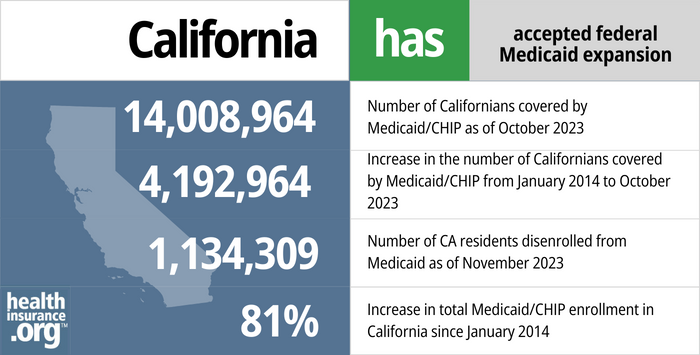

- 14,008,964 – Number of Californians covered by Medicaid/CHIP as of October 20231

- 4,192,964 – Increase in the number of Californians covered by Medicaid/CHIP from January 2014 to October 20232

- 1,134,309 – Number of CA residents disenrolled from Medicaid as of November 20233

- 81% – Increase in total Medicaid/CHIP enrollment in California since January 20142

Explore our other comprehensive guides to coverage in California

Our California health insurance guide is designed to help you understand the health coverage options and possible financial assistance available to you and your family. Having health coverage is especially necessary in California, as there’s a penalty on the state tax return for non-exempt filers who don’t have health coverage.4

Learn about health insurance coverage options in California.

Looking to improve your smile and save some money at the dentist’s office? Dental insurance may be a valuable supplement to your medical coverage. Our guide explains dental coverage options in California.

More than 6.7 million Californians were covered by Medicare as of May 2023.5 Our California Medicare guide explains the various parts of Medicare and their coverage options, as well as California regulations regarding Medigap (Medicare Supplement) plans.

Frequently asked questions about California Medicaid eligibility and enrollment

How do I enroll in Medicaid in California?

You can visit California’s Department of Health Care Services website to check if you are eligible to enroll in Medicaid.

The application process for Medicaid in California is integrated with Covered California, the health insurance marketplace. You can apply:

- Online on the Covered California website.

- By mail: complete an application, which is available in 12 languages, and mail it to Covered California at P.O. Box 989725 West Sacramento, CA 95798-9725.

- Seniors and people with Medicare can apply using this printable application, which can be mailed or submitted at a local social services office.

- In person at a county social service office. The directory includes phone numbers for each county office if you need more information or assistance.

How does Medicaid provide financial assistance to Medicare beneficiaries in California?

Many Medicare beneficiaries receive Medicaid financial assistance that can help them with Medicare premiums, lower prescription drug costs, and pay for expenses not covered by Medicare – including long-term care.

Our guide to financial assistance for Medicare enrollees in California includes overviews of these programs, including Medicaid nursing home benefits, Extra Help, and eligibility guidelines for assistance. Note that although people with disabilities and those who are 65 or older are subject to both income and asset limits for Medicaid eligibility, California will eliminate the asset restrictions as of 2024.

How is California handling Medicaid renewals after the pandemic?

During the COVID pandemic, from March 2020 through March 2023, states have been receiving additional federal Medicaid funding but have also been prohibited from disenrolling anyone from Medicaid unless the person dies, moves out of state, or requests a disenrollment. But that rule ends on March 31, 2023, and states can resume disenrollments as of April 1.

States have 12 months to initiate eligibility redeterminations for all Medicaid enrollees, and up to 14 months to complete them. This process is being referred to as “unwinding” of the pandemic-era continuous coverage requirement. States had the option to start the unwinding process as early as February 2023, in order to be able to disenroll ineligible people starting in April. But California’s unwinding plan notes that they will begin the process in April.

At that point, California will start processing enrollees who have a June renewal date (the state will use members’ existing renewal months throughout the unwinding period; members will retain coverage until their renewal month, even if they report a circumstance change prior to that month that would make them ineligible for coverage).

In April, the state will initiate ex-parte (automatic) June renewals for enrollees for whom the state has adequate information to process the renewal automatically. And the state will also mail renewal packets to people whose coverage can’t be automatically renewed. If the enrollee is found to no longer be eligible, or if they do not respond to their renewal information request, they will receive a letter in mid-June noting that their coverage will terminate at the end of the month. So July 2023 will be the first month that people actually lose Medicaid coverage in California under the unwinding process.

When a person is determined to be no longer eligible for Medi-Cal, CoveredCA (the state-run exchange) will automatically enroll them into the lowest-cost silver plan available in their area, with coverage effective the day after Medi-Cal ends (Medi-Cal ends on the last day of the month, so the exchange plan would start on the first of the following month).

The person will then need to effectuate their coverage, either by paying the first month’s premium by the end of the first month of coverage, or, if premium subsidies cover the entire premium, by agreeing to the terms and conditions of the coverage within the first month. People can opt out of this program, or select a different plan, or choose not to effectuate their auto-selected plan. Regardless, they still get a 60-day special enrollment period due to the loss of Medicaid, when they can pick a different plan.

Legislation impacting California Medicaid

Immigration status no longer an obstacle for Medi-Cal enrollment (will apply to all ages as of 2024)

By 2024, immigration status will no longer prevent anyone in California from receiving Medi-Cal benefits, regardless of their age. California has implemented changes over the last several years to achieve this incrementally, starting with children, then young adults and older adults, and then the rest of the adult population. As long as they qualify based on household income (and assets, for those who are disabled or age 65+; note that asset limits will be eliminated in California starting in 2024), undocumented immigrants can enroll in Medi-Cal (this will apply to all age groups by 2024):

- Undocumented immigrant children gained access to California Medicaid starting in May 2016, under the terms of SB4.

- Starting in January 2020, that eligibility applies to young adults through the age of 25, under the terms of SB104.

- Starting in May 2022, adults age 50 and older became eligible for Medi-Cal regardless of immigration status., under the terms of AB133.

- Starting in 2024, this provision will also apply to undocumented immigrants age 26 through 49, under the terms of SB184. (California will ensure that young adults who have aged out of the program and could potentially lose Medi-Cal in the latter half of 2023 during the COVID continuous coverage “unwinding” will have their coverage maintained until the start of 2024, when they would be eligible under the new rules. This will be done by pushing these enrollees’ renewal dates to the latter end of the unwinding period.)

California is using state funds to cover undocumented immigrants under Medi-Cal. Medicaid is jointly funded by the state and federal government, but states can opt to add services or eligibility categories that are fully funded by the state.

California had previously considered allowing undocumented immigrants to enroll in full-price private plans through Covered California (the state’s health insurance exchange), but that has not come to pass. SB10, which passed during the 2016 legislative session, initially called for allowing adults age 19 and over to enroll in Medi-Cal without regard for immigration status. But the final version of the bill instead called for the state to request a 1332 waiver from HHS to allow undocumented immigrants to enroll in unsubsidized qualified health plans (QHPs) through Covered California (without a waiver from HHS, this isn’t possible, as the ACA requires all exchange enrollees to be legally present U.S. residents, regardless of whether they receive any subsidies).

The state did submit a waiver to HHS, but on January 18, 2017, two days before Trump’s inauguration, the state withdrew the waiver, noting that they didn’t trust the Trump administration to ensure “people’s privacy and health” in implementing the waiver. They were concerned that the Trump administration would use Covered California data to deport people and separate families. State Senator Ricardo Lara, who had championed SB10, asked for the waiver withdrawal, calling it “the first California casualty of the Trump presidency.”

(Washington state has since obtained permission from CMS to allow undocumented immigrants to enroll through the exchange starting in 2024 and use state-funded subsidies. Colorado has created a separate platform that allows undocumented immigrants to enroll with state-funded subsidies.)

How does California handle Medicaid estate recovery?

Longstanding federal regulations, which predate the ACA, require states to “seek recovery of payments from the individual’s estate for nursing facility services, home and community-based services, and related hospital and prescription drug services” for any Medicaid enrollee over the age of 55. But states can choose to go further, using estate recovery to recoup any Medicaid costs.

This has become more of a problem since the ACA Medicaid expansion took effect in 2014, as people are now funneled into California’s Medicaid system in much greater numbers than they used to be (this is the case in every state that has expanded Medicaid). Covered California enrollees under age 65 with income up to 138% of the poverty level are directed to Medi-Cal, regardless of the value of their assets (there’s no asset test for subsidy eligibility or Medicaid coverage under the ACA). As a result, some families began receiving bills from California’s Medicaid program after their loved ones passed away, including bills to cover the cost of payments that the state made to managed care plans, even if the deceased didn’t use any medical services.

California S.B.826, the Budget Act of 2016, included a provision to bring Medi-Cal estate recovery into line with federal rules. For people who pass away January 1, 2017 or later, the state only uses estate recovery to recoup long-term care costs that were incurred by Medi-Cal. But that includes In-Home Supportive Services, which the state did not previously recoup through estate recovery.

In addition, estate recovery is now limited to assets that were owned by the deceased at the time of death and are subject to probate. For people who passed away prior to 2017, the state could seek to recoup costs from any assets owned by the deceased at the time of death.

Minnesota implemented similar legislation in 2016, but unlike California, they made their limits on estate recovery retroactive back to January 2014.

Medicaid expansion has played a key role in reducing the uninsured rate

California adopted Medicaid expansion through the Affordable Care Act (ACA). Enrollment began in October 2013, with coverage effective in January 2014.

According to US Census data, the state’s uninsured rate stood at 17.2% in 2013, and had dropped to 7.2% by 2017 (it remained at roughly that level in 2018 and in 2019).

Medicaid expansion has played a key role in reducing the state’s uninsured rate. Medi-Cal enrollment has grown by more than 6 million people since 2013. Much of that growth is due to the expansion of Medicaid eligibility to cover adults with income up to 138% of the poverty level. And the COVID pandemic has pushed Medicaid enrollment higher nationwide, particularly in states like California that have expanded Medicaid. Enrollment is expected to decrease gradually throughout the latter half of 2023 and the first part of 2024, as disenrollments resume after a three-year pause during the pandemic.

Funding for Medi-Cal

Because California is an affluent state, they don’t get as much in federal matching funds for Medicaid. But this is referring to the traditional Medicaid program, which is funded jointly by the states and the federal government. For the ACA expansion population, the federal government will always pay the lion’s share of the tab — 90% as of 2020 and beyond — and there’s no difference from one state to another.

California and the federal government split traditional Medi-Cal costs roughly equally, with the federal government paying about one dollar for every dollar the state spends. In poorer states, the federal government matches at a rate of double or even triple that amount. (In all states, the federal funding rate was increased by 6.2 percentage points during the COVID pandemic, but that additional funding will be phased out by the end of 2023.)

To make funds permanently available for the state’s portion of Medi-Cal costs (via a hospital fee that had already been implemented temporarily), Proposition 52 was on the November 2016 ballot in the state, and passed with 70% of the vote. Another ballot measure, Proposition 56, which passed with 64% of the vote, raises the tax on cigarettes, with a portion of the revenue being directed to various aspects of Medi-Cal.

California Medicaid History

Medi-Cal was established in 1966, and is now the nation’s largest Medicaid program in terms of enrollment. California Medicaid enrollment expanded significantly during the first three years of Medicaid expansion through the ACA, growing by more than four million people from 2013 to 2018.

Medi-Cal has expanded coverage and implemented new policies over the years, including introducing Medicaid managed care plans in 1973, implementing selective contracting strategies with hospitals in 1982, expanding access to family planning services in 1997, extending coverage to families at 100% of FPL in 2000, and expanding coverage to uninsured adults in 2010.

As of 2022, about 13 million Medi-Cal enrollees (out of about 15 million total enrollees) were covered under Medicaid managed care plans.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “October 2023 Medicaid & CHIP Enrollment Data Highlights” , Medicaid.gov, Accessed February 20204 ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment” , KFF.org, Accessed February 2024 ⤶ ⤶

- “Medi-Cal Enrollment and Renewal Data” , dhcs.ca.gov, Accessed January 2024 ⤶

- “Penalty” CoveredCA.com, Accessed August 2023 ⤶

- “Medicare Monthly Enrollment” CMS.gov, May 2023 ⤶

- “CA SB910” BillTrack*50*, Accessed August 2023 ⤶

- “Availability of short-term health insurance in California” healthinsurance.org, Aug. 14, 2023 ⤶