Key takeaways

- What is excess APTC?

- How much of the excess APTC will I have to repay?

- Is there a cap on how much I have to pay back?

- How can I avoid paying back an excess advance?

- Is there still a premium subsidy repayment forgiveness program?

- What happens to my Obamacare premium subsidy if I overestimated my income?

- What if I switched from a Marketplace plan to employer-sponsored health insurance mid-year?

- How many people have to repay premium subsidies?

- What happens if I don’t reconcile my premium tax credit?

If you received advance payments of the premium tax credit (APTC) for health insurance that you purchased last year on HealthCare.gov or a state-run health insurance Marketplace) and your income ended up increasing during that year, you might have to pay back some of your premium tax credit for health insurance.

It’s a scenario faced by many Marketplace enrollees each year at tax time: the household income they projected when enrolling for the previous year’s coverage ends up being higher than they expected. As a result, they end up with excess APTC and at tax time they may have to repay a portion of the premium subsidy that was paid on their behalf.

Advance Premium Tax Credit (APTC) Repayment and Refund Calculator

HIO developed this calculator in 2024, using the IRS guidance about the premium tax credit and ATPC, as well as IRS Form 8962 (2023).

This calculator is for educational and illustrative purposes only and should not be construed as financial or tax advice. It uses the income and other information you provide. Contact a trusted professional advisor or accountant about any specific requirements or concerns.

Click calculate to see updated repayment/refund

What is excess APTC?

Most people who enroll in health coverage through the Marketplace are eligible for premium tax credits – also called premium subsidies.1 And most people opt to receive those tax credits in advance (thus the “advance” in APTC), meaning that the government pays the money directly to their insurance company each month, reducing the amount they have to pay in premiums.

To clear up a potential point of confusion, it’s important to note that although APTC is often described as being “received” by the enrollee, the money is actually sent directly to the enrollee’s Marketplace insurance company. But excess APTC has to be repaid by the enrollee, which may catch tax filers off guard.

The premium tax credit an enrollee receives depends on their household income (an ACA-specific calculation called modified adjusted gross income (MAGI). Since most people receive it in advance (instead of waiting to claim the entire amount on their tax return), the APTC amount is based on projected income, rather than actual income. And that projection may not end up being accurate.

Once the year is over and you’re filing your tax return, your actual premium tax credit will be calculated based on your actual income, using Form 8962. That amount may not be the same as the APTC that was calculated and paid out based on the income you projected.

If your APTC was more than was actually allowed (generally meaning that you earned more than you projected), the federal government paid excess APTC on your behalf for the previous year. You’ll have to repay some or all of that excess amount to the Internal Revenue Service (IRS) when you file your tax return.

How much of the excess APTC will I have to repay?

The amount of APTC you’ll have to repay will depend on how much excess APTC was paid on your behalf, your household income, and your tax filing status.

If your household income (MAGI) is at least 400% of the previous year’s federal poverty level (FPL), you’ll have to repay all of the excess APTC. But if your household income is below that threshold, there are caps on how much excess APTC you must repay. These caps are adjusted annually by the IRS, and discussed in more detail below.

If the amount of excess APTC that was paid on your behalf is less than the cap described below, you’ll have to repay the entire amount. But if the excess APTC is more than the cap (which depends on your income and filing status), the amount you’ll have to repay will be limited by the cap.

One point of confusion that sometimes comes up here has to do with the temporary elimination of the “subsidy cliff” under the American Rescue Plan (ARP) and the Inflation Reduction Act (IRA). Under the ACA, premium subsidies are not available at all if a household’s income is over 400% of FPL. But under the ARP and IRA, households with income above 400% of FPL are eligible for subsidies through 2025 if the cost of the benchmark plan would otherwise be more than 8.5% of the household’s income.

That premium subsidy did not change anything about the repayment caps for excess APTC. Under the ARP, an enrollee with household income above 400% of FPL can be eligible for premium tax credits. But there is no limit on how much excess APTC they must repay if it turns out that their APTC was more than their actual PTC.

Is there a cap on how much I have to pay back?

Yes. If your 2023 household income was less than 400% of the 2022 federal poverty level, here’s the maximum amount of excess APTC you’ll have to repay:

2023 Tax Year Excess APTC Repayment Caps2 |

||

|---|---|---|

| If your 2023 household income is: | Filing status = Single | Any other filing status |

| Less than 200% of 2022 federal poverty level | $350 | $700 |

| At least 200% but less than 300% of 2022 federal poverty level | $900 | $1,800 |

| At least 300% but less than 400% of 2022 federal poverty level | $1,500 | $3,000 |

Source: IRS.gov2

The excess APTC repayment caps for the 2024 coverage / tax year are available here.

How can I avoid having excess APTC?

An easy way to avoid having excess APTC is to project your income as accurately as possible when you enroll, and then update your Marketplace account if your income changes during the year.

If you realize that your household income is going to be higher or lower than you initially projected, you can modify your income projection in your Marketplace account to reduce your subsidy amount for the rest of the year.

You also have the option to choose to receive less than the full amount of your APTC each month as a hedge against having to repay excess APTC at tax time. Your state’s Marketplace (HealthCare.gov or a state-run Marketplace, depending on where you live) might give you the option to adjust this on your application or in your account, or you might have to call the Marketplace and ask for the change to be made.

So for example, if your APTC is calculated as $300/month based on your projected household income, you can choose to have it set to $250/month instead. That would mean you’ll pay a higher after-subsidy premium each month, but it will also reduce the chance that you’ll have to repay excess APTC, assuming your income does not increase. And if it turns out that your actual premium tax credit does end up being $300/month, you’ll be able to claim the difference when you file your taxes. The premium tax credit is refundable, which means the IRS will refund it to you if it’s more than the amount you otherwise owe in taxes.

It’s also worth noting that contributions to a pre-tax retirement account and/or a health savings account will reduce your MAGI, which is what the IRS uses to determine your premium tax credit eligibility.

If you had HSA-qualified health coverage (a high-deductible health plan) during the year, you may find that some pre-tax savings from contributing to a health savings account may end up reducing the amount of excess premium tax credit that you’d otherwise have to repay. You should consult your tax advisor.

Is there still a premium subsidy repayment forgiveness program?

No. For the 2020 tax year, Marketplace enrollees were not required to repay any excess APTC, and did not have to file Form 8962 at all unless they wanted to claim additional premium tax credits that were owed to them. (Tax filers who were owed additional APTC when they filed their 2020 tax returns. were advised to still file Form 8962 for 2020 even though they didn’t have to because it was the only way to get the money they were owed for 2020.)

But that was a one-time provision in the American Rescue Plan, related to the COVID- 19 pandemic. For all tax years other than 2020, enrollees who receive APTC are required to reconcile the amount on their tax return.3

What happens to my Obamacare premium subsidy if I overestimated my income?

If your actual income for last year ended up being lower than you projected, you may be able to claim some additional premium tax credit when you file your taxes. In other words, if your APTC was smaller than it should have been (because your income ended up being less than you thought it would be), the IRS will give you the additional premium tax credit that’s owed to you. This will either be added to your tax refund or subtracted from the overall tax you owe (depending on whether you’re owed a refund or owe the IRS money).

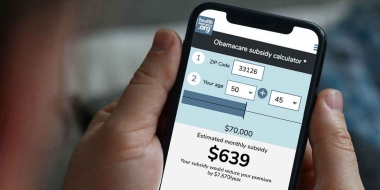

For example, let’s say you’re a single 40-year-old in Chicago and you projected an income of $40,000 for 2023, which resulted in an APTC amount of $185/month. Now let’s say your income ended up being $35,000 instead. With that income, your actual premium tax credit would be $252/month. You’ll be able to claim the difference ($67 per month / $804 for the year) on Form 8962 when you file your 2023 taxes. If you owe taxes for 2023, that $804 will be subtracted from the amount you owe. If you don’t owe anything or are already owed a refund by the IRS, the $804 will be refunded to you.

But there are a couple of caveats to keep in mind here:

- Your premium tax credit can’t be more than the price of your plan. So if you enrolled in a plan that’s less expensive than your premium tax credit ends up being, you’ll only be able to recoup up to the cost of your plan.

- If your income ended up being in the range that’s Medicaid-eligible (or under the FPL in a state that hasn’t expanded Medicaid), you’re technically not eligible for premium tax credits at all. But the IRS will not require you to repay any APTC unless it determines that the information you provided when you enrolled was incorrect and given with “intentional or reckless disregard for the facts” (meaning you didn’t intentionally deceive the Marketplace when you enrolled by, for example, purposefully providing incorrect data such as income and family size) even though you wouldn’t have been eligible for any APTC when you enrolled if the Marketplace had known the amount that your income would actually end up being (i.e. Medicaid-eligible or below the federal poverty level, depending on the state). However, you won’t be able to recoup any additional premium tax credit beyond what was already paid in the form of APTC.

What if I switched from a Marketplace plan to employer-sponsored health insurance mid-year?

If you enrolled in an employer-sponsored health plan later in the year – after you had already received APTC during the months you had individual-market coverage – you may end up having to repay some or all of those subsidies when you file your tax return.

It all depends on your total household income for the year, including income from your new job. In the eyes of the IRS, annual household income is annual household income – it can be evenly distributed throughout the year or come in the form of a windfall on December 31.

But premium tax credit reconciliation is done on a month-by-month basis, so you’ll still be able to claim a premium tax credit for the months you had Marketplace coverage as long as your total income for the year still makes you eligible for a premium subsidy.

If your new job results in total annual income that’s higher than you projected, you may have to repay some or all of your APTC when you file your taxes. This is true regardless of whether your income was lower during the months you had Marketplace coverage.

Once you become eligible for an affordable health insurance plan through your employer that provides minimum value, you’re no longer eligible for premium subsidies as of the month you become eligible for the employer’s plan.

Finally, if you’re offered health insurance through an employer that you feel is too expensive based on the portion you have to pay, you can’t just opt out, buy your own health plan, and attempt to receive a premium subsidy. The fact that an affordable plan (by IRS definitions) is available to you will make you ineligible for any premium subsidies.4

How many people have to repay premium subsidies?

Millions of people have to repay excess APTC each year, but there are also millions of people who are owed additional premium tax credits when they file their taxes.

IRS data for the 2021 tax year shows the following:

- About 2.6 million tax returns included excess APTC, amounting to $3.8 billion that had to be repaid to the IRS. This amounts to an average of about $1,464 per return for filers who had to repay excess APTC.5 Excess APTC that has to be repaid is either subtracted from the filer’s refund or added to the amount they owe, as applicable.

- About 4.2 million tax returns were filed by people whose actual premium tax credit ended up being more than the APTC that had been paid on their behalf during the year. The IRS paid these filers the additional amount they were owed – a total of nearly $3.5 billion. This amounted to an average of about $834 per return, for filers who were owed additional premium tax credits.6 This money is either added to the filer’s refund or subtracted from the tax they owe.

What happens if I don’t reconcile my premium tax credit?

Under the Affordable Care Act (ACA), a person who didn’t reconcile a prior year’s APTC (using Form 8962 with their tax return) was ineligible to receive APTC the next year.7 This approach was relaxed during the pandemic, and starting in 2024, APTC is terminated only if the applicant has failed to reconcile their premium tax credit for two consecutive years.

As of the 2022 tax filing season, the IRS no longer accepted e-filed returns that were missing Form 8962, if premium tax credits had been provided for the household. This helps to ensure that people do not inadvertently file a return without reconciling their premium tax credit, and the IRS noted that it has significantly reduced the number of e-filed returns that have to be sent to the agency’s Error Resolution System.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- ”Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average” CMS.gov. March 15, 2023 ⤶

- ”Part III Administrative, Procedural, and Miscellaneous, 26 CFR 601.602” p. 11, IRS.gov. Accessed January 2024 ⤶ ⤶

- ”Questions and Answers on the Premium Tax Credit” IRS.gov. July 28, 2023 ⤶

- ”Questions and Answers on the Premium Tax Credit” Q5, IRS.gov. Feb. 24, 2022 ⤶

- ”Irs-soi” Lines 85, 86. IRS.gov. Accessed February 2024 ⤶

- ”Irs-soi” Lines 125, 126. IRS.gov. Accessed February 2024 ⤶

- ”Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2024” p. 19. CMS.gov. Accessed January 2024 ⤶