Please provide your zip code to see plans in your area.

Featured

Featured

balance billing

What is balance billing?

What is balance billing?

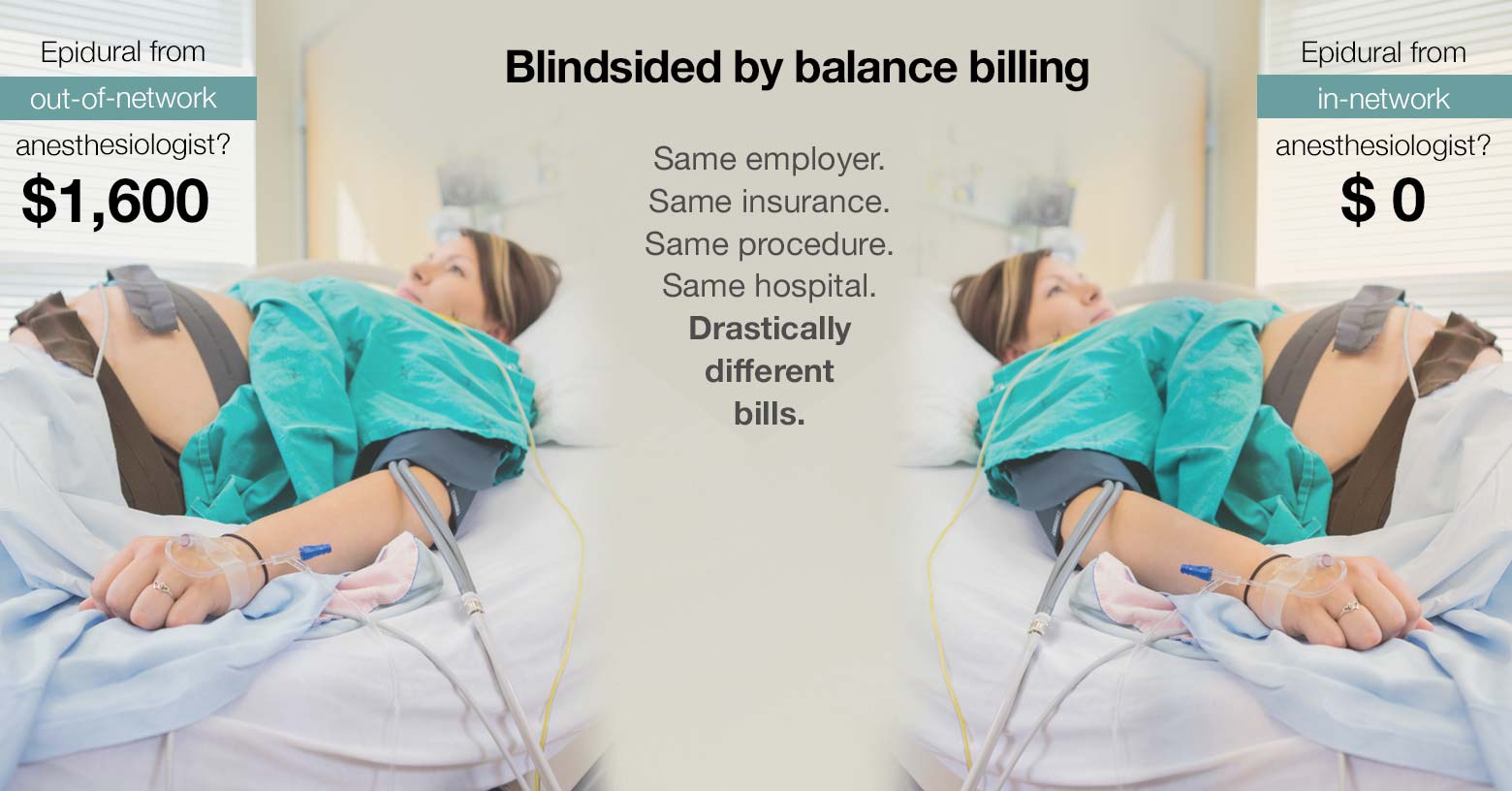

Balance billing occurs when providers bill a patient for the difference between the amount they charge and the amount that the patient’s insurance approves.

The amount that insurers approve (including the portion that the health plan pays as well as the portion that the patient pays in cost-sharing, if applicable) is almost always less than the providers’ “retail price.” Out-of-network providers will generally bill the patient for the difference, or balance; this is called balance billing. (Note that “surprise” balance billing is a specific type of balance billing, addressed in more detail below.)

Providers that are in-network have agreed to accept the insurance payment as payment in full (less any applicable copays, deductible, or coinsurance), and are not allowed to balance bill the patient. Balance billing is allowed if the provider is not in your insurance network. But as described below, there are varying state rules that apply in certain circumstances, and federal legislation took effect in 2022 to protect consumers from balance billing in certain circumstances.

Some insurance plans (usually PPOs and POS plans) cover out-of-network care, but the medical provider has not signed any sort of agreement with the insurer in that case. If the insurer covers out-of-network care, they will pay the provider based on the insurer’s reasonable and customary rates (keeping in mind that the patient will be responsible for the out-of-network deductible and coinsurance, which is typically quite a bit higher than in-network cost-sharing). But at that point, the provider can bill the patient for the difference between what was billed and what the insurer paid. They do not have to write off the difference the way an in-network provider would.

Surprise balance billing: Federal relief in effect as of 2022

Balance billing is fairly straightforward in situations where the patient chooses to see an out-of-network provider, with the understanding that out-of-pocket costs will be significantly higher and that balance billing is likely.

However, it’s a very different scenario when patients seek care at an in-network facility, and later find out that they were also treated by one or more out-of-network medical providers, or when patients receive emergency care and don’t have any choice in terms of where they go or who treats them.

These scenarios can result in “surprise balance billing,” which could be frustrating and costly for patients — particularly in cases where their insurance simply doesn’t cover out-of-network care at all, and the provider “balance bills” the entire bill (under the ACA, the zero-coverage approach was not allowed for emergency care, but was allowed when out-of-network providers perform services at an in-network facility).

For several years, states had been working to address this issue, but state laws don’t apply to self-insured health plans — which account for the majority of employer-sponsored coverage — and some states haven’t yet tackled the issue. This is why federal legislation to protect from surprise balance billing was necessary.

How does the No Surprises Act protect people from surprise balance billing?

Protection from most surprise balance billing arrived as of 2022, thanks to the No Surprises Act. This federal legislation was incorporated into the Consolidated Appropriations Act, 2021, which Congress passed with overwhelming bipartisan support in December 2020; President Trump signed it into law in late 2020.

This was a massive piece of legislation that was widely referred to as the second major COVID-19 relief bill (it does contain a substantial amount of COVID relief measures), but which also appropriated government funding for the first nine months of 2021, addressed climate change, and tackled surprise balance billing — among many other things.

The surprise balance billing provisions in the legislation are designed to hold consumers harmless in nearly all scenarios that would otherwise result in surprise balance bills — ie, all emergency situations, and situations in which services are received from out-of-network providers at in-network facilities — for plan years beginning on or after January 1, 2022.

Although air ambulance charges are addressed by the legislation, ground ambulance charges are not. Sarah Kliff and Margo Sanger-Katz explain more about this here; most ground ambulance services are provided by local governments as opposed to private entities.

But the legislation did include a provision to create a commission to study ground ambulance charges in an effort to incorporate consumer protections for these services into a future piece of legislation. The Biden administration announced the committee members in late 2022, and they are working to study the issue and provide recommendations in 2023.

In July 2021, HHS published an interim final rule with details regarding how the surprise balance billing protections would be implemented as of 2022 (more details are available here and also available here). A second interim final rule was issued in September, and a third in November. HHS also published guidance for the implementation of the law, but the final rule didn’t come until August 2022, well after the law took effect.

Additional guidance was published in 2023, clarifying that for circumstances addressed by the No Surprises Act (emergencies, and out-of-network care provided at in-network facilities), patients must either be protected by the health plan’s maximum limit on in-network out-of-pocket costs, or by the No Surprises Act’s ban on surprise balance billing. The sort of “gray” areas described in this article are not allowed.

The No Surprises Act does still face pending lawsuits that have challenged its implementation. But from a consumer perspective, the No Surprises Act’s consumer protections took effect as of January 2022, with enforcement shared between the federal and state governments in most states.