Frequently-asked questions by tag

Who ISN’T eligible for Obamacare’s premium subsidies?

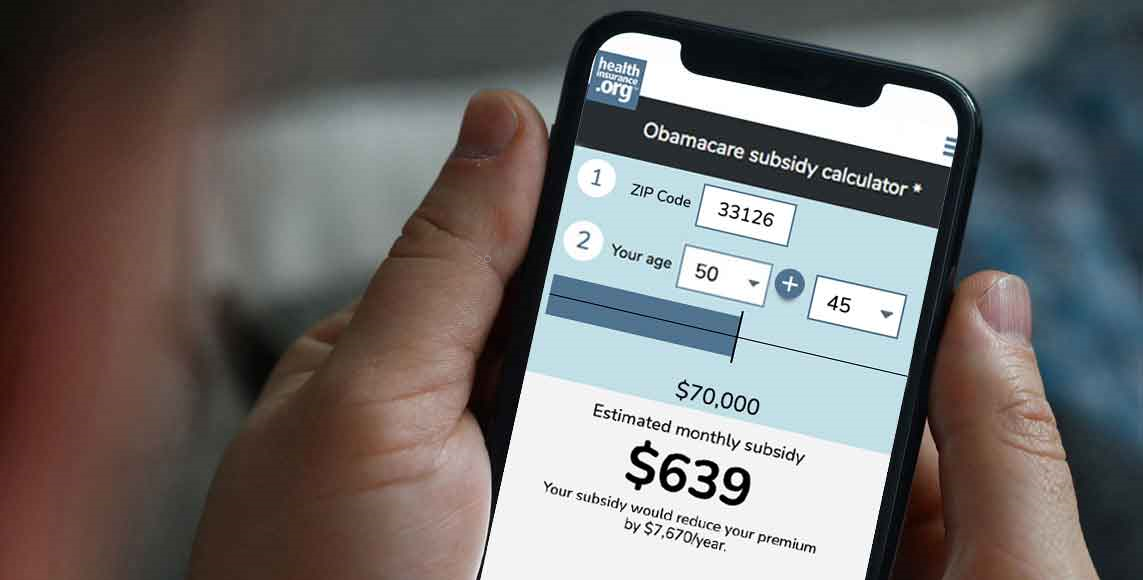

January 3, 2024 – If your income is just a little over the subsidy-eligibility threshold, you can talk with a tax advisor about strategies for lowering your…

My employer offers insurance, but I think it’s too expensive. Can I apply for a subsidy to help me buy my own insurance?

September 11, 2023 – You cannot qualify for a health insurance premium subsidy unless the insurance your employer offers would force you to kick in more than…

Can small businesses use the ACA’s health insurance marketplaces (exchanges)?

June 29, 2023 – The Affordable Care Act included an enrollment platform called SHOP (Small Business Health Options Program), an exchange where businesses…

If an individual pays for an exchange plan, how do they pay for the premium pre-tax as would someone with an employer plan?

January 11, 2023 – If you’re self-employed, you can generally deduct the full amount you pay in premiums without having to itemize your deduction.…

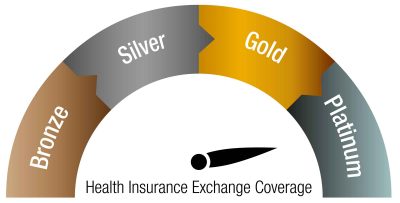

Can I purchase a Platinum policy and also get a premium subsidy?

July 12, 2022 – You can buy a Platinum plan and also get a premium subsidy. The size of the subsidy is based on the cost of a Silver plan, but you can…

I understand that subsidies come in the form of tax credits. But I’m unemployed and probably won’t owe any taxes. How would the subsidy help me?

June 7, 2021 – The premium subsidy offered through the exchanges is a tax credit, but it differs from some other tax credits in two important ways. First…