Q. What happens if I don’t buy ACA-compliant health insurance?

A. It depends on where you live and what medical care you end up needing during the year. But it’s also important to understand that if you don’t buy ACA-compliant health insurance, you’re potentially missing out on the financial assistance that’s available to most Marketplace enrollees.

And the subsidies are larger and more widely available through 2025, thanks to the American Rescue Plan and Inflation Reduction Act. Many enrollees will find that they can qualify for free or very low-cost coverage with robust benefits, but this opportunity is lost if you don’t shop for coverage in your state’s health insurance Marketplace (where all of the available plans are ACA-compliant).

If I don't buy an ACA-compliant plan, will I have to pay a penalty?

The Affordable Care Act’s individual mandate penalty was reduced to $0 as of 2019, so there is no longer a federal penalty for not having minimum essential health coverage.

But unless you qualify for an exemption, there is a penalty for being without minimum essential coverage if you live in California, Rhode Island, Massachusetts, New Jersey, or the District of Columbia. You don’t necessarily need ACA-compliant coverage to avoid the penalty in those states, and some types of minimum essential coverage aren’t ACA-compliant (for example, grandmothered and grandfathered health plans are not fully ACA-compliant, and yet they count as minimum essential coverage). But an ACA-compliant plan is going to give you the most robust coverage.

If my plan is not ACA-compliant, how will my benefits differ?

All ACA-compliant plans in the individual and small group markets are required to cover the ACA’s essential health benefits without any caps on the total amount that the plan spends on your care. So they’ll provide a solid safety net if you end up needing significant medical care (although ACA-compliant large group plans and self-insured plans are not required to cover the essential health benefits, most do so voluntarily to attract and retain employees). And all ACA-compliant plans are required to cover pre-existing conditions without any waiting periods.

But if you buy a plan that’s not ACA-compliant, the insurer will be likely to use medical underwriting to adjust the premiums or the coverage based on your medical history, and the plan won’t have to cover the essential health benefits unless the state has its own requirements (Idaho’s enhanced short-term health plans, for example, are not fully compliant with the ACA, but are required to cover the essential health benefits).

What health insurance plans are not considered ACA-compliant?

If you’re purchasing your own coverage, there is a wide range of health insurance plans that aren’t required to comply with the ACA’s rules. These include:

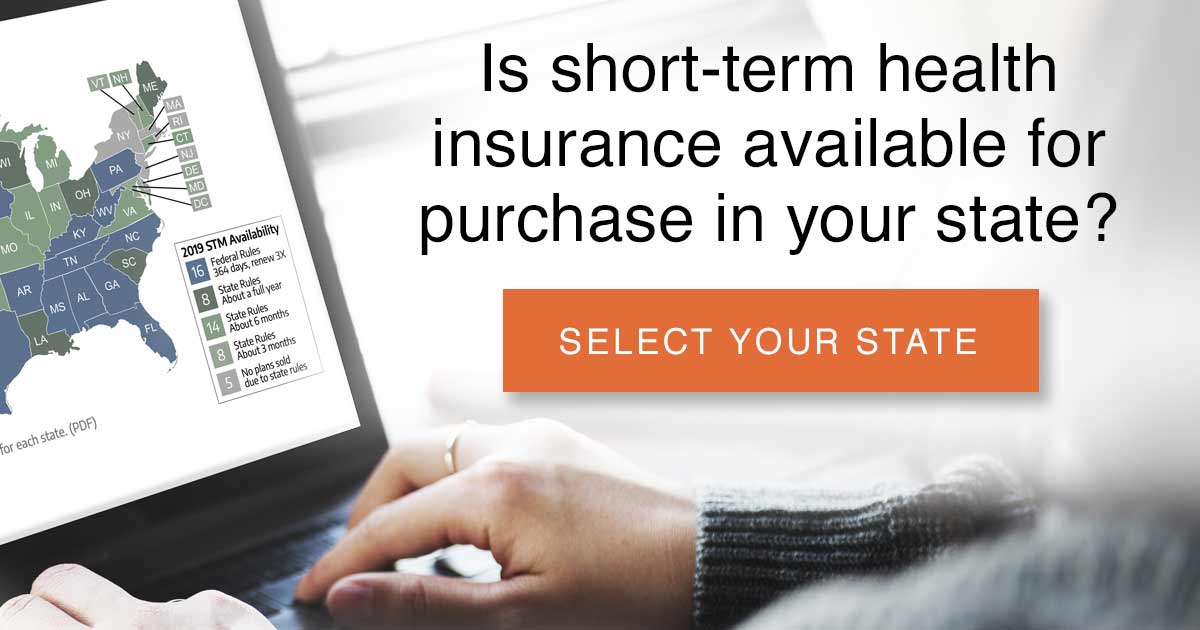

- short-term health insurance

- Farm Bureau plans in Iowa, Indiana, Tennessee, Kansas, South Dakota, and Texas

- travel insurance

- accident supplements

- limited benefit plans

- fixed indemnity plans

- other supplemental or limited coverage.

Some of these plans are intended to supplement (but not replace) major medical coverage, while others are designed to be a less-robust replacement for major medical coverage. As long as you’re not in a state that has a penalty for people who go without minimum essential coverage, you’re free to purchase a plan that’s not compliant with the ACA, and you won’t be penalized for doing so. But your coverage won’t be anywhere near as solid as it would be under an ACA-compliant plan. If you stay healthy, you’ll be fine. But if you end up needing extensive medical care, your non-ACA-compliant plan could leave you on the hook for substantial medical bills.

Is a grandmothered or grandfathered plan ACA-compliant?

If you’ve got coverage under a pre-ACA plan (a grandmothered or grandfathered plan), it’s likely not compliant with the ACA. But it is considered minimum essential coverage – so it will fulfill a state-based individual mandate and you won’t be subject to a penalty.

It’s in your best interest, however, to make sure you carefully compare it with the ACA-compliant plans that are available for purchase during open enrollment or when your existing plan is up for renewal. And even if you looked a few years ago and weren’t eligible for premium subsidies, you may be subsidy-eligible now.

This is always a possibility due to yearly increases in the poverty level (for 2014 coverage, a family of four could only earn up to $94,200 to be subsidy-eligible; by 2020, that amount had increased to $103,000), but the American Rescue Plan’s substantial enhancement of premium subsidies — now extended through 2025 — means that coverage is much more affordable than it would normally be. There is no income cap for subsidy eligibility through 2025; instead, people who earn more than 400% of the poverty level can still qualify for a subsidy if the benchmark plan would otherwise cost more than 8.5% of their ACA-specific modified adjusted gross income.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.