Home > Health insurance Marketplace > Michigan

Michigan Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Michigan health insurance Marketplace guide

We created this guide, including the FAQs below, to help you choose the right health insurance plan in Michigan for you and your family. An ACA Marketplace plan may be a good choice for many consumers, including those who do not have access to Medicare, Medicaid, or an employer’s health plan.

Michigan’s ACA Marketplace plans – also known as Obamacare plans – are available on the federally-facilitated HealthCare.gov platform, although Michigan lawmakers are considering legislation in 2024 that would direct the state to create a state-based exchange platform that would be in use by the fall of 2025.3

The Michigan Marketplace provides access to health insurance products from ten private insurers for 2025,4 including one newcomer5 (more details below). Plan availability varies by area.6

Depending on your income and circumstances, you may qualify for financial assistance that can offset the cost of the coverage you obtain through the Michigan Health Insurance Marketplace.

Frequently asked questions about health insurance in Michigan

Who can buy Marketplace health insurance?

You can purchase individual/family coverage in the Michigan Marketplace (exchange) if you meet these criteria:7

- You must be a resident of Michigan and lawfully present in the U.S.

- You must not have Medicare coverage.

- You must not be incarcerated.

Although most people are thus eligible to enroll in a Marketplace plan, there are additional criteria to qualify for financial assistance in the Marketplace. To be eligible for subsidies:8

- You must not have access to an affordable employer health plan. Use our employer health plan affordability calculator to see if you may be eligible for subsidies to offset the cost of a Marketplace plan.

- You must not be eligible for Medicaid/CHIP.

- You must not be eligible for premium-free Medicare Part A.9

- If you’re married, you must file a joint tax return.

- You must not be able to be claimed as a dependent on someone else’s tax return.

Subsidy eligibility is also based on how your income compares with the premium for the second-lowest-cost Silver plan in the Marketplace (for premium subsidies) and whether your income is more or less than 250% of the federal poverty level (for cost-sharing reductions).

When can I enroll in an ACA-compliant plan in Michigan?

In Michigan, the open enrollment period for individual and family insurance runs from November 1 to January 15.

Enrollments completed by December 15 will take effect on January 1, while enrollments completed between December 16 and January 15 will take effect on February 1.

Outside of open enrollment, you can enroll in new coverage or make changes to your existing coverage during a special enrollment period if you’ve experienced a qualifying life event. Learn more about qualifying events.

Where do I enroll in a Marketplace plan in Michigan?

Michigan residents use HealthCare.gov to enroll in individual and family health plans. You can also sign up with a licensed agent/broker or a Navigator. There is also an option to enroll through various third-party websites authorized by the Centers for Medicare & Medicaid Services.10

How can I find affordable health insurance in Michigan?

In Michigan, consumers may find affordable health insurance by enrolling through the ACA Marketplace (HealthCare.gov).

Nearly nine out of ten enrollees are eligible for advance premium tax credits (APTC), which reduce the amount that they have to pay each month for their coverage. In 2024, the average premium subsidy in the Michigan Marketplace amounted to $426/month.11 Subsidy-eligible enrollees in Michigan paid an average net premium of $98/month after subsidies in 2024.12

People with household incomes up to 250% of the federal poverty level also qualify for cost-sharing reductions (CSR) that may reduce your deductibles and out-of-pocket expenses when you buy a Silver plan.13

Both the premium tax credits and the CSR benefits are only available in Michigan if you enroll in a Marketplace plan.

Source: CMS.gov14

Depending on your household income, you may be eligible for Medicaid/CHIP. Michigan is among the states where Medicaid has been expanded under the ACA, making it easier for low-income adults to qualify for coverage. Learn more about Michigan Medicaid.

How many insurers offer Marketplace coverage in Michigan?

For 2025 coverage, ten insurers offer Marketplace/exchange plans in Michigan.15 This includes one new carrier, HAP CareSource, which is new for 2025.5

As is the case in most states, carrier participation varies by area, as not all carriers offer plans in all areas of the state.6

There were ten Marketplace insurers in Michigan in 2023, but one of them, U.S. Health & Life/Ascension Personalized Care, opted to withdraw from the market at the end of 2023, leaving nine participating insurers for 2024. According to U.S. Health & Life’s discontinuation notice, there were more than 5,000 enrollees in five Michigan counties whose coverage terminated at the end of 2023.16 These individuals were able to select replacement 2024 coverage from another insurer during open enrollment.

Are Marketplace health insurance premiums increasing in Michigan?

For 2025, ten insurers are offering Michigan Marketplace/exchange coverage. The following average rate changes were approved as filed, amounting to an overall increase of 10.5% before any subsidies are applied.17

Michigan’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Blue Care Network of Michigan | 8.9% |

| Blue Cross Blue Shield of Michigan Mutual Insurance Company | 7.5% |

| Oscar Insurance Company | 9.3% |

| McLaren Health Plan Community | 3.8% |

| Meridian Health Plan of Michigan, Inc. | 3.2% |

| Molina Healthcare of Michigan, Inc. | 8.1% |

| Physicians Health Plan | 7.3% |

| Priority Health | 18.9% |

| UnitedHealthcare Community Plan, Inc. | 0.6% |

| HAP CareSource | new for 2025 |

Source: Michigan SERFF, RateReview.HealthCare.gov,18 and ACA Signups.19

Your premium change might be quite different from the average that applies to your insurer, as it also depends on where you live (rates vary by region for each carrier), your age, and your income.

The average premium changes described above are for full-price (unsubsidized) premiums. However, most Marketplace enrollees qualify for subsidies, so they do not pay full price.20 For these enrollees, net premium changes depend on changes in their own plan’s price as well as changes in their subsidy amount from one year to the next.

For perspective, here’s an overview of how average premiums have changed in Michigan’s individual/family market over the years:

- 2015: Average decrease of 1%.21

- 2016: Average increase of 6.5%.22

- 2017: Average increase of 16.7%.23

- 2018: Average increase of 26.9%.24

- 2019: Average increase of 1.7%.25

- 2020: Average decrease of 2.1%.26

- 2021: Average increase of 1.1%.27

- 2022: Average increase of 4.7%.28

- 2023: Average increase of 5.5%.29

- 2024: Average increase of 5.3%.30

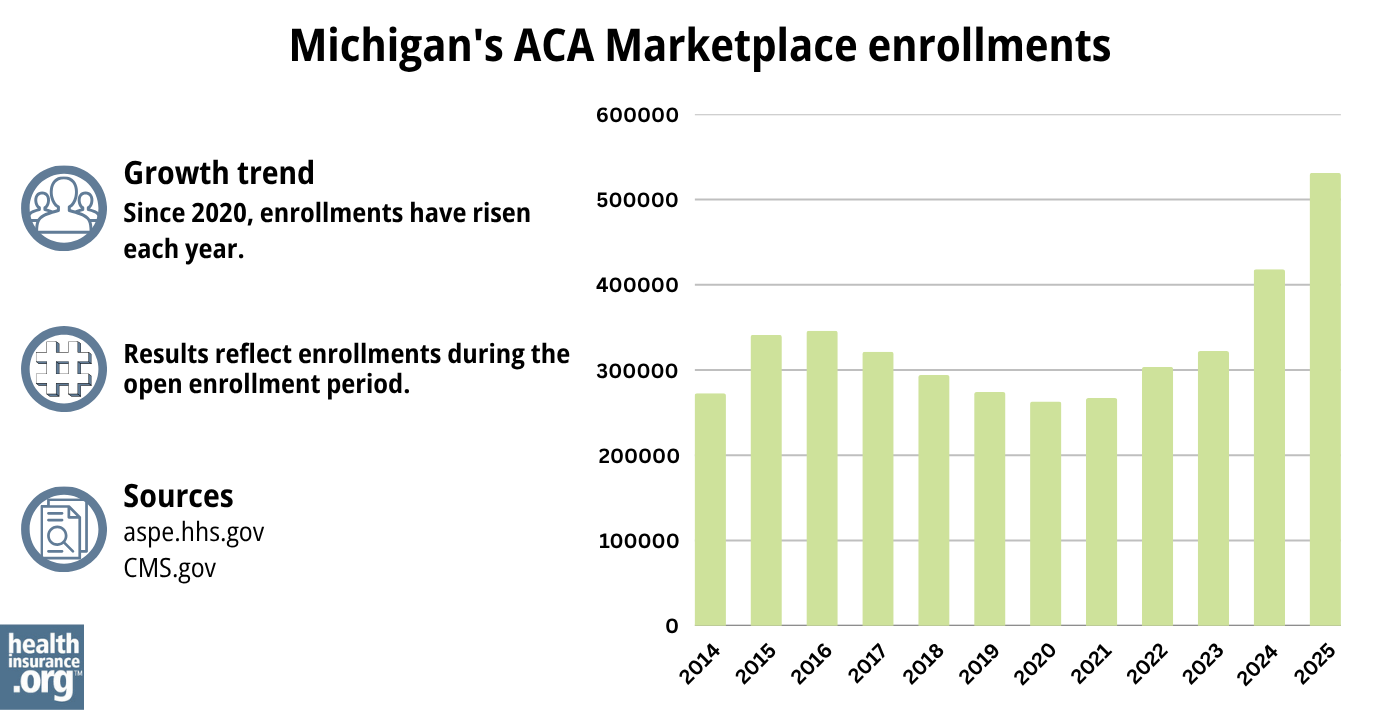

How many people are insured through Michigan's Marketplace?

418,100 people enrolled in private health plans through the Michigan Exchange/Marketplace during the open enrollment period for 2024 coverage.20

This was a substantial record high (see below for prior year enrollment totals). The increases in recent years have been driven in large part by the subsidy enhancements created by the American Rescue Plan and Inflation Reduction Act.

And the 2024 growth is also due in part to the fact that Medicaid disenrollments resumed in 2023, after being paused for three years during the pandemic. As of February 2024, CMS reported that 138,106 Michigan residents who had previously been covered by Medicaid had transitioned to Marketplace coverage.31

Source: 2014,32 2015,33 2016,34 2017,35 2018,36 2019,37 2020,38 2021,39 2022,40 2023,12 2024,41 202542

What health insurance resources are available to Michigan residents?

- Michigan health insurance Marketplace – HealthCare.gov (800) 318-2596

- Michigan Health Insurance Consumer Assistance Program (HICAP) – (877) 999-6442

- Michigan Department of Insurance and Financial Services – Serves as a resource for Michigan residents with questions or complaints related to health insurance.

- Arab Community Center for Economic & Social Services (ACCESS) – A federally funded Navigator organization that provides outreach and enrollment assistance to Michigan residents who need help obtaining health insurance.

- Michigan Medicare/Medicaid Assistance Program (MMAP) – A local service that provides health benefits counseling and assistance to Medicare beneficiaries, including those who are eligible for both Medicaid and Medicare.

- Medicare Rights Center – A nationwide service (website and call center) that can provide a wide variety of assistance to Medicare beneficiaries who have questions about enrollment, eligibility, benefits, and claims.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Michigan?

Explore more resources for options in Michigan including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- ”Michigan SB633” and “Michigan SB634” BillTrack50. Accessed June 26, 2024 ⤶

- ”2025 Michigan Health Insurance Rate Change Requests” Michigan Department of Insurance and Financial Services. Accessed November 1, 2024. ⤶

- ”Health Alliance Plan and CareSource to Partner in Michigan” HAP.org. Feb. 21, 2023 ⤶ ⤶

- Plan Year 2025 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces. Centers for Medicare and Medicaid Services. October 25, 2024 ⤶ ⤶

- ”Are you eligible to use the Marketplace?” HealthCare.gov. Accessed November 2023. ⤶

- ”Explaining Health Care Reform: Questions About Health Insurance Subsidies” KFF. October 6, 2023. ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- ”Entities approved to use enhanced direct enrollment” Centers for Medicare and Medicaid Services. December 27, 2022. ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov ⤶ ⤶

- APTC and CSR Basics. Centers for Medicare and Medicaid Services. June 2023. ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”2025 Michigan Health Insurance Rate Change Requests” Michigan Department of Insurance and Financial Services. Accessed November 1, 2023. ⤶

- SERFF Tracking Number USHL-133808625. Michigan SERFF. Accessed November 2023. ⤶

- ”Michigan: Preliminary Avg. Unsubsidized 2025 #ACA Rate Change: +10.5%” ACA Signups. (data from Michigan SERFF filings) June 17, 2024 ⤶

- ”Michigan Rate Review Submissions” RateReview.HealthCare.gov. Accessed Nov. 1, 2024 ⤶

- ”Michigan: Preliminary Avg. Unsubsidized 2025 #ACA Rate Change: +10.5%” ACA Signups (data from Michigan SERFF filings). June 17, 2024 ⤶

- Marketplace 2024 Open Enrollment Period Report: Final National Snapshot. Centers for Medicare and Medicaid Services. January 2024. ⤶ ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- Health insurance rate hikes approved for 2016: 1% rise for Michigan small businesses. Crains Detroit Business. August 2015. ⤶

- Michigan Department of Insurance and Financial Services Release 2017 Health Plans Rates. TV6. October 2016. ⤶

- Obamacare rates will skyrocket 27% in Michigan in 2018. Detroit Free Press. October 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- 2021 Health Insurance Marketplace Rates Now Available to Preview; Open Enrollment Begins Nov. 1. Office of Governor Gretchen Whitmer. October 2020. ⤶

- Big rate hikes coming in 2022 for some Michigan health insurance plans. Detroit Free Press. October 2021. ⤶

- 2023 Michigan Health Insurance Rate Change Requests Michigan SERFF Filing Access Individual Market (Approved). Michigan Department of Insurance and Financial Services. Accessed November 2023. ⤶

- 2024 Michigan Health Insurance Rate Change Requests. Michigan Department of Insurance and Financial Services. Accessed November 1, 2023. ⤶

- HealthCare.gov Marketplace Medicaid Unwinding Report. Centers for Medicare and Medicaid Services. Data through February 2024. ⤶

- “ASPE Issue Brief (2014)” ASPE ⤶

- “2015 OEP Snapshot Public Use File (ZIP)” CMS.gov ⤶

- “2016 OEP Snapshot Public Use File (ZIP)” CMS.gov ⤶

- “Health Insurance Marketplaces 2017 Open Enrollment Period Final Enrollment Report: November 1, 2016 – January 31, 2017” CMS.gov ⤶

- “Health Insurance Exchanges 2018 Open Enrollment Period Final Report” CMS.gov ⤶

- “Health Insurance Exchanges 2019 Open Enrollment Report” CMS.gov ⤶

- “Health Insurance Exchanges 2020 Open Enrollment Report” CMS.gov ⤶

- “2021 Open Enrollment Report” CMS.gov ⤶

- “2022 Open Enrollment Report” CMS.gov ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶