Find affordable health insurance coverage that best suits your needs

Get your free health insurance quote through licensed agency partners!

Choosing coverage can be overwhelming -

we're here to help you understand insurance

Learn from our health insurance analysts so you can choose coverage that best suits your needs

Health insurance Marketplace

Looking for affordable health insurance? An ACA (Affordable Care Act) Marketplace plan might be a great option for anyone who doesn’t receive health benefits through work, is self-employed, retiring early, or who doesn’t qualify for Medicaid or Medicare.

Research Marketplace optionsShort-term health insurance

Short-term health insurance may not offer all benefits of major medical but can offer temporary coverage during life transitions like job loss or missed enrollment. Find out if it’s right for you.

Research short-term health insuranceMedicaid

Medicaid is a joint federal and state health insurance program for low-income individuals and families. Coverage is generally free or low-cost. Eligibility varies by state.

Research MedicaidMedicare

Medicare is federal health insurance for those 65 and older and younger people with certain disabilities, permanent kidney failure (ESRD), or amyotrophic lateral sclerosis (ALS). For added benefits like Rx coverage and help with out-of-pocket costs, many individuals buy Medicare Advantage, Medigap, Part D, and other supplemental plans.

Research MedicareDental insurance

Adult dental care isn’t typically covered by major medical insurance plans. Dental insurance can help with the cost of services such as cleanings, dentures, and costly procedures like fillings and crowns.

Research dental optionsSupplemental options

Supplemental insurance can help cover out-of-pocket medical costs and non-medical expenses that major medical insurance may not cover, helping with unexpected costs. Some plans offer cash benefits paid directly to the insured that can be used for medical bills, lost income, or daily living expenses during emergencies. Benefits may also be assigned directly to the provider.

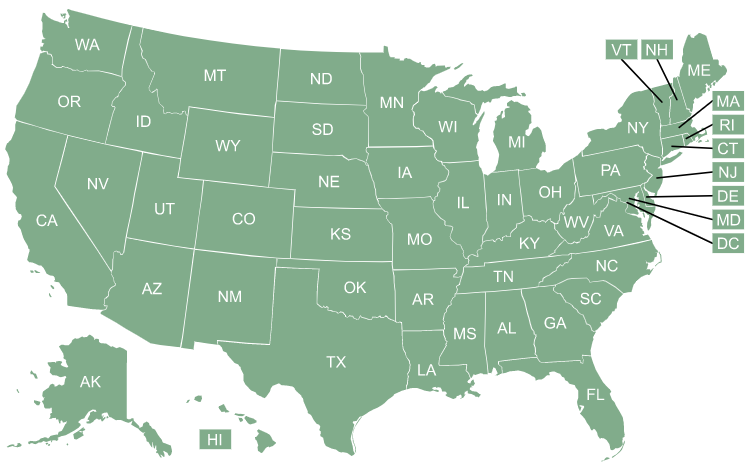

Research supplemental optionsAvailability and coverage can vary by state

Select your state below to see the options available to you

Stay up to date on the latest

Browse health insurance topicsWe're here to help individuals understand health insurance

-

2M+

users turned to our pages for info and help in 2025 -

1K+

articles, online guides and calculators -

1999

educating users for 25+ years