Home > Health insurance Marketplace > Washington

Washington Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Washington health insurance Marketplace guide

We created this health insurance guide, including the FAQs below, to help you understand the coverage options and potential financial assistance available to you and your family in the state of Washington.

Washington runs its own health insurance exchange (Marketplace), called Washington Healthplanfinder. Residents who need to buy their own health insurance – including those who aren’t eligible for Medicare, Medicaid, or an affordable employer-sponsored health plan – can use Washington Healthplanfinder to compare plans and enroll in coverage.

Eleven private insurers offer 2025 coverage through Washington’s exchange, with varying service areas.3 And as detailed below, enrollment in Washington Marketplace coverage for 2025 had reached a new record high, well before the end of open enrollment.4

Washington’s exchange can be used by undocumented immigrants, under the terms of a 2023 waiver that the state obtained from the federal government.5

Public option (Cascade Select Plans) and standardized plans (Cascade Plans) — collectively known as Cascade Care — became available as of 2021 in Washington, and Washington is among the states that provide additional state-funded subsidies, in addition to federal health insurance subsidies.6 The Cascade Select (public option) program has been growing over time, and the plans are available statewide for the first time in 2025.7

Frequently asked questions about health insurance in Washington

Who can buy Marketplace health insurance in Washington?

To be eligible to enroll in private health coverage through Washington Healthplanfinder, you must:8

- Live in Washington

- Not be incarcerated

- Not be enrolled in Medicare

Under the ACA, a person must also be lawfully present in the U.S. in order to use the exchange/Marketplace in any state. But Washington obtained federal permission to allow undocumented immigrants to enroll in health plans through Washington Healthplanfinder starting with the 2024 plan year. The approval is effective through 2028,9 but could be extended in the future.

Undocumented immigrants are not eligible for federal subsidies, but Washington Healthplanfinder can provide them with state-funded Cascade Care Savings subsidies if their income doesn’t exceed 250% of the poverty level.9

Starting in July 2024, a limited number of undocumented immigrant adults in Washington were able to enroll in Medicaid (Apple Health) if their income wasn’t more than 138% of the federal poverty level.10 This coverage is free, whereas the Marketplace coverage for undocumented immigrants averages about $210/month after the state-funded subsidies are applied.11

But the state only had enough funding to provide Apple Health coverage to 13,000 undocumented immigrants, and that enrollment cap was reached within just a couple of days. Undocumented residents can still apply and be put on a waiting list in case spots open up.12 And Apple Health is seeking additional funding from the state legislature, in order to further expand Apple Health coverage for undocumented immigrants.13

In addition to basic enrollment eligibility, additional parameters must be met to qualify for financial assistance. To be eligible for income-based federal Advance Premium Tax Credits (APTC), state-funded Cascade Care Savings, or federal cost -sharing reductions (CSR), you must:

- Not have access to an affordable plan offered by an employer. If you are eligible to sign up for an employer’s plan and aren’t sure whether it’s considered affordable, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies for a plan obtained through Washington Healthplanfinder.

- Not be eligible for Apple Health (Medicaid/CHIP).

- Not be eligible for premium-free Medicare Part A.14

- File a joint tax return with your spouse, if you’re married.15 (with very limited exceptions)16

- Not be able to be claimed by someone else as a tax dependent.17

Beyond those basic requirements, premium subsidy eligibility depends on your household’s income and how it compares with the cost of the second-lowest-cost Silver plan in your area – which depends on your age and location.

When can I enroll in an ACA-compliant plan in Washington?

In Washington, the open enrollment period begins November 1 and continues through January 15 each year. Enrollments completed by December 15 will have coverage effective January 1, whereas enrollments completed between December 16 and January 15 will have coverage effective February 1.18

After the open enrollment period ends, you may still be able to enroll or make a plan change if you experience a qualifying life event, such as giving birth or losing other health coverage. And some people can enroll year-round even without a specific qualifying life event.

Enrollment in Washington’s Apple Health (Medicaid) is available year-round for eligible applicants.

How do I enroll in a Marketplace plan in Washington?

To enroll in an ACA Marketplace/exchange plan in Washington, you can:

- Visit Washington Healthplanfinder – the state’s health insurance exchange – to compare the health plans that are available in your area, determine whether you’re eligible for financial assistance (including federal subsidies and Washington’s Cascade Care Savings), and enroll in coverage during open enrollment or during a special enrollment period.

- Enroll in coverage through Washington Healthplanfinder with the help of an insurance agent or broker, or an exchange-certified Navigator.

You can reach Washington Healthplanfinder’s customer service team at 855-923-4633 (TTY/TDD: 855-627-9604). They are available Monday through Friday, 7:30 am to 5:30 pm.

How can I find affordable health insurance in Washington?

When you enroll in a health plan through Washington Healthplanfinder, you may find that you’re eligible for financial assistance. And for those with income up to 250% of the federal poverty level, the assistance may be more robust than it is in many other states, as both federal and state subsidy programs are available in Washington.

As a result of the Affordable Care Act (ACA), federal premium subsidies (advance premium tax credits, or APTC) are available depending on your income. If you’re eligible for APTC, it will reduce the amount you pay for your health coverage each month, as long as you select a metal-level plan through Washington Healthplanfinder.

More than seven out of ten Washington Healthplanfinder enrollees qualified for APTC during the open enrollment period for 2024 coverage. These subsidies covered an average of $453/month, reducing the average APTC-eligible enrollee’s net premium to about $160/month.19

Source: CMS.gov20

Applicants with household income up to 250% of the federal poverty level are also eligible for federal cost-sharing reductions (CSR), which will reduce the deductible and other out-of-pocket expenses for Silver-level plans. One-third of Washington Healthplanfinder’s enrollees were receiving CSR benefits as of 2024.19

And Washington is among the states where additional state-funded subsidies are available. Starting in 2023, Washington began offering state-funded premium subsidies for applicants with income up to 250% of the poverty level, as long as they select a Cascade Care silver or gold plan. The Cascade Care Savings are available in addition to the federal premium subsidies and cost-sharing reductions.6

(Note that federal APTC can be used with any metal-level plan, federal CSR is available with any silver-level plan, and Cascade Care Savings are available with silver or gold Cascade Care plans. To receive all three benefits at once, an enrollee would need to have income up to 250% of the poverty level and select a silver Cascade Care plan.)

Depending on your income and circumstances, you may be able to enroll in free or low-cost health coverage through Apple Health (Washington Medicaid). Learn more about whether you might be eligible for Medicaid in Washington. As noted above, Apple Health became available as of July 2024 to a limited number of undocumented immigrants who met the income requirements.10 But once 13,000 people had enrolled, additional applicants were put on a waiting list, as the state only had enough funding to provide Apple Health to 13,000 undocumented immigrants.12

How many insurers offer Marketplace coverage in Washington?

Eleven insurers offer Marketplace coverage for 2025 in Washington.3

There were 12 in 2024, but PacificSource (which offered Marketplace plans in four counties in 2024, and was the only carrier that offered PPO plans21) exited the Washington market at the end of 2024.22 People who were enrolled in PacificSource plans in 2024 needed to select a new plan during open enrollment, which began November 1, 2024.

Are Marketplace health insurance premiums increasing in Washington?

For 2025, the following average rate increases were approved for individual/family coverage offered through Washington Healthplanfinder, amounting to an overall average rate increase of 10.7% (before subsidies are applied):3

Washington’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| BridgeSpan Health Company | 14.9% |

| Community Health Plan of Washington | 9.3% |

| Coordinated Care Corporation | 9.3% |

| Kaiser Foundation Health Plan of the Northwest | 9.9% |

| Kaiser Foundation Health Plan of Washington | 8.6% |

| LifeWise Health Plan of Washington | 8% |

| Molina Healthcare of Washington | 5.7% |

| PacificSource Health Plans | exiting market |

| Premera Blue Cross | 14.9% |

| Regence BlueCross BlueShield of Oregon | 16.7% |

| Regence BlueShield | 22.8% |

| UnitedHealthcare of Oregon | 23.7% |

Source: Washington Office of the Insurance Commissioner3

It’s important to note that average rate changes apply to full-price premiums, and most enrollees do not pay full price. Seven out of ten Washington Healthplanfinder enrollees were receiving premium subsidies in 2024.19 These subsidies change each year to keep pace with the cost of the second-lowest-cost Silver plan in each area.

In addition to the exchange insurers, there are two insurers in Washington’s individual/family market – Asuris Northwest Health and Providence Health Plan – that only offer plans outside the exchange. Their proposed average rate increases for 2024 are 15.8% and 9.3%, respectively.23 These proposals were still under review when the approved rates for Marketplace plans were announced.

For perspective, here’s an overview of how average full-price premiums have changed in Washington’s individual/family market over the years:

- 2015: Average increase of 1.9%24

- 2016: Average increase of 4.2%25

- 2017: Average increase of 13.6%26

- 2018: Average increase of 36.4%27

- 2019: Average increase of 13.6%28

- 2020: Average decrease of 3.3%29

- 2021: Average decrease of 3.2%30

- 2022: Average increase of 4.17%31

- 2023: Average increase of 8.18%32

- 2024: Average increase of 8.9%33

How many people are insured through Washington’s Marketplace?

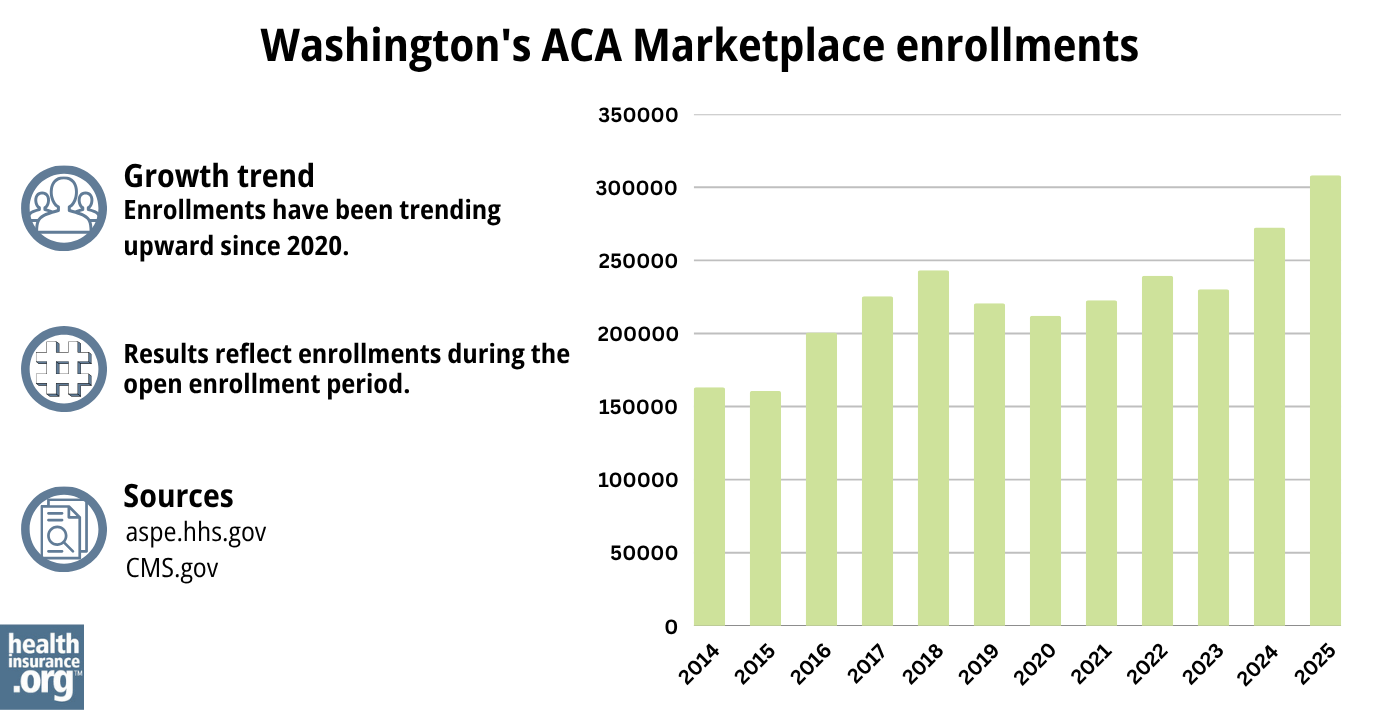

During the open enrollment period for 2024 coverage, Washington Healthplanfinder enrollment reached a record high, with 272,494 people selecting plans through the Marketplace.34 (See below for a chart of enrollment in previous years.)

And 2025 enrollment had far surpassed that record by early January 2025, with nearly two weeks remaining in open enrollment. At that point, more than 291,000 people had already enrolled in coverage through Washington Healthplanfinder for 2025.4

The record-high enrollment in 2024 (which mirrored national trends) was due to the continued enhancement of premium subsidies under the American Rescue Plan and Inflation Reduction Act, as well as the “unwinding” of the pandemic-era Medicaid continuous coverage rule. CMS reported that more than 89,000 Washington residents transitioned from Medicaid (Apple Health) to Marketplace coverage during the “unwinding” process.35

Source: 2014,36 2015,37 2016,38 2017,39 2018,40 2019,41 2020,42 2021,43 2022,44 2023,45 2024,46 202547

What health insurance resources are available to Washington residents?

Washington Healthplanfinder

The state-based health insurance exchange, where individuals and families can enroll in health plans and receive subsidies based on household income. Washington Healthplanfinder is also the enrollment portal for income-based Apple Health (Medicaid) and CHIP enrollment.

Washington State Office of the Insurance Commissioner

Licenses and regulates the state’s health insurance companies, brokers, and agents. Provide assistance and information to consumers who have questions or complaints about regulated entities.

Washington Statewide Health Insurance Benefits Advisors (SHIBA)

A local service that can answer questions and provide information, counseling, and assistance related to Medicare in Washington.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Washington?

Explore more resources for options in Washington including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Average 10.7% rate increase approved for 2025 individual health insurance market” Washington State Office of the Insurance Commissioner. Sep. 11, 2024 ⤶

- ”Average 10.7% rate increase approved for 2025 individual health insurance market” Washington State Office of the Insurance Commissioner. Sep. 11, 2024 ⤶ ⤶ ⤶ ⤶

- ”Marketplace 2025 Open Enrollment Period Report: National Snapshot” Centers for Medicare & Medicaid Services. Jan. 8, 2025 ⤶ ⤶

- ”Washington: State Innovation Waiver” Centers for Medicare and Medicaid Services. December 2022 ⤶

- “Cascade Care” Washington Health Benefit Exchange, October 2022 ⤶ ⤶

- ”Cascade Select will be available across Washington in 2025” Washington Health Benefit Exchange. Oct. 15, 2024 ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- ”Washington: State Innovation Waiver” Centers for Medicare & Medicaid Services. December 9, 2022. ⤶ ⤶

- ”Apple Health Expansion” Washington State Health Care Authority. Accessed June 21, 2024 ⤶ ⤶

- ”WA expanding health care options for undocumented immigrants” The Seattle Times. Mar. 11, 2024 ⤶

- ”Apple Health Expansion Enrollment Cap” Washington Health Care Authority. July 3, 2024 ⤶ ⤶

- ”Washington Health Care Authority seeks more funding to expand Medicaid for undocumented adults” Northwest Public Broadcasting. Dec. 20, 2024 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 10, 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed March 1, 2024. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- “Enrollment Periods” Washington Healthplanfinder, Accessed September 14, 2023 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶ ⤶ ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- “2025 Qualified Health and Dental Plan Certification” Washington Health Benefit Exchange. Sep. 12, 2024 ⤶

- ”PacificSource lays off 29, will largely pull out of Washington” Lund Report. Mar. 28, 2024 ⤶

- ”Thirteen insurers request average 11.3% rate change for 2025 individual health insurance market” Washington Office of the Insurance Commissioner. May 29, 2024 ⤶

- ”Washington slashes exchange rates, doubles plans” Healthcare Dive. August 29, 2014. ⤶

- ”Washington State: 2016 *approved* rate increases: 4.2% weighted avg. (potentially up to 5%)” ACA Signups. Aug. 27, 2015 ⤶

- ”Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups, October 2016 ⤶

- ”2018 Rate Hikes” ACA Signups, October 2017 ⤶

- ”2019 Rate Hikes” ACA Signups, October 2018 ⤶

- ”Washington State: *Approved* 2020 ACA Exchange Premium Rate Changes: 3.3% Decrease!“Washington Office of the Insurance Commissioner, September 14, 2022 ⤶

- ”Kreidler approves average rate decrease of 3.2% for Washington’s 2021 Exchange health insurers” Washington Office of the Insurance Commissioner, September 24, 2020 ⤶

- ”Average 4.17% rate change approved for 2022 Exchange health insurance market” Washington Office of the Insurance Commissioner, September 20, 2021 ⤶

- ”12 insurers approved for 2023 Exchange health insurance market, 8.18% average rate change“Washington Office of the Insurance Commissioner, September 14, 2022 ⤶

- “Average rate increase of 8.9% approved for 2024 individual health insurance market” Washington Office of the Insurance Commissioner, September 13, 2023 ⤶

- ”Marketplace 2024 Open Enrollment Period Report: Final National Snapshot” Centers for Medicare & Medicaid Services. January 24, 2024. ⤶

- ”State-based Marketplace (SBM) Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through September 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶