What is the federal poverty level (federal poverty guidelines)?

The federal poverty level (FPL) is commonly used to refer to the federal poverty guidelines that HHS issues each year. (Although HHS notes that "federal poverty guidelines" is actually the correct terminology, and that "federal poverty level" should be avoided, the latter tends to be more frequently used.)

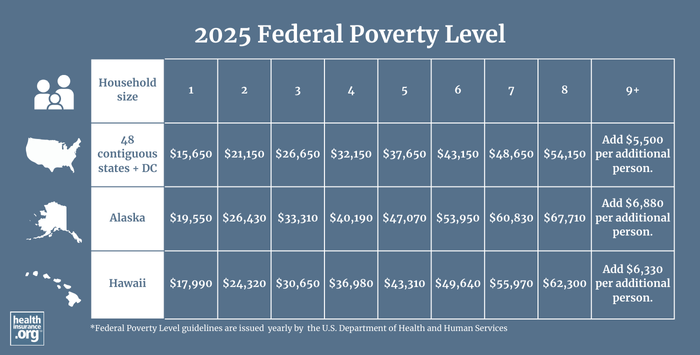

It's specified as an income amount that is used to determine eligibility for various income-based public programs, such as Medicaid, health insurance premium tax credits, and cost-sharing reductions. The specific dollar amount varies based on the number of people in the household and whether the household is in Alaska, Hawaii, or the continental U.S.

The following charts show federal poverty guidelines for 20241 and 2025,2 which are used for various healthcare programs in 2024 and 2025.

(See details below in terms of how this works, but note that Marketplace subsidy eligibility for 2025 coverage is calculated based on 2024 FPL numbers, whereas Medicaid eligibility will start to be based on 2025 FPL numbers in early 2025; in most months, the switch to the new FPL numbers happens in March or April.)

| 2024 Federal Poverty Guidelines | |||

|---|---|---|---|

| Persons in family / household | 48 contiguous states and DC | Alaska | Hawaii |

| 1 | $15,060 | $18,810 | $17,310 |

| 2 | $20,440 | $25,540 | $23,500 |

| 3 | $25,820 | $32,270 | $29,690 |

| 4 | $31,200 | $39,000 | $35,880 |

| 5 | $36,580 | $45,730 | $42,070 |

| 6 | $41,960 | $52,460 | $48,260 |

| 7 | $47,340 | $59,190 | $54,450 |

| 8 | $52,720 | $65,920 | $60,640 |

| 9+ | If more than 8 in household / family, add $5,380 per additional person. | If more than 8 in household / family, add $6,730 per additional person. | If more than 8 in household / family, add $6,190 per additional person. |

| 2025 Federal Poverty Guidelines | |||

|---|---|---|---|

| Persons in family / household | 48 contiguous states and DC | Alaska | Hawaii |

| 1 | $15,650 | $19,550 | $17,990 |

| 2 | $21,150 | $26,430 | $24,320 |

| 3 | $26,650 | $33,310 | $30,650 |

| 4 | $32,150 | $40,190 | $36,980 |

| 5 | $37,650 | $47,070 | $43,310 |

| 6 | $43,150 | $53,950 | $49,640 |

| 7 | $48,650 | $60,830 | $55,970 |

| 8 | $54,150 | $67,710 | $62,300 |

| 9+ | If more than 8 in household / family, add $5,500 per additional person. | If more than 8 in household / family, add $6,880 per additional person. | If more than 8 in household / family, add $6,330 per additional person. |

How is the FPL used in healthcare?

The federal poverty level is used to determine

- eligibility for Medicaid and CHIP (the Children's Health Insurance Program);

- eligibility for Affordable Care Act premium tax credits and cost-sharing reductions (subsidies); and

- eligibility for Medicare Savings Programs (MSPs) and the Low-Income Subsidy for Medicare Part D.

Medicaid and CHIP:

- For Medicaid and CHIP eligibility determinations, the current year's federal poverty level numbers are used (and are compared with the household's current monthly or annual income — enrollees can use either one). The poverty level numbers are updated by HHS each year in mid-late January, although states typically don't start to use the new numbers for Medicaid eligibility determination until March or April (states can begin even earlier; for example, Wisconsin switches to the updated poverty level numbers on February 1.)3 By the spring of 2025, the 2025 FPL numbers (shown above) will be in use nationwide to determine Medicaid and CHIP eligibility.

- In states that have expanded Medicaid, adults under age 65 will qualify for Medicaid if they earn up to 138% of the FPL. (Note that although you'll often see this written as 133%; there's a 5% income disregard that effectively brings it up to 138%.)

- Children and people who are pregnant are eligible for Medicaid or CHIP at higher income levels; the specific thresholds vary by state.4

- In states that haven't expanded Medicaid, the eligibility guidelines are stricter, with much lower income limits for parents and coverage generally not available at all to non-disabled childless adults, regardless of how low their income is. This creates a coverage gap that exists in nine states as of 2025.

- For people who are disabled or 65+, Medicaid eligibility also depends on assets (varies by state; click on a state on this map to see details).

- CHIP eligibility is also based on the federal poverty level, but the specific thresholds vary from one state to another.4

Premium tax credits:

- For premium tax credit eligibility determinations, the prior year's FPL numbers are used, and are compared with the applicant's projected total annual income for the year the coverage will be in force. So for a plan with a 2025 effective date, the household's projected total 2025 income is compared with the 2024 poverty level numbers.

- If you're in a state that has expanded eligibility for Medicaid, premium tax credit (premium subsidy) eligibility in the marketplace/exchange starts above 138% of the federal poverty level (ie, where Medicaid ends). It used to end at 400% of the poverty level (or lower, if the coverage was already considered affordable without a subsidy) but the American Rescue Plan temporarily eliminated that income limit, and the Inflation Reduction Act has extended that provision through 2025. So for the time being, premium tax credits are available even if household income exceeds 400% FPL, if the cost of the benchmark plan would otherwise be more than 8.5% of the household's income.

- If you're in a state that has not expanded Medicaid (10 states have not expanded Medicaid as of 2025), premium tax credit eligibility starts at 100% of the federal poverty level. And as is the case in the rest of the states, there is not an upper income limit for premium subsidy eligibility through 2025. So a person who earns 120% of the poverty level would qualify for Medicaid in some states (states that have expanded Medicaid) and for premium subsidies in others (states that have not expanded Medicaid).

- It’s important to note that children are eligible for Medicaid or CHIP at much higher household incomes than the Medicaid eligibility limits for adults. 4 So it’s common to see households where the kids are eligible for Medicaid or CHIP, while the parents are eligible for premium tax credits instead. If the family chooses to enroll the kids along with the parents on the private plan in the exchange, they have to pay full price for the kids’ coverage, since they could have enrolled in Medicaid or CHIP instead.

- If you're a recent immigrant and ineligible for Medicaid due to your immigration status, eligibility for federal premium tax credits extends down to 0% of the poverty level.

- Use our calculator to estimate how much you could save on your ACA-compliant health insurance premiums.

Cost-sharing reductions:

- Cost-sharing reductions are available to marketplace/exchange enrollees who select Silver plans and whose household income doesn't exceed 250% of the FPL. But cost-sharing reductions are strongest for households with income that doesn't exceed 200% of the poverty level.

- As is the case with premium tax credits, the household's projected income is compared with the prior year's poverty level numbers to determine eligibility for cost-sharing reductions.

- As is the case for premium tax credits, the lower eligibility threshold is 100% of the poverty level in states that have not expanded Medicaid, and above 138% in states that have.

- For coverage effective in 2025, 250% of the federal poverty level in the continental U.S. is $37,650 for a single individual, $64,550 for a family of three, and $104,900 for a family of six. (The amounts are higher in Alaska and Hawaii, since they have higher federal poverty levels).

Medicare Savings Programs and Part D Low-Income Subsidy:

- Medicare beneficiaries with limited financial means can qualify for Medicare Savings Programs, with eligibility that depends on income being within a specified percentage of the FPL, as well as asset limits.

- The Medicare Part D Low-Income Subsidy (Extra Help) depends on income (no more than 150% of the poverty level) and assets. As a result of the Inflation Reduction Act, people who were previously eligible only for partial Extra Help are eligible for full Extra Help. In other words, there is no longer full or partial eligibility; everyone eligible for Extra Help is eligible for the full benefit.

FPL calculator

The calculator below is now using the 2025 FPL numbers for Medicaid/CHIP eligibility determinations. But depending on where you live, your state may not start to use those numbers until April 2025. So if you're near the upper limit for Medicaid eligibility, you may need to wait until April to qualify. Check with your state's Medicaid office for details.

The calculator below uses the 2024 FPL numbers for Marketplace subsidy eligibility determination, and that will continue to be the case for all Marketplace plans with 2025 effective dates. It will be updated to use the 2025 FPL numbers in November 2025, when enrollment begins for 2026 Marketplace coverage.

Which federal agency determines the federal poverty guidelines?

The federal poverty guidelines are set each year by the Department of Health and Human Services (as opposed to the poverty threshold, which is set by the Census Bureau and used for statistical purposes rather than for the administration of income-based federal programs).

Does the FPL vary from one state to another?

The federal poverty level is higher in Alaska and Hawaii. HHS sets three different amounts each year: One for the continental United States, a higher level for Hawaii, and an even higher level for Alaska. But within the continental U.S., the federal poverty level does not vary.

When does the FPL change each year?

HHS publishes updated FPL numbers in mid-January each year. Agencies use this new amount soon thereafter (no later than April 1) to determine eligibility for Medicaid and CHIP. But the prior year’s FPL numbers continue to be used to determine eligibility for premium tax credits and cost-sharing reductions until open enrollment starts again in the fall.

So for example, if a person applies for Medicaid in June 2025, their current household income at that point would be compared with the 2025 FPL amount. But if they qualify for a special enrollment period and apply for an individual-market plan through the marketplace, the marketplace will compare their total projected 2025 household income (including what they’ve already earned in 2025 and what they expect to earn for the rest of the year) with the 2024 FPL amount for their household size.

When a consumer applies for a plan in the marketplace, the marketplace checks the applicant’s eligibility for Medicaid and CHIP eligibility first. If a person is eligible for Medicaid or CHIP, they are not eligible for premium subsidies for a marketplace plan. But assuming they’re not eligible for Medicaid or CHIP, the marketplace will then determine whether they’re eligible for premium subsidies, and if so, the size of the subsidy.

What is the FPL that's used for 2025 health coverage?

The 2024 FPL numbers, published in January 2024, are used to determine subsidy eligibility for 2025 Marketplace coverage. For a single person in the continental United States, the 2024 federal poverty level is $15,060. For each additional person in the household, the federal poverty level increases by $5,380. (So for a household of three, for example, the 2024 federal poverty level is $25,820.)

But to determine 2025 eligibility for Medicaid and CHIP, states will switch to the 2025 FPL numbers (published in January 2025)2 by March or April 2025. For private health plans, the Marketplaces will start to use the 2025 FPL numbers in November 2025, when subsidy eligibility is being calculated for 2026 coverage.

How are the FPL numbers for subsidy eligibility different in Alaska and Hawaii?

The FPL numbers are higher in Alaska and Hawaii than they are in the rest of the United States. Both Alaska and Hawaii have expanded Medicaid eligibility under the ACA, so Medicaid is available to adults under the age of 65 if their household income doesn’t exceed 138% of FPL. Premium subsidy eligibility in both states starts above 138% of FPL, which is a different dollar amount in Alaska and Hawaii, since they have different federal poverty levels.

- The 2024 FPL for a single person is $17,310 in Hawaii and $18,810 in Alaska. These numbers are used to determine Marketplace subsidy eligibility for 2025 coverage, and Medicaid/CHIP eligibility until the states transition to the new 2025 numbers in early 2025.

- The 2025 FPL for a single person is $17,990 in Hawaii and $19,550 in Alaska.2 These numbers are used to determine Medicaid/CHIP eligibility starting in the spring of 2025, and Marketplace subsidy eligibility for 2026 coverage.

You can see the 2024 and 2025 federal poverty levels at the top of this page, with amounts based on family size and location (Alaska, Hawaii, or the Continental U.S.).

The 2024 poverty level numbers are used to determine subsidy eligibility for people enrolling in individual market coverage will effective dates throughout 2025. Medicaid/CHIP eligibility will switch to the 2025 FPL numbers by March or April 2025, but the Marketplace won’t start to use the 2025 FPL numbers to determine subsidy eligibility until people are enrolling in coverage for 2026, starting in November 2025.

When and why was the FPL established?

The federal poverty thresholds were first introduced in 1965, based on the work of the Social Security Administration’s Mollie Orshansky. The amounts were tied to the bare minimum amount that people needed in order to have adequate food, with a multiplier used to account for other necessary expenses. Orshansky noted at the time that the poverty thresholds were a measure of the amount of income that would be inadequate for people to live, as opposed to a minimum adequate amount.

By the late 1960s, the federal poverty guidelines began to be indexed based on the Consumer Price Index. And other changes have been made over the years as well, such as eliminating the separate poverty level guidelines for farm families in the early 1980s.

Footnotes

- “2024 Poverty Guidelines” U.S. Department of Health and Human Services. Published January 2024 ⤶

- “2025 Poverty Guidelines” U.S. Department of Health and Human Services. Published January 2025 ⤶ ⤶ ⤶

- “BadgerCare Plus Federal Poverty Levels” Wisconsin Department of Health Services. Accessed Feb. 13, 2025 ⤶

- “Medicaid, Children's Health Insurance Program, & Basic Health Program Eligibility Levels” Centers for Medicare & Medicaid Services. December 2023. ⤶ ⤶ ⤶

See if you are eligible for an ACA premium subsidy

Most Marketplace enrollees could be eligible for enhanced subsidies through 2025!