What is Obamacare (Affordable Care Act) Marketplace coverage?

Learn how Obamacare’s provisions may help you save money on comprehensive health insurance.

What is Obamacare?

“Obamacare” is a commonly used reference to the Affordable Care Act (ACA) legislation enacted in 2010. The ACA’s sweeping reforms included provisions that set standards for comprehensive health coverage and other provisions aimed at helping make the coverage more affordable to more people.1 But while the term Obamacare can be used to refer to the entire law, this article will use this term to describe ACA-compliant individual/family major medical health plans that are obtained through the health insurance exchange/Marketplace in each state.

Four ways to enroll in Obamacare

Once open enrollment begins, you can enroll in an ACA-compliant individual and family health insurance plan – or make changes to your existing coverage – through the Marketplace in your state.

Enroll through your state’s Marketplace on your own or with the help of a broker, Navigator, or enrollment counselor. Or enroll through an enhanced direct enrollment entity.

Live in a state that uses the federally facilitated Marketplace? Call 866-553-3223 to speak with a licensed health insurance agent. If not, check your state’s exchange for enrollment by phone.

Enroll in person at enrollment centers and during enrollment events all across the country. Brokers, Navigators, or enrollment counselors can provide you with zero-cost assistance with the enrollment process.

In a state that uses HealthCare.gov? Find assisters nearby.

Complete a paper application. (State-run Marketplaces will have their own paper application.) Here’s the paper application for HealthCare.gov.

How much could you save on 2026 coverage?

Compare health plans and check subsidy savings through licensed third-party partners!

How does Obamacare work?

When we’re talking about Obamacare coverage, we’re referring to health insurance plans that are compliant with the ACA and offered by private health insurance companies on the Marketplace/exchange. (You can also buy ACA-compliant coverage outside of the Marketplace/exchange; this is often referred to as “off-exchange” coverage.) ACA-compliant means that the plans conform to ACA rules for things like minimum benefit levels, maximum out-of-pocket limits, guaranteed-issue coverage, and various other consumer protections.

(The ACA sets the minimum federal requirements, but states can impose their own additional requirements.)

In every state, residents can use the Marketplace/exchange to learn about and enroll in Obamacare (ACA) plans. The majority of the states use the federally operated HealthCare.gov for enrollment, but quite a few states run their own exchange platforms. In addition, individuals can enroll in Obamacare/Marketplace plans through a direct enrollment (DE) or an enhanced direct enrollment (EDE) pathway if they live in a state that uses HealthCare.gov as its Marketplace.2

Everywhere except the District of Columbia,3 residents also have the option to enroll in ACA-compliant plans outside the Marketplace/exchange. But financial assistance in the form of premium subsidies and cost-sharing reductions is only available when coverage is purchased through the Marketplace (which can be done directly or through a DE or an EDE). That financial assistance is the primary reason that most eligible residents purchase Marketplace individual and family health plans.4

Frequently asked questions about Obamacare

What does Obamacare cover?

All Obamacare/Marketplace health plans are required to offer a core comprehensive set of benefits, known as essential health benefits (EHB),5 without any lifetime or annual dollar limits.6 These include:

Source: HealthCare.gov7

Each state sets its own rules for what has to be covered within each of those general categories, with details outlined by the state’s EHB benchmark plan.8 So some of the coverage specifics under a Marketplace plan will depend on where you live. (For example, a state can specify how many physical therapy visits a plan has to cover in a given year.)

Any ACA-compliant individual or family health plan that is not grandfathered or grandmothered/transitional – including all Obamacare plans – must limit out-of-pocket costs for in-network care. The limit can’t be more than $9,200 for a single person in 2025,9 although this limit increases significantly, to $10,600, in 2026.

And Obamacare plans must also spend at least 80% of premium revenue on medical costs and quality improvements.10 If they don’t, carriers are required to send rebates to enrollees.

Who qualifies to enroll in Obamacare through the Marketplace?

You can enroll in ACA-compliant individual/family health coverage through your state’s Marketplace (or a DE or EDE if you’re in a state that uses HealthCare.gov) as long as you live in the United States, are a U.S. citizen/national or are lawfully present in the United States, not incarcerated, and not enrolled in Medicare.11 But while most people are eligible to enroll in Obamacare coverage, they can only sign up during an annual open enrollment period or a special enrollment period. More on that in a moment.

Who’s eligible for financial assistance with Obamacare coverage?

But eligibility for financial assistance in the Marketplace involves a few additional criteria.12 To qualify for Obamacare subsidies (cost-sharing subsidies and/or premium subsidies):13

- You must enroll in a plan through the Marketplace14 (as noted above, this can be via a DE or EDE if you’re in a state that uses HealthCare.gov).

- You must not be eligible for Medicaid/CHIP or premium-free Medicare Part A.14

- You must not have access to a comprehensive, affordable employer-sponsored plan.15 If you have access to an employer’s health plan and aren’t sure if it’s considered affordable, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies to offset the cost of a Marketplace plan

- To qualify for premium subsidies, the full-price premium for the second-lowest-cost Silver plan must be more than a specific percentage of your household income.

- As of 2026, unless Congress extends the federal subsidy enhancements that have been in effect since 2021, there will once again be an income limit for subsidy eligibility, equal to 400% of the federal poverty level.

- To qualify for premium subsidies, you must agree to file an income tax return, including Form 8962 (for reconciling the premium tax credit) and if married, must file a joint tax return with your spouse.

- To qualify for cost-sharing reductions, your household income can’t exceed 250% of the prior year’s federal poverty level and you must select a Silver plan.16

How much is Obamacare per month?

If you buy health coverage through the Marketplace, the monthly premium you pay is going to depend on several factors, including:

- The specific plan you select. Depending on where you are, there could be dozens or even hundreds of available options.

- Your location.

- Your age and the ages of any family members who will be on your plan.

- Your household income. which is determined by an ACA-specific calculation. More than nine out of ten Marketplace enrollees qualify for premium subsidies, which are income-based.17 But if you don’t qualify for subsidies, your income will not impact your selected plan’s premiums. You’ll simply pay the full price of the plan you select.

- Tobacco use will also factor into your premium in most states, and tobacco surcharges cannot be covered by federal premium subsidies.

In 2025, the average Marketplace enrollee paid about $106/month for their health plan. But the average full price premium was about $619/month.18 This demonstrates how valuable the premium subsidies are, as they cover the large majority of the premiums for the average enrollee.

When is Obamacare enrollment?

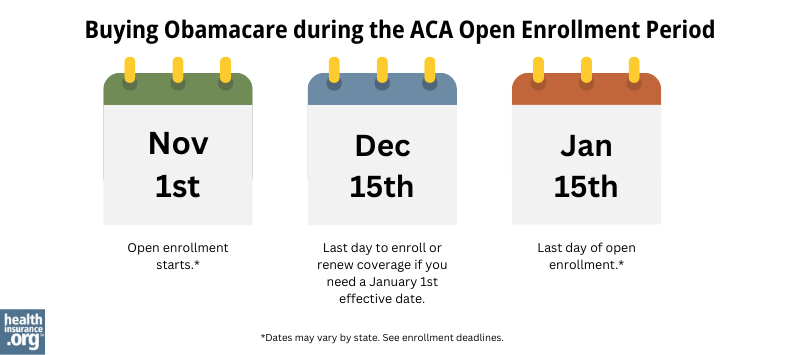

In most states, open enrollment for ACA-compliant individual/family health plans runs from November 1 through January 15, though you will need to enroll by December 15 to have a January 1 effective date.

For coverage effective in 2026, that schedule applies to the 30 states that use HealthCare.gov as their Marketplace, as well as several of the state-run Marketplaces. But there are some state-run Marketplaces that have different enrollment schedules, and different deadlines to get a January 1 effective date.

Note: The open enrollment period will be shorter starting in the fall of 2026, due to a federal rule that was finalized in 2025. But this does not affect the open enrollment period in the fall of 2025.

Read our guide to ACA open enrollment.

Outside of the annual Open Enrollment Period, you won’t be able to enroll for an ACA-compliant individual health plan (even outside the exchange) unless you qualify for a Special Enrollment Period. A variety of qualifying life events will trigger a Special Enrollment Period.

Read our guide to ACA special enrollment periods.

How do I sign up for Obamacare?

You can enroll in an Obamacare plan online, by phone, with a paper application, or in-person.

The majority of the states use HealthCare.gov as their Marketplace, but many do not. If you’re not sure about your state’s Marketplace, you can enter your zip code in this tool. If your state doesn’t use HealthCare.gov, the tool will point you to your state’s Marketplace.

You’ll then be able to enroll directly through the website, either on your own or with the help of a broker, Navigator, or enrollment counselor.

You’ll also have the option to submit a paper application. Here’s the paper application for HealthCare.gov. (If your state runs its own Marketplace, it will have its own paper application.)

You can also choose to enroll over the phone. If you’re in a state that uses HealthCare.gov, the phone number is 1-800-318-2596. If you’re in a state that runs its own exchange, that exchange will provide an enrollment phone number. Find information about your state’s exchange.

If you prefer to sit face-to-face with someone who can help you enroll, there are enrollment centers and enrollment events all across the country. They are staffed with brokers, Navigators, or enrollment counselors, all of whom can provide you with zero-cost assistance with the enrollment process. Find assisters nearby.

If you’re in a state that uses HealthCare.gov and you want to find someone who can help you understand your coverage options and get enrolled, you can use this tool to find enrollment assisters in your community. This will include people who can help you over the phone, online, or in person.

What should I know about buying Obamacare / ACA-compliant coverage through the health insurance Marketplace?

There are several things to keep in mind when you’re buying coverage:

- Most Marketplace enrollees qualify for premium subsidies.[efn_note]“Effectuated Enrollment: Early 2025 Snapshot and Full Year 2024 Average” CMS.gov, July 24, 2025[/efn_note]

- But unless Congress acts to extend the subsidy enhancements that have been in effect since 2021, premium subsidies will be smaller and available to fewer people in 2026.

- If you qualify for cost-sharing reductions, it’s important to note that this benefit is only available on Silver plans. You don’t have to select a Silver plan, but you’ll forfeit your CSR if you don’t enroll in a Silver plan.

- If you don’t qualify for cost-sharing reductions, a Gold plan might be similar in cost or even less expensive than the available Silver plans, depending on where you live. This is because insurers in nearly every state add the cost of CSR to Silver plan premiums, but not to the premiums of plans at other levels.19 This can make some Silver plans more expensive than some Gold plans, although it varies from one area to another and from one insurer to another. (Bronze plans will also tend to be less expensive than Silver plans, but the benefits of a Gold plan will be more robust than the benefits of a Bronze plan, due to their much higher actuarial value.)20

- Individual/family health plans set their own provider networks, so networks differ from one insurer to another. And they can also differ from the same insurer’s provider networks in the group insurance market. Be sure to check each plan you’re considering to see which providers are in-network.

- The same is true for prescription drug formularies (covered drug lists). Be sure you check to see whether and how each plan covers the medications you need.

Here’s more about what you should keep in mind when you’re choosing a health insurance plan in the exchange.

Are there different types of Obamacare plans?

In the individual/family and small-group market, health plans sold since 2014 must fit into one of four metal level categories: Bronze, Silver, Gold, or Platinum. (There are also catastrophic plans available to some enrollees in the individual market.)

Learn more about Obamacare’s metal plan levels.

What are the pros and cons of Obamacare?

The pros of the Obamacare legislation include the fact that individual/family health insurance:

- is now guaranteed-issue,21

- covers pre-existing conditions,22

- includes coverage for all of the essential health benefits,23 and

- government subsidies may pay for a significant portion of many enrollees’ premiums.24

The cons depend on your perspective, but include the fact that individual/family health insurance is no longer available for purchase year-round, and can be quite expensive for people who don’t qualify for premium subsidies.

The American Rescue Plan and Inflation Reduction Act temporarily ensured that nobody has to pay more than 8.5% of their household income for the benchmark plan, between 2021 and 2025.25

But unless Congress extends that provision, it will expire at the end of 2025. That would result in a return of the “subsidy cliff,” with subsidy amounts dropping to zero as soon as a household’s income rises above 400% of the federal poverty level, regardless of how much they have to spend on their health insurance.

Is there still a penalty for not having health insurance?

In most states, no. The federal penalty included in the ACA was eliminated at the end of 2018. But there are some states that have instituted their own coverage mandate penalty, which is assessed by each state during income tax filing. They include Massachusetts, New Jersey, California, Rhode Island, and Washington DC.

Health reform history: When did Obamacare start?

Obamacare (the Affordable Care Act) was signed into law in March 2010.26 Some of its provisions took effect later that year, including the preventive care coverage rule and a provision that allows young adults to stay on a parent’s health plan until age 26.

But the ACA’s expansion of Medicaid and the bulk of the new rules for individual/family health coverage didn’t take effect until January 2014. The exchanges debuted in the fall of 2013, allowing people to buy ACA-compliant health coverage that took effect in 2014.

How does Obamacare combat health insurance discrimination?

Before the ACA reformed the individual health insurance market, insurers routinely discriminated against people with pre-existing medical conditions, and premiums were based on gender.

Prior to 2014, there were only five states where individual health insurance was guaranteed-issue regardless of medical history.27 In the rest of the states, people with pre-existing medical conditions were generally subjected to condition-specific exclusions, higher premiums, or outright denials. In many states, high-risk pools served as ‘coverage of last resort’, but even those plans came with benefit caps.

As a result of Obamacare, medical history and gender are no longer a factor in eligibility for individual health insurance, nor do they affect the premiums people pay.

Section 1557 of the ACA prohibits discrimination in health plans, including discrimination based on gender or sexual orientation.28 The details are left to the Department of Health and Human Services (HHS), so there have been some changes as administrations have taken differing approaches:

- The initial Section 1557 rulemaking was issued in 2016, under the Obama administration.

- Much of the original rulemaking was subsequently rolled back in 2020, under the Trump administration.

- HHS finalized new rules in 2024 under the Biden administration, once again strengthening non-discrimination protections under ACA Section 1557.29 But a subsequent court ruling blocked the implementation of some of the non-discrimination provisions.30

- In May 2025, under the Trump administration, HHS announced that it would not enforce certain provisions of existing Section 1557 rules, specifically rules about sex-based discrimination related to gender identity and pregnancy/abortion status.31

- In June 2025, CMS finalized a rule change that prohibits insurers from covering “Sex-trait Modification Procedures” (gender affirming care) as an essential health benefit.32

Footnotes

- “Affordable Care Act (ACA)” HealthCare.gov, Accessed September 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, Aug. 9, 2024 ⤶

- ”State Marketplace Profiles: District of Columbia” KFF.org. Accessed Sep. 23, 2025 ⤶

- “As ACA Marketplace Enrollment Reaches Record High, Fewer Are Buying Individual Market Coverage Elsewhere” KFF.org, Sept. 7, 2023 ⤶

- “Health benefits & coverage” HealthCare.gov, Accessed October 2023 ⤶

- “Why health insurance is important” HealthCare.gov, Accessed September 2023 ⤶

- “What Marketplace health insurance plans cover” HealthCare.gov, Accessed Sep. 23, 2025 ⤶

- “Information on Essential Health Benefits (EHB) Benchmark Plans” CMS.gov. Accessed Sep. 23, 2025 ⤶

- Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year. Centers for Medicare and Medicaid Services. Nov. 15, 2023 ⤶

- “Medical Loss Ratio” CMS.gov, Accessed September 2023 ⤶

- “A quick guide to the Health Insurance Marketplace®” HealthCare.gov, Accessed October 8, 2023 ⤶

- “Subsidized coverage” HealthCare.gov, Accessed Sep. 23, 2025 ⤶

- “Explaining Health Care Reform: Questions About Health Insurance Subsidies” KFF.org, Oct. 6, 2023 ⤶

- “Subsidized coverage” HealthCare.gov, Accessed September 2023 ⤶ ⤶

- “Subsidized coverage” HealthCare.gov, Accessed September 5, 2023 ⤶

- “Cost-sharing reductions” HealthCare.gov, Accessed October 8, 2023 ⤶

- “Effectuated Enrollment: Early 2025 Snapshot and Full Year 2024 Average” CMS.gov, July 24, 2025 ⤶

- ”Effectuated Enrollment: Early 2025 Snapshot and Full Year 2024 Average” Centers for Medicare & Medicaid Services. July 24, 2025 ⤶

- ”Explaining Cost-Sharing Reductions and Silver Loading in ACA Marketplaces” KFF.org. June 26, 2025 ⤶

- ”Actuarial values in ACA health plans: Impact of cost sharing adjustments” Milliman. Jan. 29, 2025 ⤶

- “Affordable Care Act Basics” CMS.gov. Accessed, January 2025 ⤶

- “Health insurance rights & protections” HealthCare.gov, Accessed Sep. 23, 2025 ⤶

- “Essential health benefits” HealthCare.gov, Accessed Sep. 23, 2025 ⤶

- “In Celebration of 10 Years of ACA Marketplaces, the Biden-Harris Administration Releases Historic Enrollment Data” HHS.gov, March 22, 2024 ⤶

- “Inflation Reduction Act Tax Credits Improve Coverage Affordability for Middle-Income Americans” CMS.gov, Accessed September 2023 ⤶

- “About the Affordable Care Act” HHS.gov, Accessed September 2023 ⤶

- “Health Insurance Guaranteed Issue — Background Memorandum” North Dakota Legislative Branch, June 2019 ⤶

- “Section 1557 of the Patient Protection and Affordable Care Act” HHS.gov, Feb. 3, 2023 ⤶

- “Nondiscrimination in Health Programs and Activities” Department of Health and Human Services, April 26, 2024 ⤶

- ”Courts Invoke Loper Bright to Block Expansion of ACA Section 1557 Nondiscrimination Rules to Gender Identity” Thomson Reuters. July 11, 2024 ⤶

- ”ACA Section 1557 Rulemaking Notice of Non-enforcement” The Baldwin Group. June 24, 2025 ⤶

- ”2025 Marketplace Integrity and Affordability Final Rule” Centers for Medicare and Medicaid Services. June 20, 2025 ⤶