Dental insurance

Take the first step toward ensuring your oral health by exploring insurance that may help cover the costs of dental care you may need – whether it’s routine preventive exams and cleanings or more involved dental work.

How to get dental insurance

You can buy individual dental coverage year-round (without a qualifying life event) directly from insurers, from local insurance brokers, or from licensed online vendors that offer multiple insurers’ plans. (Note that the ACA’s pediatric dental benefit rules do not apply to plans purchased outside the exchange/Marketplace.)

You can also buy dental insurance through the public health insurance exchange/Marketplace in your state, but this is generally limited to the same open enrollment and special enrollment periods that apply to health insurance.

And in most states (including all of the states that use HealthCare.gov as their exchange), you can only buy a Marketplace dental plan if you’re also buying a health insurance plan at the same time.

If your employer offers dental insurance, you can enroll in it when you first become eligible, or during the employer’s annual open enrollment period.

Your state’s exchange is a good place to start, though you will likely find that you can only purchase dental coverage through the exchange if you’re also purchasing health insurance. Federal legislation has been introduced in 2023 (still in committee as of June 2023) that would allow a person to buy stand-alone dental coverage through the exchange even if they’re not also buying health insurance.

If you love your dentist, make sure they’re in the provider network of any plan you’re considering. If they don’t accept any dental insurance you might need to consider a dental PPO or an indemnity plan, as these types of policies don’t require a policyholder to see an in-network dentist to receive some benefits under the plan.

When comparing dental plans, pay close attention to factors like waiting periods (generally only required for major services), deductibles, benefit caps, and monthly premiums. You may find that in your situation it’s worthwhile to pay a larger premium in order to have more extensive coverage or a shorter waiting period for certain services, for example.

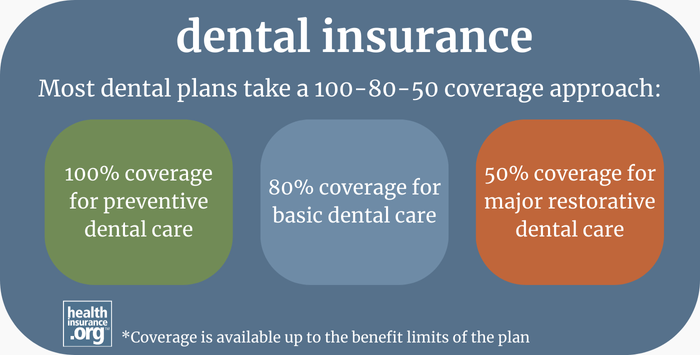

(Basic services include fillings and extractions. Some plans may also cover deep cleanings as a basic service. Major services include crowns, bridges, root canals, implants, and dentures.).

How much could you save on coverage?

Explore your dental coverage options.

Is dental insurance worth it?

Depending on the premium for the plan you’re considering, you may find that you come out ahead by paying for the dental insurance. But perhaps that’s assuming you’ll make full use of the benefits and get yourself to the dentist for all of your routine care.

If you’re currently spending $0 on dental care because you just don’t go to the dentist, you’ll obviously start spending more now with a dental plan, since you have to pay the premiums. But routine dental care can help to avoid major dental care down the road. Your future self — and your wallet — will thank you.

What does dental insurance cover?

The benefits and cost of your dental coverage will depend on whether your plan is offered by an employer, obtained through a public health insurance Marketplace, provided as part of your state’s Medicaid program, obtained through a Medicare Advantage plan, or purchased directly from a dental insurance company.

Your policy may give you access to cleanings and routine exams with low – even $0 – out-of-pocket costs. And it may cover a portion of the cost of fillings and extractions after your deductible is met.

Some plans may also pay some of the cost of more extensive dental work, such as root canals, crowns, endodontics, and periodontics. But plans may have a waiting period for these services, or may cover a larger percentage of their cost after your plan has been in effect for a certain amount of time.

Some dental plans include benefits for cosmetic orthodontia services. Under pediatric dental coverage obtained via a health insurance Marketplace, orthodontia services will generally only be covered when considered medically necessary. It’s important to carefully review a dental insurance policy before and after purchasing.

Frequently asked questions about dental insurance

What insurance covers dental implants?

The specifics of what’s covered by dental insurance varies considerably from one dental plan to another. While many dental plans stick to the “basics” by covering preventive / routine care, some plans are more comprehensive – covering at least part of the cost of some expensive dental procedures.

Oral surgery, impacted extractions, and crowns are often covered, at least in part, by dental insurance plans. And depending on the plan and the circumstances, you may find that it may pay part of the cost of a dental bridge.

But some expensive dental procedures tend to be considered cosmetic rather than restorative, and are thus less likely to be covered. Veneers, for example, are generally considered cosmetic and typically are not covered by dental insurance. Some dental plans may cover some of the cost of implants, but a plan may consider implants to be cosmetic and thus will not cover the cost.

Employer-sponsored dental plans can be more generous, particularly if the employer is focused on creating a competitive benefits package. Some employers focus on keeping premiums as low as possible, so their dental benefits might be fairly basic. But other employers focus on providing a competitive benefits package, including robust dental coverage, as part of their recruiting and retention strategy.

So dental benefits vary considerably from one employer to another. But you may find that your employer offers a dental plan that does cover at least some of the cost of services like braces, implants, and bridges.

However, even when a dental plan does cover expensive services, it’s important to keep in mind that nearly all dental plans have annual benefit caps that can seem fairly low in comparison to the cost of major dental work. For example, if your plan has a $1,500 benefit cap and you’re getting a $5,000 dental implant that’s covered by your plan, you’ll still have a considerable out-of-pocket expense after the plan pays its maximum allowable benefit.

How much does a dental bridge cost without insurance?

Dental bridges can range in price from around $1,000 to $5,000 per tooth, assuming implants are not needed to support the bridge. Some dental plans may cover at least a portion of the cost of a bridge.

But depending on the total cost and the specifics of your dental plan, you may find that dental bridges exhaust the plan’s annual benefit cap and have to pay the rest of the charges yourself.

How much is a dental cleaning without insurance?

According to an analysis by CareCredit, a dental cleaning can range from $75 to $200, depending on the dentist you use. Another study found that, including x-rays, which are often done in conjunction with a cleaning, the cost for a teeth cleaning visit can be $300 or more.

Many dental plans will cover all or most of the cost of routine check-ups, cleanings, and x-rays, as long as you use a provider who is in the dental plan’s network. You might find that a basic dental plan nearly pays for itself when you factor in your reduced out-of-pocket costs for semi-annual dental cleanings.

Can you get dental insurance without a waiting period?

If you’re shopping for a dental plan because you’re in need of dental work other than preventive care, be aware that there may be waiting periods for dental plans before they’ll pay for services. The waiting period can potentially be waived if you’re transitioning from a comparable dental plan, but it will be applicable if you haven’t had recent dental coverage.

Which companies offer dental insurance?

There are hundreds of carriers that sell dental insurance in the US. The National Association of Dental Plans lists more than 240 member insurers, although many of them are affiliate entities of a variety of well-known parent organizations. For example, among the top 25 dental carriers in the large employer market, nearly half are Delta Dental member companies that operate in specific states.

Some dental insurers provide group coverage that employers can offer as part of an employee benefits package, others sell individual/family dental plans, and some offer both types of coverage. Dental insurers can also partner with state Medicaid agencies or Medicare Advantage plans, and provide dental benefits to enrolled members.

Footnotes

- 2023 National health interview survey.cdc.gov, May 2024. ⤶

- Cavity Facts. cdc.gov. May 15, 2024. ⤶

- Oral health in America. nidcr.nih.gov, Accessed September, 2024. ⤶