In this article

- Open enrollment for 2026 coverage has ended.

- Starting in the fall of 2026, the deadline will be December 15 in most states.

- What states ended open enrollment for 2026 on January 15, 2026?

- What states did not end open enrollment for 2026 on January 15, 2026?

- For some coverage programs or applicants, enrollment is available year-round.

- Outside of open enrollment, you normally need a qualifying event to enroll.

- The open enrollment schedule has varied over the years.

What was the deadline to enroll in 2026 ACA-compliant health insurance coverage in the individual market?

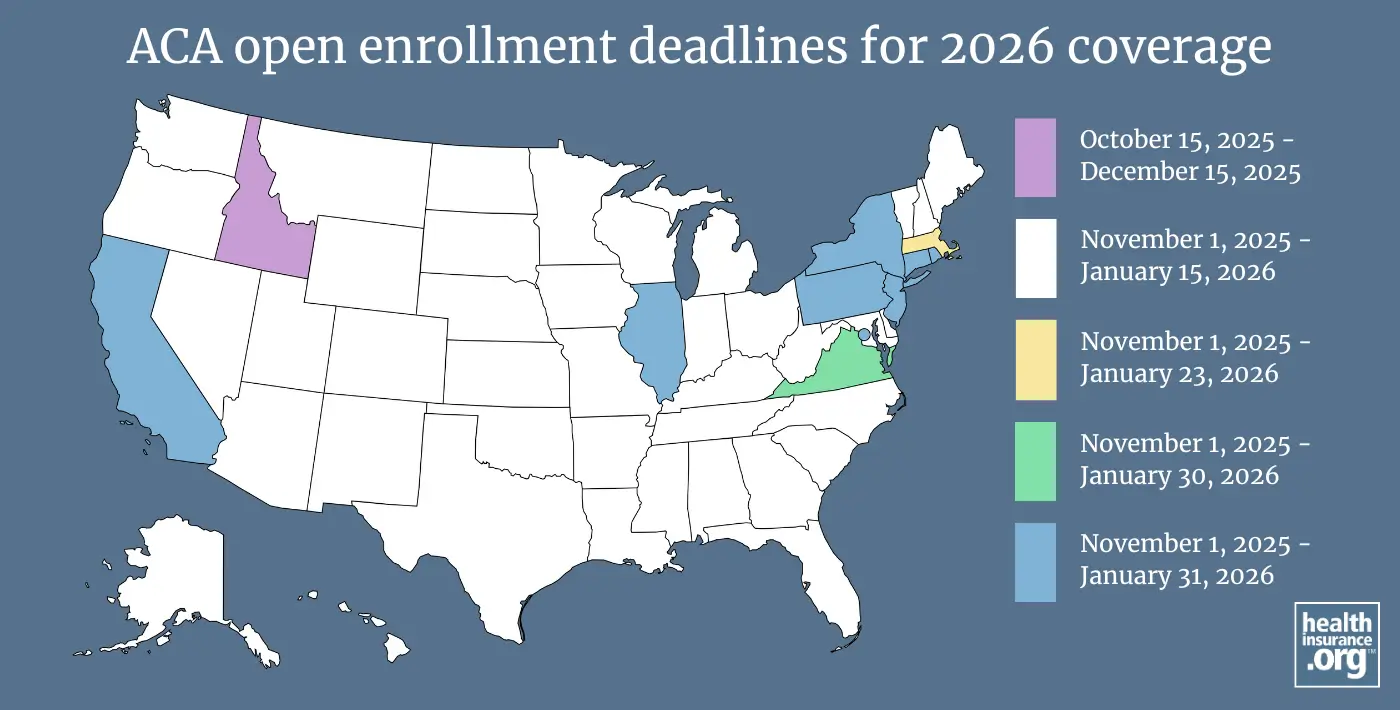

In most states, open enrollment for individual/family health coverage for 2026 ended on January 15, 2026, although it ended in December 2025 in Idaho, and there are several states where it continued until January 31, 2026. Washington, DC had the latest enrollment deadline, of February 4, which a last-minute extension.1

Although open enrollment has ended in Connecticut, people who are eligible for Connecticut's new state-funded subsidies have a special enrollment period that began February 1, 2026.2

And in Illinois, people whose 2025 coverage automatically renewed — and who had not claimed their Get Covered Illinois account by February 1, 2026 — have a special enrollment period that runs through March 31, during which they can select a different plan to cover them for the rest of 2026.3 (Illinois transitioned from HealthCare.gov to the Get Covered Illinois platform for the 2026 plan year; Illinois residents with HealthCare.gov were assigned Get Covered Illinois accounts as part of the transition, but some enrollees didn't visit the new site and let their coverage auto-renew instead. These people are eligible for the special enrollment period.)

How is the open enrollment schedule changing for 2027 coverage?

Starting in the fall of 2026, open enrollment will be shorter and will end on December 15 in many states. And all plans selected during open enrollment will take effect on January 1, as there will no longer be an option for a February 1 start date without a special enrollment period. State-run exchanges will have the option to extend their enrollment period later than December 15, but not later than December 31.4

But for coverage effective in 2026, the open enrollment period followed the same schedule that had been used for the last few years, with most states running open enrollment from November 1 through January 15. Now that open enrollment has ended, a person will need to qualify for a special enrollment period to enroll in coverage with a 2026 effective date. This is true for both on-exchange and off-exchange individual market coverage. (Note that most special enrollment periods require that the person already had minimum essential coverage before the qualifying life event.)5

What states had a January 15 open enrollment deadline for 2026 health insurance?

In 40 states, the deadline to enroll in individual/family health coverage for 2026 was January 15, 2026. Most of these states use HealthCare.gov and thus do not have the discretion to set their enrollment dates. But 10 of the 21 state-run exchange platforms used the same enrollment schedule:

- Alabama

- Alaska

- Arizona

- Arkansas

- Colorado (state-run exchange)

- Delaware

- Florida

- Georgia (state-run exchange)

- Hawaii

- Indiana

- Iowa

- Kansas

- Kentucky (state-run exchange)

- Louisiana

- Maine (state-run exchange)

- Maryland (state-run exchange)

- Michigan

- Minnesota (state-run exchange)

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada (state-run exchange)

- New Hampshire

- New Mexico (state-run exchange)

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont (state-run exchange)

- Washington (state-run exchange)

- West Virginia

- Wisconsin

- Wyoming

What states did not have a January 15 deadline to enroll in 2026 health insurance?

Fully state-run exchanges (there are 21 of them for the 2026 plan year) have some flexibility in terms of the enrollment deadlines they set. About half of these state-run exchanges used a November 1 - January 15 open enrollment schedule for 2026 coverage. However, 11 of the state-run exchanges had different enrollment windows. Here are the enrollment deadlines used by the rest of the state-run exchanges for 2026 coverage:

- California: January 31, 2026

- Connecticut: January 31, 20266 (plus a special enrollment period starting February 1 for people eligible for the state's new state-funded subsidies).2

- District of Columbia: February 4, 2026 (last-minute deadline extension; normal deadline is January 31 in DC)1

- Idaho: December 15, 20257 (only state where open enrollment ended in December)

- Massachusetts: January 238

- Illinios: January 31, 2026 (last-minute extension)9

- New Jersey: January 3110

- New York: January 3111

- Pennsylvania: January 31, 202612

- Rhode Island: January 31, 202613

- Virginia: January 30, 202614

As noted above, open enrollment for 2027 coverage will end no later than December 31, 2026, even in states that have historically extended open enrollment through the end of January.

Who can enroll in ACA-compliant health plans year-round?

Year-round enrollment is available for some populations and for some types of health coverage, without a need for a specific qualifying life event. This includes:

- American Indians and Alaska Natives

- Coverage under the Basic Health Programs in Minnesota, Oregon, and DC,15 and the BHP-like program in New York.

- Coverage under the ConnectorCare program in Massachusetts, for people who are newly eligible or who haven't enrolled before16

- Coverage under Connecticut's Covered Connecticut program17

- Applicants who are eligible for Medicaid or CHIP can enroll year-round.18

Outside of ACA's open enrollment window, enrollment is only available with a special enrollment period

After open enrollment ends, people can normally only purchase coverage if they have a special enrollment period (SEP). Most SEPs are triggered by a specific qualifying event such as:

- Marriage (since 2017, this generally only applies if at least one spouse already had coverage before the wedding, although there are some exceptions),

- Becoming a U.S. citizen,

- Birth or adoption,

- Involuntary loss of other health coverage.

- A permanent move to an area where new health plans are available (since July 2016, this only applies in most cases if you already had coverage prior to your move).

- Here’s a complete guide to qualifying events in the individual market, and their associated special enrollment periods. Note that in most cases, special enrollment periods can be used to obtain replacement coverage, but not to go from being uninsured to insured. But some qualifying life events, such as the birth of a baby, will allow a household to obtain new coverage even if they weren't previously insured.

Regardless of whether you purchase insurance through the exchange or off-exchange, the annual open enrollment window applies, and special enrollment periods are necessary to enroll at any other time of the year.

Open enrollment schedule has varied over time

In the federally-run marketplaces, the following enrollment windows have been used (with some last-minute extensions, and with somewhat different schedules used by the state-run marketplaces):

- 2014 coverage: October 1, 2013 through March 31, 2014

- 2015 coverage: November 15, 2014 through February 15, 2015

- 2016 coverage: November 1, 2015 through January 31, 2016

- 2017 coverage: November 1, 2016 through January 31, 2017

- 2018 coverage: November 1, 2017 through December 15, 2017

- 2019 coverage: November 1, 2018 through December 15, 2018

- 2020 coverage: November 1, 2019 through December 15, 2019

- 2021 coverage: November 1, 2020 through December 15, 2020

- 2022 coverage: November 1, 2021 through January 15, 2022

- 2023 coverage: November 1, 2022 through January 15, 2023

- 2024 coverage: November 1, 2023 through January 16, 2024 (one-day extension due to a federal holiday)

- 2025 coverage: November 1, 2024 through January 15, 2025

- 2026 coverage: November 1, 2025 through January 15, 2026

- 2027 coverage: November 1, 2026 through December 15, 202619

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- "DC Health Link Enrollment Deadline Extended" HillRag. Feb. 2, 2026 ⤶ ⤶

- "Access Health CT to Offer Special Enrollment Period for Eligible Customers to Enroll in Coverage with New State Subsidy" Access Health CT. Jan. 23, 2026 ⤶ ⤶

- "Limited-time marketplace transition year Special Enrollment Period" Get Covered Illinois. Accessed Feb. 6, 2026 ⤶

- "Patient Protection and Affordable Care Act; Marketplace Integrity and Affordability" Federal Register, U.S. Department of Health & Human Services. June 25, 2025 ⤶

- "Title 45 § 155.420 Special enrollment periods" Code of Federal Regulations. Accessed Jan. 18, 2026 ⤶

- "Deadline to Enroll in Health and Dental Coverage Through Access Health CT Has Been Extended to Jan. 31" Accessed Health CT. Jan. 2, 2026 ⤶

- "How to Enroll" Your Health Idaho. Accessed Oct. 18, 2025 ⤶

- "Important Dates" Massachusetts Health Connector. Accessed Oct. 18, 2025 ⤶

- "Get Covered Illinois announcement" Jan. 12, 2026 ⤶

- "When Can I Buy Health Insurance?" Get Covered NJ. Accessed Oct. 18, 2025 ⤶

- "Open Enrollment and Renewals for the 2026 Plan Year" NY State of Health. Sep. 24, 2025 ⤶

- "Pennie social media post" Instagram. Jan. 3, 2026 ⤶

- "Open Enrollment" HealthSourceRI. Accessed Oct. 18, 2025 ⤶

- "Plan Year 2026 Updates" Virginia Health Insurance Marketplace. Accessed Oct. 18, 2025 ⤶

- "Eligibility Changes to the Medicaid Program Effective January 1, 2026" DC Department of Health Care Finance. Nov. 11, 2025 ⤶

- "Special Enrollment Period" Massachusetts Health Connector. Accessed Jan. 18, 2026 ⤶

- "Covered Connecticut Program" CT.gov. Accessed Jan. 18, 2026 ⤶

- "Medicaid and CHIP coverage" HealthCare.gov. Accessed Jan. 18, 2026 ⤶

- "Patient Protection and Affordable Care Act; Marketplace Integrity and Affordability" Federal Register, U.S. Department of Health & Human Services. June 25, 2025 ⤶