What is modified adjusted gross income (MAGI)?

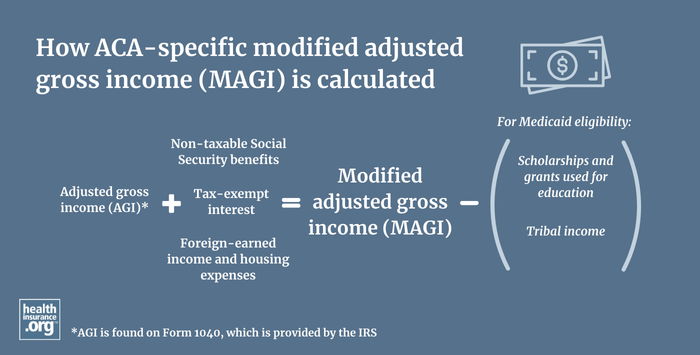

Under the Affordable Care Act (ACA), eligibility for Medicaid, premium tax credits or premium subsidies, and cost-sharing reductions or is based on modified adjusted gross income (MAGI). But the ACA has its own calculation of MAGI, which differs from MAGI calculations used for other purposes.

The details of the MAGI calculation are outlined here. If you have questions or want guidance about your particular circumstances, consult a tax advisor or other professional.

MAGI starts with adjusted gross income (AGI) from Form 1040, but three things must be added to AGI to get MAGI under the ACA. If applicable, you must add in these amounts:

- Non-taxable Social Security benefits (this includes Social Security Disability Insurance benefits (SSDI), but Supplemental Security Income (SSI) does not get counted when the ACA-specific MAGI is determined)

- Tax-exempt interest (typically earned on municipal bonds)

- Foreign-earned income and housing expenses for Americans living abroad

Calculate Yearly Income

Use this to calculate your household’s estimated yearly income. Consider including your income, your spouse’s income, and that of any tax dependents, all of which are usually counted by the Marketplace. After that, provide information about expenses that may be deducted.This calculator is for educational and illustrative purposes only and should not be construed as financial or tax advice. It uses the income and other information you provide. We included categories of income and expenses that the Marketplace commonly (but not always) uses. You should contact a tax advisor or other professional about any specific requirements or concerns.

Click calculate to see updated yearly income

For Medicaid eligibility, some expenses can be subtracted, including scholarships and grants used for education, and certain American Indian/Native American income.

Income received as a lump sum is counted as income only in the month it’s received when determining eligibility for Medicaid (whereas it would be counted as part of an enrollee’s annual income for determining eligibility for premium subsidies), although there’s an exception for lottery and gambling winnings of $80,000 or more — those amounts can be counted as income spread out across up to 120 months.

If you receive advance premium subsidies (paid to your insurer on your behalf) based on your projected MAGI, the amount has to be reconciled on your tax return based on your actual MAGI for the year. But there’s no after-the-fact reconciliation process for Medicaid or cost-sharing reductions.

In other words, Medicaid and CSR eligibility are determined at the time a person applies for coverage, and the benefits do not have to be repaid if the person’s actual MAGI ends up being different from what they projected.

Legislation introduced in Congress in September 2024 calls for the exclusion of income earned by tax dependents when a household's MAGI is calculated to determine eligibility for premium tax credits.1 Under current rules, a dependent's income is included in ACA-specific MAGI if they earn enough money to have to file a tax return. H.R.9831 would exclude tax dependents' income, up to a maximum of 15% of the taxpayer's MAGI.

If enacted, this legislation would help to make health insurance more affordable for families with tax dependents who earn an income, since it would result in a lower MAGI, which in turn results in larger premium subsidies. And the legislation includes a clause noting that it would not apply if it caused the household's MAGI to drop below 100% of the federal poverty level, since subsidies are not available below that level.

Footnotes

- "United States H.R.9831" BillTrack50. Introduced Sep. 25, 2024 ⤶