Home > Health insurance Marketplace > Delaware

Delaware Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Delaware health insurance Marketplace guide

We’ve created this guide, including the FAQs below, to help you understand the health insurance options available to you and your family in Delaware.

ACA Marketplace (exchange) plans – or Obamacare – are available for people who need to buy their own health coverage, including those who aren’t eligible for Medicare, Medicaid, or employer-sponsored coverage.

Delaware has a partnership exchange. The state runs Choose Health Delaware – an informational website – and the federally-facilitated Marketplace platform, HealthCare.gov, is used for enrollment. Delaware residents who need to obtain their own health insurance can use HealthCare.gov to shop for individual and family health coverage offered by various private health insurers.

For several years, there was only one insurance company that offered individual/family coverage through Delaware’s exchange. But four insurance companies are offering coverage for 2024, including another new carrier. All four plan to continue to offer coverage in 2025.3

Frequently asked questions about health insurance in Delaware

Who can buy Marketplace health insurance?

In order to sign up for private health coverage through the Marketplace in Delaware, you must:

- Live in Delaware and be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

By those rules, most Delaware residents qualify to use the Marketplace.4 But a more important question for most people is eligibility for financial assistance, and there are a few additional parameters in order to qualify for subsidies in the Marketplace. To be eligible for income-based Advance Premium Tax Credits (APTC) or cost-sharing reductions (CSR), you must:

- Not be eligible to enroll in affordable health coverage offered by an employer. If you have access to an employer’s plan but it seems too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.5

- File a joint tax return with your spouse, if you’re married.6 (with very limited exceptions)7

- Not be able to be claimed by someone else as a tax dependent.8

In addition to those basic parameters, eligibility for Marketplace subsidies depends on your household income and how it compares with the cost of the second-lowest-cost Silver plan in your area (the cost of this plan will depend on your age and location).

When can I enroll in an ACA-compliant plan in Delaware?

You can sign up for an ACA-compliant individual or family health plan in Delaware between November 1 and January 15, the annual open enrollment period.9

To have a January 1 coverage effective date, you need to complete your application by December 15. Plan selections made between December 16 and January 15 will have a February 1 coverage effective date.10

Outside of the annual open enrollment window, you may still be eligible to enroll or make a plan change if you experience a qualifying life event, such as giving birth or losing other health coverage. And some people can enroll year-round even without a specific qualifying life event.

Enrollment in Delaware Medicaid/CHIP is available year-round.

How do I enroll in a Delaware Marketplace plan?

To enroll in an ACA Marketplace plan in Delaware, you can:

- Visit HealthCare.gov to compare plans, see your subsidy eligibility (if applicable), and enroll in the plan that best meets your needs.

- Use the state-based Choose Health Delaware website to learn about the available health plans. You’ll be directed to the HealthCare.gov platform in order to enroll.

- Purchase Marketplace coverage with the help of an insurance agent or broker, Navigator, or certified application counselor. These individuals can provide help online, over the phone, or in-person.

- Enroll via an approved enhanced direct enrollment entity.11

You can reach HealthCare.gov’s call center by dialing 1-800-318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, seven days a week, except holidays.

How can I find affordable health insurance in Delaware?

The Affordable Care Act (ACA) created income-based subsidies that can help lower your premium payments each month. These subsidies are available to Delaware residents who meet the eligibility requirements and enroll in Marketplace coverage.

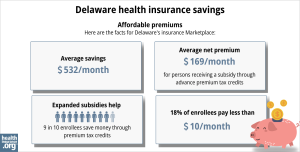

As of early 2024, more than nine out of ten Marketplace enrollees in Delaware were receiving premium subsidies. The subsidies reduced their average health insurance premiums by $588/month. After subsidies were applied, the average Delaware Marketplace enrollee’s premium was about $188/month, including those who weren’t eligible for a subsidy.12

Source: CMS.gov13

Reinsurance: Delaware has a reinsurance program, which has helped to keep full-price premiums lower than they would otherwise have been over the last few years. Although the majority of Delaware’s Marketplace enrollees qualify for premium subsidies, the reinsurance program keeps coverage more affordable than it would otherwise be for those who aren’t subsidy-eligible.14

Cost-sharing reductions: If your household income is no more than 250% of the federal poverty level, you may also be eligible for cost-sharing reductions (CSR), as long as you select a Silver-level plan. These subsidies result in lower out-of-pocket costs, including deductibles. As of 2024, more than a quarter of Delaware’s Marketplace enrollees were receiving CSR benefits.12

Medicaid/CHIP: Depending on your income and circumstances, you may be able to enroll in free or low cost health coverage through Medicaid or CHIP (Delaware Healthy Children). Check to see if you meet the eligibility criteria for Delaware Medicaid/CHIP.

Insulin cost-sharing cap: Delaware caps insulin out-of-pocket costs at $35/month for people with state-regulated health insurance, which includes Marketplace plans.15 And cost-sharing for specialty drugs is capped at no more than $150/month for Delaware residents enrolled in state-regulated health plans.16

How many insurers offer Marketplace coverage in Delaware?

Are Marketplace health insurance premiums increasing in Delaware?

The following table shows each Delaware Marketplace insurer’s approved rate changes for 2025 individual/family health plans.18 Based on the market share listed in each insurer’s rate justification (details below), the weighted average overall rate change amounts to an increase of about 8.4%.3

Delaware’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Aetna Health | 11.7% |

| AmeriHealth Caritas | 6.05% |

| Highmark BCBSD | 9% |

| Celtic | -14% |

Source: Delaware Department of Insurance318

Here is the market share for each carrier, according to their filings:3

- Aetna: 4,069 enrollees

- AmeriHealth: 4,181 enrollees

- Celtic: 954 enrollees

- Highmark: 33,116 enrollees

Based on those numbers and the final approved rates, the overall weighted average rate increase amounts to about 8.4% for 2025. But there’s a lot of variation from one carrier to another. The final approved rates for some of the carriers were significantly lower than the carriers had initially proposed; the initial proposals amounted to a weighted average rate increase of 13.3%. But Highmark’s rates were approved as filed, and they have by far the majority of the market share in Delaware’s individual market.18

It’s important to keep in mind that average rate changes are calculated based on full-price premiums, and most enrollees do not pay full price: As of 2024, more than nine out of ten Delaware Marketplace enrollees were receiving premium subsidies that reduced their monthly payments.12

For perspective, here’s an overview of how average full-price premiums have changed in Delaware over time:

- 2015: Average increase of 3%19

- 2016: Average increase of 22%20

- 2017: Average increase of 30%21

- 2018: Average increase of 25%22

- 2019: Average increase of 3%23

- 2020: Average decrease of 19%24 (reinsurance program took effect)

- 2021: Average decrease of 1%25

- 2022: Average increase of 3%26

- 2023: Average increase of 5.5%27 (plus two new insurers)

- 2024: Average increase of 3.1%28 (plus one new insurer)

How many people are insured through Delaware’s Marketplace?

During the open enrollment period for 2024 coverage, 44,842 people enrolled in private health plans through the Delaware Marketplace.29

This was a significant record high, far exceeding the previous record high set the year before, when 34,742 people selected private plans through Delaware’s Marketplace.30

Source: 2014,31 2015,32 2016,33 2017,34 2018,35 2019,36 2020,37 2021,38 2022,39 2023,30 2024,40 202541

The enrollment growth in recent years, illustrated above, stems in large part from the subsidy enhancements created by the Amerian Rescue Plan and Inflation Reduction Act.

The enrollment growth in 2024 is also partially due to the “unwinding” of the pandemic-era continuous coverage rule for Medicaid, which prevented Medicaid disenrollments for three years. By April 2024, nearly 15,000 people in Delaware had transitioned from Medicaid to a Marketplace plan.42

What health insurance resources are available to Delaware residents?

HealthCare.gov

This is the Marketplace enrollment platform in Delaware. Residents can use it to enroll in individual/family health plans and receive income-based subsidies. You can contact HealthCare.gov at 800-318-2596.

Choose Health Delaware

Delaware’s partnership exchange/Marketplace. Helps consumers learn about coverage options in the Marketplace, and directs them to HealthCare.gov for enrollment.

Quality Insights, Inc.

Delaware’s federally funded Navigator organization, helping residents find affordable coverage through the Marketplace and the state’s Medicaid/CHIP program.

Delaware Health and Social Services

Administers Medicaid and Delaware Healthy Children (CHIP), as well as other social services programs.

Delaware Department of Insurance

Regulates and oversees the insurance industry in Delaware, and assists consumers and businesses with insurance-related questions and concerns.

Delaware Medicare Assistance Bureau

A resource for Delaware Medicare beneficiaries and their caregivers. Provides information and assistance with questions related to Medicare eligibility, enrollment, and claims.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Delaware?

Explore more resources for options in Delaware including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- ”Health Insurance Rate Filings” Delaware Department of Insurance. Accessed July 31, 2024 ⤶ ⤶ ⤶ ⤶ ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed January 12, 2024. ⤶

- ”A Quick Guide to the Health Insurance Marketplace; When Can You Get Health Insurance?” HealthCare.gov ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶ ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- Reinsurance Program. Delaware.gov. Accessed December 2023. ⤶

- ”Delaware Caps Monthly Cost of Diabetes Supplies at $35” DiaTribeLearn. November 2022 ⤶

- ”Prescription Drug Spending and Rebates in Delaware” Delaware Department of Insurance, July 2022 ⤶

- 2024 Health Insurance Rate Filings. Delaware Department of Insurance. Accessed November 2023. ⤶

- ”Health Insurance Marketplace Data Released; Rates Finalized” Delaware Insurance Commissioner, Sep. 16, 2024 ⤶ ⤶ ⤶

- ”Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums” The Commonwealth Fund. December 2014 ⤶

- ”FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally*” ACA Signups. October 2015 ⤶

- ”Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups. October 2016 ⤶

- ”Highmark’s Obamacare policies to rise 25 percent in Delaware” Delaware Online. October 5, 2017 ⤶

- ”Final ACA Individual Rate Increase 3% / Highmark to Rebate Over $5 Million to Small Groups” Delaware Department of Insurance ⤶

- ”Nov 1 – Dec 15: Open Enrollment for Delaware’s Health Insurance Marketplace” Delaware Department of Insurance ⤶

- ”Rates To Decrease In Delaware Affordable Care Act Marketplace” Delaware Department of Insurance ⤶

- ”2022 Highmark BCBSD – Individual (Marketplace) Plans” Delaware Department of Insurance ⤶

- ”2023 Highmark BCBSD – Individual (Marketplace) Plans” Delaware Department of Insurance ⤶

- ”UPDATE: Delaware: *Final* Avg. Unsubsidized 2024 #ACA Rate Changes: +3.1% (Down From 4.7%)” ACA Signups. Aug. 30, 2023 ⤶

- Marketplace 2024 Open Enrollment Period Report: Final National Snapshot. Centers for Medicare and Medicaid Services. January 2024. ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶ ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- HealthCare.gov Marketplace Medicaid Unwinding Report. Centers for Medicare and Medicaid Services. Data through April 2024; Accessed July 31, 2024 ⤶