Home > Health insurance Marketplace > Missouri

Missouri Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Missouri health insurance Marketplace guide

This guide, including the FAQs below, was created to help you understand the health insurance options available to you and your family in Missouri. An Affordable Care Act (ACA) Marketplace plan is cost-effective for many people.

These plans are also called Obamacare or exchange plans (exchange is another word for Marketplace). Missouri uses the federally-facilitated health insurance Marketplace, HealthCare.gov. The Marketplace website will let you shop for health plans offered by nine private insurance companies (plan availability varies from one area of the state to another).3 If you buy a plan on the Marketplace, the government may help pay for it through an income-based advance premium tax credit.

Frequently asked questions about health insurance in Missouri

Who can buy Marketplace health insurance?

You can buy individual and family health insurance from Missouri’s Marketplace if:4

- You live in Missouri.

- You are lawfully present in the U.S.

- You don’t have Medicare.

- You are not incarcerated.

Eligibility for financial assistance with your Marketplace coverage will depend on your income. In addition, to be eligible for financial assistance in the Marketplace:

When can I enroll in an ACA-compliant plan in Missouri?

In Missouri, the open enrollment period to sign up for ACA-compliant individual and family health plans is from November 1 to January 15.

- If you enroll by December 15, your coverage starts on January 1.

- If you enroll between December 16 and January 15, your coverage starts February 1.7

Outside of open enrollment, you can still make plan changes or enroll in the Marketplace if you qualify for a special enrollment period (SEP). Most SEPs require a qualifying life event, such as involuntary loss of coverage, marriage, or having a baby.

But there are instances where you don’t need a qualifying life event to apply.8 For example:

- If you’re eligible for premium tax credits and your income is not more than 150% of the poverty level, you can enroll anytime.

- If you’re an Alaska Native or American Indian, you can enroll anytime.9

- If you lose Medicaid or CHIP between March 31, 2023 and November 30, 2024, you can enroll through the extended SEP that continues throughout that window.10

How do I enroll in a Marketplace plan in Missouri?

In Missouri, you have a few options to enroll in a Marketplace health plan:

- Directly through HealthCare.gov – the ACA exchange

- By phone at (800) 318-2596

- By contacting agents, navigators, certified application counselors or an approved enhanced direct enrollment entity.11

- By mailing in a paper application

Many people – like early retirees not yet on Medicare, self-employed people, and those who work for small businesses without health benefits – use the ACA Marketplace.

How can I find affordable health insurance in Missouri?

In Missouri, you can find affordable health plans through the ACA Marketplace’s website: HeathCare.gov.

Under the ACA, you may qualify for income-based subsidies called Advance Premium Tax Credits (APTC). These credits lower your premiums.

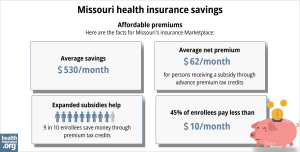

As of early 2024, 95% of the people with effectuated coverage through Missouri’s exchange were receiving premium subsidies, saving an average of $595 per month. The average after-subsidy premium (including the 5% of people paying full price) was about $85/month.12 (Note that these numbers are based on effectuated enrollment in early 2024, so they differ from the graphic below, which is based on total enrollment during the open enrollment period that began in the fall of 2023.)

If your income isn’t more than 250% of the federal poverty level, you may also receive cost-sharing reductions (CSR), as long as you enroll in a Silver-level plan.13 CSRs reduce your out-of-pocket costs when you use your health insurance.

Source: CMS.gov 14

Missourians may also find affordable coverage through Medicaid if eligible. Missouri expanded Medicaid eligibility guidelines in 2021, under the terms of a voter-approved ballot measure that implemented the ACA’s Medicaid expansion. This allows adults younger than 65 to enroll in Medicaid with a household income up to 138% of the poverty level. Learn more in our Missouri Medicaid guide.

Short-term plans are also a low-cost option for people who are not eligible for employer plans, Medicaid, Medicare, or subsidies through the exchange. However, for short-term plans issued starting in September 2024, new federal rules limit initial terms to no more than three months, and total duration are capped at four months, including renewals.

How many insurers offer Marketplace coverage in Missouri?

For 2025, nine insurers are offering coverage in Missouri’s Marketplace.15 Three of the insurers are expanding their coverage area for 2025. This includes a UnitedHealthcare expansion to offer coverage statewide (the only carrier to do so). The other six carriers will continue to offer coverage in the same number of counties they serviced in 2024.16

So although plan availability varies from one area to another, all counties in Missouri have Marketplace plans available from at least two insurers for 2025, and 71 of the state’s 115 counties have plans available from at least five insurers.15

There were ten insurers offering plans in 2023,17, but Cigna exited Missouri’s individual insurance market at the end of 2023.18

Are Marketplace health insurance premiums increasing in Missouri?

Here are the average rate changes that were approved for 2025 for Missouri’s Marketplace insurers (before any subsidies are applied)16

Missouri’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Aetna | 7.25% |

| Blue Cross Blue Shield of Kansas City | 9.91% |

| Celtic Insurance Company | -7.24% |

| Cox Health Systems Insurance Company | 0.82% |

| Healthy Alliance Life Insurance Company (Anthem) | 0.56% |

| Medica Insurance Company | -5.46% |

| Oscar Insurance Company | 1.14% |

| Medica WellFirst (previously SSM) | -1.76% |

| United HealthCare Insurance Company | 5.16% |

Source: Missouri Department of Insurance16

The approved rate changes apply to full-price premiums. Since most people on Missouri’s exchange receive premium tax credits, they don’t pay the full price.12 If you qualify for subsidies, your net rate change depends on changes in your plan rates and your subsidy amounts.

A note about rate review in Missouri: Prior to 2017, Missouri did not have an effective rate review program, but that changed in 2017 (as of 2024, only three states — Oklahoma, Tennessee, and Wyoming — do not have an effective rate review program and thus rely on the federal government for this).19

Since 2017, under the terms of SB865, the Missouri Department of Insurance has taken an active role in reviewing insurers’ proposed rate changes.20 State regulators determine whether the proposed rates are justified, although they are not allowed to prevent an insurer from implementing a rate change, even if the state does not consider it to be justified (this is the same as the federal rate review process).

For perspective, here’s a summary of how unsubsidized premiums have changed over the years in Missouri’s individual/family health insurance market:

- 2015: Average increase of 9%21

- 2016: Average increase of 14%22

- 2017: Average increase of 25.5%23

- 2018: Average increase of 40%24

- 2019: Average increase of 1.6%25

- 2020: Average decrease of 2%26

- 2021: Average increase of 4.7%.27

- 2022: Average increase of 2.3%.28

- 2023: Average increase of 11%29

- 2024: Average increase of 4.6%30

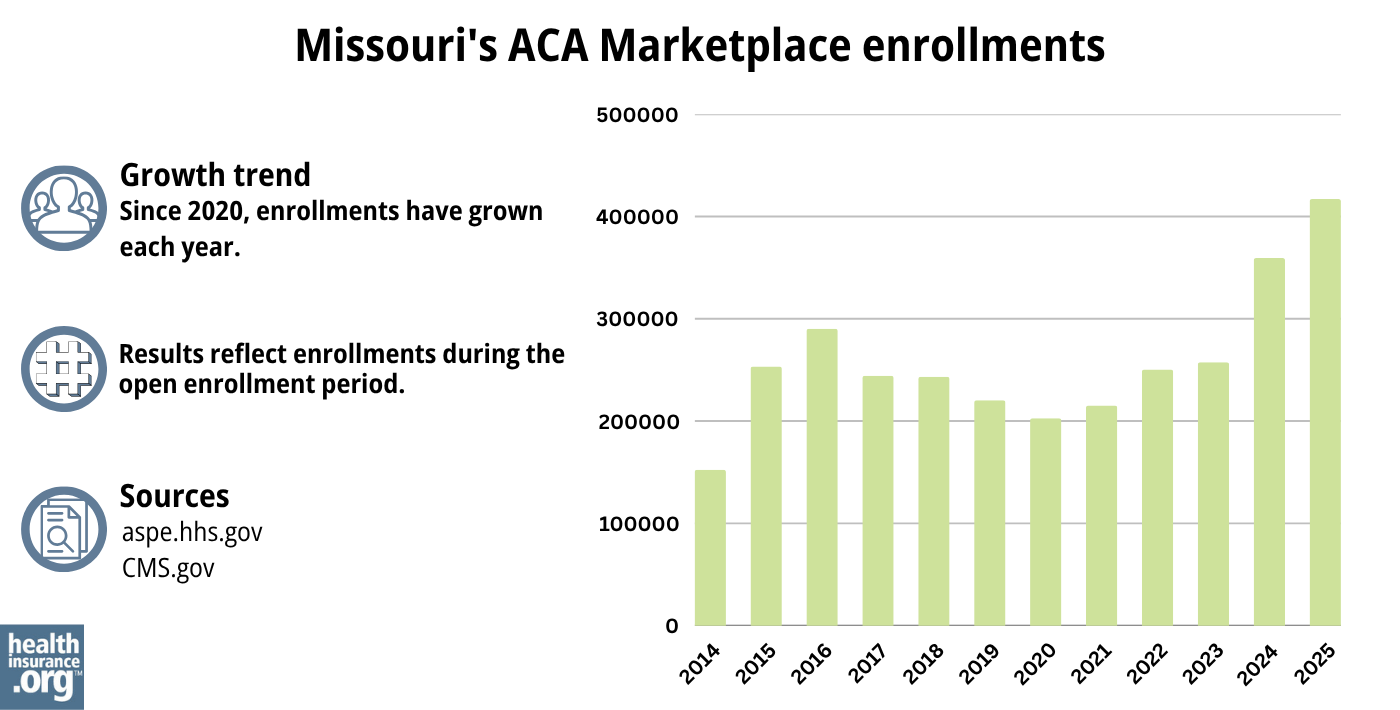

How many people are insured through Missouri’s Marketplace?

During the open enrollment period for 2024 coverage, 359,369 people signed up for private health plans through Missouri’s exchange/Marketplace.31 This was a significant new record high (see graph below).

Usually, when a state expands Medicaid, Marketplace enrollment drops. That’s because people with income between 100 and 138% of the federal poverty level transfer from Marketplace plans to Medicaid.

But Missouri’s Marketplace enrollment grew in 2022 and 2023 despite the 2021 Medicaid expansion. This growth is likely because of larger subsidies from the American Rescue Plan and the Inflation Reduction Act. The larger and more accessible subsidies make coverage more affordable.32

And the enrollment growth in 2024 was also driven by the “unwinding” of the pandemic-era Medicaid continuous coverage rule. CMS reported that by April 2024, more than 124,000 Missouri residents had transitioned from Medicaid (MO HealthNet) to a Marketplace plan.33

Source: 2014,34 2015,35 2016,36 2017,37 2018,38 2019,39 2020,40 2021,41 2022,42 2023,43 2024,44 202545

What health insurance resources are available to Missouri residents?

HealthCare.gov

The official federal website where you can sign up for health insurance plans through the ACA Marketplace.

Missouri Department of Insurance

Oversees and regulates health plans, brokers, and agents.

MO HealthNet

Missouri’s Medicaid.

Missouri State Health Insurance Assistance Program (Missouri SHIP)

Helps Missourians with Medicare benefits.

Medicare Rights Center

National resource with a website and call center to provide information and help for people on Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Missouri?

Explore more resources for options in Missouri including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- ”Missouri Department of Commerce and Insurance releases health insurance rates for 2025 with more choices for Missourians” Missouri Department of Commerce and Insurance. November 1, 2024. ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed May 10, 2024 ⤶ ⤶

- “A quick guide to the Health Insurance Marketplace®” HealthCare.gov, Accessed August, 2023 ⤶

- “Who doesn’t need a special enrollment period?“ healthinsurance.org, Accessed August 2023 ⤶

- “AIAN ACA 2021” CMS.gov, Accessed September 2023 ⤶

- ”HHS Takes Additional Actions to Help People Stay Covered During Medicaid and CHIP Renewals” CMS Newsroom. Mar. 28, 2024 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, Aug. 9, 2024 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶

- “Federal Poverty Level (FPL)” HealthCare.gov, 2023 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”Missouri Department of Commerce and Insurance releases health insurance rates for 2024 with more choices for Missourians” Missouri Department of Commerce and Insurance. Nov. 1, 2024 ⤶ ⤶

- ”Missouri Department of Commerce and Insurance releases health insurance rates for 2025 with more choices for Missourians” Missouri Department of Insurance. Nov. 1, 2024 ⤶ ⤶ ⤶

- ”Missouri Department of Commerce and Insurance releases health insurance rates for 2023“ Missouri Department of Insurance. Nov. 1, 2022 ⤶

- ”Missouri Department of Commerce and Insurance releases health insurance rates for 2024 with more choices for Missourians” Missouri Department of Insurance. Nov. 1, 2023. ⤶

- ”State Effective Rate Review Programs” Centers for Medicare and Medicaid Services. Accessed Aug. 5, 2024 ⤶

- ”Missouri SB865; enacted 2016” BillTrack50. Accessed October 2023. ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- Alabama, Hawaii, Missouri, Wyoming: Wrapping Up The 2018 Rate Hike Project W/An Assist From Avalere. ACA Signups. October 2017. ⤶

- 2019 Rate Hike Project Wrap-Up: FINAL/APPROVED Rate Changes For Missouri & New Hampshire. ACA Signups. November 2018. ⤶

- Missouri: *Final* Avg. 2020 #ACA Rate Changes: 2.0% Decrease. ACA Signups. October 2019. ⤶

- Missouri: Preliminary Avg. 2021 #ACA Premiums: +4.7% Indy Market, +9.25% Sm. Group. ACA Signups. September 2020 ⤶

- 2022 Rate Changes. ACA Signups. October 2021. ⤶

- Missouri: Final Avg. Unsubsidized 2023 #ACA Rate Changes: +11.0% (Updated). ACA Signups. July 2022. ⤶

- Missouri: *Final* Avg. Unsubsidized 2024 #ACA Rate Changes: +4.6%. ACA Signups. November 2023. ⤶

- ”Health Insurance Marketplaces 2024 Open Enrollment Period Report” CMS.gov. March 22, 2024 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, Accessed August 2023 ⤶

- ”HealthCare.gov Marketplace Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024; Accessed Aug. 5, 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶