Home > Health insurance Marketplace > Wisconsin

Wisconsin Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Wisconsin health insurance Marketplace guide

This guide, including the FAQs below, was designed to help you understand the Wisconsin health insurance options available for you and your family. The plans found in Wisconsin’s ACA Marketplace may be a good choice for many consumers, and we’re here to help explain the Marketplace and the financial assistance that’s available to most enrollees.

Wisconsin uses the federally-facilitated health enrollment platform, known as HealthCare.gov, for residents to purchase its ACA Marketplace plans. The Marketplace provides access to health insurance products from a total of 14 private insurers, although plan availability varies from one area of the state to another.3 (One additional insurer, Wisconsin Physicians Service Insurance Corporation (WPS), only offers coverage outside the Marketplace.)

Depending on your income and other circumstances, you may qualify for a premium tax credit to lower your monthly insurance premium (the amount you pay to enroll in the coverage) and possibly also a subsidy that will reduce your out-of-pocket expenses.

Wisconsin created a reinsurance program starting in 2019 (the Wisconsin Healthcare Stability Plan), which has helped to keep pre-subsidy health insurance premiums lower than they would otherwise be.3

Frequently asked questions about health insurance in Wisconsin

Who can buy Marketplace health insurance?

To qualify for health coverage through the Wisconsin Marketplace, you must4:

- Live in Wisconsin

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your income. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage offered by an employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for enrollment in Medicaid/CHIP (BadgerCare).

- Not be eligible for premium-free Medicare Part A.5

- If married, file a joint tax return.6

- Not be able to be claimed by someone else as a tax dependent.6

When can I enroll in an ACA-compliant plan in Wisconsin?

In Wisconsin, you can sign up for an ACA-compliant individual or family health plan from November 1 to January 15 during open enrollment.7

If you need your coverage to take effect on January 1, you must apply by December 15. If you apply between December 16 and January 15, your coverage will begin on February 1.8

Outside of open enrollment, you’ll need a special enrollment period to sign up for coverage or switch to a different plan. In most cases, special enrollment periods are linked to specific qualifying life events.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

How do I enroll in a Wisconsin Marketplace plan?

To enroll in an ACA Marketplace plan in Wisconsin, you can:

- Visit HealthCare.gov to access Wisconsin’s health insurance Marketplace. Here you will find an online platform to shop, compare, and choose the best health plans.

- Call the HealthCare.gov call center at 1-800-318-2596 (TTY: 1-855-889-4325). The Marketplace call center is available 24 hours a day, 7 days a week (closed on holidays)

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator or certified application counselor. Use the “find local help” tool to locate enrollment assisters in your area.

- Enroll via an approved enhanced direct enrollment entity.9

How can I find affordable health insurance in Wisconsin?

You may find affordable health insurance options in Wisconsin by signing up through HealthCare.gov – especially if you’re eligible for subsidies, which most people are.

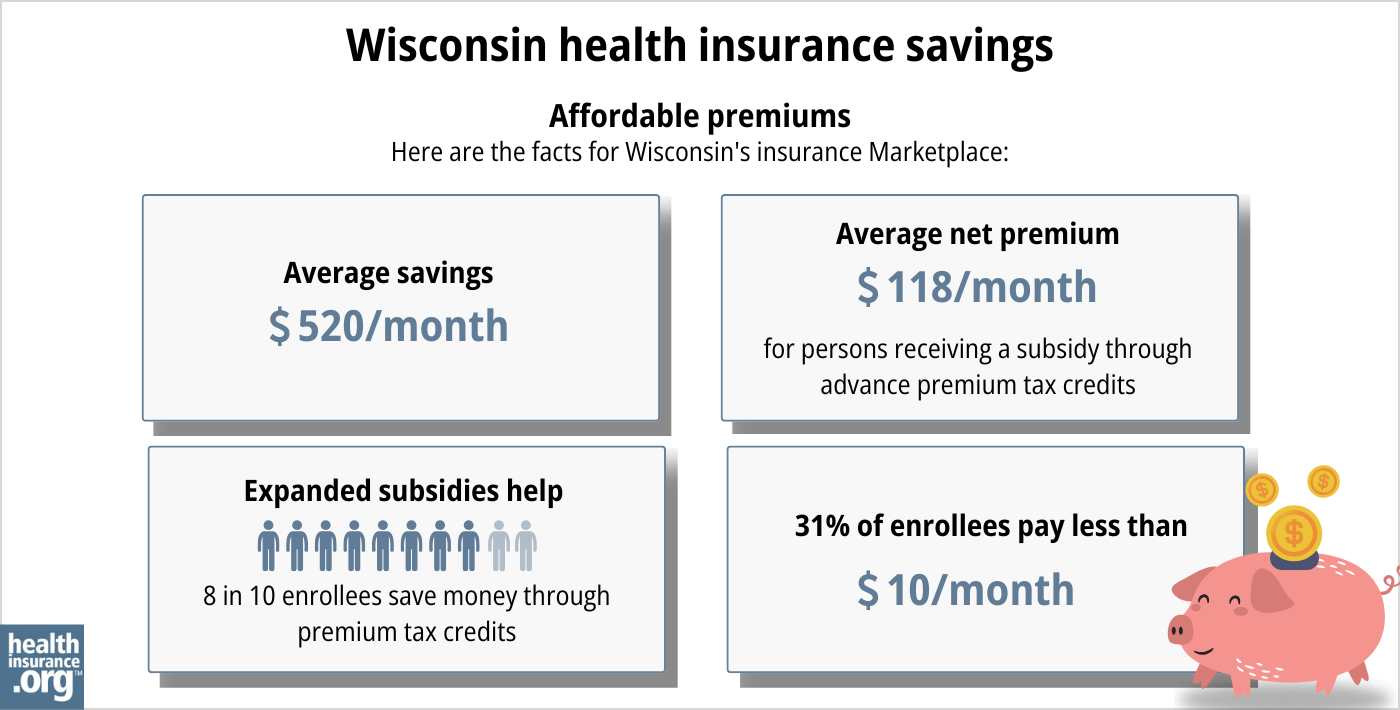

As of early 2024, almost nine out of ten Wisconsin health insurance Marketplace enrollees were receiving premium subsidies that amounted to an average savings of $573/month. As a result, the average enrollee’s net premium — including those who paid full price — was about $161.10

(Note that the chart below includes some different metrics and is based on total enrollment during the open enrollment period for 2024 coverage, whereas the numbers above are based on effectuated enrollment in early 2024.)

Source: CMS.gov11

The Affordable Care Act also ensures that people with household incomes up to 250% of the poverty level can enroll in Silver-level plans with reduced out-of-pocket costs, thanks to cost-sharing reduction (CSR) subsidies.12

Between the premium subsidies and cost-sharing reductions, you may find that an ACA Marketplace plan offers the best value in terms of fitting your coverage needs and budget.

Wisconsin has not expanded Medicaid under the ACA, but also does not have a coverage gap. This is because Wisconsin allows adults with income under the poverty level to enroll in Medicaid, and Marketplace subsidies pick up where that ends, allowing those with income of at least the poverty level to enroll in subsidized Marketplace coverage. As a result, Wisconsin is the only non-expansion state that doesn’t have a coverage gap.13

How many insurers offer Marketplace coverage in Wisconsin?

Fourteen insurers offer individual and family plans in Wisconsin’s exchange in 2025 (plus one insurer that only offers plans outside the exchange).3

These are the same insurers that offered plans in 2024, although one carrier — UnitedHealthcare — was new for 2024.14

One of Wisconsin’s Marketplace insurers (Common Ground Healthcare Cooperative) is an ACA-created CO-OP, and is one of only three CO-OPs still operational in the U.S.15

In nearly every Wisconsin county, Marketplace enrollees can select from among at least three insurers’ plans for 2025.3 (In 2024, residents of every county could select from at least three insurers’ plans,16 but there were some coverage area reductions for 2025.)

Are Marketplace health insurance premiums increasing in Wisconsin?

The following average rate changes were approved for Wisconsin’s Marketplace insurers for coverage in 2025, amounting to a weighted average rate increase of 8.2%3 (calculated before subsidies are applied):

Wisconsin’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Aspirus Health Plan Inc | 2.42% |

| Chorus Community Health Plans (formerly Children’s Community Health Plan) | 11.55% |

| Common Ground (ACA-created CO-OP) | 5.97% |

| CompCare (Anthem BCBS) | 9.79% |

| Dean Health Plan | 9.85% |

| Group Health Cooperative | 5.43% |

| Health Partners | 3.31% |

| Medica | 5.88% |

| MercyCare | 11.58% |

| Molina | 12.16% |

| Network Health Plan | 2.43% |

| Quartz | 5.03% |

| Security Health Plan | 13.2% |

| UnitedHealthcare | 8.89% |

Source: RateReview.HealthCare.gov17

The rates were almost entirely approved as proposed, although the final rate increase for Group Health was a little smaller than the carrier had initially proposed.17 Additional filing data are available in SERFF and on Wisconsin’s rate review webpage.

The approved premium changes described above are averages across each insurer’s entire set of policies (within a given insurer’s plans, there is variation in terms of how much each plan’s rate changes), and are calculated before any subsidies are applied. But most Wisconsin Marketplace enrollees receive premium subsidies,10 and thus do not pay full-price for their coverage.

For perspective, here’s an overview of how full-price (unsubsidized) premiums have changed in Wisconsin’s individual/family health insurance market over time:

- 2015: Average increase of 7%.18

- 2016: Average increase of 16.8%.19

- 2017: Average increase of 15.9%.20

- 2018: Average increase of 36%.21

- 2019: Average decrease of 4.2% (reinsurance took effect).22

- 2020: Average decrease of 3.2%.23

- 2021: Average decrease of 3.4%.24

- 2022: Average decrease of 0.3%.25

- 2023: Average increase of 7.7%.26

- 2024: Average increase of 6.8%27

How many people are insured through Wisconsin’s Marketplace?

During the open enrollment period for 2024 coverage, 266,327 people enrolled in private individual market plans through Wisconsin’s exchange.28

This was a record high for Wisconsin Marketplace enrollment (see chart below). Enrollment growth in recent years was largely due to the American Rescue Plan (ARP). Under the ARP – now extended by the Inflation Reduction Act – subsidies are more significant and accessible through the end of 2025.28

The enrollment growth in 2024 was also due to the “unwinding” of the pandemic-era Medicaid continuous coverage rule. CMS reported that by April 2024, nearly 72,000 people had transitioned from Wisconsin Medicaid to a Marketplace plan.[efn_note]”HealthCare.gov Marketplace Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024; Accessed Aug. 3, 2024[/efn_note]

Source: 2014,29 2015,30 2016,31 2017,32 2018,33 2019,34 2020,35 2021,36 2022,37 2023,38 2024,39 202540

What health insurance resources are available to Wisconsin residents?

HealthCare.gov

800-318-2596

Wisconsin Office of the Commissioner of Insurance

Assists consumers who have purchased insurance on the individual market or who have insurance through an employer who only does business in Wisconsin.

(800) 236-8517 / [email protected]

State Exchange Profile: Wisconsin

The Henry J. Kaiser Family Foundation overview of Wisconsin’s progress toward creating a state health insurance exchange.

Wisconsin Department of Health Services

Wisconsin Individual Health Insurance Market Analysis

An analysis of Wisconsin’s individual/family health insurance market from 2014 through 2022.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Wisconsin?

Explore more resources for options in Wisconsin including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- ”Wisconsin Insurance Commissioner Celebrates the Start of 2025 Open Enrollment Period on HealthCare.gov” Wisconsin Office of the Commissioner of Insurance. Oct. 25, 2024 ⤶ ⤶ ⤶ ⤶ ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed May 10, 2024 ⤶ ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “A quick guide to the Health Insurance Marketplace®” HealthCare.gov, Accessed August, 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, Aug. 9, 2024 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- APTC and CSR Basics. Centers for Medicare and Medicaid Services. June 2023. ⤶

- How Many Uninsured Are in the Coverage Gap and How Many Could be Eligible if All States Adopted the Medicaid Expansion? KFF. March 2023. ⤶

- ”UnitedHealthcare to Offer Individual and Family Plans on the Health Insurance Marketplace in 26 States for 2024” UnitedHealthGroup. October 2023. ⤶

- And Then There Were Three: The Decimation of the Affordable Care Act (ACA) CO-OPs. PubMed, National Institutes of Health. August 2022. ⤶

- Wisconsin Insurance Commissioner Celebrates Competitive Health Insurance Market Ahead of Open Enrollment Period. Wisconsin Office of the Commissioner of Insurance. October 2023. ⤶

- ”Wisconsin Rate Review Submissions” RateReview.HealthCare.gov. Accessed Nov. 24, 2024 ⤶ ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- Press Release, October 12, 2017, 2018 Open Enrollment: November 1 – December 15, 2017. Wisconsin Office of the Commissioner of Insurance. October 2017. ⤶

- Wisconsin Healthcare Stability Plan. Wisconsin Office of the Commissioner of Insurance. July 2020. ⤶

- Gov. Evers Announces Lower Rates on Wisconsin’s Individual Health Insurance Market. State of Wisconsin, Office of the Governor. August 2019. ⤶

- Evers, Afable announce more insurance options. Sun Prairie Star. December 2023. ⤶

- 2022 Rate Changes. ACA Signups. October 2021. ⤶

- Wisconsin: Final Avg. 2023 #ACA Rate Changes: +7.7%. ACA Signups. November 2022. ⤶

- ”Wisconsin: *Final* Avg. Unsubsidized 2024 #ACA Rate Changes: +6.8% (Unweighted; Updated)” ACA Signups. Nov. 8, 2023 ⤶

- ”Health Insurance Marketplaces 2024 Open Enrollment Period Report” CMS.gov. March 22, 2024 ⤶ ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶