Medicare in Colorado

Since 2003, Colorado has required Medigap insurers to make their plans available to disabled beneficiaries under age 65

Key Takeaways

- More than 1 million Colorado residents are enrolled in Medicare.1

- About 513% of Medicare beneficiaries in Colorado have Medicare Advantage plans.1

- There are Medicare Advantage plans available in most Colorado counties for 2024.2

- 38 insurers offer Medigap plans in Colorado.3

- About 80% of Colorado Medicare beneficiaries have Part D prescription drug coverage, either as a stand-alone plan or as part of a Medicare Advantage plan.1

Medicare enrollment in Colorado

Nationwide, more than 67 million people are enrolled in Medicare.4 As of July 2024, there were 1,033,082 residents with Medicare in Colorado.1 That’s about 16% of the state’s total population.5

More than 91% of people with Medicare in Colorado are eligible due to their age (ie, being at least 65), while about 8% are eligible due to a disability, including a diagnosis of amyotrophic lateral sclerosis (ALS) or kidney failure.6 Nationwide, about 88% of Medicare beneficiaries are eligible due to age, and almost 12% are eligible due to disability.7

- Read our guide to Medicare’s open enrollment.

- Understand the difference between Medigap, Medicare Advantage, and Medicare Part D.

- Learn about how Colorado Medicaid provides assistance to Medicare beneficiaries with limited financial resources.

Learn about Medicare plan options in Colorado by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Colorado

We’ve created this guide to help you understand the Colorado health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Colorado.

Learn about Colorado’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Colorado.

Frequently asked questions about Medicare in Colorado

What is Medicare Advantage?

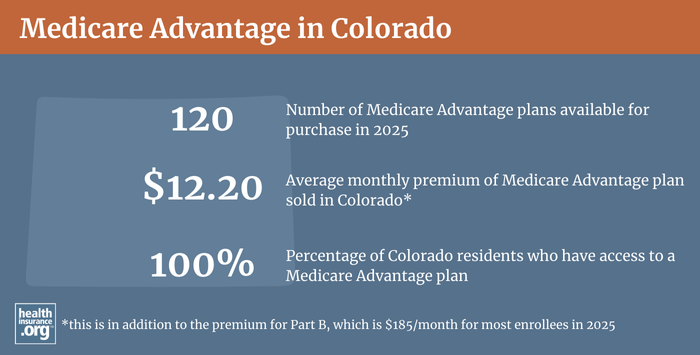

Nationwide, about 50% of all Medicare beneficiaries had Medicare Advantage plans as of July, 2024.4 In Colorado, Medicare Advantage was a little more popular, with nearly 53% of the state’s Medicare beneficiaries enrolled in Medicare Advantage plans.1 The other 47% of Colorado’s Medicare beneficiaries had opted instead for coverage under Original Medicare.

Medicare Advantage plans are provided by private insurers, which each have their own service area, so plan availability varies by area. There are Medicare Advantage plans available in most parts of Colorado in 2024, but there are some rural counties along the eastern edge of the state where no Medicare Advantage plans are available. In the rest of the state, Medicare Advantage plan availability in 2024 ranges from just two or three plans in some counties, to more than 35 in others.2

Medicare Advantage enrollment is available when a person is first eligible for Medicare, and there are also annual enrollment windows when beneficiaries can switch to Medicare Advantage or pick a different Medicare Advantage plan. Medicare beneficiaries can switch from Original Medicare to Medicare Advantage plans, and vice versa, during the Medicare Annual Election Period (AEP) each fall (October 15 through December 7), with coverage effective January 1. And there is also a Medicare Advantage open enrollment period (January 1 to March 31) during which people who are already enrolled in Medicare Advantage plans can switch to a different Medicare Advantage plan or drop their Medicare Advantage plan and enroll in Original Medicare instead.

What are Medigap plans?

Because Original Medicare has out-of-pocket healthcare costs that can be substantial (and there is no cap on how high out-of-pocket costs can be with Original Medicare), many enrollees use Medigap policies to supplement Original Medicare, covering some or all of the out-of-pocket costs (such as coinsurance and deductibles) that people would otherwise incur if they only had Original Medicare on its own. Employer-sponsored plans and Medicaid serve as supplemental coverage for about 48% of all Medicare beneficiaries nationwide,8 but Medigap policies fill a coverage need for people who don’t have access to Medicaid or an employer-sponsored plan, and who prefer Original Medicare over Medicare Advantage plans.

For 2025, there are 38 insurers in Colorado offering Medigap policies.3 And as of 2020, there were 232,748 Medicare beneficiaries in Colorado who had Medigap coverage, according to an analysis from America’s Health Insurance Plans (AHIP).9 That was more than a third of Colorado’s Original Medicare population in 2020 (Medigap plans cannot be used with Medicare Advantage coverage).10 In many states, Medigap enrollment has been declining as Medicare Advantage growth outpaces overall Medicare enrollment growth (Medigap policies cannot be used with Medicare Advantage plans).

Medigap policies are standardized under federal rules, so Medicare Supplement Plan A offers the same healthcare benefits regardless of which insurer offers it, as does Medicare Supplement Plan G, Plan N, etc. (premiums vary significantly from one insurer to another — initially and in terms of how they increase over time — as do things like customer service and additional benefits beyond the standardized benefits, such as a 24-hour nurse hotline).11 But Medigap standardization means that policy comparisons are easier than they are for other types of health insurance.

Medigap policies can be priced using attained-age rating, issue-age rating, or community rating. Colorado does not require insurers to use a particular approach, so most Medigap insurers in Colorado use attained-age rating, which means that a person’s premiums increase as they get older. There are a handful of insurers in the state that use issue-age rating, which means the rates are based on the age the person was when they enrolled.12

Under federal rules, people are granted a six-month window during which they can enroll in a Medigap policy regardless of their medical history. This window starts when they’re at least 65 and enrolled in Medicare Part B. Federal rules do not, however, guarantee access to a Medigap policy if you’re under 65 and eligible for Medicare as a result of a disability.13

To address this, the majority of the states have implemented rules ensuring at least some access to Medigap policies for people who are under age 65, and there has been slow but steady progress on this. Today, there are at least 33, including Colorado.14

Colorado statute (see 3 CCR 702-4 Series 4-3 Section 10) was changed in 2003 to ensure access to Medigap for people under age 65. Colorado requires Medigap insurers to offer all of their plans to people under age 65, with the same six-month enrollment window that applies to people who are aging onto Medicare. So a person under age 65 who becomes eligible for Medicare in Colorado has six months, starting when they’re enrolled in Medicare Part B, to sign up for a guaranteed-issue Medigap plan. When Colorado implemented this rule in 2003, there was a one-time six-month open enrollment window (September 2003 through February 2004) during which people under age 65 who were already enrolled in Medicare could sign up for a Medigap policy.

Although Medigap plans are guaranteed-issue for people under 65 during their six-month enrollment window, insurers can charge higher premiums for people under 65. As of 2022/23, virtually all of the insurers offering Medigap plans in Colorado were charging less than $200/month (some less than $110/month) for Medigap Plan A if the enrollee was 65-years-old. But for a person under the age of 65, premiums for Plan A varied from about $150 to more than $800 per month. The state does regulate the extent to which premiums can be higher for people under 65, with extensive rules governing what an insurer can charge as a “credibility-weighted average age premium rate” (see Section 10(E) of the statute).

Disabled Medicare beneficiaries have access to the normal Medigap open enrollment period when they turn 65. At that point, they have access to any of the available Medigap plans, at the standard age-65 rates.

Disabled Medicare beneficiaries have the option to enroll in a Medicare Advantage plan instead of Original Medicare. Medicare Advantage plan monthly premiums are not higher for those under 65. But Medicare Advantage plans have more limited provider networks than Original Medicare, and total out-of-pocket costs can be as high as $8,300 per year for in-network care (as of 2023), plus the out-of-pocket cost of prescription drugs.15

What is Medicare Part D?

Original Medicare does not cover outpatient prescription drugs.

Many Medicare beneficiaries have prescription drug coverage from an employer or Medicaid, but for those who don’t, Medicare Part D prescription drug plans are an important part of having insurance coverage. Medicare Part D prescription drug coverage was created under the Medicare Modernization Act of 2003, and individuals can be enrolled in a Medicare Part D prescription drug plan on a stand-alone basis or as part of a Medicare Advantage plan with integrated Medicare Part D prescription drug coverage.

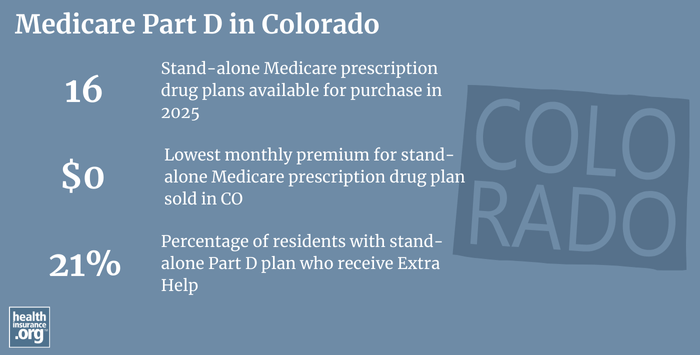

As of July 2024, there were 311,045 Colorado Medicare beneficiaries enrolled in stand-alone Medicare Part D prescription drug plans, and another 514,990 beneficiaries had Medicare Part D prescription drug coverage integrated with their Medicare Advantage plans. In total, 826,035 Colorado Medicare beneficiaries had Part D prescription drug coverage.1

For 2025 coverage, there are 16 stand-alone Medicare Part D prescription drug plans available in Colorado, with premiums starting at $0.16

Medicare Part D prescription drug enrollment follows the same schedule as Medicare Advantage plans: Beneficiaries can pick a Medicare Part D prescription drug plan when they first become eligible for Medicare, and there’s also the Annual Election Period each fall (October 15 to December 7) when Medicare beneficiaries can pick a different Medicare Part D prescription drug plan or enroll for the first time (note that there’s a late enrollment penalty for people who delay their initial enrollment and don’t have other creditable drug coverage in place). Medicare beneficiaries are encouraged to actively compare the various options each fall in order to see which one will best meet their personal prescription needs (plans vary from one year to the next, and a beneficiary’s current prescriptions may differ from what they were a year ago).

How does Medicaid provide financial assistance to Medicare beneficiaries in Colorado?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums, prescription drug expenses, and services not covered by Medicare – such as long-term care.

Our guide to financial assistance for Medicare enrollees in Colorado includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in Colorado?

If you have questions about Medicare eligibility in Colorado or Medicare enrollment in Colorado, you contact the Colorado State Health Insurance Assistance Program (there are offices in each county).

The Colorado Division of Insurance also maintains a useful Senior Publications page that includes a variety of helpful resources and information to address questions you might have about Medicare coverage in Colorado.

The Colorado Division of Insurance also regulates Medigap plans in the state, although those plans must also conform to the federal government’s standardization rules, as described above (the governance of Medicare Advantage and Medicare Part D prescription drug plans mostly lies with the federal government, the state is only responsible for licensing the insurers that offer these plans and ensuring they remain financially solvent).

This page is a comprehensive resource that details how Colorado Medicaid can provide financial assistance to Medicare beneficiaries in the state who have limited income and assets.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Colorado?

Explore more resources for options in Colorado including ACA coverage, short-term health insurance, dental insurance and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – Colorado.” Centers for Medicare & Medicaid Services Data. Accessed November, 2024. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Medicare Advantage 2024 Spotlight: First Look” KFF.org Nov. 15, 2023 ⤶ ⤶

- “Explore your Medicare coverage options.” Medicare.gov. Accessed October, 2024. ⤶ ⤶

- “Medicare Monthly Enrollment – National.” Centers for Medicare & Medicaid Services Data. Accessed November, 2024. ⤶ ⤶

- “U.S. Census Bureau Quick Facts: U.S. & Colorado.” U.S. Census Bureau, July 1, 2022. ⤶

- “Medicare Monthly Enrollment – Colorado ” Centers for Medicare & Medicaid Services Data, May 2023. ⤶

- ”Medicare Monthly Enrollment – U.S.” Centers for Medicare & Medicaid Services Data, July 2023. ⤶

- Ochieng, Nancy, Gabrielle Clerveau, and Tricia Neuman. “A Snapshot of Sources of Coverage among Medicare Beneficiaries.” Kaiser Family Foundation, August 14, 2023. ⤶

- “The State of Medicare Supplement Coverage.” AHIP, Page 10. February 2023. ⤶

- “Medicare Monthly Enrollment – Colorado (2020) ” Centers for Medicare & Medicaid Services Data, May 2023. ⤶

- “2024 Choosing a Medigap Policy.” Page 9. Medicare.gov. Accessed June 3, 2025 ⤶

- “Medicare Supplement Insurance Policies in Colorado.” Page 7. Colorado Department of Regulatory Agencies. Accessed October 23, 2023. ⤶

- “2024 Choosing a Medigap Policy.” Page 39. Medicare.gov. Accessed June 3, 2025 ⤶

- “2024 Choosing a Medigap Policy.” Page 40. Medicare.gov. Accessed June 3, 2025 ⤶

- Fuglesten Biniek, Jeannie, Nancy Ochieng, Meredith Freed, Anthony Damico, and Tricia Neuman. “Medicare Advantage in 2023: Premiums, out-of-Pocket Limits, Cost Sharing, Supplemental Benefits, Prior Authorization, and Star Ratings.” KFF, August 9, 2023. ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (17) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶