Home > Health insurance Marketplace > Maine

Maine Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Maine health insurance Marketplace guide

This guide is designed to help you understand your health insurance options in Maine, and we’ve included answers to numerous frequently asked questions below.

Maine’s ACA Marketplace health insurance plans are available on CoverME, a state-run website where four private health insurance companies offer plans.3 Most of the plans available through CoverME are Clear Choice plans, which means their cost-sharing is standardized to make plan comparisons easier.4

Depending on your income, the federal government may cover part of the cost of your health insurance through an advance premium tax credit if you buy coverage through the Maine Health Insurance Marketplace.

Maine implemented a reinsurance program (MGARA) in 2019, which has been instrumental in keeping full-price (unsubsidized) premiums lower than they would have been without the reinsurance program. As of 2023, Maine merged its individual and small group health insurance markets, with MGARA reinsurance now covering both markets.5

The Maine Bureau of Insurance noted that the state received more federal MGARA funding than expected in 2024. This allowed them to reset the reinsurance parameters for 2025 (MGARA will pay 75% of eligible claims, instead of 55%) and thus reduce 2025 premiums lower than they would have been under the original reinsurance parameters.6

Frequently asked questions about health insurance in Maine

Who can buy Marketplace health insurance?

To qualify for health coverage through the Marketplace in Maine, you must:7

- Be a Maine resident

- Be either a United States citizen or national, or be lawfully present

- Not be incarcerated

- Not have Medicare coverage

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) will depend on your household income. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable employer-sponsored health insurance. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for MaineCare (Medicaid/CHIP).

- Not be eligible for premium-free Medicare Part A.8

- File a joint tax return with your spouse if you’re married.9 (with very limited exceptions)10

- Not be able to be claimed by someone else as a tax dependent.11

When can I enroll in an ACA-compliant plan in Maine?

In Maine, the open enrollment period for individual/family health coverage on CoverME runs from November 1 to January 15.

Enrollments must be submitted by December 15 to have coverage effective January 1. Enrollments submitted in the final month of the open enrollment window have an effective date of February 1 instead.12

(A proposed federal rule change would reset the open enrollment deadline to December 15, nationwide, resulting in a shorter open enrollment window starting in the fall of 2025. If this is finalized, all enrollments submitted during open enrollment will take effect January 1.)

Outside of open enrollment, a special enrollment period is necessary to enroll or make changes to your coverage. In most cases, a qualifying life event is necessary to trigger a special enrollment period, but some special enrollment periods don’t rely on a specific life event. Learn more in our comprehensive guide to special enrollment periods.

Maine is one of several states where pregnancy is considered a qualifying event. In most states, birth is the qualifying event and the special enrollment period begins the day the baby is born. But in Maine, the expectant mother can enroll in coverage, as the confirmation of the pregnancy is considered a qualifying life event in Maine.13

Maine also enacted legislation in 2022 that creates an “easy enrollment program,” allowing uninsured residents to check a box on their state tax return if they want to be contacted by the state about enrolling in health coverage. A special enrollment period will be available if the person is not eligible for Medicaid and would thus need a special enrollment period to sign up for coverage.14 Several other states also have easy enrollment programs.

How do I enroll in a Marketplace plan in Maine?

To enroll in an ACA Marketplace plan in Maine, you can:

- Visit CoverME.gov – Maine’s health insurance marketplace to enroll in individual and family health plans. You can contact CoverME by phone at (866) 636-0355 if you need assistance.

- Purchase Marketplace coverage with the help of an insurance agent or broker, or a Maine Enrollment Assister.15

How can I find affordable health insurance in Maine?

To locate affordable health insurance options in Maine, consumers can enroll through the state’s ACA Marketplace (CoverME.gov).

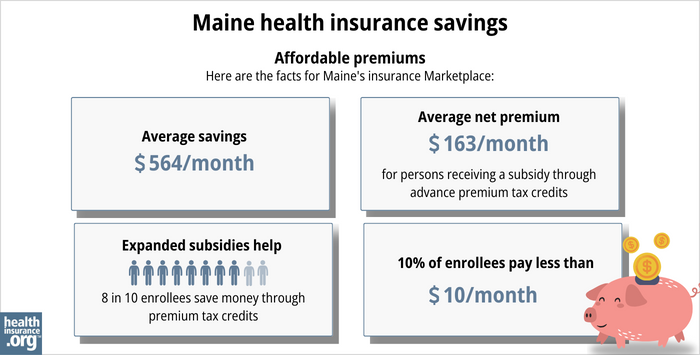

During the open enrollment period for 2025 coverage, nearly 85% of CoverME enrollees qualified for income-based premium subsidies. These subsidies averaged $607/month and reduced the average enrollee’s premium to about $245/month, including the 15% of enrollees who paid full price.16

Premium subsidies are larger and more widely available than they used to be, thanks to the American Rescue Plan, and the Inflation Reduction Act). 17 But unless Congress extends those subsidy enhancements, subsidies will shrink in 2026, resulting in less affordable coverage.

In addition to premium subsidies, the Affordable Care Act provides cost-sharing reductions (CSR) to Marketplace enrollees whose household income isn’t more than 250% of the poverty level, as long as they select a Silver-level plan. The CSR benefits result in lower out-of-pocket costs when you need medical care.18 During the open enrollment period for 2025 coverage, about 29% of CoverME enrollees selected plans with CSR benefits.16

Between the premium subsidies and cost-sharing reductions, you may find that an ACA-compliant plan obtained via Maine’s Health Insurance Marketplace plan will provide you with the best overall value.

Source: CMS.gov 19

Individual/family health plans in Maine are required to fully pay for a member’s first primary care visit and behavioral health care visit each year. The 2nd and 3rd primary care and behavioral health visits have to be covered with only a copay (no deductible or coinsurance). There is an exception for HSA-qualified high-deductible health plans, to comply with IRS rules that prohibit those plans from covering anything other than preventive care before the minimum deductible is met.20

Maine has expanded Medicaid under the ACA, so MaineCare (Medicaid) coverage is available to adults under age 65 with household income up to 138% of the federal poverty level. Children and pregnant women are eligible for MaineCare with higher household incomes.

How many insurers offer Marketplace coverage in Maine?

Four insurers offer exchange plans in Maine for 2025.21 CHO, Harvard Pilgrim, and Anthem all offer plans statewide. Taro Health offers plans in Cumberland, Sagadahoc, York and Lincoln counties. So in those four counties, there are four insurers offering plans, while residents in the rest of the state have access to plans from three insurers.22

Maine has one of the few remaining ACA-created CO-OPs (Community Health Options, or CHO), which is one of only three CO-OPs (nationwide) offering coverage as of 2024.

During the open enrollment period for 2025 coverage, CoverME’s carriers had the following market share:23

- Anthem: 46% of enrollees

- CHO: 33% of enrollees

- Harvard Pilgrim: 20% of enrollees

- Taro: 2% of enrollees

Are Marketplace health insurance premiums increasing in Maine?

For 2025 coverage, the following average rate increases were approved by the Maine Bureau of Insurance for the four insurers that offer individual/family health insurance through CoverME. They amount to a weighted average increase of 8.6% (before subsidies), which was significantly smaller than the 14.2% average rate increase the insurers initially proposed.6

Maine’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Anthem Health Plans of ME(Anthem BCBS) | 7.4% |

| Harvard Pilgrim Health Care Inc. | 11.6% |

| Maine Community Health Options | 8.1% |

| Taro Health | 11.8% |

Source: Maine Bureau of Insurance24

For three of the carriers, the approved rate increases were quite a bit smaller than the carriers had proposed, but Taro’s approved average rate increase was significantly larger than the carrier had proposed.25

Part of the reason for the lower approved rate increases is that Maine’s federal pass-through funding for MGARA (the state’s reinsurance program) was larger than expected in 2024, allowing the state to adjust the reinsurance parameters. This allowed the carriers to refile new rates, which were generally lower than they had initially filed.6

Average rate changes are calculated for full-price plans, before any premium subsidies are applied. But the majority of CoverME enrollees qualify for subsidies, which change each year to keep pace with the cost of the second-lowest-cost Silver plan.

The change in net (after-subsidy) premium depends on the specific plan (each carrier’s approved rate change is an average, across all plans they offer), geographic rating area, your age, and federal premium tax credits.

If the cost of your current plan increases, you can explore other plans in the exchange that may be less expensive and offer similar benefits.

For perspective, here’s a summary of how full-price premiums have changed in Maine over the years:

- 2015: Average decrease of 1%26

- 2016: Average increase of 0.7%27

- 2017: Average increase of 23.5%28

- 2018: Average increase of 25%29

- 2019: Average increase of 1%30 (Reinsurance took effect)

- 2020: Average decrease of 1.6%31

- 2021: Average decrease of 13.1%32

- 2022: Average decrease of 2.1%33

- 2023: Average increase of 11.4%34

- 2024: Average increase of 14.6%35

How many people are insured through Maine’s Marketplace?

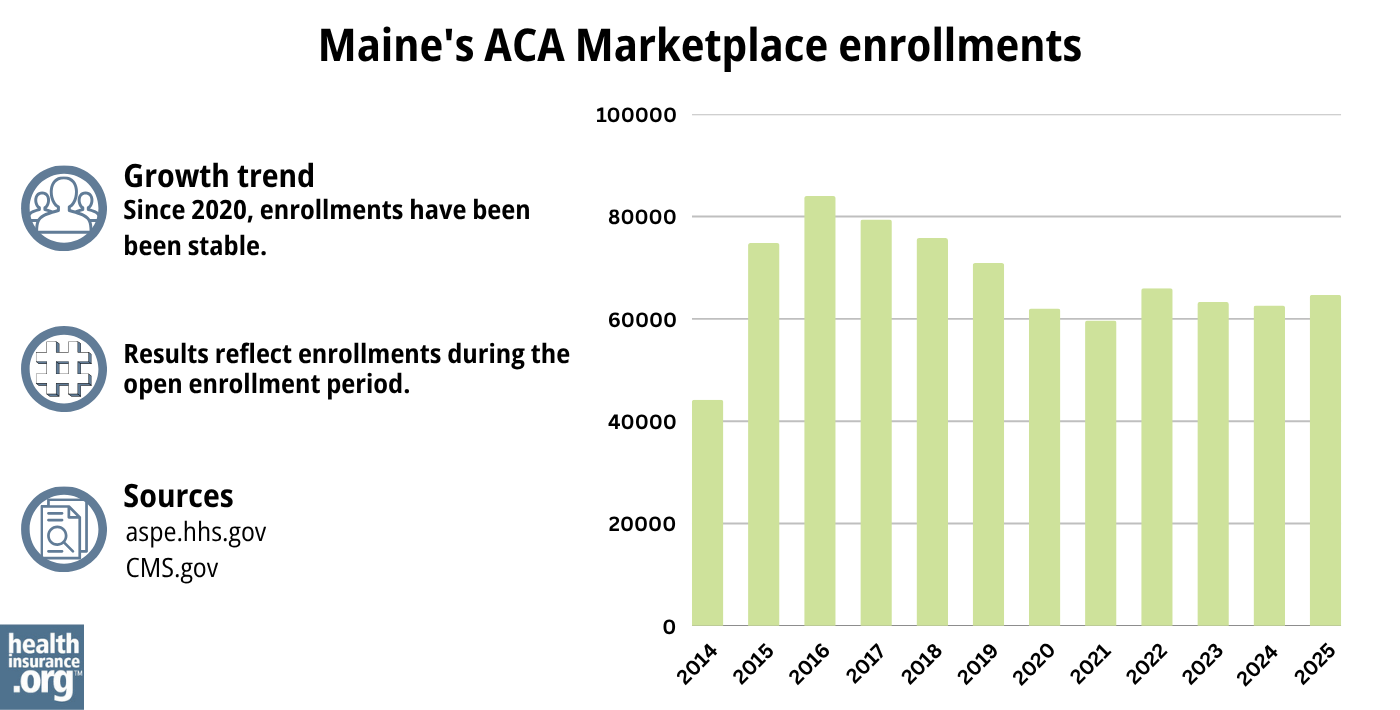

During the open enrollment period for 2025 coverage, 64,678 people enrolled in plans through Maine’s exchange.16

In most states, enrollment numbers have been climbing in recent years, reaching significant record highs. But that hasn’t been the case in Maine, where enrollment has hovered around the same level for several years (see chart below).

Maine was the only state where 2024 enrollment was lower than 2023 enrollment had been, with a 1.3% decrease.36 Maine officials noted37 that the enrollment decrease in 2024 was due to an increase in the income limits for children and young adults to qualify for Medicaid.38 As a result, some children and young adults were able to transition from CoverME plans to Medicaid starting in late 2023.

And CoverME enrollment did increase slightly in 2025, although certainly not to the sort of record-high levels it reached nationwide.39

Source: 2014,40 2015,41 2016,42 2017,43 2018,44 2019,45 2020,46 2021,47 2022,48 2023,49 2024,50 202551

What health insurance resources are available to Maine residents?

CoverME.gov Maine’s health insurance marketplace. Can also be reached at 1-866-636-0355.

State Exchange Profile: Maine The Henry J. Kaiser Family Foundation overview of Maine’s progress toward creating a state health insurance exchange.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Maine?

Explore more resources for options in Maine including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”2025 IndividualHealth Insurance Rate Filings” Maine.gov. Accessed June 19, 2024 ⤶

- ”CoverME.gov’s Fourth Annual Open Enrollment Begins November 1” CoverME. Oct. 28, 2024 ⤶

- Clear Choice Plans. CoverME. Accessed May 14, 2025 ⤶

- Federal Government Approves Maine’s Plan to Improve Health Insurance for Small Businesses. State of Maine, Office of Governor Mills. July 2022. ⤶

- ”Maine Bureau of Insurance Approves 2025 Health Insurance Rates for Individuals and Small Groups” Maine Bureau of Insurance. Aug. 26, 2024 ⤶ ⤶ ⤶

- “Frequently Asked Questions” CoverME.gov, ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed January 12, 2024. ⤶

- CoverME.gov Now Open for Shopping and Enrolling in Affordable Health Plans. Maine Department of Health and Human Services. November 2023. ⤶

- Special Enrollment Periods. CoverME. Accessed December 2023. ⤶

- Maine LD1390. BillTrack50. Enacted April 2022. ⤶

- Free, local help is available to understand your options and apply for coverage. CoverME. Accessed December 2023. ⤶

- ”2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 12, 2025 ⤶ ⤶ ⤶

- ”Health Insurance Marketplaces 2024 Open Enrollment Period Report” CMS.gov. March 22, 2024 ⤶

- “APTC and CSR Basics” CMS.gov, June 2024 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2024 ⤶

- Consumer’s Guide to Individual Major Medical Insurance in Maine. Maine Department of Professional and Financial Regulation. Accessed December 2023. ⤶

- ”2025 IndividualHealth Insurance Rate Filings” Maine.gov. Accessed June 19, 2024 ⤶

- CoverME.gov Now Open for Shopping and Enrolling in Affordable Health Plans. Maine Department of Health and Human Services. November 2023. ⤶

- ”2025 Open Enrollment Overview” CoverME. Feb. 2025 ⤶

- ”Maine Bureau of Insurance Approves 2025 Health Insurance Rates for Individuals and Small Groups” and “2025 Individual (On/Off Exchange)Health Insurance Rate Filings” Maine Bureau of Insurance. Aug. 26, 2024 ⤶

- ”2025 Individual (On/Off Exchange)Health Insurance Rate Filings” Maine Bureau of Insurance. Aug. 26, 2024 ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- UPDATED: Maine: Thanks To Reinsurance, 2019 Rates Only Increasing 1.0%…But They WOULD Likely Be DROPPING By ~9.0% W/Out Sabotage. ACA Signups. July 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- 2021 Rate Changes. ACA Signups. October 2020. ⤶

- 2022 Rate Changes. ACA Signups. October 2021. ⤶

- Individual and Small Group Health Insurance Approved Rate Filings for 2023. Maine Bureau of Insurance. Accessed December 2023. ⤶

- 2024 Individual Health Insurance Rate Filings. Maine.gov. Accessed December 2023. ⤶

- “Health Insurance Marketplaces 2024 Open Enrollment Report CMS.gov, March 22, 2024 ⤶

- “2024 Open Enrollment Overview” Coverme.gov. Feb. 1, 2024 ⤶

- “Help Spread the News to Families – MaineCare Eligibility Expanded for Children and Young Adults” Maine Department of Education. Dec. 18, 2023 ⤶

- ”Enrollment Growth in the ACA Marketplaces” KFF.org. Apr. 2, 2025 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶