Medicare in New York

New York’s Medigap regulations are among the strongest in the country, with community rating and year-round guaranteed-issue plans

Key takeaways

- Over 3.9 million residents are enrolled in Medicare in New York.1

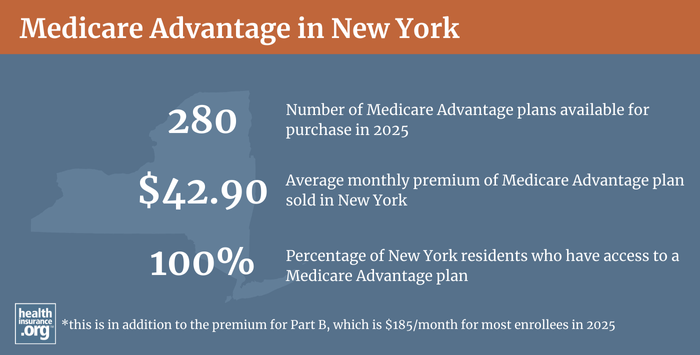

- Over 52% of New York Medicare beneficiaries are enrolled in Medicare Advantage plans.1

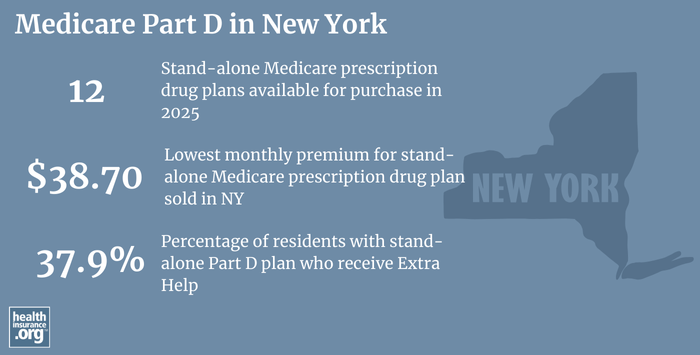

- New York residents can select from among 12 stand-alone Part D prescription plans in 2025, with premiums starting at $0 per month.2

New York Medicare enrollment

As of September 2024, over 3.9 million people were covered by Medicare in New York,1 amounting to more than 18% of the state’s population.3

In most cases, Medicare enrollment goes along with turning 65 years old. But people who have been receiving disability benefits for at least 24 months are also eligible for Medicare, as are people with arnyotrophic lateral sclerosis (ALS) or end-stage renal disease (those latter two groups do not have to wait 24 months for their Medicare eligibility to take effect).

In New York, about 11% of Medicare beneficiaries are under 65 and eligible due to disability.1

- Understand the difference between Medigap, Medicare Advantage, and Medicare Part D (including tips for picking the best coverage combination to meet your needs).

- Learn how Medicaid can provide assistance to New York Medicare beneficiaries who have limited financial resources.

Medicare options

Medicare, a healthcare insurance program for older and disabled Americans, operates under the guidance of the Centers for Medicare & Medicaid Services (CMS). CMS is part of the federal Department of Health and Human Services (HHS).

Medicare beneficiaries can choose to receive their benefits directly from the federal government via Original Medicare — along with supplemental coverage for prescriptions and out-of-pocket costs — or enroll in Medicare Advantage plans (as long as Medicare Advantage plans are available in their area, which typically is the case in most of the country, including all of New York).4

Original Medicare includes Medicare Part A and Medicare Part B. Medicare Part A (also called hospital insurance) helps pay for inpatient stays, like at a hospital, skilled nursing facility, or hospice center. Medicare Part B (also called medical insurance) helps pay for outpatient care like a doctor appointment or a preventive healthcare service, such as most vaccination).

Medicare Advantage plans include all of the basic coverage of Medicare Part A and Medicare Part B, and these plans generally include additional benefits — such as integrated Part D prescription drug coverage and extras like dental and vision — for a single monthly plan premium. But members of Medicare Advantage plans may be required to use a limited provider network for the Medicare plan they select, and total out-of-pocket costs (like deductibles, co-payments, or co-insurance) may be higher than they would be under Original Medicare plus a Medigap plan. There are pros and cons to either option, and no single solution that works for everyone.

During the Medicare Annual Election Period (October 15 to December 7 each year) beneficiaries have the opportunity to switch between Medicare Advantage and Original Medicare and/or add or drop a Medicare Part D prescription drug plan. And Medicare Advantage enrollees also have the option to switch to a different Medicare Advantage plan or change to Original Medicare during the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31.

Learn about Medicare plan options in New York by contacting a licensed agent.

Explore our other comprehensive guides to coverage in New York

We’ve created this guide to help you understand the New York health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in New York.

Learn about New York’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in New York.

Frequently asked questions about New York Medicare

What is Medicare Advantage?

New York has a robust Medicare Advantage market, with 2023 plan availability ranging from 26 plans offered in Dutchess County to 54 plans offered in Erie County.4 As of September 2024, over 53% of New York’s Medicare beneficiaries were enrolled in Medicare Advantage, while 47% were enrolled in Original Medicare.1

The Medicare Advantage insurance companies dominating the market in New York are led by UnitedHealth Group, which held 18% of MA market share in 2022. Between late 2019 and early 2022, enrollment in UnitedHealth Group MA plans was virtually unchanged. (See table below).

What is Medigap?

While Original Medicare does provide fairly comprehensive coverage, it does not cover everything (for example, prescription drugs are not covered) and it doesn’t have a cap on out-of-pocket costs. Under Medicare Part B, that amounts to an unlimited 20% coinsurance. To address the gaps in Original Medicare, most enrollees have some sort of supplemental coverage. Nationwide, over 80% of Original Medicare beneficiaries have supplemental coverage.5

For those who have only Medicare Part A and Medicare Part B, Medigap plans (also known as Medicare supplement insurance plans) are designed to pay some or all of the out-of-pocket costs (deductibles and coinsurance) that Original Medicare beneficiaries would otherwise have to pay themselves (in order to have prescription drug coverage, it’s also necessary to buy a Medicare Part D prescription drug plan).

Although Medigap plans are sold by private insurers, the plans are standardized under federal rules.6 There are ten different plan designs (differentiated by letters, A through N; not all insurers offer all plans for sale), and the benefits offered by a particular plan (Plan A, Plan G, etc.) are the same regardless of which insurer is selling the plan. So consumers can base their plan selection on premiums and less tangible things like customer service, since the benefits themselves are uniform.

There are 7 insurers licensed to offer Medigap plans in New York.7

New York has among the strongest Medigap consumer protections in the nation. As long as a person in New York is enrolled in Medicare Part A and Medicare Part B, they can enroll in a Medigap plan at any time, year-round, and premiums do not vary based on the applicant’s age or health status. This is also true for enrollees who are under 65 and eligible for Medicare due to a disability. Premiums do vary from one insurer to another, and from one area to another (2023 premiums are available here; an insurer can only vary the price of a particular Medigap plan based on where enrollees reside).

New York’s rules go far beyond the federal rules, and beyond the rules that most states have imposed on Medigap insurers. (Connecticut is the only other state where Medigap is available year-round, without medical underwriting; several other states offer windows each year when some or all plans are guaranteed-issue). Federal rules do not require an annual open enrollment window for Medigap plans. Instead, federal rules provide only a one-time six-month window when Medigap coverage is guaranteed-issue, starting when the person is at least 65 and enrolled in Medicare Part B. And federal rules don’t guarantee access to Medigap plans at all for people who are under 65 and enrolled in Medicare due to a disability. New York’s rules are much more robust.

Because of the year-round availability, community rating, and lack of medical underwriting, premiums for Medigap enrollees in New York are generally higher than they are in most other states when enrollees are 65.8 Alaska is a good example of how high Medigap premiums can be for older enrollees in states that allow Medigap insurers to increase premiums over time, as an enrollee ages (referred to as attained-age rating, as opposed to New York’s community rating). Although the rates are higher for newly eligible enrollees, older enrollees pay the same amount as younger enrollees.9

New York also has fewer Medigap insurers than most high-population states with fewer Medigap regulations. For example, Arizona, which defaults to the federal rules for Medigap plans, had 48 insurers offering policies as of 2025.7

Although the Affordable Care Act eliminated pre-existing condition exclusions in most of the private health insurance market, those regulations don’t apply to Medigap plans, and New York allows Medigap insurers to conform to federal Medigap regulations for pre-existing conditions. Medigap insurers can impose a pre-existing condition waiting period of up to six months, if an applicant didn’t have at least six months of continuous coverage prior to enrolling. But beyond that, consumers are protected in New York. In most other states, people enrolling after their initial six-month open enrollment window can be denied coverage or charged higher premiums due to pre-existing conditions, and that’s not the case in New York.

What is Medicare Part D?

Original Medicare doesn’t provide coverage for outpatient prescription drugs. More than 80% of Original Medicare beneficiaries have a supplemental plan,5, and these plans often include prescription coverage. Medicare enrollees without a supplemental plan can still enroll in a Medicare Part D prescription drug plan. Part D coverage is available through plans called stand-alone Medicare Part D prescription drug plans (PDPs) or as part of a Medicare Advantage plan with integrated Part D prescription drug coverage.

In 2025, insurers in New York are offering 12 stand-alone Medicare Part D prescription drug plans, with premiums starting at $0 per month.2

As of September 2024, 1,320,459 New Yorkers had stand-alone Medicare Part D prescription drug plans, while another 1,939,950 had Medicare Part D prescription drug coverage integrated with their Medicare Advantage plans.1

Medicare Part D prescription drug plan enrollment is available during the Medicare Annual Open Enrollment Period each fall (October 15 to December 7), as well as during a person’s initial enrollment period when they’re first eligible for Medicare.

How does Medicaid provide financial assistance to Medicare beneficiaries in New York?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in New York includes overviews of these programs, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What resources are available for beneficiaries and their caregivers in New York?

Need help with your Medicare application in New York, or have questions about Medicare eligibility in New York? These resources provide free assistance and information.

- Contact HIICAP, New York’s Health Insurance Information Counseling and Assistance program.

- Visit the Medicare Rights Center. This website provides helpful information geared to Medicare beneficiaries, caregivers, and professionals.

- Access the New York State Department of Financial Services for helpful information about Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in New York?

Explore more resources for options in New York including ACA coverage, short-term health insurance, dental insurance and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – New York.” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (98) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶

- “U.S. Census Bureau Quick Facts: New York; U.S.” U.S. Census Bureau, July 1, 2024. ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶ ⤶

- Ochieng, Nancy, and Jeannie Fuglesten Biniek. “Cost-Related Problems Are Less Common among Beneficiaries in Traditional Medicare than in Medicare Advantage, Mainly Due to Supplemental Coverage.” Kaiser Family Foundation, July 7, 2021. ⤶ ⤶

- “Compare Medigap Plan Benefits.” Medicare.gov. Accessed July 23, 2023. ⤶

- “Explore your Medicare coverage options.” Medicare.gov. Accessed October, 2024. ⤶ ⤶

- “Community Rating – Glossary.” HealthCare.gov. Accessed July 24, 2023. ⤶

- “Alaska Department of Commerce, Community, and Economic Development.” Page 25. Alaska Department of Commerce. Accessed July 23, 2023. ⤶