Home > Health insurance Marketplace > New Hampshire

New Hampshire Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

New Hampshire health insurance Marketplace guide

We’ve created this New Hampshire health insurance guide, including the FAQs below, to help you understand the coverage options available to you and your family in New Hampshire. ACA Marketplace (exchange) plans – or Obamacare – are available for people who need to buy their own health coverage. We’re here to help you understand the coverage options and how financial assistance works under the ACA.

New Hampshire did not create a state-based exchange, so New Hampshire’s Marketplace is the federally-facilitated HealthCare.gov. A New Hampshire Marketplace plan can be a great coverage option if you aren’t eligible for Medicare or Medicaid, and also don’t have an offer of affordable health insurance from your employer. Depending on your household income and circumstances, you may be eligible for financial assistance when you enroll in health coverage through the New Hampshire Marketplace.

Four private health insurance companies offer individual/family coverage through New Hampshire’s Marketplace for 2025, including one newcomer.3 (more details below).

As a result of legislation enacted in 20234 New Hampshire’s previous high-risk pool association,5 the New Hampshire Individual Health Plan Benefit Association (the New Hampshire Health Plan), is now tasked with “protect[ing] the citizens of the state who participate in the individual health insurance market by providing a mechanism to equitably distribute the excess risk sometimes associated with this market.”6

The New Hampshire Health Plan works to support the state’s reinsurance program and Medicaid expansion (although New Hampshire has expanded Medicaid under the ACA, the expansion is not permanently authorized in the state7), and is also working on a study of ground ambulance costs and rate setting (under the federal No Surprises Act, consumers are protected from most instances of surprise balance billing, but those protections do not apply to ground ambulance bills).

Frequently asked questions about health insurance in New Hampshire

Who can buy Marketplace health insurance?

In order to sign up for private health coverage through the New Hampshire Marketplace, you must:

- Live in New Hampshire

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare 8

By those rules, the majority of Americans qualify to use the Marketplace.9 But a bigger question for most people is financial assistance, and there are a few additional parameters to qualify for subsidies in the Marketplace.

To qualify for income-based Advance Premium Tax Credits (APTC) or cost-sharing reductions (CSR), you must:

- Not have access to affordable health coverage through an employer. If you have access to an employer’s plan but it seems too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A. 10

- If married, file a joint tax return.11

- Not be able to be claimed by someone else as a tax dependent.11

Beyond those basic parameters, qualifying for Marketplace subsidies depends on your household income.

When can I enroll in an ACA-compliant plan in New Hampshire?

You can sign up for an ACA-compliant individual or family health plan in New Hampshire between November 1 and January 15, which is the annual open enrollment period.12

For coverage to take effect on January 1, you need to complete your application by December 15. Applications submitted between December 16 and January 15 will have a February 1 coverage effective date.9

Outside of the annual open enrollment window, you may be eligible to enroll if you experience a qualifying life event, such as giving birth or losing other health coverage. And some people can enroll year-round even without a specific qualifying life event.

Enrollment in New Hampshire Medicaid/CHIP is available year-round.

How do I enroll in a New Hampshire Marketplace plan?

To enroll in an ACA Marketplace plan in New Hampshire, you can:

- Visit HealthCare.gov, New Hampshire’s health insurance Marketplace. HealthCare.gov is an online platform where you can compare plans, see your subsidy eligibility, and enroll in the plan that best meets your needs.

- Purchase Marketplace coverage with the help of an insurance agent or broker, a Navigator, or certified application counselor.

- Enroll via an approved enhanced direct enrollment entity.13 (Confirm that you’re enrolling in Marketplace coverage, as that’s the only way you can take advantage of financial assistance if you’re eligible for it.)

You can reach HealthCare.gov’s call center by dialing 1-800-318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, seven days a week, except holidays.

How can I find affordable health insurance in New Hampshire?

Under the Affordable Care Act (ACA), there are income-based subsidies that can help lower your premium payments each month. These subsidies are available to New Hampshire residents who meet the eligibility requirements and enroll in Marketplace coverage.

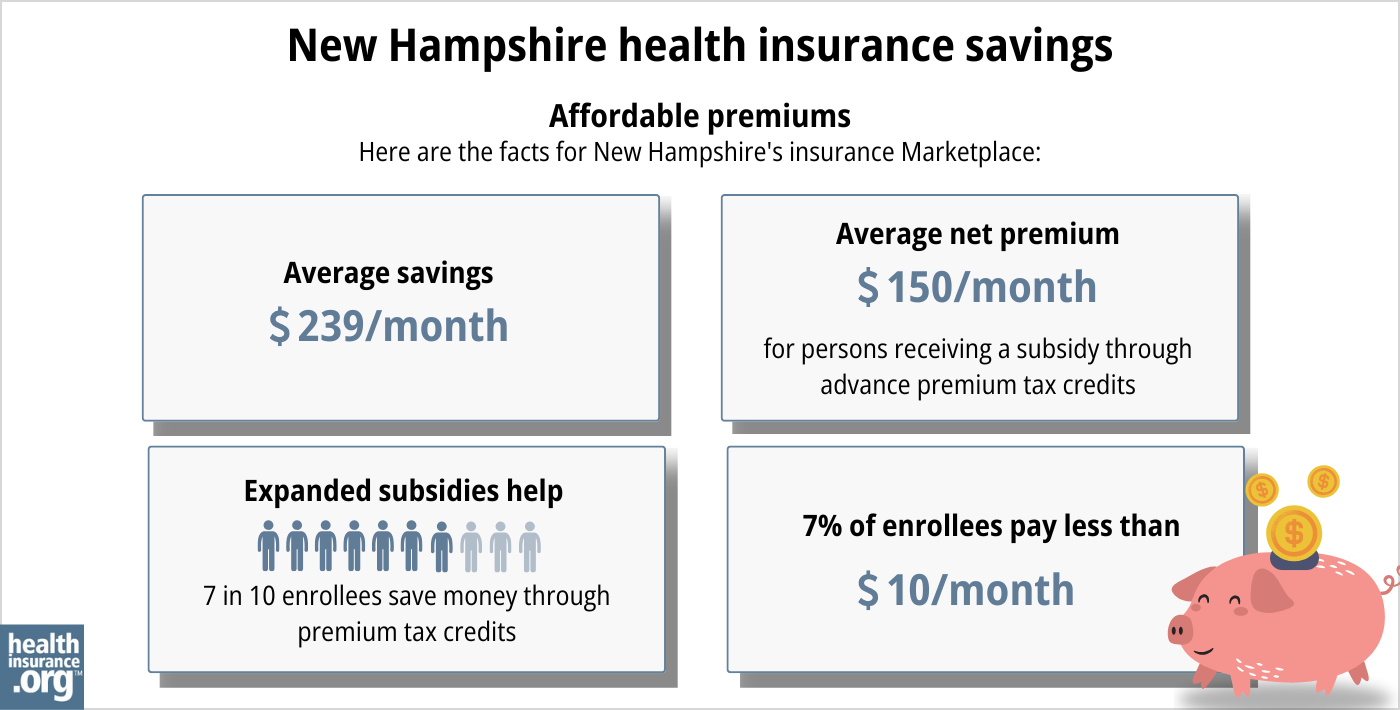

As of early 2024, nearly three-quarters of New Hampshire Marketplace enrollees were receiving premium subsidies, and these subsidies reduced their health insurance premiums by an average of $352/month. After accounting for subsidies, the average enrollee’s premium — including those who paid full-price — was about $199/month.14

(Note that the numbers above are based on effectuated enrollment in early 2024; the chart below shows some different metrics and is based on total enrollments submitted during the open enrollment period for 2024.)

For individual/family market enrollees who aren’t eligible for premium subsidies, the state’s reinsurance program, which took effect in 2021, keeps full-price premiums lower than they would otherwise be.15

If your household income isn’t more than 250% of the federal poverty level, you may also be eligible for cost-sharing reductions (CSR), as long as you select a Silver-level plan. These subsidies are designed to reduce your deductibles and out-of-pocket expenses. As of early 2024, nearly a third of Marketplace enrollees in New Hampshire Marketplace were receiving CSR benefits.14

You can use both APTC and CSR benefits if you’re eligible for both and you select a Silver-level plan in the Marketplace (APTC can be used with plans at any metal level, but CSR benefits are only available on Silver plans).

New Hampshire has expanded Medicaid eligibility under the Affordable Care Act, so adults under age 65 are eligible for Medicaid with household incomes up to 138% of the poverty level. From 2014 through 2018, New Hampshire purchased private Marketplace plans for people who were eligible for expanded Medicaid. However, the state opted to transition to regular Medicaid managed care starting in 2019, so the program now functions much the way it does in most other states.

Source: CMS.gov16

How many insurers offer Marketplace coverage in New Hampshire?

Four private insurers offer coverage through the New Hampshire Marketplace for 2025, including WellSense, which is new for 202517 3 (the New Hampshire Insurance Department confirmed that WellSense plans will be available both on-exchange and off-exchange).

(Another carrier, Anthem Health Plans of New Hampshire, offers coverage only outside the exchange. But a separate Anthem entity, Matthew Thornton Health Plans, offers coverage in the New Hampshire Marketplace.17)

Are Marketplace health insurance premiums increasing in New Hampshire?

The following average rate changes have been approved for 2025 for the insurers that offer Marketplace coverage in New Hampshire (rate changes are calculated before subsidies are applied; most enrollees qualify for subsidies):

New Hampshire’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Celtic Insurance Company | -6.22% |

| Harvard Pilgrim Health Care of NE | 11.19% |

| Matthew Thornton Health Plan (Anthem BCBS) | 11.91% |

| WellSense | New for 2025 |

Source: New Hampshire Rate Review Submissions17 New Hampshire Insurance Department3

The rate changes for 2025 were approved as filed, without any changes to the rate proposals during the rate review process.17

Here’s an overview of how average full-price (pre-subsidy) premiums have changed in New Hampshire’s individual/family health insurance market over the years:

- 2015: Average increase of 0.5%18 (accounting for four new insurers)

- 2016: Average increase of 6.2%19

- 2017: Average increase of 6.8%20(insurer participation down to four)

- 2018: Average increase of 52%21(insurer participation down to three)19

- 2019: Average decrease of 11%22 (Medicaid Premium Assistance Program no longer in use)

- 2020: Average decrease of 0.7%22

- 2021: Average decrease of 15.6%15 (reinsurance program took effect)

- 2022: Average increase of 3.3%22

- 2023: Average increase of 4.8%23

- 2024: Average increase of 0.7%24

How many people are insured through New Hampshire’s Marketplace?

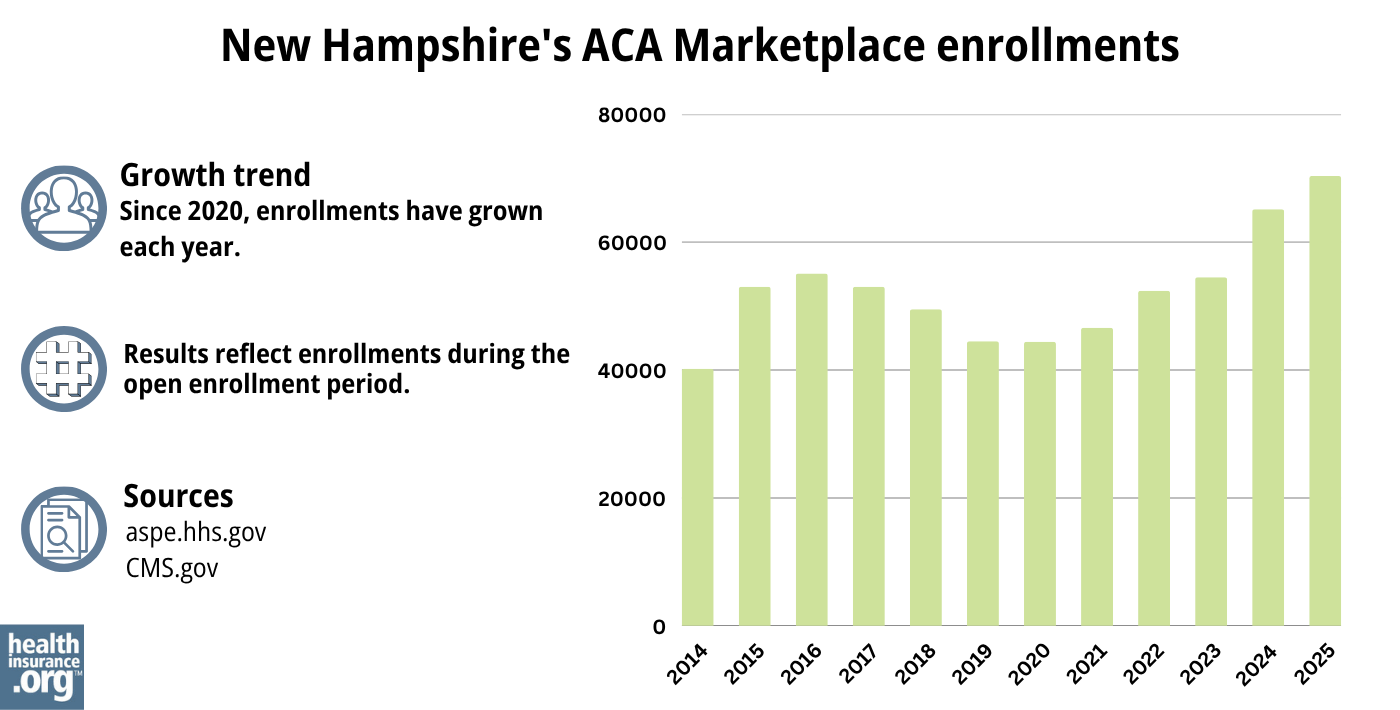

New Hampshire’s 2024 Marketplace enrollment reached a record-high, with 65,117 people enrolling in plans during the open enrollment period.25

The previous record high enrollment in New Hampshire’s Marketplace came in 2016, when a total of 55,183 people signed up during open enrollment.26

As illustrated below, New Hampshire Marketplace enrollment has been climbing since 2021, largely due to the American Rescue Plan’s enhancement of the ACA’s premium subsidies. The Inflation Reduction Act has extended these subsidy enhancements through 2025.

The enrollment growth in 2024 was also due to the “unwinding” of the pandemic-era Medicaid continuous coverage rule. CMS reported that by April 2024, nearly 20,000 New Hampshire residents had transitioned from Medicaid to a Marketplace plan during the unwinding process.27

Source: 2014,28 2015,29 2016,30 2017,31 2018,32 2019,33 2020,34 2021,35 2022,36 2023,37 2024,38 202539

What health insurance resources are available to New Hampshire residents?

HealthCare.gov: This is New Hampshire’s Marketplace. Residents can enroll in individual/family health plans and receive income-based subsidies. You can contact HealthCare.gov at 800-318-2596.

New Hampshire Department of Health and Human Services: The New Hampshire Department of Health and Human Services administers Medicaid and CHIP, as well as other social services programs. You can reach them at 1-844-ASK-DHHS (1-844-275-3447) For TDD Access, use Relay NH 1-800-735-2964

New Hampshire Insurance Department: Regulates the New Hampshire insurance industry, and assists consumers and businesses with insurance-related questions and concerns.

New Hampshire State Health Insurance Assistance Program: A local service that provides information and assistance with questions related to Medicare eligibility, enrollment, and claims.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in New Hampshire?

Explore more resources for options in New Hampshire including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- ”New Product Highlights Remarkable Growth and Stability in New Hampshire’s Health Insurance Market” New Hampshire Insurance Department. Aug. 14, 2024 ⤶ ⤶ ⤶

- ”New Hampshire HB613” BillTrack50. Enacted June 21, 2023 ⤶

- ”New Hampshire Health Plan Plan of Operation, High-Risk Pool” The New Hampshire Health Plan. Oct. 8, 2009 ⤶

- ”Protecting Granite Staters who participate in the individual health insurance market” The New Hampshire Health Plan. Accessed Aug. 28, 2024 ⤶

- ”NH House declines to make expanded Medicaid permanent” New Hampshire Bulletin. Jan. 4, 2024 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- “A quick guide to the Health Insurance Marketplace®” HealthCare.gov, Accessed August, 2023 ⤶ ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed May 10, 2024 ⤶ ⤶

- “What do I need to know about open enrollment in New Hampshire?” New Hampshire Insurance Department ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶

- 2021 Final Report of Health Care Premium and Claim Cost Drivers. New Hampshire Insurance Department. October 2022. ⤶ ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”New Hampshire Rate Review Submissions” RateReview.HealthCare.gov. Accessed Nov. 1, 2024 ⤶ ⤶ ⤶ ⤶

- Final Report of the 2015 Medical Cost Drivers. New Hampshire Insurance Department. November 2016. ⤶

- Final Report of the 2016 Health Care Premium and Claim Cost Drivers. New Hampshire Insurance Department. December 2017. ⤶ ⤶

- NHID Annual Hearing Health Insurance Premiums and Cost Drivers. New Hampshire Insurance Department. October 2018. ⤶

- Health care cost spike stuns NH residents. Foster’s Daily Democrat. November 2017. ⤶

- 2023 FINAL Report of Health Care Premium and Claim Cost Drivers. New Hampshire Insurance Department. December 2023. ⤶ ⤶ ⤶

- New Hampshire: Final Avg. Unsubsidized 2023 #ACA Rate Changes: +4.8% (W/Caveat). ACA Signups. November 2022. ⤶

- New Hampshire: *Final* Avg. Unsubsidized 2024 #ACA Rate Changes: +0.7% (Updated). ACA Signups. November 2023. ⤶

- ”Health Insurance Marketplaces 2024 Open Enrollment Period Report” CMS.gov. March 22, 2024 ⤶

- Health Insurance Marketplaces 2016 Open Enrollment Period: Final Enrollment Report. HHS.gov, 2016. ⤶

- ”HealthCare.gov Marketplace Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024. Accessed Aug. 13, 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶