Home > Health insurance Marketplace > Pennsylvania

Pennsylvania Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Pennsylvania health insurance Marketplace guide

This guide, including the FAQs below, was developed to help you choose the right Pennsylvania health insurance plan for you and your family. The options found in Pennsylvania’s ACA Health Insurance Marketplace can be a good choice for individuals and families who don’t have access to employer-sponsored health insurance or government-run coverage like Medicare or Medicaid.

Pennsylvania uses a fully state-based health insurance Marketplace known as Pennie to enroll its residents in ACA Marketplace plans. The Marketplace provides access to health insurance products from private insurers. The Pennsylvania Health Insurance Marketplace is robust, with 14 insurers offering coverage for 2024 — including Jefferson Health Plans (Health Partners Plan/Partners Insurance Company), which was new for 2024.3

Thirteen of those insurers — all but Cigna — will continue to offer Marketplace plans in Pennsylvania for 2025 (details below).4

Depending on income and other circumstances, most Pennsylvania Marketplace enrollees get help to lower their monthly insurance premium (the amount you pay to enroll in the coverage). And many also receive financial assistance with their out-of-pocket expenses.

As described below, Pennsylvania is considering a state-funded subsidy program that will stack on top of the federal ACA subsidies to make coverage more affordable for lower-income Pennie enrollees. Pennie officials had hoped that the state-funded subsidies would become available in the fall of 2024, but funding was not available for that. So the state is now planning for the subsidies to become available in the fall of 2025, to make 2026 coverage more affordable.5 Several other states already offer state-funded subsidies, in addition to the ACA’s federal subsidies.

Pennsylvania also has an “easy enrollment” program that allows uninsured residents to access Pennsylvania health insurance via their state tax returns.6 The state also established a reinsurance program that took effect in 2021, helping to keep unsubsidized individual/family health insurance premiums lower than they would otherwise be.7

Frequently asked questions about health insurance in Pennsylvania

Who can buy Marketplace health insurance?

To be eligible to enroll in Pennsylvania Health Insurance Marketplace coverage, you must:

- Live in Pennsylvania

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for financial assistance in the form of premium subsidies and cost-sharing reductions depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area – which depends on your age and location. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage through your employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP, or premium-free Medicare Part A.8

- File a joint tax return, if married.9 (with very limited exceptions)10

- Not be able to be claimed by someone else as a tax dependent.11

When can I enroll in an ACA-compliant plan in Pennsylvania?

In Pennsylvania the open enrollment period for individual and family coverage runs from November 1 to January 15.12

Your coverage starts on January 1 if you enroll before December 15. But if you apply between December 16 and January 15, your coverage will begin on February 1.13

Outside of open enrollment, you’ll need a special enrollment period (SEP) to enroll or make changes to your coverage. In most cases, a SEP requires a qualifying life event, but there are some SEPs that do not.

If you’re disenrolled from Pennsylvania Medicaid during the “unwinding” of the pandemic-era continuous coverage rule, you’ll have an opportunity to sign up for coverage through Pennie at that point, without having to wait for open enrollment. Medicaid disenrollments resumed in April 2023 in Pennsylvania (after being paused since March 2020), and by January 2024, 67,488 people previously covered by Medicaid had enrolled in private health plans through Pennie.14

Pennsylvania also has an “easy enrollment” program that allows uninsured residents to begin the process of accessing health insurance via their state tax returns.6 Pennie confirmed by phone that about 900 people used Path to Pennie to obtain coverage in 2023, including Medicaid and private plans.

How do I enroll in a Pennsylvania Marketplace plan?

To enroll in an ACA Marketplace plan in Pennsylvania, you can:

- Visit Pennie to enroll in Pennsylvania’s Marketplace. Here you will find an online platform to shop, compare plans and determine your subsidy eligibility.

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator or certified application counselor.

How can I find affordable health insurance in Pennsylvania?

You may find affordable health insurance options in Pennsylvania by utilizing the state’s health insurance exchange – Pennie. Here, residents can enroll in health coverage as well as determine their eligibility for financial assistance.

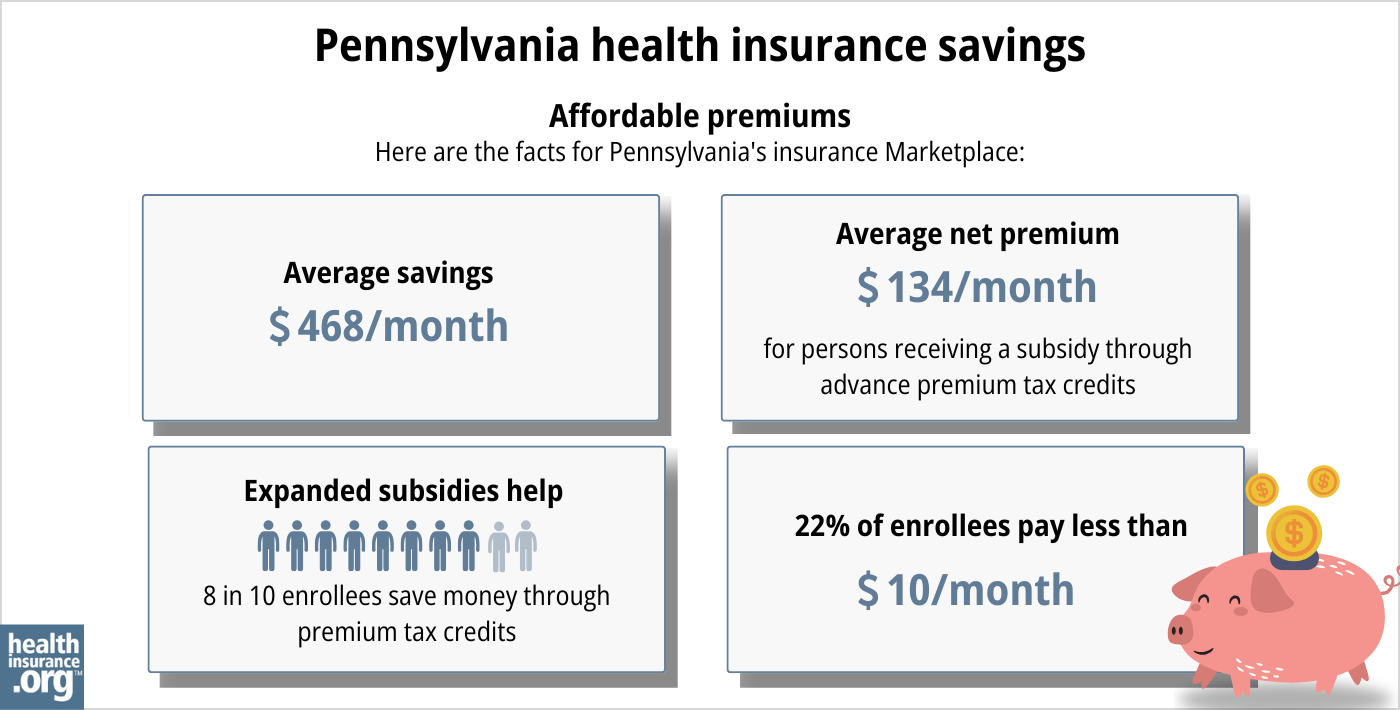

As of early 2024, about 88% of Pennie enrollees were receiving premium tax credits (premium subsidies). These tax credits amounted to an average savings of $527/month. With subsidies, enrollees paid an average of $177 per month for health coverage.15

(Note that the numbers above are based on effectuated enrollment; the chart below uses some different metrics and shows data based on all enrollments submitted during the open enrollment period for 2024 coverage.)

In addition to premium tax credits, Marketplace enrollees with household incomes up to 250% of the federal poverty level also qualify for cost-sharing reductions (CSR) that result in lower out-of-pocket costs (deductible, coinsurance, copays) on Silver plans. As of early 2024, three out of ten Pennie enrollees were receiving CSR benefits.15

Between the premium subsidies and cost-sharing reductions, you’ll likely find that a plan obtained via Pennie provides you with the best overall value.

Starting in the fall of 2025, for coverage effective in 2026, Pennsylvania may start to offer additional subsidies, beyond the federal subsidies that are already available.5

Governor Shapiro’s proposed 2024-25 budget calls for the state to create “an additional subsidy wrap” to make Pennie coverage more affordable for low-income and middle-income applicants.16

Legislation to create an “affordability assistance program” passed the Pennsylvania House in June 2024 and was sent to the Senate for consideration, but had not advanced by mid-August.17 As a result, Pennie’s board of directors noted in early August that funding for the state subsidy program was not available for plan year 2025.18

The legislation does not contain any specific parameters for how the subsidies will work (premium subsidies or cost-sharing reductions) or who will be eligible for them. It only notes that the program should be designed “to incentivize enrollment in on-exchange policies based on income or other eligibility criteria.”17

As of May 2024, the Pennie Board of Directors was recommending a sliding scale premium subsidy for gold and silver plans, for households earning between 151% and 300% of the federal poverty level.19

That structure was still the assumption as of August 2024, but the program had been delayed until plan year 2026 by that point. So board members noted that if the American Rescue Plan’s federal subsidy enhancements aren’t extended past 2025, the lower income bound for Pennie’s additional premium subsidies could be reduced.18

The state will only be able to proceed with the subsidy program, however, if the legislation is enacted and if the state can secure alternate funding for its reinsurance program, so that some of the funds currently being used for reinsurance can be diverted to the affordability assistance program.20

Because funding was not made available for plan year 2025, officials are now targeting plan year 2026 to start the state-funded subsidy program.

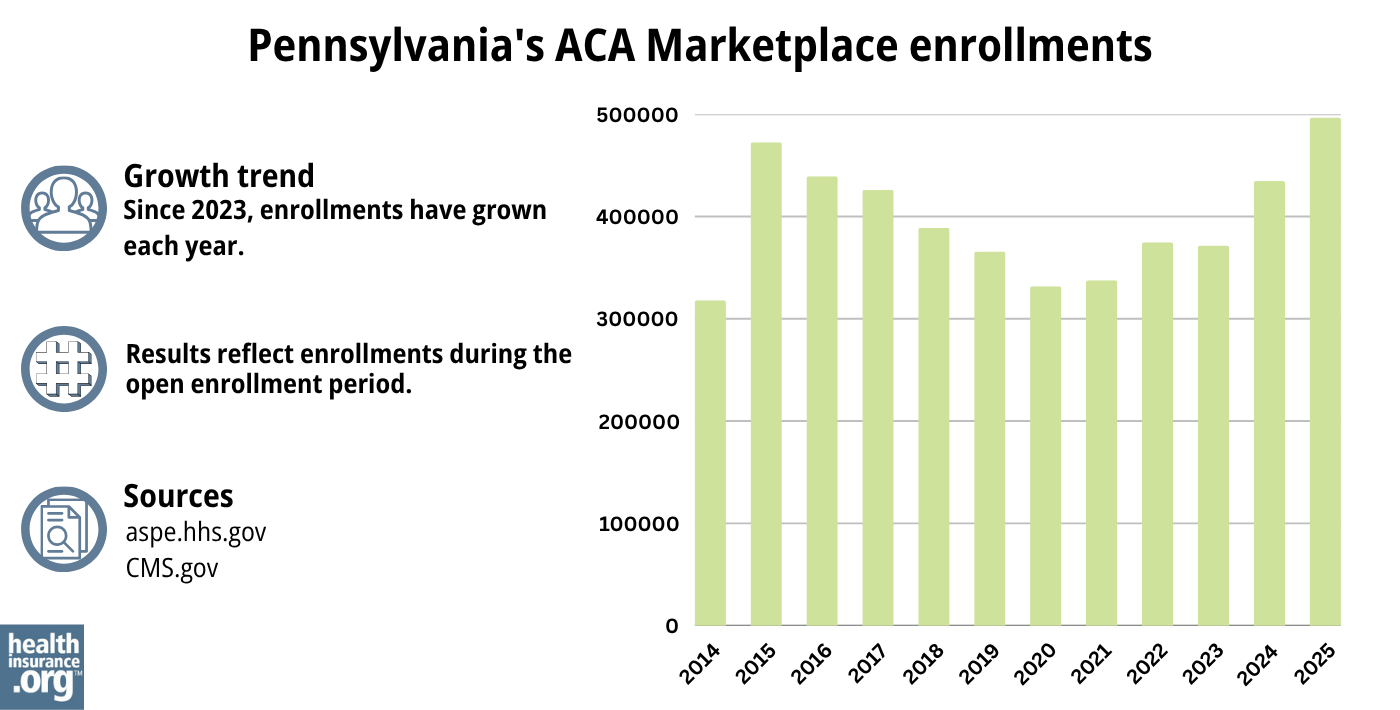

Source: CMS.gov21

How many insurers offer Marketplace coverage in Pennsylvania?

Fourteen insurers offer plans through Pennie for 2024 (including one new carrier, Jefferson Health Plans, which is Health Partners Plan/Partners Insurance Company in 2025), with varying coverage areas.22

Thirteen of those carriers plan to continue to offer Marketplace coverage in Pennsylvania in 2025 (14 if you count Jefferson Health Plans’ HMO and PPO entities separately),23 but Cigna is exiting the market.24 Pennie enrollees with Cigna coverage in 2024 will need to select a plan from another carrier during the open enrollment period that begins in November 2024.

Are Marketplace health insurance premiums increasing in Pennsylvania?

The following average rate changes have been approved for 2025 for the insurers that offer Marketplace coverage in Pennsylvania. The approved rates amount to an overall average rate increase of about 6%, before subsidies are applied.23

Pennsylvania’s ACA Marketplace Plan 2025 APPROVED Rate Changes by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Capital Advantage Assurance | 7.59% |

| Geisinger Health Plan | 10.1% |

| Geisinger Quality Options | 6.33% |

| Highmark, Inc. (EPO and PPO) | 7.81% |

| Highmark Benefits Group | 10.41% |

| Highmark Coverage Advantage | 9.21% |

| Keystone Health Plan East (Independence Blue Cross HMO) | 5.38% |

| QCC Insurance Company (Independence Blue Cross PPO) | 5.46% |

| UPMC Health Coverage | 5.74% |

| UPMC Health Options | 3.9% |

| PA Health and Wellness | 1.88% |

| Oscar Health | 4.81% |

| Jefferson Health Plans HMO (Health Partners Plans, Inc.) | 2.4% |

| Jefferson Health Plans PPO (Partners Insurance Company) | 0% |

| Cigna | exiting the market |

Source: Pennsylvania Insurance Department23

Average rate changes apply to full-price health plans, but the majority of Pennsylvania health insurance marketplace enrollees receive premium subsidies, and thus do not pay full price.25 Net premium changes depend on how much the plan’s rate is changing as well as how much the person’s premium subsidy is changing for the coming year.

For perspective, here’s a summary of how average full-price premiums for Pennsylvania health insurance have changed over time:

- 2015: Average increase of 12%26

- 2016: Average increase of 12%27

- 2017: Average increase of 32.5%28

- 2018: Average increase of 30.6%

- 2019: Average decrease of 2.3%29

- 2020: Average increase of 3.8%30

- 2021: Average decrease of 3.3%31

- 2022: Average increase of 0.2%32

- 2023: Average increase of 5.5%33

- 2024: Average increase of 3.9%34

How many people are insured through Pennsylvania’s Marketplace?

What health insurance resources are available to Pennsylvania residents?

Pennie

The official Pennsylvania health coverage Marketplace.

State Exchange Profile: Pennsylvania

The Henry J. Kaiser Family Foundation overview of Pennsylvania’s progress toward creating a state health insurance exchange.

Health Care Matters, Pennsylvania Office of the Attorney General

Serves Pennsylvania consumers with health-related problems.

(717) 705-6938 / Toll-free: 1-877-888-4877 (only in Pennsylvania)

Pennsylvania Consumer Assistance Program

Assists people with private insurance, Medicaid, or other insurance with resolving problems pertaining to their health coverage; assists uninsured residents with access to care.

(877) 881-6388 / [email protected]

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Pennsylvania?

Explore more resources for options in Pennsylvania including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Affordable Care Act Health Rate Filings” Pennsylvania Insurance Department. Accessed Dec. 18, 2024 ⤶

- “Affordable Care Act Health Rate Filings; ACA-Related Rate Filings for 2024 Plans” Pennsylvania Insurance Department. Accessed October 2023 ⤶

- ”Pennsylvania Rate Review Submissions” RateReview.HealthCare.gov. Accessed Aug. 15, 2024 ⤶

- ”Pennie Board of Directors Strategic Planning Session” (pages 27-30). Pennie Board of Directors. February 22, 2024, AND “Pennie Board Meeting Recording” and Pennie Board Meeting Deck” Aug. 8, 2024 ⤶ ⤶

- ”Path to Pennie” Pennie.com. Accessed October 2023. ⤶ ⤶

- Section 1332 Waiver. Pennsylvania Insurance Department. Accessed November 2023. ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed January 12, 2024. ⤶

- “What Is Open Enrollment?” Pennie.com. Accessed May 7, 2024 ⤶

- “What Is Open Enrollment?” Pennie.com. Accessed May 7, 2024 ⤶

- State-based Marketplace (SBM) Medicaid Unwinding Report (data through January 2024). Medicaid.gov. April 30, 2024. ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶

- ”Governor Josh Shapiro Executive Budget 2024-2025” Budget.pa.gov. February 6, 2024 ⤶

- ”Pennsylvania HB2234” BillTrack50. Accessed Aug. 16, 2024 ⤶ ⤶

- ”Pennie Board Meeting Recording” and Pennie Board Meeting Deck” Pennie Board of Directors. Aug. 8, 2024 ⤶ ⤶

- ”Pennie Board of Directors Meeting” Pennie.com. May 16, 2024 ⤶

- ”Fiscal Note, HB2234” Pennsylvania House Committee on Appropriations. June 5, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- “Pennsylvania Rate Review Submissions” HealthCare.gov, Accessed August 2023 ⤶

- ”Affordable Care Act Health Rate Filings” Pennsylvania Insurance Department. Accessed Dec. 18, 2024 ⤶ ⤶ ⤶

- ”Health Insurance Plans in Pennsylvania” Cigna. Accessed Aug. 16, 2024 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶

- ”Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums” The Commonwealth Fund. December 2014. ⤶

- ”Pennsylvania: APPROVED 2016 Avg. Rate Hike: 12.0% (Reduced From 15.6%)” ACA Signups. October 2015. ⤶

- ”ACA Rates Q&A” Pennsylvania Insurance Department. Accessed October 2023. ⤶

- ”Rate Change Request Summary – 2019” Pennsylvania Insurance Department. Accessed October 2023. ⤶

- ”Pennsylvania: *Final* 2020 Avg. #ACA Exchange Rate Changes: 3.8% Increase” ACA Signups. October 2019. ⤶

- ”PA’s ACA Marketplace Rates to Decrease by an Average of 3.3% in 2021” Pennsylvania Health Access Network. October 2020. ⤶

- ”Pennsylvania: Approved 2022 #ACA Rate Changes: +0.2% Individual Market, +4.8% Sm. Group Market” ACA Signups. October 2021. ⤶

- ”Pennsylvania: Final 2023 Unsubsidized #ACA Rate Changes: +5.5% (Down From +7.1%)” ACA Signups. October 2022. ⤶

- ”Shapiro Administration Announces 2024 Health Insurance Rates” Pennsylvania Pressroom. September 28, 2023. ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶