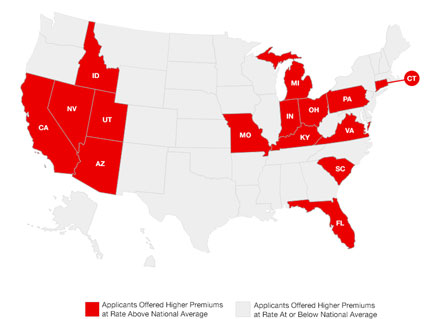

According to HealthPocket, insurer 'rate up' practice varied widely state by state.(Click for a larger illustration.)

I recently completed a study of health insurance premium practices. The results illustrated how hard it is for consumers to be effective shoppers for health insurance.

Over 80 percent of the 10,000+ health plans investigated change the premium costs for some consumers AFTER their applications were submitted. Consumers in Pennsylvania were most likely to receive these post-application premium increases, with 32 percent of Pennsylvania applicants unable to get the premium they were initially quoted.

Nationally, nearly one out of five people applying for individual health insurance found they could not get the initially quoted premium.

When insurers wait until an application is reviewed to reveal the true monthly premium, it is impossible for consumers to know what health insurance plan is the least expensive for their circumstances.

Imagine visiting a car dealership to buy a minivan. After reviewing your options, you tell the dealer "I want the $15,000 Dodge Caravan." The dealer takes your purchase paperwork and then tells you afterwards "You can have the minivan for $22,000. We only sell this car at $15,000 to people under 170 pounds." If this happened to you, you would feel you were the victim of a 'bait-and-switch.'

Health insurance shoppers who are brand loyal may be surprised by some of the results in our HealthPocket study. Blue Cross Shield companies were ranked among insurance companies least likely to offer applicants the premium they were first quoted. Anthem Health Plans of Virginia, part of Anthem Blue Cross Blue Shield, raised the premium on 68 percent of the applicants to their health insurance plans.

Read the rest of our discoveries in our health insurance premium surcharge InfoStat study.