Medicare in Alabama

More than 1.1 million Alabama residents have Medicare coverage; 51% of them have selected Medicare Advantage plans

Key Takeaways

- More than a million Alabama residents are enrolled in Medicare, accounting for more than 21% of the state’s population.1

- 51% of Alabama Medicare beneficiaries select Medicare Advantage plans.2

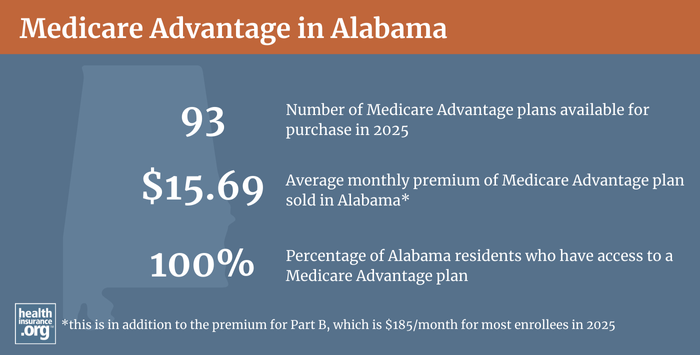

- Alabama residents can select from 93 Medicare Advantage plans in 2024, depending on their county.3

- In all states, including Alabama, access to Medigap plans is limited for enrollees under age 65 in most cases.4 (The state does not require insurers to offer plans to people under 65, and can use medical underwriting to qualify individuals.5 Only three insurers offer Medigap plans for those under 65 who qualify in Alabama.)6 But insurers offer 12 plans to those 65+.7

- In 2024 845,000 Alabama Medicare beneficiaries have Part D prescription coverage — most via Medicare Advantage plans, but 242,668 have stand-alone Part D prescription coverage.8

Medicare enrollment in Alabama

When it comes to determining which Medicare coverage is right for your situation, there’s a long list of factors that you can and should consider.

As of June 2024, there were 1,101,548 people enrolled in Medicare in Alabama.1 That’s more than 21% of the state’s total population, compared with about 18.5% of the United States population enrolled in Medicare in 2022.9 Alabama’s higher-than-average Medicare enrollment is due in part to the fact that a higher-than-average number of people under the age of 65 are enrolled in Medicare in Alabama.

Medicare covers most people who are age 65 or older, and it also covers disabled individuals under the age of 65. Nationwide, almost 88% of Medicare beneficiaries are eligible due to their age, and the remaining 12% are eligible due to a disability.10 But in Alabama in 2021, nearly 22% of Medicare beneficiaries were under age 65.11

(Individuals under age 65 with a disability automatically get Part A and Part B after receiving disability benefits from Social Security or certain disability benefits from the federal Railroad Retirement Board for 24 months. Individuals’ eligibility can be due to ALS or end-stage kidney disease as well.)12

Learn how Alabama Medicaid can provide financial assistance to Medicare beneficiaries with limited income and assets.

Learn about Medicare plan options in Alabama by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Alabama

We’ve created this guide to help you understand the Alabama health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Alabama.

Learn about Alabama’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Alabama.

Frequently asked questions about Medicare in Alabama

What is Medicare Advantage?

Medicare Advantage is an alternative to Original Medicare, provided by private insurers instead of directly by the federal government. It covers all of the benefits of Original Medicare (ie, hospital care and medical/physician care), albeit with different out-of-pocket costs and access to medical providers.

And most Medicare Advantage plans also provide helpful additional healthcare benefits, such as Medicare Part D coverage for prescription drugs, plus extras like dental and vision coverage. But provider networks tend to be much more limited and localized with Medicare Advantage, unlike Original Medicare’s nationwide access to providers. There are pros and cons to either option.

Fifty-one percent of Alabama Medicare beneficiaries were enrolled in private Medicare Advantage and other health plans in 2021.13 Nationwide, the average was 43%.13 The remaining 49% of the state’s Medicare beneficiaries had opted instead for coverage under Original Medicare.13 But by mid-2024, 63% of the people with Medicare in Alabama were enrolled in private plans (ie, Medicare Advantage, as opposed to Original Medicare).14 The increase in Medicare Advantage enrollment has been a steady trend in most states over the last several years; nationwide, about 54% of Medicare beneficiaries had Advantage plans as of 2024.14

The availability of Medicare Advantage plans depends on where a person lives. In Alabama in 2023, the number of Medicare Advantage plans available can range up to 108 plans, depending on the county.15 It’s not a coincidence that the most populated counties have a higher number of available plans, as insurer service areas tend to be concentrated in areas where there is a large population.

Medicare Advantage enrollment is available when a person is first eligible for Medicare, and there’s also an annual window each fall called the Annual Election Period (AEP), from October 15 to December 7. During this window, Medicare beneficiaries can switch from one Medicare Advantage plan to another, or from Medicare Advantage to Original Medicare or vice versa (note that there is no annual enrollment window for Medigap plans; medical underwriting is necessary in most cases in order to enroll in a Medigap plan after a person’s initial enrollment window).

There’s also a Medicare Advantage open enrollment period (January 1 to March 31) during which people who are already enrolled in Medicare Advantage plans can switch to a different Medicare Advantage plan or drop their Medicare Advantage plans and enroll in Original Medicare instead.2

What are Medigap plans?

Medigap plans are used to supplement Original Medicare, covering some or all of the out-of-pocket healthcare costs (for coinsurance and deductibles) that people would otherwise incur if they only had Original Medicare on its own.

According to Medicare’s plan finder tool, there are 12 Medigap plans offered in Alabama as of 2024.16

Medigap plans are standardized under federal rules, and people are granted a six-month window, when they turn 65 and enroll in Original Medicare, during which coverage is guaranteed issue for Medigap plans, and insurers can’t use medical underwriting to determine eligibility or premiums. Federal rules do not, however, guarantee access to a Medigap plan if you’re under 65 and eligible for Medicare as a result of a disability.

The majority of the states have adopted rules to ensure at least some access to Medigap plans for enrollees under the age of 65, but Alabama is not among them. In Alabama, Medicare beneficiaries who are under 65 can apply for a Medigap plan, but coverage is not guaranteed issue and insurers can use medical underwriting to determine whether to issue a policy and at what price.

In Alabama there are three Medigap plans offered for enrollees who are under age 65.17 They offer just a few plan options, with premiums are substantially higher than premiums for similar plans for a person who is 65.

A person who has Medicare prior to age 65 as a result of a disability does qualify for an open enrollment period, upon turning age 65, during which they can select any Medigap plan, guaranteed-issue, from any insurer offering plans in their area.

People under age 65 who are eligible for Medicare also have the option of enrolling, with standard premiums, in a Medicare Advantage plan. This now includes people with end-stage renal disease, who were ineligible to join most Medicare Advantage plans prior to 2021.

What is Medicare Part D?

Original Medicare does not cover outpatient prescription drugs. But Medicare beneficiaries can get prescription coverage via a Medicare Advantage plan, an employer-sponsored plan (offered by a current or former employer), or a stand-alone Medicare Part D plan.

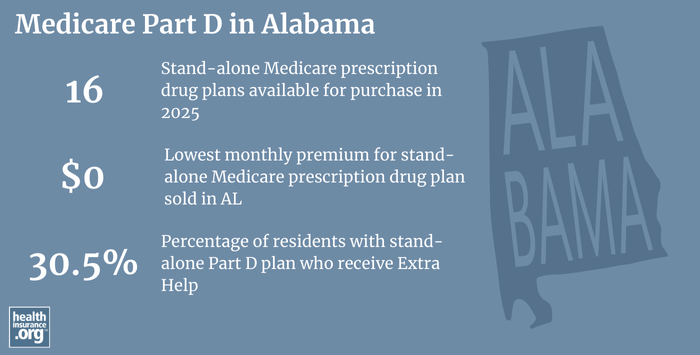

As of June 2024, there were 845,654 Medicare beneficiaries in Alabama who were enrolled in Medicare Part D coverage. The majority, more than 602,986, had coverage under a Medicare Advantage plan with integrated Part D coverage. Another 242,668 had stand-alone Part D plans.18

For 2023 coverage, there are 24 stand-alone Part D plans available in Alabama, with premiums starting at $7.40 per month.15

Medicare Part D enrollment is available when a beneficiary is first eligible for Medicare, and also during the annual open enrollment period in the fall (October 15 – December 7; the same enrollment window that applies to Medicare Advantage plans). This window is an opportunity for Medicare beneficiaries to change their Part D coverage, with any plan changes taking effect January 1 of the coming year.

How does Medicaid provide financial assistance to Medicare beneficiaries in Alabama?

Many Medicare beneficiaries receive assistance through Medicaid with the cost of Medicare premiums, prescription drug expenses, and services not covered by Medicare – such as long-term care.

Our guide to financial assistance for Medicare enrollees in Alabama includes overviews of these programs, including long-term care benefits, Medicare Savings Programs, and eligibility guidelines for assistance.

What additional help is available for Medicare in Alabama?

If you have questions about filing for Medicare benefits in Alabama, Medicare eligibility in Alabama, or Medicare enrollment in Alabama, you can contact the Alabama State Health Insurance Assistance Program.

You can also reach out to the Alabama Department of Insurance for assistance with Medigap plans in Alabama. The Department of Insurance also oversees the agents and brokers who offer health coverage in Alabama, and can provide assistance and information in a variety of health coverage situations.

The Medicare Rights Center is an excellent resource, as is Medicare.gov.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Alabama?

Explore more resources for options in Alabama including ACA coverage, short-term health insurance, dental insurance and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Eligibility.” Centers for Medicare & Medicaid Services Data. Accessed Oct.10. ⤶ ⤶

- Total Number of Medicare Beneficiaries by Type of Coverage.” Kaiser Family Foundation, May 4, 2023 ⤶

- Fact Sheet – Centers for Medicare & Medicaid Services | Centers for Medicare & Medicaid Services. September 27, 2024. ⤶

- “Get Ready to Buy.” Medicare.gov. Accessed June 28, 2023. ⤶

- “Alabama Department of Insurance.” ALDOI. Accessed June 30, 2023. ⤶

- “Find a Medicare plan.” Medicare.gov. Accessed Oct. 10, 2024 ⤶

- Find a Medicare plan. Medicare.gov. Accessed Oct. 10, 2024 ⤶

- “Medicare Monthly Eligibility.” Centers for Medicare & Medicaid Services Data. Accessed Oct. 10, 2024 ⤶

- “U.S. health care coverage and spending – federation of American scientists.” Congressional Research Service. March 20, 2024. ⤶

- ”Quick Guide to Recent Changes to Medicare.” Administration for Community Living, April 20, 2023. ⤶

- “Medicare Open Enrollment Ends Soon.” Alabama Department of Senior Services, Nov. 30, 2022. ⤶

- “Medicare and You” Centers for Medicare & Medicaid Services. Accessed Oct. 10, 2024. ⤶

- “Total Number of Medicare Beneficiaries by Type of Coverage.” Kaiser Family Foundation, May 4, 2023. ⤶ ⤶ ⤶

- “Medicare Advantage in 2024: Enrollment Update and Key Trends” Kaiser Family Foundation, Aug. 8, 2024. ⤶ ⤶

- Fact Sheet – Centers for Medicare & Medicaid Services | Centers for Medicare & Medicaid Services. September 29, 2022. ⤶ ⤶

- Find a Medicare plan. Medicare.gov. Accessed Oct. 10, 2024. ⤶

- Find a Medicare plan. Medicare.gov. Accessed Oct. 10, 2024.. ⤶

- “Medicare Monthly Eligibility.” Centers for Medicare & Medicaid Services Data. Accessed Oct. 10, 2024. ⤶