What is the individual mandate?

The individual mandate is a provision within the Affordable Care Act (ACA) that required individuals to purchase minimum essential coverage – or face a tax penalty – unless they were eligible for an exemption. The individual mandate still exists, but the federal penalty for non-compliance was eliminated starting in 2019. As described below, some states still impose their own penalties for people who don't maintain minimum essential coverage.

Who was affected by the individual mandate?

Most Americans already get health insurance either from an employer or from the government (Medicaid, Medicare, VA). They didn’t need to worry about the penalty, because employer-sponsored and government-sponsored health insurance count as minimum essential coverage.

But for people who were uninsured or relying on plans that aren't regulated by the ACA, such as short-term health insurance of fixed indemnity plans, the individual mandate meant that they needed to obtain better coverage starting in 2014 to avoid a possible financial penalty. Fortunately, the ACA also provides significant subsidies to make ACA-compliant coverage affordable.

How big were Obamacare penalties?

The IRS reported that for tax filers subject to the penalty in 2014, the average penalty amount was around $210. In 2015, the average penalty was around $470. On 2016 tax returns, the average was about $667 per filer who owed a penalty.

For 2018, the penalty for a middle-income family of four earning $60,000 was $2,085.

The penalty could never exceed the national average cost for a Bronze plan, though – as penalty caps were readjusted annually to reflect changes in the average cost of a Bronze plan.

Is the individual mandate still in effect?

Technically, the individual mandate itself is still in effect, but there's no longer a penalty to enforce it. The tax penalty was eliminated after the end of 2018, under the terms of the Tax Cuts and Jobs Act of 2017.

The continued existence of the mandate – but without the penalty – was the crux of the California v. Texas (aka Texas v. Azar) lawsuit, in which 20 states challenged the constitutionality of the mandate without the penalty, arguing that the entire ACA should be overturned if the mandate is unconstitutional. That case ultimately went to the Supreme Court in 2020, and a ruling to uphold the ACA was issued in 2021.

What was the basis for including an individual mandate?

When the Affordable Care Act was written, lawmakers knew that it would be essential to get healthy people enrolled in coverage, since insurance only works if there are enough low-cost enrollees to balance out the sicker, higher-cost enrollees. So the law included an individual mandate, otherwise known as the shared responsibility provision. Although there is no longer a penalty for non-compliance with the mandate, the ACA-compliant individual market has remained very stable — with record high enrollment in 20241 — due in large part to the robust premium subsidies that make coverage much more affordable than it would otherwise be.

Do states have their own individual mandates?

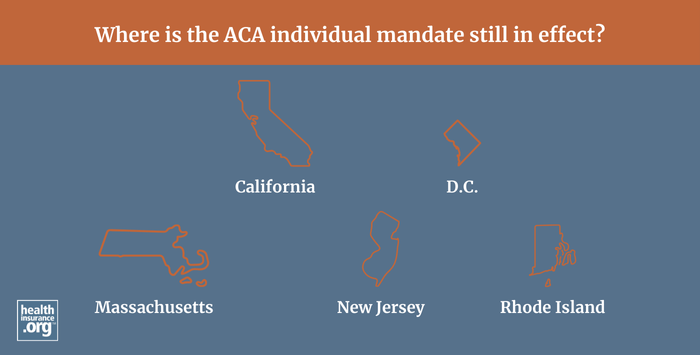

Yes. Although the federal individual mandate penalty was eliminated at the end of 2018, some states have implemented their own individual mandates and associated penalties. Mandates with penalties for non-compliance are in effect in Massachusetts, New Jersey, the District of Columbia, California, and Rhode Island.

Footnotes

- "Historic 21.3 Million People Choose ACA Marketplace Coverage" HHS.gov. Jan. 24, 2024 ⤶