Medicaid eligibility and enrollment in Massachusetts

Some people who lost MassHealth post-pandemic were automatically enrolled in $0-premium coverage in the exchange

Who is eligible for Medicaid in Massachusetts?

Massachusetts Medicaid is known as MassHealth, and eligibility rules are more generous than many other Medicaid programs. Individuals qualify with household incomes up to the following levels (the numbers here include a 5% income disregard that’s used when determining eligibility for income-based Medicaid/CHIP coverage).

- Children up to age 1: up to 205% of the federal poverty level (FPL)

- Children ages 1 to 18: up to 155% of FPL

- Pregnant women: up to 205% of FPL (coverage for the mother continues for 12 months after the baby is born)

- Children with family income too high to qualify for Medicaid and pregnant women who aren’t eligible for Medicaid due to immigration status are eligible for the Children’s Health Insurance Program (CHIP); CHIP is available to kids with family income up to 305% of FPL and to non-resident pregnant women with income up to 205% of FPL

- Parents and other adults are covered with incomes up to 138% of FPL

Apply for Medicaid in Massachusetts

Apply online. Fill out a paper application. Apply by phone: 1-800-841-2900 or TTY 1-800-497-4648. Apply in person at a MassHealth Enrollment Center.

Eligibility: Children up to 1 year with household income up to 200% of FPL. Children ages 1-18 with household income up to 150% of FPL. Pregnant women with household income up to 200% of FPL. Adults with household income up to 138% of FPL.

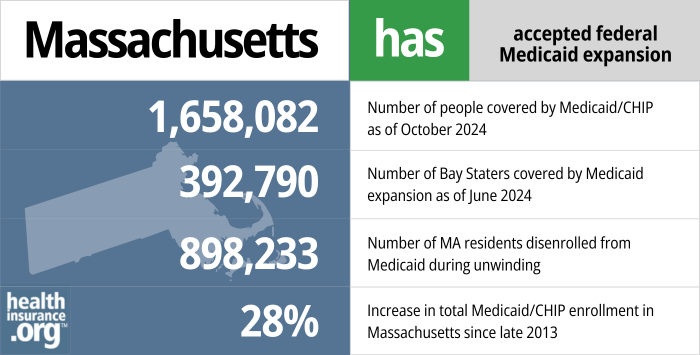

ACA’s Medicaid eligibility expansion in Massachusetts

It’s no surprise that Massachusetts has a robust Medicaid program (MassHealth), giving the commonwealth’s leadership in expanding health care coverage. Massachusetts has relatively high income limits for the groups it covered prior to the Affordable Care Act (ACA) rollout, and it adopted ACA Medicaid expansion to cover low-income adults in 2014.

In Massachusetts, MassHealth CarePlus is the Medicaid expansion program. MassHealth CarePlus operates under an 1115 waiver, which was renewed in 2022 and continues through 2027.

- 1,658,082 – Number of people covered by Medicaid/CHIP as of October 20241

- 392,790 – Number of Bay Staters covered by Medicaid expansion as of June 20242

- 898,233 – Number of MA residents disenrolled from Medicaid during unwinding3

- 28% – Increase in total Medicaid/CHIP enrollment in Massachusetts since late 20134

Explore our other comprehensive guides to coverage in Massachusetts

This guide was created to help you better understand the health coverage options available to you and your family in Massachusetts. The options found in Massachusetts’s ACA Marketplace may be a good choice for many consumers, and we will guide you through the options below.

Learn about health insurance coverage options in Massachusetts.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Massachusetts.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Massachusetts as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage.

Learn about short-term insurance regulations in Massachusetts.

Frequently asked questions about Massachusetts Medicaid eligibility and enrollment

How do I enroll in Medicaid in Massachusetts?

Residents have several options to apply for Medicaid in Massachusetts (MassHealth) if they are under 65:

- Submit an application online at MAhealthconnector.org.

- Fill out a paper application. Return your completed form:

- By mail: Health Insurance Processing Center; P.O. Box 4405; Taunton, MA 02780.

- By fax to 617-887-8770. Use this cover sheet when faxing your application.

- Apply by phone by calling 1-800-841-2900 or TTY: 1-800-497-4648 for people who are deaf, hard of hearing, or speech disabled.

- Apply in person at a MassHealth Enrollment Center. See the left side of this webpage for a list of centers or call 1-888-665-9993 (or TTY: 1-888-665-9997 for people who are deaf, hard of hearing, or speech disabled).

Seniors and people with Medicare can apply for Medicaid using this website or by contacting MassHealth at (800) 841-2900.

How does Medicaid provide assistance to Medicare beneficiaries in Massachusetts?

Many people with Medicare receive help through Medicaid with Medicare premium costs, prescription drug expenses, and expenses that Medicare doesn’t cover — such as long-term care.

Medicare Resources’ guide to financial resources for Medicare enrollees in Massachusetts provides an overview of those programs, including Medicare Savings Programs, nursing home benefits, and income guidelines for assistance.

How did Massachusetts handle Medicaid renewals after the pandemic?

Nationwide, Medicaid disenrollments were paused during the COVID pandemic, from March 2020 through March 2023. During that time, Medicaid enrollees continued to have coverage even if their circumstances had changed such that they no longer met the eligibility criteria. Partly as a result of the COVID-related ban on disenrollments, MassHealth enrollment grew by about 500,000 people from early 2020 to early 2023.

But in 2023, states began disenrolling people who are no longer eligible for Medicaid. MassHealth disenrollments resumed in June 2023, and the state had completed its review of all enrollees’ eligibility by May 2024.5

During the “unwinding” period, 898,233 people were disenrolled from MassHealth.6 But due to re-enrollments as well as new applications, total net enrollment only decreased by 362,499 people during the unwinding period.7

About one-third of the disenrollments were because the person was no longer eligible while the other two-thirds were procedural disenrollments (meaning the state didn’t have enough information to determine eligibility).

About 133,000 people who lost MassHealth during the unwinding process transitioned to private plans through Massachusetts Health Connector (the state-run exchange/Marketplace).5 Some were automatically enrolled, which is a protocol the state is using if the person qualifies for a $0-premium policy through Massachusetts Health Connector and opts into the automatic enrollment program (which became available in 2022, so it predates the unwinding of the pandemic-era Medicaid continuous coverage rule). As of April 2024, CMS reported that more than 24,000 people had been automatically enrolled in a plan through Massachusetts Health Connector following disenrollment from MassHealth.8

Just like most states’ Medicaid programs, MassHealth continued to conduct regular renewals/eligibility redeterminations throughout the pandemic, so a significant number of enrollees remained current on their renewals. MassHealth had 2.3 million enrollees in the spring of 2023, and eligibility redeterminations had to be conducted for all of them during the “unwinding” period. But the timing depended on whether the person’s coverage had been continued (despite lack of eligibility verification) during the pandemic:

- For people whose enrollment was protected due to the pandemic-era ban on disenrollments (ie, they either didn’t respond to a renewal packet during the pandemic, or the state received information indicating that they’re no longer eligible), MassHealth processed eligibility redeterminations at some point in the first nine months of the unwinding period.

- For people who had stayed up-to-date on their renewals during the pandemic, renewals were processed 12 months after the person’s last renewal.

In processing renewals, MassHealth noted that they would accept reported income within 20% of the income that the state had on file (this threshold was previously 10%, but the expanded range makes it easier for more renewals to go through automatically).

How many people are enrolled in Massachusetts Medicaid?

There were about 2 million Massachusetts residents covered by Medicaid/CHIP as of May 2024.9

Between September 2013 and April 2024, MassHealth enrollment grew by 31%.10 This increase was mostly due to Medicaid expansion, as the enrollment growth due to the pandemic had been largely “unwound” by April 2024.

Massachusetts Medicaid History and Details

Massachusetts Medicaid history

Former Gov. Deval Patrick signed legislation authorizing Medicaid expansion in July 2013. But for several years before that, Massachusetts had already been receiving additional federal funding to provide Medicaid or subsidized private coverage to people with income up to 150% of the poverty level (the approach that Massachusetts used starting in 2006 ending up being a partial blueprint for the ACA).

While former Gov. Charlie Baker, a Republican, called for modifications to the commonwealth’s Medicaid program (including capping Medicaid expansion at 100% of the poverty level, which the Trump administration rejected), he was one of the Republican governors who pushed back against his party’s efforts to repeal the ACA in 2017. Baker’s initial focus with regards to Medicaid was to ensure that the eligibility verification process was in place, so that the state wouldn’t have to provide MassHealth coverage to people who weren’t actually eligible.

Temporary MassHealth enrollment in 2014

The Massachusetts Health Connector is a state-run exchange that pre-dates the ACA. But the process of making it compliant with the ACA proved to be technologically challenging; the system was supposed to screen applicants to determine whether they were eligible for MassHealth or premium subsidies, but wasn’t functional in its first year. As a result, about 325,000 applicants were temporarily enrolled in MassHealth in 2014. This allowed those residents to have health insurance despite the exchange glitches, but it also cost the state about $140 million in 2014.

By the end of January 2015, about 130,000 people who had been temporarily placed on MassHealth in 2014 had been able to verify their eligibility for coverage through Massachusetts Health Connector. Roughly half of them were eligible for MassHealth and remained covered under the program (the rest were able to transition to private plans instead, with subsidies if eligible based on household income).

Eligibility verifications in 2015

When Governor Baker unveiled his budget in March 2015, one of the primary focuses was on reducing Medicaid spending. That included verifying eligibility for 1.2 million of MassHealth’s 1.9 million enrollees (the other 700,000 had enrolled recently enough that their eligibility was current). Federal Medicaid rules require that enrollees’ eligibility be verified annually, but the technology problems with the Massachusetts Health Connector in 2013 – 2014 resulted in MassHealth coverage being automatically renewed for 1.2 million people without verifying eligibility.

Enrollees had to update their information in order to renew their benefits, and by May 2015, the program had disenrolled 158,000 people – out of 500,000 – who hadn’t responded to the state’s information requests. The state began combing through the next round of 500,000 enrollees in July, making sure that they were still eligible to remain on MassHealth. By September, the eligibility verification process had reduced total MassHealth enrollment by about 205,000 people.

By 2017, Baker was advocating for cost-containment measures for MassHealth, including a proposal to move 140,000 people with income between 100% and 138% of the poverty level from MassHealth to ConnectorCare, and a proposed rule that would make people ineligible for MassHealth if they have access to affordable employer-sponsored health insurance (defined as having premiums equal to less than 5% of income). That provision was projected to make roughly 42,000 people ineligible for MassHealth.

Ultimately, lawmakers passed legislation to temporarily (for 2018 and 2019) increase assessments on employers in Massachusetts in order to generate about $200 million in revenue for the MassHealth program, but did not implement Baker’s proposal to prevent people with access to affordable employer-sponsored insurance from enrolling in MassHealth. In 2018 and 2019, employers paid a higher Employer Medical Assistance Contribution (the maximum contribution increased from $55 to $71 per employee per year) if employees received benefits via MassHealth or ConnectorCare, and were also subject to an additional assessment of up to $750 per employee per year.

The Massachusetts Department of Health and Human Services also submitted a 1115 waiver proposal in September 2017, seeking permission to cap Medicaid eligibility for non-disabled adults at 100% of the poverty level. The state projected that 40,000 Medicaid expansion enrollees, and 100,000 parents and caretakers (who were already eligible for MassHealth before the ACA’s expansion of Medicaid) would have been shifted from MassHealth to ConnectorCare if the waiver had been approved, but CMS rejected that proposal in 2018 (consumer advocates had noted that the proposed change would not have furthered the goals of the Medicaid program, and could have resulted in coverage becoming less affordable for the population that would have been moved to ConnectorCare).

CMS has consistently rejected states’ requests to provide enhanced federal Medicaid funding if the state only expands eligibility to 100% of the poverty level. Other examples of this are Utah, Wisconsin, and Georgia.

Maura Healey, a Democrat, took office as the Governor of Massachusetts in 2023. Healey was previously the attorney general, and has long supported the ACA and Medicaid expansion.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Massachusetts?

Explore more resources for options in Massachusetts including ACA coverage, short-term health insurance, dental insurance and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”October 2024 Medicaid & CHIP Enrollment Data Highlights” , Medicaid.gov, Accessed January 2025 ⤶

- “Medicaid Enrollment – New Adult Group”, Medicaid.gov, Accessed February 2025 ⤶

- ”MassHealth Redetermination Dashboard” (Departures), MASS.gov, Accessed January 2025 ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment”, KFF.org, Accessed February 2025 ⤶

- ”June 2024: Final Update on MassHealth Redeterminations” MassHealth. June 2024 ⤶ ⤶

- ”MassHealth Redetermination Dashboard” (Departures), MASS.gov, Accessed Aug. 23, 2023 ⤶

- ”MassHealth Redetermination Dashboard” (Data Summary), MASS.gov, Accessed Aug. 23, 2023 ⤶

- ”State-based Marketplace (SBM) Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024; Accessed Aug. 18, 2024 ⤶

- ”MassHealth Snapshot Enrollment Summary of May 2024 Caseload” MassHealth Dashboard. Accessed Aug. 26, 2024 ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment”, KFF.org, Accessed Aug 23, 2024 ⤶