Medicare in Idaho

Original Medicare, Medicare Advantage, Part D prescription drug, and Medigap coverage in Idaho

Key takeaways

- More than 393,000 residents are enrolled in Medicare in Idaho.1

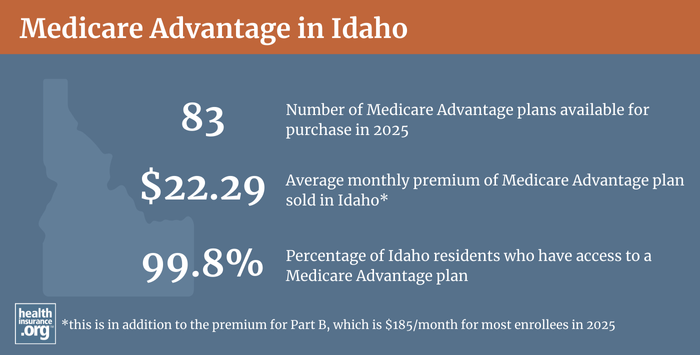

- About 49% of Idaho’s Medicare beneficiaries are enrolled in Medicare Advantage plans.1

- Medicare Advantage plans availability depends on the county.

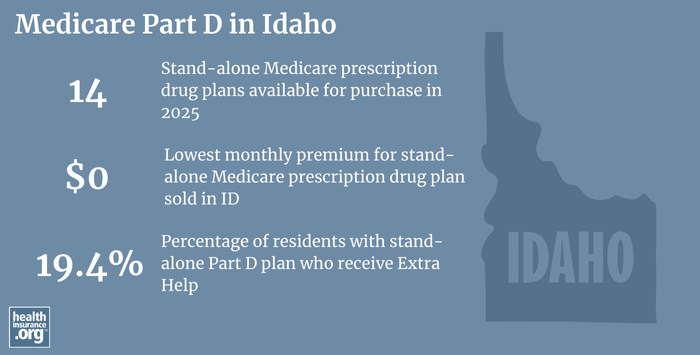

- There are 14 stand-alone Part D prescription plans available in Idaho for 2025.2

Medicare enrollment in Idaho

As of August 2024, 393,238 Idaho residents were enrolled in Medicare, amounting to about 17% of the state’s population.13

For most Americans, Medicare eligibility starts when they turn 65. But Medicare also provides coverage for younger Americans after they have been receiving disability benefits for 24 months (or have ALS or end-stage renal disease; people with these diagnoses do not have to wait two years for their Medicare enrollment to start).

Less than 10% of Medicare beneficiaries in Idaho are eligible due to disability rather than age, versus less than 11% nationwide.14

Learn about Medicare plan options in Idaho by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Idaho

The ACA Marketplace allows individuals and families to shop for and enroll in ACA-compliant health insurance plans. Subsidies may be available based on household income to help lower costs.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Idaho.

Learn about Idaho’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Idaho.

Frequently asked questions about Medicare in Idaho

What is Medicare Advantage?

Medicare beneficiaries can choose to get their healthcare coverage directly from the federal government via Original Medicare, or through private Medicare Advantage plans — assuming Advantage plans are available in their area.

Medicare Advantage plans are offered by private insurers that each have their own service area, so plan availability varies from one part of the state to another. In counties where Medicare Advantage is available, plan availability ranges from two plans to 51 options.5

Despite the lack of Medicare Advantage availability in some of Idaho’s more rural areas, almost 50% of of all Idaho residents with Medicare were enrolled in private Medicare Advantage plans.1 As of August 2024, there were 192,526 Idaho residents with private Medicare coverage.1

Total Medicare enrollment has been climbing steadily in Idaho, as has been the case nationwide. But Medicare Advantage enrollment has been increasing even more sharply in recent years, resulting in declining enrollment in Original Medicare in Idaho.

Original Medicare coverage is provided directly by the federal government, and enrollees have access to a nationwide network of providers. But people with Original Medicare need supplemental coverage (from an employer-sponsored plan, Medicaid, or privately purchased plans) for things like prescription drugs and out-of-pocket costs (out-of-pocket costs for deductibles and coinsurance are not capped under Original Medicare).

Original Medicare includes Medicare Part A (inpatient hospital care) and Medicare Part B (outpatient care). Medicare Advantage plans include all of the benefits of Medicare Parts A and B, and they often provide additional benefits and programs, such as integrated Part D coverage for prescription drugs, dental and vision coverage, a 24-hour nurse hotline, gym memberships, and even assistance with things like transportation and in-home safety.

The Medicare Advantage insurers also work to manage and coordinate members’ care in an effort to keep costs down and reduce hospitalizations. But Medicare Advantage insurers establish their own provider networks, which are generally localized and more limited than the nationwide network for Original Medicare. Out-of-pocket costs for Medicare Advantage are often higher than they would be if a beneficiary had Original Medicare plus a Medigap plan, but the monthly premium costs for Medicare Advantage tend to be lower than the monthly premium costs for Medigap plus Part D. There are pros and cons to either option, and the right solution is different for each person.

Medicare’s annual election period (October 15 to December 7 each year) allows Medicare beneficiaries the chance to switch between Medicare Advantage and Original Medicare (and add, drop, or switch to a different Medicare Part D prescription plan). People who are already enrolled in Medicare Advantage also have the option to switch to a different Advantage plan or to Original Medicare during the Medicare Advantage open enrollment period, which runs from January 1 to March 31.

What are Medigap plans?

Original Medicare does not limit out-of-pocket costs, so most enrollees maintain some form of supplemental healthcare coverage. For beneficiaries who don’t have supplemental coverage via an employer/retiree plan or Medicaid, Medigap plans (also known as Medicare supplement plans, or MedSupp) will pay some or all of the out-of-pocket costs (deductible and coinsurance) they would otherwise have to pay if they were covered only by Original Medicare.

As of 2021, there were 94,149 Idaho Medicare beneficiaries with Medigap coverage, according to an AHIP analysis. That’s about 42% of the state’s Original Medicare enrollees (Medigap coverage cannot be used with Medicare Advantage plans).

Although Medigap plans are sold by private insurers, the plans are standardized under federal rules, with ten different plan designs (differentiated by letters, A through N). The benefits offered by a particular plan (Plan G, Plan K, etc.) are the same regardless of which insurer sells the plan. There are 24 insurance companies in Idaho approved to offer Medigap plans for 2025.6

Idaho state law requires Medigap insurers to spend at least 65% of premiums (75% for group plans) on benefits for enrollees, as opposed to administrative costs. And for all Medigap plans sold since 1995, state law (see page 35) has prohibited insurers from using attained-age rating, which means that premiums cannot increase simply due to the enrollee’s increasing age. Attained-age rating is the most common approach that Medigap insurers use in most states, but it’s not allowed in Idaho.

Instead, until 2022, insurers had the option to use either issue-age rating (premiums based on the age the person was when they enrolled) or community rating (premiums don’t vary based on age). And since March 2022, Medigap insurers in Idaho are no longer allowed to use issue-age rating for new policies, under the terms of legislation that was enacted in 2021.

That law, SB1143, also allowed the Idaho Department of Insurance to establish an annual window when people with Medigap coverage can switch to a different Medigap plan on a guaranteed-issue basis. The proposed rulemaking on this was issued in September 2021, and was finalized in late 2021.

Idaho’s “birthday rule” became available as of March 2022. According to the Idaho Department of Insurance, this allows people who already have Medigap coverage to switch to any other Medigap plan — of equal or lesser benefits —during a 63-day window that starts each year on their birthday.

For perspective, unlike other private Medicare coverage (Medicare Advantage and Medicare Part D plans), there is no federal annual open enrollment window for Medigap plans. Instead, federal rules provide a one-time six-month window when Medigap coverage is guaranteed-issue. This window starts when a person is at least 65 and enrolled in Medicare Part B (you must be enrolled in both Part A and Part B to buy a Medigap plan). It’s important to secure coverage during this window; if you submit an application later on, Medigap insurers are allowed to use medical underwriting to determine your eligibility for coverage.

To clarify, the “birthday rule” does not allow a person to newly enroll in Medigap coverage without medical underwriting after their initial enrollment window has ended — it only allows people who already have Medigap to make a plan change. But that’s an important consumer protection, and one that’s available in very few other states.

Are Medigap plans available for beneficiaries under age 65 in Idaho?

People who aren’t yet 65 can enroll in Medicare if they’re disabled and have been receiving disability benefits for at least two years (or if they have ALS or end-stage renal disease), which is the case for about 9% of Idaho’s Medicare beneficiaries.1 Federal rules do not guarantee access to Medigap plans for people who are under 65, but the majority of the states have implemented rules to ensure that disabled Medicare beneficiaries have at least some access to Medigap plans. Idaho joined those states in 2018, with changes to Idaho insurance statute that took effect January 1, 2018.

Idaho Medigap insurers are required to offer their plans to disabled Medicare beneficiaries under age 65, with the same six-month open enrollment period that applies to people who gain eligibility for Medicare due to age (ie, there’s a six-month window when the person is first enrolled in Medicare Part B, during which they can enroll in any Medigap plan, guaranteed issue, regardless of age). Idaho’s new rule included a provision to grant a one-time six-month Medigap open enrollment window (January through June 2018) to people who were under age 65 and already enrolled in Medicare at that point.

In addition, the new rule limits the premiums for under-65 Medigap to no more than 150% of the premiums that apply to a person who is 65 years old (see 2023 premiums for a non-smoker under age 65, and for a non-smoker who is age 65). This is an important provision — some states that require Medigap plans to be offered to people under age 65 do not limit premiums and insurers end up charging several times as much as they charge 65-year-old enrollees.

As of March 2022, under the terms of SB1143, Idaho requires community rating for all new Medigap enrollees, which means premiums for people 65+ no longer vary by age. But the state still allows Medigap insurers to charge up to 150% of that community-rated amount if the beneficiary is under age 65.

Disabled Medicare beneficiaries have another Medigap open enrollment period when they turn 65. At that point, they can switch to a plan with the lower premiums that apply to people who are aging into Medicare, rather than qualifying due to disability. The new rule notes that for younger Medigap enrollees, their premium has to be reduced once they turn 65 to the rate that applies to people who are enrolling at age 65 (again, as of March 2022, this is the rate that applies to any new enrollee who is 65 or older, as issue-age rating is no longer used for that population, and rates no longer vary by age for new enrollees who are 65+).

Disabled Medicare beneficiaries have the option to enroll in a Medicare Advantage plan instead of Original Medicare. Medicare Advantage plans are otherwise available to anyone who is eligible for Medicare, and the premiums are not higher for those under 65. But as noted above, Advantage plans have more limited provider networks than Original Medicare, and total in-network out-of-pocket costs can be as high as $8,850 in 2024, plus the out-of-pocket cost of prescription drugs.

And crucially, there are five rural counties in Idaho where Medicare Advantage plans are not available for purchase as of 2023. This makes it particularly important for disabled Medicare beneficiaries in Idaho to have access to guaranteed-issue Medigap plans, as those in counties without Medicare Advantage plans would otherwise have no access to an out-of-pocket cap of any sort, since Original Medicare on its own doesn’t include one.

Although the Affordable Care Act eliminated pre-existing condition exclusions in most of the private health insurance market, those rules don’t apply to Medigap plans. Medigap insurers can impose a pre-existing condition waiting period of up to six months if you didn’t have at least six months of continuous coverage prior to your enrollment (although many of them choose not to do so). And if you apply for a Medigap plan after your initial enrollment window closes (assuming you aren’t eligible for one of the limited guaranteed-issue rights), the Medigap insurer can consider your medical history in determining whether to accept your application, and at what premium.

What is Medicare Part D?

Original Medicare does not provide coverage for outpatient prescription drugs. More than half of Original Medicare beneficiaries nationwide have supplemental coverage via an employer-sponsored plan (from a current or former employer or spouse’s employer) or Medicaid, and these plans often include prescription coverage.

But Medicare beneficiaries who do not have drug coverage through Medicaid or an employer-sponsored plan need Medicare Part D in order to have coverage for prescriptions. Part D can be purchased as a stand-alone plan, or obtained as part of a Medicare Advantage plan that has integrated Part D coverage. Part D was created under the Medicare Modernization Act of 2003, which was signed into law by President George W. Bush.

There are 14 stand-alone Medicare Part D plans for sale in Idaho for 2025, with premiums that start at $0/month.2

As of August 2024, there were 129,416 Idaho Medicare beneficiaries with stand-alone Medicare Part D plans. Another 177,768 had Part D prescription coverage as part of their Medicare Advantage plans.1

Medicare Part D enrollment is available during the annual open enrollment period each fall, from October 15 to December 7. The plan choice you make during this window will take effect January 1. You can change your mind more than once during the fall enrollment period; the last plan you select will be the one that covers you for the coming year.

What additional resources are available for Medicare beneficiaries and their caregivers in Idaho?

Need help filing for Medicare benefits, or with your Medicare enrollment in Idaho? Questions about Medicare eligibility in Idaho? You can contact SHIBA, Idaho’s Senior Health Insurance Benefits Advisers, with questions related to Medicare in Idaho. The SHIBA website provides a variety of helpful information, including a series of Medicare FAQs.

The Medicare Rights Center has a comprehensive national website and a helpful call center that can provide a variety of assistance with Medicare-related questions.

Programs of All-Inclusive Care for the Elderly (PACE): A Medicare/Medicaid program that helps seniors receive the care they need in their homes and local communities, without having to move into a nursing home.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Idaho?

Explore more resources for options in ID including ACA coverage, short-term health insurance, dental and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – Idaho.” Centers for Medicare & Medicaid Services Data. Accessed December, 2024. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (38) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶

- U.S. Census Bureau Quick Facts: United States & Florida.” U.S. Census Bureau, July 2023. ⤶

- “Medicare Monthly Enrollment – US” Centers for Medicare & Medicaid Services Data, December 2024. ⤶

- ”Medicare Advantage 2024 Spotlight: First Look” KFF.org Nov. 15, 2023 ⤶

- “Explore your Medicare coverage options.” Medicare.gov. Accessed October, 2024. ⤶