Medicare in Nebraska

Original Medicare, Medicare Advantage, Part D prescription drug, and Medigap coverage in Nebraska

Key takeaways

- More than 380,000 residents are enrolled in Medicare in Nebraska.

- About a third of Nebraska Medicare beneficiaries are enrolled in Medicare Advantage plans (versus about half nationwide)

- Nebraska residents can select from among 22 stand-alone Medicare Part D prescription plans in 2024, with premiums starting as low as 50 cents per month.

Medicare enrollment in Nebraska

As of mid-2024, there were 380,220 Nebraska residents with Medicare coverage, amounting to about 20% of the state’s population.

Most Medicare beneficiaries are eligible for coverage because they’re at least 65 years old. But Medicare eligibility is also triggered when a person has been receiving disability benefits for 24 months, or if the person has ALS or end-stage renal disease.

Nationwide, less than 11% of all Medicare beneficiaries are under 65 and eligible due to disability.1 It’s a little lower in Nebraska, with less than 10% of the state’s Medicare population eligible due to a disability. The rest of the state’s Medicare beneficiaries are at least 65 years old.

Learn about Medicare plan options in Nebraska by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Nebraska

The ACA Marketplace allows individuals and families to shop for and enroll in ACA-compliant health insurance plans. Subsidies may be available based on household income to help lower costs.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Nebraska.

Learn about Nebraska’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Nebraska.

Frequently asked questions about Medicare in Nebraska

What is Medicare Advantage?

Medicare Advantage is available as an alternative to Original Medicare. Medicare Advantage includes all of the benefits of Original Medicare (hospital and outpatient/physician coverage), although out-of-pocket medical costs can be very different between the two options, as Medicare Advantage plans can set their own coinsurance, copays, and deductible levels (within parameters set by CMS).

Most Medicare Advantage plans also include Medicare Part D prescription drug coverage, as well as extra programs like dental and vision coverage. But Medicare Advantage plans tend to have localized provider networks, as opposed to Original Medicare’s nationwide access to medical providers who accept Medicare assignment. There are pros and cons to either option, and no single solution that works for everyone.

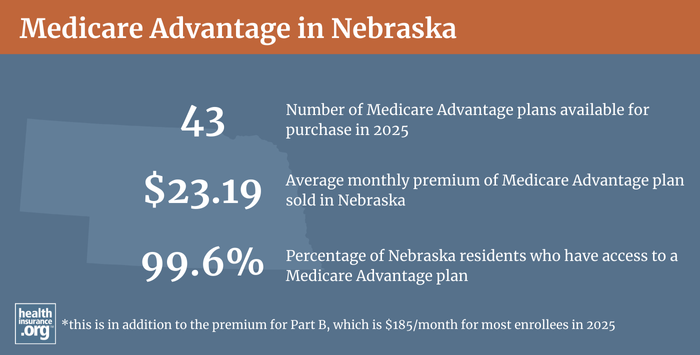

Although most counties in the United States do have Medicare Advantage plans available for purchase, there are some rural areas in Nebraska where Original Medicare is the only option. Nebraska has 93 counties, and Medicare Advantage plans are available in 89 of them in 2024. Across those 87 counties, plan availability ranges from just three plans in several counties, up to 38 in some of the more populous counties.2

For 2024, CMS noted that nearly 99% of Medicare beneficiaries in Nebraska would have access to Medicare Advantage plans. So while there continue to be some areas that don’t have these plans, the vast majority of beneficiaries can select them if that’s their choice.

As of mid-2024, about 129,000 Medicare beneficiaries in Nebraska were enrolled in private Medicare Advantage plans, amounting to about a third of the state’s Medicare population.3

Medicare’s annual open enrollment period (October 15 to December 7 each year) allows Medicare beneficiaries the opportunity to switch between Medicare Advantage and Original Medicare and/or add or drop a Medicare Part D prescription plan. Medicare Advantage enrollees also have the option to switch to a different Advantage plan or to Original Medicare during the Medicare Advantage open enrollment period, which runs from January 1 to March 31.

What are Medigap plans?

Original Medicare does not limit out-of-pocket costs, so most enrollees maintain some form of supplemental coverage. More than half of Original Medicare beneficiaries receive their supplemental coverage through an employer-sponsored plan or Medicaid. But for those who don’t, Medigap plans (also known as Medicare Supplement plans) are designed to pay some or all of the out-of-pocket costs (deductibles and coinsurance) that Medicare beneficiaries would otherwise have to pay themselves.

Medigap plans are sold by private insurers, but the plans are standardized under federal rules, with ten different plan designs (differentiated by letters, A through N). The benefits offered by a particular plan (Plan G, Plan F, etc.) are the same regardless of which insurer is selling the plan. So plan comparisons are much easier for Medigap policies than for other types of health insurance; consumers can base their decision on premiums and less tangible things like customer service, since the benefits themselves are uniform.

According to the Medicare plan finder tool, 36 insurers in Nebraska offer Medigap plans in 2024. And according to an AHIP analysis, there were more than 173,000 Nebraska Medigap enrollees in 2022 (down from more than 182,000 in 2020; the growth of Medicare Advantage enrollment means fewer people who need Medigap to supplement Original Medicare). So almost 70% of Nebraska’s Original Medicare population (and almost half of the state’s entire Medicare population) had supplemental coverage through Medigap plans. This is higher than the rate in most states; nationwide, about a quarter of Original Medicare beneficiaries have Medigap coverage.

Unlike other private Medicare coverage enrollment (Medicare Advantage and Medicare Part D plans), there is no annual open enrollment window for Medigap plans. Instead, federal rules provide a one-time six-month window when Medigap coverage is guaranteed issue. This window starts when a person is at least 65 and enrolled in Medicare Part B (you must be enrolled in both Part A and Part B to buy a Medigap plan).

People who aren’t yet 65 can enroll in Medicare if they’re disabled and have been receiving disability benefits for at least two years, and almost 10% of Nebraska Medicare beneficiaries are under 65 years old. However, federal rules do not guarantee access to Medigap plans for people who are under 65.

The majority of the states have stepped in to ensure at least some access to private Medigap plans for disabled enrollees under the age of 65, and Nebraska joined them with legislation enacted in 2024. Starting in 2025, Nebraska Medigap insurers will be required to offer at least one plan to beneficiaries under age 65, with rates that can’t exceed 150% of the rate that would be charged if they were 65 years old.4

Prior to 2025, Medigap insurers in Nebraska are not required to offer coverage to people under 65 years of age. United American Insurance Company voluntarily offers some Medigap plans to disabled Medicare beneficiaries in Nebraska who are under age 65, albeit at significantly higher premiums than the rates that apply when a person is 65.

Nebraska used to allow Medicare enrollees under the age of 65 to enroll in the state’s high-risk pool (NECHIP), but the high-risk pool ceased operations in 2023. The Nebraska Department of Insurance confirmed in 2023 that there were no other supplemental coverage options for Medicare beneficiaries under age 65. They could select a Medigap plan from United American Insurance Company, enroll in Medicare Advantage, or rely on Medicaid or an employer’s plan to supplement Original Medicare. Disabled Medicare beneficiaries have access to the normal federally-required Medigap open enrollment period when they turn 65, regardless of how long they’ve been enrolled in Original Medicare at that point. As noted above, access to Medigap in Nebraska for under-65 enrollees will change in 2025, due to the legislation the state enacted in 2024.

(Coverage through NECHIP began to be offered in the 1980s, for people who were unable to obtain medically underwritten health coverage. That’s no longer necessary for people who buy individual/family coverage, due to the ACA (medical underwriting is prohibited in that market). But the ACA did not change anything about medical underwriting for Medigap plans outside of a person’s initial enrollment window. So NECHIP used to be an option for Medicare enrollees under the age of 65, helping to cover out-of-pocket costs that enrollees would otherwise have (several other states still use high-risk pools as an option for Medicare beneficiaries under age 65.) As of 2019, however, there were only two people enrolled in NECHIP coverage in Nebraska, so this was not a widely used option.)

Although the Affordable Care Act eliminated pre-existing condition exclusions in most of the private health insurance market, those regulations don’t apply to Medigap plans. Medigap insurers can impose a pre-existing condition waiting period of up to six months, if you didn’t have at least six months of continuous coverage prior to your enrollment. And if you apply for a Medigap plan after your initial enrollment window closes (assuming you aren’t eligible for one of the limited guaranteed-issue rights), the insurer can look back at your medical history in determining whether to accept your application, and at what premium.

What is Medicare Part D?

Original Medicare does not cover outpatient prescription drugs. More than half of Original Medicare beneficiaries have supplemental coverage via an employer-sponsored plan or Medicaid, and these plans often include prescription coverage. But Medicare enrollees without creditable drug coverage need to obtain Medicare Part D in order to have coverage for prescription drugs. Medicare Part D plans can be purchased as a stand-alone plan, or as part of a Medicare Advantage plan that includes Medicare Part D prescription drug coverage.

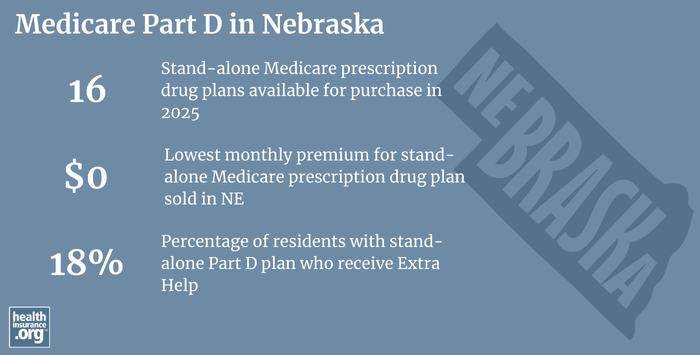

Insurers in Nebraska are offering 22 stand-alone Part D plans for 2024, with premiums that start as low as 50 cents per month (many plans have much higher premiums, and it’s important to compare available options during the Annual Election Period in the fall).

As of mid-2024, there were 187,224 Medicare beneficiaries in Nebraska with stand-alone Medicare Part D plans. Another 116,770 had Medicare Part D coverage as part of their Medicare Advantage plans.3

Medicare Part D enrollment follows the same schedule as Medicare Advantage enrollment: Beneficiaries can select a Medicare Part D plan when they’re first eligible for Medicare, and the annual election period each fall (October 15 to December 7) allows people to pick a different plan or enroll for the first time if they didn’t enroll when they were first eligible (there’s a late enrollment penalty for people who enroll in Medicare Part D after their initial enrollment window, unless they maintained creditable drug coverage from another source).

What additional resources are available for Medicare beneficiaries and their caregivers in Nebraska?

If you have questions about Medicare eligibility in Nebraska or Medicare enrollment in Nebraska, the Nebraska Senior Health Insurance Information Program (SHIIP) can provide assistance with a wide range of topics related to Medicare in Nebraska.

Nebraska Medicare beneficiaries with limited income and assets may be eligible for Medicaid as well (nationwide, about 1 in 5 Medicare beneficiaries is also eligible for Medicaid). You can contact the Nebraska Department of Health and Human Services to learn more about Medicaid eligibility for people who are enrolled in Medicare.

The Nebraska Department of Insurance maintains a helpful consumer information page about Medicare supplements (Medigap), including a list of the companies that offer Medigap plans and how much they charge for a 65-year-old applicant.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Nebraska?

Explore more resources for options in NE including ACA coverage, short-term health insurance, dental and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”May 2024 Medicare Monthly Enrollment” Centers for Medicare & Medicaid Services. Accessed Sep. 23, 2024 ⤶

- ”Medicare Advantage 2024 Spotlight: First Look” KFF.org. Nov. 15, 2023 ⤶

- ”May 2024 Nebraska Medicare Monthly Enrollment” Centers for Medicare & Medicaid Services. Accessed Sep. 23, 2024 ⤶ ⤶

- ”Nebraska Legislative Bill 852” BillTrack50. Enacted April 18, 2024 ⤶