Medicare in North Carolina

Original Medicare, Medicare Advantage, Part D prescription drug, and Medigap coverage in North Carolina

Key takeaways

- More than 2.2 million residents are enrolled in Medicare in North Carolina1

- Over 56% North Carolina Medicare beneficiaries are enrolled in Medicare Advantage plans.1

- All counties in North Carolina have Medicare Advantage plans available, with plan availability ranging from 6 to 60 plans, depending on the county.2

- There are 16 stand-alone Part D prescription plans available in North Carolina in 2025, with premiums starting at $0 per month.3

North Carolina Medicare enrollment

As of September 2024, there were 2,227,758 residents with Medicare in North Carolina.1 For most of them, Medicare coverage enrollment was triggered by turning 65. But more than 12% of North Carolina Medicare beneficiaries — almost 268,000 people — were under age 65 as of September 2024.1

Nationwide, there are over seven million people under the age of 65 who are covered by Medicare, accounting for almost 11% of all Medicare beneficiaries.4 This is because Medicare eligibility is also triggered once a person has been receiving disability benefits for 24 months, or has kidney failure or amyotrophic lateral sclerosis (ALS).

Medicare options

Medicare beneficiaries can choose among a number of coverage options. The first choice is between Medicare Advantage, with coverage provided by private insurance companies that contract with Medicare, and Original Medicare, with coverage provided directly by the federal government. There are pros and cons to either option, and the right solution depends on each enrollee’s needs.

Medicare beneficiaries also have options around Medigap policies (if they enroll in Original Medicare) and Medicare Part D (prescription drug) coverage.

Who is eligible for Medicare?

Medicare is a nationwide program created in 1965 to provide health insurance coverage for individuals aged 65 and older.5 Recipients must be a U.S citizen or a permanent legal resident who has lived in the United States for at least five years.6 To be eligible for premium-free Medicare Part A, the enrollee or their spouse must have worked in the US and paid Medicare taxes for at least 10 years.7 Medicare is run by the federal government, specifically the Centers for Medicare & Medicaid Services.

Learn about Medicare plan options in North Carolina by contacting a licensed agent.

Explore our other comprehensive guides to coverage in North Carolina

The ACA Marketplace allows individuals and families to shop for and enroll in ACA-compliant health insurance plans. Subsidies may be available based on household income to help lower costs.

Learn about the health insurance Marketplace in North Carolina.

Need dental coverage? Learn about available options and find the right dental plan in North Carolina with our guide.

Learn about North Carolina’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in North Carolina.

Learn about short-term insurance regulations in North Carolina.

Frequently asked questions about Medicare in North Carolina

What is Medicare Advantage?

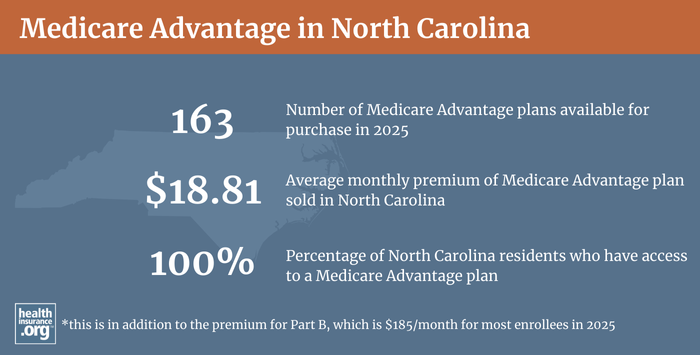

Since Medicare Advantage plans are offered by private insurers, plan availability varies from one area to another. There are Medicare Advantage plans in all counties in North Carolina for 2025, but plan availability ranges from 8 plans in Carteret County, to 60 plans in Forsyth County.2 In total, there are 163 Medicare Advantage plans available in North Carolina for 2025.8

The average 2025 Medicare Advantage premium in North Carolina is $18.81/month (in addition to the premium for Part B, which is $185/month for most enrollees), but all Medicare beneficiaries in North Carolina have access to at least one $0-premium Medicare Advantage plan in 20258 (meaning they would only pay the Part B premium).

As of 2018, a little more than a third of all Medicare beneficiaries nationwide were enrolled in Medicare Advantage plans, and North Carolina’s Medicare Advantage enrollment was very much in line with the national average, with 33% of the state’s Medicare beneficiaries covered by Advantage plans.

By September 2024, 1,241,644 people enrolled in Medicare Advantage plans while the other 986,114 Medicare beneficiaries had Original Medicare coverage.1 So well over half of all North Carolina Medicare beneficiaries have Medicare Advantage coverage.

Medicare Advantage plan enrollment is an option when people are initially eligible for Medicare, and during the Medicare Annual Election Period (October 15 to December 7 each year) allows Medicare beneficiaries the chance to change between Medicare Advantage and Original Medicare (and add, drop, or switch to a different Medicare Part D prescription drug plan). The Medicare Advantage open enrollment period, which runs from January 1 to March 31, gives people who already have a Medicare Advantage plan an opportunity to change to a different one or switch to Original Medicare.

What is Medigap?

Original Medicare does not limit out-of-pocket costs, so most enrollees maintain some form of supplemental coverage. Nationwide, almost half of Original Medicare beneficiaries get their supplemental coverage from an employer or Medicaid.9 But for those who don’t, Medigap plans (also known as Medicare supplement insurance plans, or MedSupp) will pay some or all of the out-of-pocket costs they would otherwise have to pay if they had Original Medicare on its own. Medigap plans are the most common way that Original Medicare beneficiaries obtain supplemental coverage.9

According to an American Health Plans (AHIP) analysis, there were 481,942 North Carolina Medicare beneficiaries enrolled in Medigap plans as of 2022.10 This was down slightly from 2019, when there were 510,098 Medigap enrollees in the state. As Medicare Advantage plan enrollment growth outpaces overall Medicare enrollment growth, Medigap enrollment tends to decrease. This is because people do not need (and cannot use) Medigap coverage if they have Medicare Advantage plans.

Medigap plans are sold by private insurers, but they’re standardized under federal rules and regulated by state laws and insurance commissioners.

Forty-eight insurers offered Medigap plans in North Carolina as of late 2024.11 The state’s plan comparison tool displays the plans based on how much they cost, to make it easy to compare the various options. Since the plan benefits are standardized (so for example, Plan G has the same benefits regardless of which insurer sells it), consumers can make their plan selection based on premiums and less tangible factors like customer service. North Carolina’s Medigap shopping guide is a useful resource for consumers.

North Carolina allows Medigap insurers to pick their own rating approach, so nearly all of the plans for sale in the state use attained-age rating, which means that an enrollee’s premiums will increase as they get older, regardless of how old they were when they first enrolled. The other two approaches to Medigap premiums are issue-age rating, in which premiums are based on the age the person was when they enrolled, and community rating (sometimes called “no age” rating), which means premiums don’t vary based on age; some states require one of these approaches, but North Carolina does not.

Federal rules require Medigap insurers to offer plans on a guaranteed-issue basis during an enrollee’s Medigap Open Enrollment Period, which begins when the person is at least 65 years old and enrolled in Medicare Part B (and Medicare Part A; you have to be enrolled in both to obtain Medigap).12 Federal rules do not guarantee access to Medigap plans for people under age 65. But North Carolina is among the majority of the states that have enacted rules to ensure access to Medigap plans for disabled enrollees under age 65.

North Carolina law (see North Carolina statute § 58-54-45) requires all Medigap insurers in the state to offer at least Plan A to people under age 65 who are enrolled in Medicare due to a disability. And if the insurer also offers either Plan C or Plan F to people who are 65+, they must also make that plan available to beneficiaries under age 65 who were eligible for Medicare prior to 2020.

If the insurer offers either Plan D or Plan G to people who are 65+, they must also offer that plan to people who are under 65 and eligible for Medicare (under federal rules, as a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap Plans C and F cannot be sold to people who become eligible for Medicare in 2020 or later).13

North Carolina Medicare beneficiaries under age 65 are granted a one-time six-month Medigap Open Enrollment Period that begins when they’re enrolled in Medicare Part B (or when they find out they’ve been retroactively enrolled in Part B). So they essentially have the same enrollment period as people who are turning 65, but it applies regardless of age, and it only guarantees access to Plan A and, in some cases, Plan C and Plan F or Plan D and Plan G.

But while state law in North Carolina guarantees access to Medigap plans for disabled beneficiaries under age 65, the insurers may charge significantly higher premiums for these enrollees.14 For example:

- Medigap Plan A rates in 2025 for a person aged 55 range from $280 per month to $1,381 per month. In comparison, the same Plan A for a person aged 65 ranges in price from $106 per month to $335 per month.

- Medigap Plan G premiums in 2025 for a 55-year-old range from $432 per month to $1,482 per month, whereas a 65-year-old would pay between $105 and $394 per month for the same plans.

Disabled Medicare beneficiaries have access to the Medigap open enrollment period when they turn 65. At that point, they have access to any of the available Medigap plans in their state, at the standard age-65 rates.

Disabled Medicare beneficiaries have the option to enroll in a Medicare Advantage plan instead of Original Medicare. Medicare Advantage plan monthly premiums are not higher for those under 65.15

But Medicare Advantage plans may have more limited provider networks than Original Medicare, and total out-of-pocket costs can be as high as $9,350 in 2025 for in-network care,16 plus the out-of-pocket cost of prescription drugs (as of 2025, out-of-pocket prescription drug costs under Part D — including Part D coverage integrated with a Medicare Advantage plan — is capped at $2,000 for the year.17)

What is Medicare Part D?

Original Medicare does not provide coverage for outpatient prescription drugs.

Some Medicare beneficiaries have supplemental coverage from a current or former employer, and that may include drug coverage.

But Medicare Part D, created under the Medicare Modernization Act of 2003, provides prescription drug coverage for Medicare beneficiaries who do not have another source of coverage for prescription costs. Nationwide, almost 55 million Medicare beneficiaries have Part D coverage.4

Medicare beneficiaries can enroll in Medicare Part D prescription drug plans on a stand-alone basis, or obtain Part D coverage integrated with a Medicare Advantage plan (not all Medicare Advantage plans include Part D coverage, but most do).

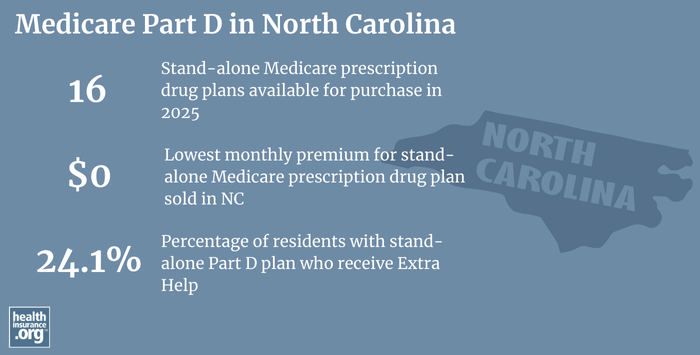

There are 16 stand-alone Medicare Part D plans in North Carolina for 2025, with monthly premiums starting at $0 per month.3

642,395 North Carolina beneficiaries were enrolled in stand-alone Medicare Part D prescription drug plans (which are called prescription drug plans or PDPs) as of September 2024.1 Another 1,163,101 beneficiaries had Medicare Advantage plans that included integrated Medicare Part D coverage.1

Medicare Part D prescription drug plan enrollment is available when a person is first eligible for Medicare, and also during the Medicare Annual Enrollment Period that runs from October 15 to December 7.

What additional resources are available for Medicare beneficiaries and their caregivers in North Carolina?

Do you have questions about Medicare eligibility in North Carolina or need help selecting the best options for your specific situation? These resources provide free assistance and information.

- You can contact North Carolina’s Seniors’ Health Insurance Information Program (SHIIP) with questions related to Medicare enrollment in North Carolina. Visit the website or call 855-408-1212.

- North Carolina’s Senior Medicare Patrol Program (NCSMP) strives to “reduce Medicare error, fraud, and abuse” by educating Medicare beneficiaries and their caregivers about Medicare benefits, statements, explanations of benefits, etc.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in North carolina?

Explore more resources for options in NC including ACA coverage, short-term health insurance, dental and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – North Carolina ” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (101) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶

- Medicare Monthly Enrollment – US.” Centers for Medicare & Medicaid Services Data. Accessed, January 2025. ⤶ ⤶

- “Medicare History.” CMS.gov. Accessed, September 2024. ⤶

- “Original Medicare (Part A and B) Eligibility and Enrollment.” CMS.gov. Accessed, January 2025. ⤶

- ”Costs” Medicare.gov. Accessed Jan. 22, 2025 ⤶

- ”Medicare Open Enrollment in North Carolina, 2025” (Page 100) CMS.gov. Sep. 27, 2024 ⤶ ⤶

- ”A Snapshot of Sources of Coverage Among Medicare Beneficiaries” KFF.org. Sep. 23, 2024 ⤶ ⤶

- ”The State of Medicare Supplement Coverage” AHIP. May 2024 ⤶

- ”Medigap Company Names Sold in NC” North Carolina Department of Insurance. Oct. 29, 2024 ⤶

- “Choosing a Medigap Policy.” Medicare.gov. Accessed June 13, 2025 ⤶

- “2024 Choosing a Medigap Policy.” Medicare.gov. Accessed Jan. 22, 2025 ⤶

- Supplement Insurance (Medigap) Plans – North Carolina.” Medicare.gov. Accessed Jan. 22, 2025 ⤶

- “Can I Be Charged a Higher Premium for Medicare Advantage Plans?” Kaiser Family Foundation. Accessed August 4, 2023. ⤶

- ”Final Contract Year (CY) 2025 Standards for Part C Benefits, Bid Review and Evaluation” Centers for Medicare & Medicaid Services. May 6, 2024 ⤶

- Cubanski, Juliette. “Changes to Medicare Part D in 2024 and 2025 under the Inflation Reduction Act and How Enrollees Will Benefit.” Kaiser Family Foundation, April 20, 2023. ⤶