Medicare in Rhode Island

Original Medicare, Medicare Advantage, Part D prescription drug, and Medigap coverage in Rhode Island

Key takeaways

- More than 240,000 Rhode Island residents are enrolled in Medicare.1

- Well over half of Rhode Island Medicare beneficiaries are enrolled in Medicare Advantage plans.1

- More than half of Rhode Island Medicare beneficiaries have Part D prescription coverage that’s integrated with a Medicare Advantage plan.1

- There are 16 stand-alone Part D plans available in Rhode Island for 2025, with premiums that start as low as $6.30/month.2

Rhode Island Medicare enrollment

243,377 people were enrolled in Medicare in Rhode Island as of September 2024,1 amounting to about 19% of the state’s population.3

For most people, filing for Medicare benefits is part of turning 65. But Medicare eligibility is also triggered by a diagnosis of ALS or kidney failure, or by a disability that lasts more than two years. Nationwide, more than 89% of Medicare beneficiaries are eligible due to age (ie, being at least 65).4 In Rhode Island, more than 87% of Medicare beneficiaries are eligible due to age.1

Learn about Medicare plan options in Rhode Island by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Rhode Island

The ACA Marketplace allows individuals and families to shop for and enroll in ACA-compliant health insurance plans. Subsidies may be available based on household income to help lower costs.

Learn about the health insurance Marketplace in Rhode Island.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Rhode Island.

Learn about Rhode Island’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Rhode Island.

Learn about short-term insurance regulations in Rhode Island.

Frequently asked questions about Medicare in Rhode Island

What is Medicare Advantage?

Medicare Advantage is an alternative to Original Medicare, offered by private health insurance companies. Medicare Advantage plans cover all of the healthcare benefits that Original Medicare covers (ie, hospital services, and outpatient/medical/physician services), but the out-of-pocket costs can be very different, as Advantage plans set their own copays, coinsurance, and deductible (within parameters defined by CMS).

Most Medicare Advantage plans also cover prescription drugs with integrated Part D coverage, and many provide additional benefits, such as dental and vision coverage. But Advantage plans tend to have localized provider networks, as opposed to Original Medicare’s nationwide access to medical providers. There are pros and cons to either option.

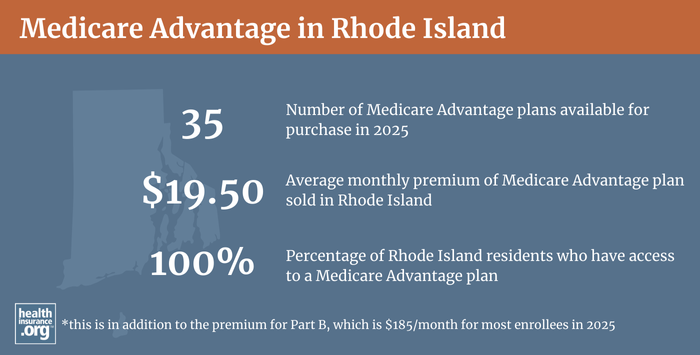

As of September 2024, there were 144,610 people enrolled in Medicare Advantage plans in Rhode Island.1

Nationwide, about 50% of Medicare beneficiaries were enrolled in private Advantage plans as of late 2024.4

Medicare Advantage availability and service areas vary by county in most states. There are five counties in the state, and they all have Medicare Advantage plans available as of 2025.5

Medicare Advantage enrollment is an option when a person is first eligible for Medicare. There is also an annual election period each fall (October 15 – December 7) during which Medicare beneficiaries can switch from Original Medicare to Medicare Advantage, and vice versa, with coverage effective January 1. There is also a Medicare Advantage open enrollment period (January 1 to March 31) during which people who are already enrolled in Medicare Advantage plans can switch to a different Medicare Advantage plan or drop their Medicare Advantage plan and enroll in Original Medicare instead.

Medigap enrollment and regulations in Rhode Island

According to AHIP, 44,352 Rhode Island residents had Medigap plans in 2023,6 supplementing their Original Medicare coverage.

Federal rules provide a six-month window, when a person is at least 65 and enrolled in Medicare Part A and B, during which Medigap coverage is guaranteed issue. Federal rules do not, however, guarantee access to a Medigap plan if you’re under 65 and eligible for Medicare as a result of a disability.

Rhode Island Medigap access for beneficiaries under age 65

But many states, including Rhode Island, have implemented rules to ensure access to Medigap coverage for disabled Medicare beneficiaries. Since July 2023, all Rhode Island Medigap insurers have been required to offer Medigap Plan A to applicants who are under 65, as long as they apply within six months of becoming eligible for Medicare Part B.7

As is the case in most states that ensure Medigap access to enrollees under the age of 65, premiums are higher for these enrollees. They have another enrollment window that starts when they turn 65, during which they can switch to any Medigap plan available in the state, at the lower premiums that are charged when an applicant is 65.

Rhode Island’s minimum standards for Medigap plans can be seen here.

What is Medicare Part D?

Original Medicare does not cover outpatient prescription drugs. But Medicare beneficiaries can get prescription coverage via a Medicare Advantage plan, an employer-sponsored plan (offered by a current or former employer), or a stand-alone Medicare Part D prescription drug plan.

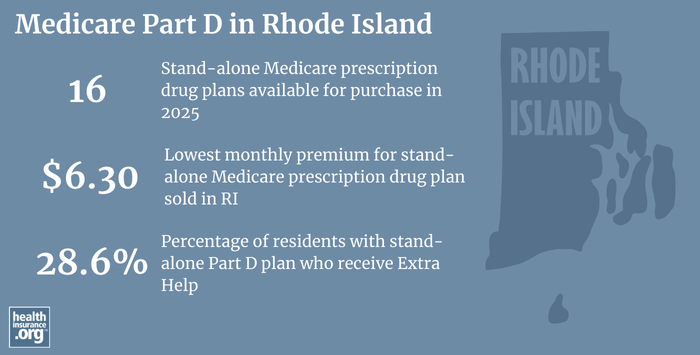

For 2025 coverage, there are 16 stand-alone Part D plans available in Rhode Island, with premiums that start as low as $6.30/month.2

As of September 2024, there were 62,442 Medicare beneficiaries in Rhode Island who were enrolled in stand-alone Medicare Part D plans.1 An additional 140,002 beneficiaries had Part D coverage integrated with their Medicare Advantage coverage.1

The annual Medicare open enrollment period (October 15 to December 7) is an opportunity for Medicare beneficiaries to change their Medicare Part D coverage, with the new plan taking effect January 1. Enrollment in Part D is optional, but there’s a late enrollment penalty for people who don’t enroll when they’re first eligible (and aren’t covered under other creditable coverage) and then enroll later on during a future open enrollment period.

Learn more: Seven rules for shopping Medicare Part D plans.

What additional resources are available for Medicare beneficiaries and their caregivers in Rhode Island?

If you need help with Medicare enrollment in Rhode Island or Medicare eligibility in Rhode Island, you can contact the Rhode Island Senior Health Insurance Program (SHIP). They can provide information and assistance, and help with a variety of questions related to Medicare coverage in Rhode Island.

The Rhode Island Insurance Division oversees, regulates, and licenses the insurance companies that offer coverage in the state, including Medigap plans (and although CMS has most of the regulatory control over Medicare Advantage and Part D plans, the state Insurance Division is responsible for ensuring that the carriers are licensed in the state and fiscally solvent), as well as the agents and brokers who sell the plans. Their office can provide information and address inquiries and complaints about a wide range of insurance topics.

The Medicare Rights Center is a nationwide service that can provide information and assistance with Medicare enrollment, eligibility, and benefits.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Rhode island?

Explore more resources for options in RI including ACA coverage, short-term health insurance, dental and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – Rhode Island.” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (119) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶

- U.S. Census Bureau Quick Facts: United States & Rhode Island.” U.S. Census Bureau, July 2024. ⤶

- “Medicare Monthly Enrollment – US” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶

- “The State of Medicare Supplement Coverage” AHIP. May 2025. Accessed Oct. 4, 2025 ⤶

- “Bulletin No 2023-01, Updates to Rhode Island’s Medicare Supplement Insurance Statute” Rhode Island Office of the Health Insurance Commissioner. Effective Date: July 1, 2023 ⤶