Medicare in Texas

Texas requires Medigap insurers to offer at least Plan A to disabled beneficiaries under the age of 65

Key takeaways

- Over 4.7 million people in Texas have Medicare plans.1

- More than half of Texas Medicare beneficiaries had Medicare Advantage plans as of late-2024.1

- Premiums for stand-alone Medicare Part D prescription drug plans in Texas start at $0 per month for 2025 coverage.2

- Around 1.5 million Texas Medicare beneficiaries have stand-alone Medicare Part D prescription drug plans, and more than 2 million have Medicare Part D prescription drug plans integrated with Medicare Advantage plans.1

Texas Medicare enrollment

The number of Medicare beneficiaries in Texas stood at over 4.7 million as of September 2024.1

Although most people become eligible for Medicare coverage enrollment when they turn 65, Medicare also provides coverage for people under age 65. Those who have been receiving disability benefits for 24 months or more have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) are eligible for Medicare. About 10% of all Medicare beneficiaries in Texas were under the age of 65 as of late-2024.1

Medicare options

In most areas of the country, Medicare beneficiaries can choose Original Medicare or a Medicare Advantage plan.

Original Medicare is provided directly by the federal government and includes Medicare Part A and Medicare Part B. Medicare Part A, also called hospital insurance, helps to pay for inpatient stays at hospitals, skilled nursing facilities, and hospice centers.

Part B, also called medical insurance, helps pay for outpatient care like physician services, kidney dialysis, preventive care, durable medical equipment, etc.

Medicare Advantage plans are administered by private insurance companies that have contracts with the federal government. Medicare Advantage plans include all of the benefits of Original Medicare (albeit with different cost-sharing, as the plans set their own deductibles, coinsurance, and copays, within the limits established by the federal government), and they typically have additional benefits, such coverage for prescription drugs, dental, and vision.

But provider networks are often limited with Medicare Advantage plans, and out-of-pocket costs are typically higher than a person would have if they opted for Original Medicare plus a Medigap plan. In short, there are pros and cons either way, and no one-size-fits-all solution.

Medicare beneficiaries can switch between a Medicare Advantage plan and Original Medicare (and can add or drop a Medicare Part D prescription drug plan) during the Medicare Annual Election Period, which runs from October 15 to December 7 each year. Medicare Advantage enrollees also have the option to switch to a different Medicare Advantage plan or to Original Medicare during the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31.

Learn about Medicare plan options in Texas by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Texas

We’ve created this guide to help you understand the Texas health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Texas.

Learn about Texas’ Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Texas.

Frequently asked questions about Medicare in Texas

What is Medicare Advantage?

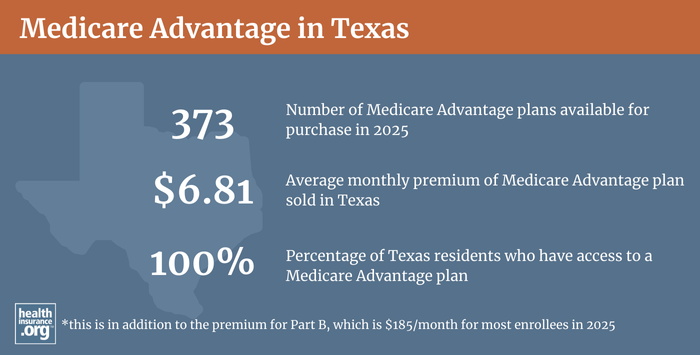

Medicare Advantage plans are available in all counties in Texas in 2025, but plan availability ranges from county to county.3

As of September 2024, 54% of Texas Medicare beneficiaries enrolled in Medicare Advantage plans.1 The other 46% of Medicare beneficiaries in Texas were enrolled in Original Medicare instead.1

What is Medigap?

More than half of Original Medicare beneficiaries have supplemental coverage provided by an employer-sponsored plan or Medicaid.4 But for those who don’t, Medigap plans (also known as Medicare supplement insurance plans) are designed to pay some or all of the out-of-pocket costs (deductibles, copays and coinsurance) that enrollees would otherwise have to pay themselves. Since Original Medicare does not include a cap on out-of-pocket costs, most enrollees maintain some form of supplemental coverage, and Medigap plans are one way to do this.

According to America’s Health Insurance Plans (AHIP) analysis, there were 940,986 Texas Medicare beneficiaries with Medigap coverage as of 2022.5

There are 45 insurers licensed to sell Medigap plans in Texas.6

Although Medigap plans are sold by private insurers, the plans are standardized under federal rules. There are ten different plan designs (differentiated by letters, A through N), and the benefits offered by a particular plan (Plan A, Plan F, etc.) are the same from one insurer to another.

Unlike other Medicare plan coverage (Medicare Advantage and Medicare Part D prescription drug plans), there is no annual open enrollment window for Medigap plans. Instead, federal rules provide a one-time six-month window when Medigap coverage is guaranteed-issue. This window starts when a person is at least 65 and enrolled in Medicare Part B (you have to be enrolled in both Part A and Part B to buy a Medigap plan).

Although disabled Americans under the age of 65 are eligible for Medicare, federal rules do not guarantee access to Medigap plans for people who are under 65. But the majority of the states — including Texas — have implemented rules to ensure that disabled Medicare beneficiaries have at least some access to Medigap plans. Texas law requires Medigap insurers to offer at least Medigap Plan A to disabled enrollees under age 65, during the six-month period that begins when they’re enrolled in Medicare Part B. Medigap Plan A is the least comprehensive of the Medigap plans, but it will cover the 20% Part B coinsurance that the enrollee would otherwise have to pay out-of-pocket.

Disabled Medicare beneficiaries under the age of 65 have another six-month Medigap Open Enrollment Period when they turn 65. At that point, they have access to any of the available Medigap plans, at the standard premiums that apply to people who are enrolling in Medicare due to turning 65.

Legislation was introduced in 2023 in Texas that would have required Medigap insurers to offer all of their plans to people under 65, at the same premiums they charge people who are 65. The bill passed in the Texas House in May 2023, but did not advance in the Senate.

Medicare Advantage plans are available to anyone eligible for Medicare, and the rates are not higher for people under age 65. So Texas Medicare beneficiaries under the age of 65 can choose a Medicare Advantage plan instead of Medigap Plan A. Medicare Advantage plans do have a cap on out-of-pocket costs, but they also tend to have limited provider networks, which is an important consideration for people with serious health issues.

Although the Affordable Care Act eliminated pre-existing condition exclusions in most of the private health insurance market, those regulations don’t apply to Medigap plans. Medigap insurers can impose a pre-existing condition waiting period of up to six months, if you didn’t have at least six months of continuous coverage prior to your enrollment. And if you apply for a Medigap plan after your initial enrollment window closes (assuming you aren’t eligible for one of the limited guaranteed-issue rights), the insurer can look back at your medical history in determining whether to accept your application, and at what premium.

What is Medicare Part D?

Original Medicare does not cover the cost of outpatient prescription drugs. As noted above, more than half of Original Medicare beneficiaries have supplemental coverage via an employer-sponsored plan (from a current or former employer or spouse’s employer) or Medicaid, and these plans often include prescription coverage. But Medicare beneficiaries who don’t have prescription drug coverage through Medicaid or an employer-sponsored plan need to obtain Medicare Part D prescription drug coverage (prior to 2006, some Medigap plans included prescription coverage; people who still have those plans can keep them, but they have not been available since the end of 2005).

Part D coverage can be purchased as a stand-alone plan, or as part of a Medicare Advantage plan that includes Part D prescription drug coverage.

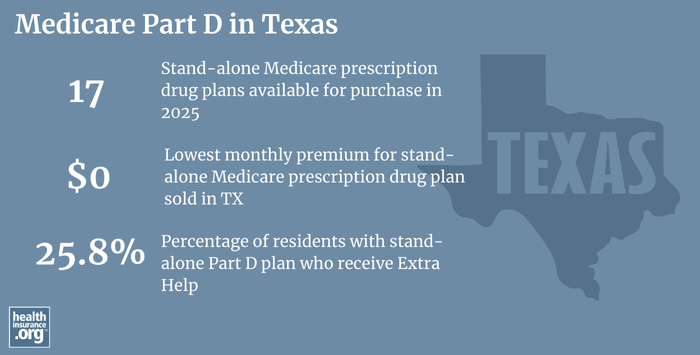

In Texas, there are 17 stand-alone Medicare Part D prescription drug plans for 2025, with premiums starting at $0.2

As of late-2024, there were about 1.5 million Medicare beneficiaries in Texas with stand-alone Medicare Part D prescription drug plans.1 More than 2 million Texas residents had Medicare Part D prescription drug coverage integrated with their Medicare Advantage plans.1 As Medicare Advantage enrollment has grown, the number of people with Medicare Part D prescription drug coverage integrated with Medicare Advantage plans has also grown, while the number of people with stand-alone Medicare Part D prescription drug plans (used in conjunction with Original Medicare) has decreased.

Medicare Part D prescription drug plan enrollment follows the same schedule as Medicare Advantage plan enrollment. Beneficiaries can enroll in Medicare Part D prescription drug plans when they’re first eligible for Medicare, and there’s also an annual enrollment window (October 15 to December 7) when people can enroll or switch to a different Medicare Part D prescription drug plan.

How does Medicaid provide financial assistance to Medicare beneficiaries in Texas?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in Texas includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in Texas?

Need help with your Medicare application in Texas, or have questions about Medicare eligibility in Texas? These resources provide free assistance and information.

- The Health Information, Counseling, and Advocacy Program (HICAP), with any questions related to Medicare coverage in Texas. Visit the website or call 1-800-252-9240.

The Texas Department of Insurance has a resources page for Texas residents with Medicare coverage.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Texas?

Explore more resources for options in Texas including ACA coverage, short-term health insurance, dental insurance and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – Texas.” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (131) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶

- Ochieng, Nancy, Gabrielle Clerveau, and Tricia Neuman. “A Snapshot of Sources of Coverage among Medicare Beneficiaries.” Kaiser Family Foundation, August 14, 2023. ⤶

- ”The State of Medicare Supplement Coverage” AHIP. May 2024 ⤶

- “Explore your Medicare coverage options.” Medicare.gov. Accessed October, 2024. ⤶