Medicare in Wyoming

82% of Wyoming Medicare beneficiaries have Original Medicare, as much of the state didn’t have Medicare Advantage plans available before 2019.

Key takeaways

- More than 127,000 residents are enrolled in Medicare in Wyoming.1

- About 82% of Wyoming Medicare beneficiaries opt for Original Medicare (instead of Medicare Advantage).1

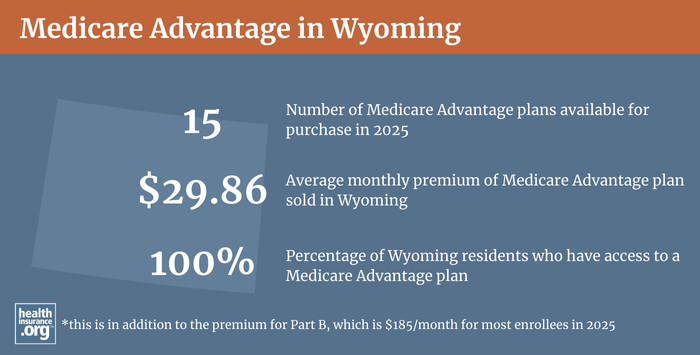

- Of Wyoming’s 23 counties, 15 didn’t have Medicare Advantage plans available for purchase at all prior to 2019,2 but gained Medicare Advantage options in all counties as of 2019.3 Plans continue to be available statewide for 2025.4

- Wyoming has 27 Medigap insurers for 2024,5 but only one will consider applicants under age 65.6 The state’s high-risk pool also offers supplemental coverage for Medicare beneficiaries.7

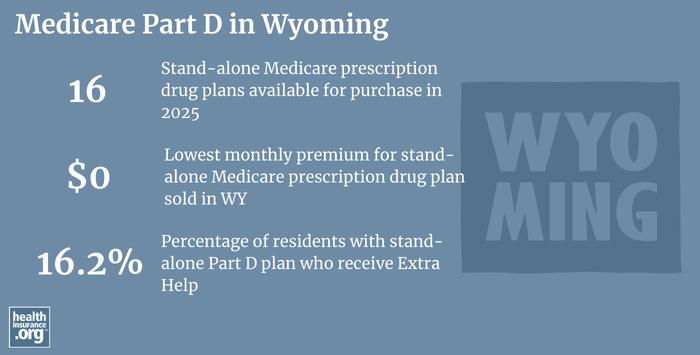

- More than two-thirds of Wyoming Medicare beneficiaries with Original Medicare have stand-alone Medicare Part D prescription drug coverage.1

- Wyoming has 16 stand-alone Medicare Part D prescription drug plans in 2025, with premiums as low as $0 per month.4

Wyoming Medicare enrollment

As of July 2024, about 21%8 of Wyoming’s population — 127,083 people — were enrolled in Medicare coverage.1

For most individuals, enrolling in Medicare is part of turning 65. But Medicare eligibility is also triggered by receiving certain disability benefits for at least two years, or by a diagnosis of end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS). Nationwide, a little more than 10% of Medicare beneficiaries are under the age of 65.9 In Wyoming, it’s 9%; the other 91% of Wyoming Medicare beneficiaries are eligible because they’re 65 or older.1

See more information below about Medicare options in Wyoming, including Medicare Advantage, Medigap, and Medicare Part D prescription coverage.

Learn about Medicare plan options in Wyoming by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Wyoming

We’ve created this guide to help you understand the Wyoming health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Wyoming.

Learn about Wyoming’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Wyoming.

Frequently asked questions about Medicare in Wyoming

What is Medicare Advantage?

Most Wyoming Medicare beneficiaries opt for Original Medicare – only 22,825 people had Medicare Advantage coverage as of July 2024, which amounts to about 18% of Wyoming’s Medicare population enrolled in Medicare Advantage plans1 (although that’s up from just 6% in 2021).10 Nationwide, more than half of all Medicare beneficiaries were enrolled in Medicare Advantage plans as of mid-2024,9 but Original Medicare enrollment in Wyoming is much more popular.

That’s due in large part to the fact that until the last few years, much of Wyoming simply didn’t have many Medicare Advantage plans available for purchase. Prior to 2019, there were no Medicare Advantage plans in 15 of the state’s 23 counties11

But starting in 2019, one carrier began offering Medicare Savings Account (MSA) plans — a type of Medicare Advantage plan — statewide in Wyoming.12 And other Medicare insurers have joined the state’s market since then.

The MSAs are no longer available after the end of 2023,13 but all counties in Wyoming have at least three Medicare Advantage plans available as of 2024 (they may all be offered by the same insurance company, depending on the county).14 5

And all counties in Wyoming continue to have Medicare Advantage plans available for 2025.4

Medicare Advantage plans provide all of the benefits of Original Medicare (Part A, hospital coverage, and Part B, outpatient/medical coverage), although out-of-pocket costs and provider network access can differ considerably. Medicare Advantage plans also tend to include additional benefits, including Medicare Part D prescription drug coverage for drugs, nurse hotlines, fitness, and covered dental and vision services. But Medicare Advantage plans also tend to have much more limited provider networks than the nationwide access granted by Original Medicare, and they also tend to use things like prior authorization and step therapy to contain costs.

Medicare Advantage plan enrollment is available when a person is first eligible for Medicare, and there’s the Medicare Annual Open Enrollment Period (October 15 to December 7) when beneficiaries can switch to or from Medicare Advantage, or pick a different Medicare Advantage plan. There is also a window at the start of the year (January 1 to March 31) when people who are already enrolled in Medicare Advantage plans can switch to a different Medicare Advantage plan or switch to Original Medicare instead.

- Learn more about the Medicare Annual Enrollment Period (Oct. 15-Dec. 7)

- Questions to ask when you’re deciding between Medicare Advantage and Medigap + Part D.

- Learn how Wyoming Medicaid provides assistance to Medicare beneficiaries with limited income and assets.

What is Medigap?

Original Medicare does not have a cap on out-of-pocket costs (the deductible, copay and coinsurance the people pay when they need medical care), so most beneficiaries rely on some sort of supplemental insurance coverage.15

Many have Medicare supplement insurance coverage from a current or former employer, or from Medicaid. But for those who don’t, Medigap plans provide supplemental insurance coverage that pays some or all of the out-of-pocket expenses Original Medicare beneficiaries would otherwise have to pay on their own.

Medigap plans are standardized at the federal level, with ten different plan options available, but not all insurers offer all plan options.

For people who are age 65 or older, 27 insurance companies offered Medigap plans in Wyoming as of 2024.5

The Wyoming Department of Insurance publishes an annual buyer’s guide for Medigap coverage (here’s the 2024 guide) with helpful state-specific information related to Medicare plans. The guide notes that people under age 65 who have Medicare eligibility in Wyoming due to a disability are not guaranteed access to a Medigap plan, and that insurers can use medical underwriting to determine eligibility for people under 65 — all of whom have at least one significant pre-existing condition (because their Medicare eligibility stems from a long-term disability).

There are no federal rules to ensure access to Medigap plans for people under age 65. Many states have taken action to address this, but Wyoming has not.

According to Medicare’s plan finder tool, only one insurer (United American) offers Medigap coverage to Wyoming applicants under 65 for 2025. They offer only Plan B and high-deductible Plan F for these enrollees, and at much higher premiums than the standard rates (under federal rules, any version of Plan F can only be purchased by someone who became eligible for Medicare prior to 2020).6

However, the Wyoming Health Insurance Pool provides guaranteed-issue coverage for applicants who are unable to obtain Medigap coverage due to medical underwriting.

Wyoming is one of several states where state-run high-risk pools are still operational, with supplemental insurance coverage available to Medicare beneficiaries who are unable to obtain Medigap insurance policies.16 Wyoming enacted legislation in 2019 that extends the operation of the Wyoming Health Insurance Pool through 2030.17

Unlike other Medicare plan coverage options (ie, Medicare Advantage and Medicare Part D prescription drug plans), there is no annual open enrollment period for Medigap insurance policies. Coverage is guaranteed-issue during the first six months that a person is at least 65 and also enrolled in Medicare Part A and Medicare Part B. After that, in most circumstances, insurers can use medical underwriting if a person applies for a Medigap policy.

(The exception to this is a case where a person has a guaranteed-issue right to Medigap due to various circumstances, such as being enrolled in a Medicare Advantage plan that will no longer be offered for the coming year.)

What is Medicare Part D?

Original Medicare does not cover outpatient prescription drugs. But Medicare beneficiaries can get coverage for prescription drugs via a Medicare Advantage plan, an employer-sponsored plan (offered by a current or former employer), or a stand-alone Medicare Part D prescription drug plan. In areas where Medicare Advantage plan enrollment is lower, Medicare Part D prescription drug plan enrollment for stand-alone plans tends to be higher.1

As of July 2024, almost 92,000 Wyoming Medicare beneficiaries were enrolled in Part D prescription coverage. Most of them — more than 72,000 — had stand-alone Medicare Part D prescription drug plans, while about 19,000 were enrolled in Medicare Advantage plans that had integrated Part D prescription coverage.1

For 2025 coverage, there are 16 stand-alone Medicare Part D prescription drug plans (PDPs) available in Wyoming, with premiums starting at $0 per month.4

Medicare Part D prescription drug enrollment is available when a person is first eligible for Medicare, and the same fall Annual Enrollment Period that applies to Medicare plans is also used for Medicare Part D prescription drug plans: Beneficiaries can enroll in a Medicare Part D prescription drug plan or switch to a different plan between October 15 and December 7, with coverage effective the first of the following year.

It’s recommended that beneficiaries use Medicare’s plan finder tool each year to actively compare the available options and see how each plan will cover their prescription drugs in the coming year; plans change from one year to the next, and so do beneficiaries’ medication needs. A more costly plan in terms of monthly premiums might work out to be the best option, due to lower out-of-pocket costs when the enrollee fills prescriptions throughout the year.

How does Medicaid provide financial assistance to Medicare beneficiaries in Wyoming?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in Wyoming includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in Wyoming?

If you have questions about Medicare eligibility in Wyoming or need help with Medicare coverage enrollment in Wyoming, you can reach out to the Wyoming Insurance Department. They have a page devoted to health coverage for Medicare beneficiaries, which includes information about Wyoming’s State Health Insurance Information Program.

The Medicare Rights Center is a nationwide service, with a website and call center, that can provide information and assistance with a variety of Medicare-related questions.

This guide to how Wyoming Medicaid can provide assistance to Medicare beneficiaries with limited financial means is a useful resource for Medicare beneficiaries in Wyoming and their caregivers.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Wyoming?

Explore more resources for options in Wyoming including ACA coverage, short-term health insurance, dental insurance and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – Wyoming, July 2024.” Centers for Medicare & Medicaid Services Data. Accessed Nov. 1, 2024 ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- Damico, Anthony, Gretchen Jacobson, and Tricia Neuman. “Medicare Advantage 2018 Data Spotlight: First Look.” Kaiser Family Foundation. Accessed October 13, 2023. ⤶

- Damico, Anthony, Gretchen Jacobson, and Tricia Neuman. “Medicare Advantage 2019 Spotlight: First Look.” Kaiser Family Foundation. Accessed October 13, 2023. ⤶

- Fact Sheet – Centers for Medicare & Medicaid Services. Page 169. CMS, September 27, 2024 ⤶ ⤶ ⤶ ⤶

- “2024 Wyoming Buyer’s Guide to Medicare Supplement ‘Medigap’ Insurance.” Wyomingseniors.com. Accessed Nov. 1, 2024 ⤶ ⤶ ⤶

- “Supplement Insurance (Medigap) Plans in Wyoming.” Medicare.gov. Accessed Nov. 1, 2024 ⤶ ⤶

- “Wyoming Health Insurance Pool.” dio.wyo.gov. Accessed October 13, 2023 ⤶

- “U.S. Census Bureau Quick Facts: U.S. & Wyoming.” U.S. Census Bureau, July 1, 2023 ⤶

- Medicare Monthly Enrollment – U.S., July 2024.” Centers for Medicare & Medicaid Services Data. Accessed Nov. 1, 2024 ⤶ ⤶

- “Medicare Monthly Enrollment – Wyoming.” Centers for Medicare & Medicaid Services Data, June 2021. ⤶

- Damico, Anthony, Gretchen Jacobson, and Tricia Neuman. “Medicare Advantage 2018 Data Spotlight: First Look.” Kaiser Family Foundation. Accessed October 13, 2023. ⤶

- Lasso Healthcare. “Lasso Healthcare to Launch a Medicare MSA in 17 States.” GlobeNewswire News Room. Accessed October 14, 2023. ⤶

- ”Important Notice about Medicare Medical Savings Account (MSA) from Lasso Healthcare” Lasso Healthcare. Accessed Nov. 1, 2024 ⤶

- ”Medicare Advantage 2024 Spotlight: First Look” KFF.org. Nov. 15, 2024 ⤶

- ”A Snapshot of Sources of Coverage Among Medicare Beneficiaries” KFF.org. Sep. 23, 2024 ⤶

- “Wyoming Health Insurance Pool.” dio.wyo.gov. Accessed October 13, 2023. ⤶

- “State of Wyoming 19LSO-0164.” Page 9, Wyoming Legislature. Accessed November 7, 2023 ⤶