Medicare in New Hampshire

New Hampshire has guaranteed access to Medigap plans for disabled enrollees since the 1990s

Key Takeaways

- More than 345,000 residents are enrolled in a Original Medicare or Medicare Advantage plan in New Hampshire1

- About 35% of New Hampshire Medicare beneficiaries are enrolled in Medicare Advantage plans.1

- Medicare Advantage availability varies depending on the county.2

- There are 16 stand-alone Medicare Part D prescription drug plans available in New Hampshire in 2025, with premiums starting at $0.3

Medicare enrollment in New Hampshire

As of September 2024, there were 345,184 residents with coverage through Medicare in New Hampshire.1 That’s about 21% of the state’s population;4 nationwide, nearly 17% of individuals have Medicare coverage.45

Most individuals become eligible for Medicare enrollment when they turn 65. But younger individuals gain Medicare eligibility after they have been receiving disability benefits for 24 months, or if they have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS). In New Hampshire, about 12% of Medicare beneficiaries are under 65 and eligible due to disability rather than age.1

Learn about Medicare plan options in New Hampshire by contacting a licensed agent.

Explore our other comprehensive guides to coverage in New Hampshire

We’ve created this guide to help you understand the New Hampshire health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Learn about health insurance coverage options in New Hampshire.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in New Hampshire.

Learn about New Hampshire’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in New Hampshire.

Learn about short-term insurance regulations in New Hampshire.

Frequently asked questions about Medicare in New Hampshire

What is Medicare Advantage?

Medicare Advantage plans are an alternative to Original Medicare. Medicare Advantage plans are offered by insurance companies that contract with Medicare, whereas Original Medicare is administered directly by the federal government; both are overseen by CMS, the Centers for Medicare & Medicaid Services. As of September 2024, nearly 35% of Medicare beneficiaries nationwide were enrolled in Medicare Advantage, while more than 65% were enrolled in Original Medicare.1

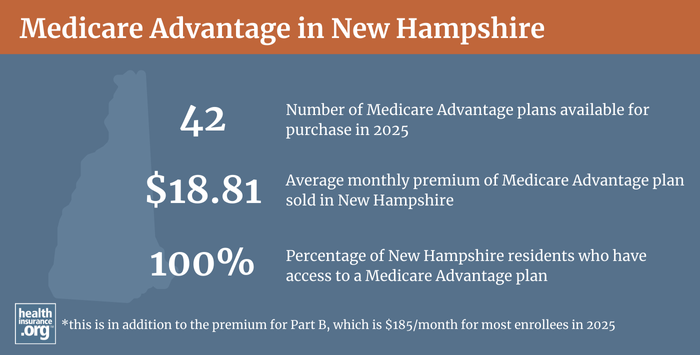

Medicare Advantage plan availability varies by county, but residents in New Hampshire all have at least 20 plans from which to choose for 2025.3 2

Nationwide, more than 35% of all Medicare beneficiaries were enrolled in Medicare Advantage plans as of 2018,6 but just 13% of New Hampshire’s Medicare population had Medicare Advantage coverage that year.7 As of September 2024, however, there were 120,311 New Hampshire residents1 (up from 37,610 in late 2018)7 with Medicare Advantage coverage — 35% of the state’s Medicare population — while the other 224,873 beneficiaries had coverage under Original Medicare.1

Original Medicare coverage is provided directly by the federal government, and enrollees have access to a nationwide network of providers. But people with Original Medicare may need supplemental coverage (from an employer-sponsored plan, Medicaid, or privately purchased plans) for things like prescription drugs and out-of-pocket costs (out-of-pocket costs are not capped under Original Medicare, and outpatient prescription drugs are not covered at all).

Original Medicare includes Medicare Part A and Medicare Part B. Medicare Advantage includes all of the benefits of Medicare Part A and Medicare Part B, and the plans usually also have additional covered benefits, such as integrated Medicare Part D prescription drug coverage and coverage for things like dental and vision care. But Medicare Advantage insurers establish their own provider networks, which are generally localized and more limited than the nationwide network for Original Medicare. Out-of-pocket costs for Medicare Advantage are often higher than they would be if a beneficiary had Original Medicare plus a Medigap plan, with deductibles, copays, and coinsurance that differ from the out-of-pocket costs under Original Medicare. There are pros and cons to either option, and the right solution is different for each person.

The Medicare Annual Election Period (October 15 to December 7 each year) allows Medicare beneficiaries the chance to switch between Medicare Advantage and Original Medicare (and add, drop, or switch to a different Medicare Part D prescription drug plan). And people who are already enrolled in Medicare Advantage also have the option to switch to a different Medicare Advantage plan or to Original Medicare during the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31.

What are Medigap plans?

Original Medicare does not limit out-of-pocket costs, so most enrollees maintain some form of supplemental coverage. Nationwide, more than half of Original Medicare beneficiaries get their supplemental coverage through an employer-sponsored plan or Medicaid.8 But for those who don’t, Medigap plans (also known as Medicare supplement plans, or MedSupp) will pay some or all of the out-of-pocket costs (ie, coinsurance and deductible) they would otherwise have to pay if they had only Original Medicare. There were 98,784 New Hampshire residents with Medigap coverage as of 2022, according to an America’s Health Insurance Plans (AHIP) report.9

Although Medigap plans are sold by private insurers, the plans are standardized under federal rules, with ten different plan designs (differentiated by letters, A through N). The benefits offered by a particular plan (Plan A, Plan F, etc.) are the same regardless of which insurer sells the plan.

But premiums vary significantly from one insurer to another. Insurers in New Hampshire can choose whether to base premiums on the age the enrollee was when they signed up (issue age rating) or to have premiums increase as enrollees get older (attained age rating). Insurers can also choose to use community rating — charging everyone the same rate regardless of age — but that’s not a common approach unless a state requires it, and New Hampshire does not. Attained age rating is the most common approach for Medigap insurers nationwide, but the two Medigap insurers with the largest market share in New Hampshire both use issue-age rating.

There were 23 insurers in New Hampshire approved to offer Medigap plans as of 2025. 10

In October 2020, the state of New Hampshire unveiled a new Medigap rate comparison tool that residents can use to see pricing, benefits information, and plan availability.

Unlike other Medicare plan coverage (Medicare Advantage and Medicare Part D prescription drug plans), there is no Medicare Annual Open Enrollment window for Medigap plans. Instead, federal rules provide a one-time six-month window when Medigap coverage is guaranteed-issue. This window starts when a person is at least 65 and enrolled in Medicare Part B (you must be enrolled in both Part A and Part B to buy a Medigap plan). Once that initial enrollment window ends, Medigap insurers in nearly all states can use medical underwriting to determine an applicant’s eligibility for coverage, unless one of the limited guaranteed-issue rights applies.

In 2020, bipartisan legislation (SB646) was considered in New Hampshire that would have added to the state’s Medigap consumer protections. The bill passed in the Senate but died in the House. If it had been enacted, it would have put New Hampshire among a handful of states that ensure some sort of ongoing access to Medigap plans without medical underwriting. It would have required Medigap insurers to let a member switch to any of the insurer’s other Medigap plans during the month of the member’s birthday (several other states have taken this same approach, with a “birthday rule” plan change window). Insurers would have had to notify members each year of the opportunity to change their coverage, and would have had to allow the coverage change regardless of whether it would result in an increase or decrease in benefits. The expected impact of the bill in terms of premiums and plan offerings is discussed at the bottom of this version of the text, but ultimately, it was not enacted.

Similar legislation (SB124) was again considered in 2021 in New Hampshire. And although that legislation was enacted, an amendment was introduced during the legislative process that stripped the “birthday rule” guaranteed issue provision out of the bill, and the final version did not contain it.

Is Medigap available if you are under 65 in Nevada?

People who aren’t yet 65 can enroll in Medicare if they’re disabled and have been receiving disability benefits for at least two years, or if they have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS); about 12% of New Hampshire Medicare beneficiaries are under age 65.1 Federal rules do not guarantee access to Medigap plans for people who are under 65, but the majority of the states have implemented rules to ensure that disabled Medicare beneficiaries have at least some access to Medigap plans. New Hampshire was among the first states to require Medigap insurers to offer plans to people under age 65, with a rule that took effect in the late 1990s. The state’s requirements were reiterated in a 2005 bulletin issued by the New Hampshire Insurance Department.

All Medigap plans in New Hampshire are available to disabled enrollees under age 65, as long as they enroll during the six-month window that begins when they’re enrolled in Medicare Part B. Premiums are higher than the age-65 rates for these enrollees — substantially so for some insurers, and modestly higher for others. Disabled Medicare beneficiaries have another Medigap Open Enrollment Period when they turn 65. At that point, they can switch to a plan with the lower premiums that apply to people who are aging into Medicare, rather than qualifying due to disability. And SB124, enacted in 2021, prohibits Medigap insurers from continuing to charge the higher premiums once a disabled enrollee turns 65. So regardless of whether the person switches to a different plan or keeps the plan they already have, their Medigap rates will reset to the lower age-65 rates once they turn 65.

SB646 (described above) would have also prohibited Medigap insurers from charging higher premiums to enrollees under the age of 65. The bill has passed the New Hampshire Senate, but failed in the House. So Medigap rates are still higher for enrollees under age 65 in New Hampshire.

Disabled Medicare beneficiaries have the option to enroll in a Medicare Advantage plan instead of Original Medicare (since 2021, this has included people with kidney failure, who were unable to enroll in most Medicare Advantage plans prior to 2021).11 But as noted above, Medicare Advantage plans may have more limited provider networks than Original Medicare, and total out-of-pocket costs can be as high as $8,300 per year for in-network care, plus the out-of-pocket cost of prescription drugs.12

Although the Affordable Care Act eliminated pre-existing condition exclusions in most of the private health insurance market, those rules don’t apply to Medigap plans. Medigap insurers can impose a pre-existing condition waiting period of up to six months if you didn’t have at least six months of continuous coverage prior to your enrollment (although not all of them choose to do so). And if you apply for a Medigap plan after your initial enrollment window closes (assuming you aren’t eligible for one of the limited guaranteed-issue rights), the Medigap insurer can consider your medical history in determining whether to accept your application, and at what premium.

What is Medicare Part D?

Original Medicare does not provide coverage for outpatient prescription drugs. Well over half of Original Medicare beneficiaries nationwide have supplemental coverage via an employer-sponsored plan (from a current or former employer or spouse’s employer) or Medicaid, and these plans often include prescription drug coverage.8

But Medicare beneficiaries who do not have prescription drug coverage through Medicaid or an employer-sponsored plan may need Medicare Part D prescription drug plan enrollment in order to have coverage for prescription drugs. Medicare Part D can be purchased as a stand-alone Medicare Part D prescription drug plan, or integrated with a Medicare Advantage plan. Medicare Part D prescription drug plans were created under the Medicare Modernization Act of 2003, which was signed into law by President George W. Bush.

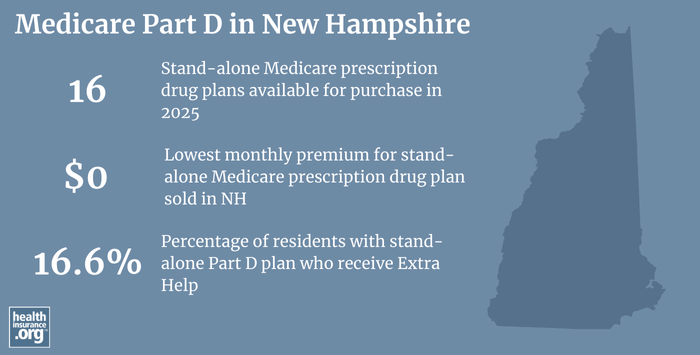

There are 16 stand-alone Medicare Part D prescription drug plans in New Hampshire for 2025, with premiums starting at $0 per month.3

In New Hampshire as of September 2024, there were 149,872 people with stand-alone Part D prescription drug coverage.1 Another 110,046 beneficiaries of Medicare in New Hampshire had Medicare Part D prescription coverage as part of their Medicare Advantage plans.1

(Medicare Advantage plan enrollment has grown considerably in New Hampshire in recent years; as enrollment in Medicare Advantage plans has increased, more people obtain their prescription coverage via Medicare Advantage plans with integrated Medicare Part D prescription drug coverage.)

How does Medicaid provide financial assistance to Medicare beneficiaries in New Hampshire?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in New Hampshire includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in New Hampshire?

You can contact New Hampshire’s Service Link Aging and Disability Resource Center with questions related to Medicare coverage in New Hampshire.

The New Hampshire Insurance Department oversees and regulates health insurance companies in New Hampshire as well as the brokers and agents who sell policies in the state. They can provide assistance, answer questions, and address complaints from consumers regarding the entities they license and regulate.

The Medicare Rights Center is a nationwide service, with a website and call center, that can provide information and assistance to Medicare beneficiaries.

This overview of Medicaid programs for Medicare beneficiaries in New Hampshire is a helpful resource for beneficiaries with limited financial resources.

Need a replacement Medicare Card or have questions about your Medicare card?

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in New Hampshire?

Explore more resources for options in New Hampshire including ACA coverage, short-term health insurance, dental insurance and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – New Hampshire” Centers for Medicare & Medicaid Services Data. Accessed, January 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (89) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶ ⤶

- “U.S. Census Bureau Quick Facts: U.S. & New Hampshire.” U.S. Census Bureau, July, 2024. ⤶ ⤶

- ”Medicare Monthly Enrollment – U.S.” Centers for Medicare & Medicaid Services Data. Accessed, January 2025. ⤶

- Monthly Medicare Enrollment – US (2018).” Centers for Medicare & Medicaid Services Data, May 2018. ⤶

- Medicare Monthly Enrollment – New Hampshire (2018).” Centers for Medicare & Medicaid Services Data, May 2023. ⤶ ⤶

- Ochieng, Nancy, Gabrielle Clerveau, and Tricia Neuman. “A Snapshot of Sources of Coverage among Medicare Beneficiaries.” Kaiser Family Foundation, August 14, 2023. ⤶ ⤶

- ”The State of Medicare Supplement Coverage” AHIP. May 2024 ⤶

- “Explore your Medicare coverage options.” Medicare.gov. Accessed October, 2024. ⤶

- Nguyen , Kevin, Eunhae Oh , David Meyers, Daeho Kim, Rajnish Mehrotra, and Amal Trivedi. “Medicare Advantage Enrollment among Beneficiaries with End-Stage Renal Disease in the First Year of the 21st Century Cures Act.” ncbi.nlm.nih.gov, March 14, 2023. ⤶

- “Medicare Advantage in 2023: Premiums, out-of-Pocket Limits, Cost Sharing, Supplemental Benefits, Prior Authorization, and Star Ratings.” KFF, August 9, 2023. ⤶