Home > Health insurance Marketplace > Kentucky

Kentucky Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Kentucky health insurance Marketplace guide

This guide, including the FAQs below, was developed to help you understand the health coverage options available to you and your family in Kentucky. The health plan options offered by Kentucky’s ACA Marketplace may be a good choice for many consumers.

Kentucky residents use a fully state-based health insurance Marketplace – Kynect – to shop for and purchase ACA Marketplace/exchange plans. From 2017 through 2021, Kentucky used the federally-facilitated HealthCare.gov enrollment platform, but reverted to a state-based platform as of the 2022 plan year.

Kynect provides access to health insurance products from four private insurers. All four will continue to offer Marketplace coverage in Kentucky in 2025, with a weighted average rate increase — before subsidies — of 7.9% (details below).

The federal government helps pay for insurance through an income-based advance premium tax credit if you buy coverage from the exchange. Most enrollees qualify for this financial assistance.3

Kentucky had been planning to create a Basic Health Program that would have been operational as of 2024,4 but paused implementation of the BHP in late 2022.5 As of 2025, Minnesota, New York, and Oregon are the only states with BHPs.

Frequently asked questions about health insurance in Kentucky

Who can buy Marketplace health insurance?

To qualify for health coverage through the Kentucky Marketplace, you must:6

- Live in Kentucky

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area – which depends on your age and location. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage through your employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.7

- File a joint tax return, if you’re married.8 (with very limited exceptions)9

- Not be able to be claimed by someone else as a tax dependent.10

When can I enroll in an ACA-compliant plan in Kentucky?

In Kentucky, the open enrollment period for individual and family health insurance runs from November 1 to January 15.11 (A proposed federal rule change would shorten this window starting in the fall of 2025, with a new deadline of December 15.)

Enrollments must be submitted by December 15 to have coverage effective January 1. Enrollments submitted in the final month of the open enrollment window have an effective date of February 1 instead.6 (If the proposed rule change is implemented, all plans selected during open enrollment would take effect January 1.)

Outside of open enrollment, a special enrollment period (usually linked to a specific qualifying life event) is necessary to enroll or change your coverage.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

Several bills were considered in 2024 in Kentucky that would have made pregnancy a qualifying life event, but none of them passed.12 Similar legislation was considered in 2023 but did not pass.13 (There are several state-based exchanges where pregnancy is a qualifying life event.)

How do I enroll in a Marketplace plan in Kentucky?

To enroll in an ACA Marketplace plan in Kentucky, you can:

- Visit Kynect to access Kentucky’s state-based health insurance Marketplace. Here you will find an online platform to shop, compare, and choose the best health plans.

- Purchase individual and family health coverage with the help of an insurance agent or broker, or a kynector (Kynect-certified enrollment assister).14

How can I find affordable health insurance in Kentucky?

You may find affordable health insurance options in Kentucky through its state-based health insurance exchange. Kentucky residents use Kynect (not HealthCare.gov) to shop, review, and enroll in health coverage as well as to determine any available subsidies.

Of the more than 97,000 people who enrolled in coverage through Kynect during the open enrollment period for 2025 coverage, more than 83,000 — about 86% — qualified for premium subsidies (premium tax credits). These subsidies averaged $489/month. The subsidies resulted in an average net premium of $180/month (including the enrollees who paid full price).3

People with household incomes of no more than 250% of the federal poverty level also qualify for cost-sharing reductions (CSR). CSR benefits reduce deductibles and other out-of-pocket expenses, as long as the enrollee selects a Silver plan.15 Of the more than 97,000 Kentucky residents who enrolled during the open enrollment period for 2025 coverage, 48% enrolled in plans with built-in CSR benefits.3

Between the premium subsidies and cost-sharing reductions, you may find that an ACA plan is the cheapest health insurance option for you.

Source: CMS.gov16

How many insurers offer Marketplace coverage in Kentucky?

Four insurers offer individual and family health plans through Kynect for 2025, in addition to three dental insurers.2

Are Marketplace health insurance premiums increasing in Kentucky?

For 2026, the Kentucky Department of Insurance has instructed the insurers to file two sets of rates: One based on the Marketplace subsidy enhancements expiring at the end of 2025, and a second based on them being extended (which would require an act of Congress). Overall premioums will be higher — and subsidies smaller — if the subsidy enhancements are not extended.17

The following average rate changes were approved for 2025 for Kentucky’s individual market insurers:18 (Average rate changes are calculated before subsidies are applied.)

Kentucky’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Anthem | 8.6% |

| CareSource | 12.7% |

| Ambetter/WellCare | 1.8% |

| Molina | 0.4% |

Source: Kentucky SERFF Filings18

According to the SERFF filings, the carriers have the following enrollment in 2024:18

- Anthem: 34,403 members

- CareSource: 15,202 members

- Molina: 1,186 members

- WellCare: 14,535 members

Using those enrollment numbers, the weighted average approved rate increase for 2025 is about 7.9%, applicable to full-price plans. But most enrollees receive premium subsidies, and thus do not pay full price. The net premium change from one year to the next depends on how a specific plan’s premium changes as well as how much the premium subsidy amount changes.

For perspective, here’s a summary of how average pre-subsidy premiums have changed in Kentucky’s individual/family market over the years:

- 2015: Average increase of 7%.19

- 2016: Average increase of 14%.20

- 2017: Average increase of 24.5%.21

- 2018: Average increase of 45%.22

- 2019: Average increase of 12.5%.23

- 2020: Average increase of 3.7%.24

- 2021: Average increase of 5%.25

- 2022: Average decrease of 3.8%.26

- 2023: Average increase of 6.25%.27

- 2024: Average increase of 3.5% (unweighted)28

How many people are insured through Kentucky’s Marketplace?

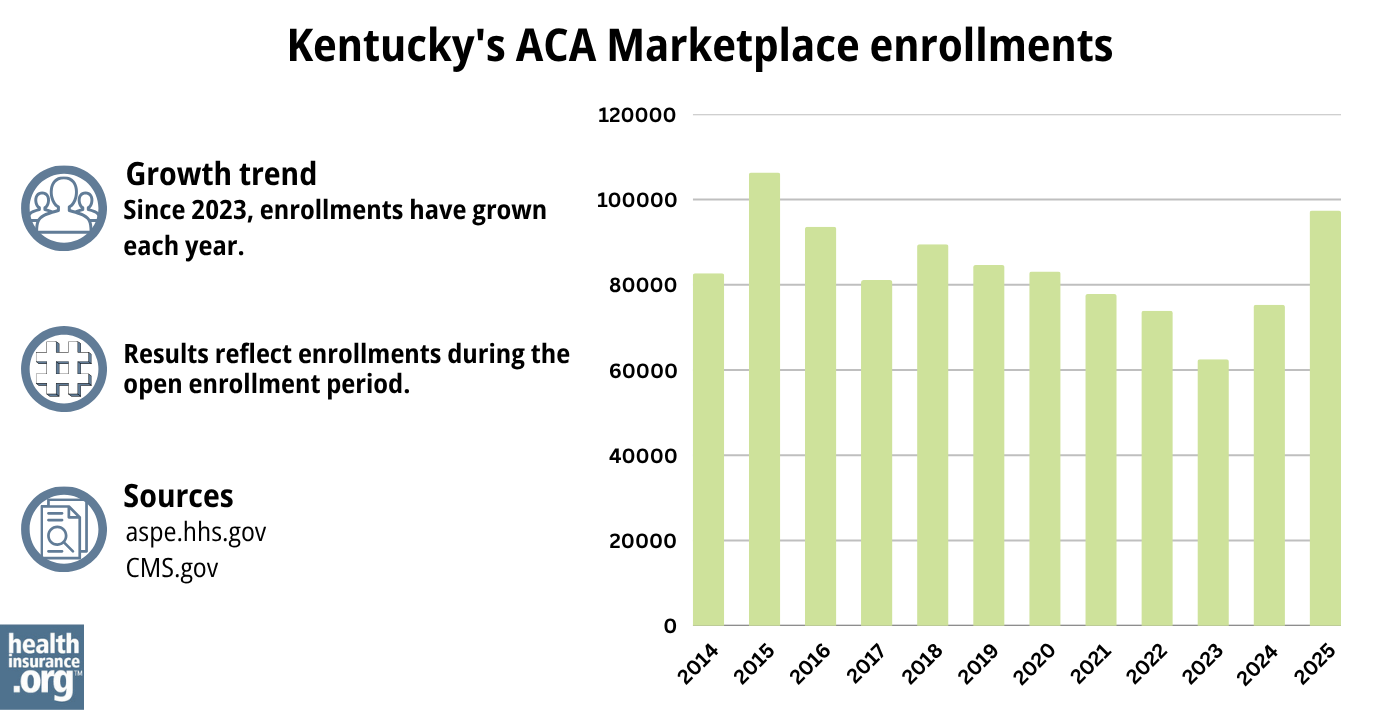

97,374 people enrolled in private coverage through Kynect during the open enrollment period for 2025 coverage.3 This was the highest enrollment total since 2015.

Most states experienced record-high Marketplace enrollment in 2023, 2024, and again in 2025 — due in large part to the American Rescue Plan (ARP), which expanded enrollee access to ACA’s premium subsidies.29 However, Kentucky has not followed that trend, but enrollment in 2025 did surpass all previous years except 2015 (see chart below for prior year enrollment data).

Enrollment in Kentucky’s Marketplace declined for several years, from 2019 through 2023. Although it did grow in 2024, the enrollment total was still well below the record high set in 2015, before Kentucky transitioned to the HealthCare.gov platform for a few years.

Source: 2014,30 2015,31 2016,32 2017,33 2018,34 2019,35 2020,36 2021,37 2022,38 2023,39 2024,40 202541

What health insurance resources are available to Kentucky residents?

Kynect – Kentucky’s Healthcare Connection

855-4kynect (855-459-6328)

Kentucky Health Benefit Exchange

Administrative site for Kentucky’s Marketplace

Foundation for a Healthier Kentucky

Kentucky Health Insurance Advocate, Kentucky Department of Insurance

Assists people insured by private health plans, Medicaid, or other plans in resolving problems pertaining to their health coverage; assists uninsured residents with access to care.

(877) 587-7222 /[email protected]

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Kentucky?

Explore more resources for options in Kentucky including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Shopping for Health Insurance Plans” Kentucky Health Benefit Exchange. Accessed May 13, 2025 ⤶ ⤶

- ”2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 12, 2025 ⤶ ⤶ ⤶ ⤶

- Basic Health Program. Kentucky Cabinet for Health and Family Services. Accessed November 2023. ⤶

- ”Kentucky: No longer down with #BHP? It looks that way for now” ACA Signups. Dec. 20, 2022 ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶ ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed January 12, 2024. ⤶

- “Need Health Insurance” Kentucky.gov, 2023 ⤶

- ”Kentucky SB34, Kentucky HB10, Kentucky HB734, Kentucky HB380, and Kentucky HB700” BillTrack50. Accessed March 19, 2024. ⤶

- Kentucky House Bill 286; 2023 Session. BillTrack50. Accessed November 2023. ⤶

- Get Local Help. Kynect. Accessed November 2023. ⤶

- Cost-Sharing Quick Reference Guide. Kynect Health Coverage. Accessed November 2023. ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”The Effects of Not Extending the Expanded Premium Tax Credits for the Number of Uninsured People and the Growth in Premiums” Congressional Budget Office. Dec. 5, 2024 ⤶

- ”Kentucky SERFF Filings” Accessed Aug. 16, 2024 ⤶ ⤶ ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- Kentucky: APPROVED 2016 Weighted Avg. Rate Hikes: 13.8% Likely, 15.2% Maximum. ACA Signups. August 2015. ⤶

- Kentucky: *Approved* Avg. 2017 Rate Hikes: 24.5% (Vs. 23.6% Requested). ACA Signups. August 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- Kentucky: APPROVED 2019 #ACA Rate Hikes: ~12.5%, But WOULD Likely Be FLAT W/Out #ACASabotage. ACA Signups. August 2018. ⤶

- Kentucky: *Approved* Avg. 2020 #ACA Premiums: 3.7% Increase (Down From 5.0%). ACA Signups. September 2019. ⤶

- Kentucky: Approved Avg. 2021 #ACA Premiums: +5.0% Indy Market, +8.8% Sm. Group Market. ACA Signups. October 2020. ⤶

- Kentucky: Approved Avg. 2022 #ACA Rate Changes: -3.8% Individual Market; +10.4% Sm. Group. ACA Signups. September 2021. ⤶

- “KY final average unsubsidized rates 2023” ACAsignups.net, Oct. 19, 2022 ⤶

- ”Kentucky: *Final* avg. unsubsidized 2024 #ACA rate changes: +3.5% (unweighted; updated)” ACA Signups. Aug. 9, 2023 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, Accessed August 2023 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶