Home > Health insurance Marketplace > Connecticut

Connecticut Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Connecticut health insurance Marketplace guide

This guide, including the FAQs below, can help you find the right health plan in Connecticut for you and your family. For many, an Affordable Care Act (ACA) Marketplace/exchange plan, also called Obamacare, can be an affordable and robust coverage solution.

Connecticut runs its own state-based exchange called Access Health CT. Individual and family plans on the ACA Marketplace are offered by two private insurance companies (one of which offers plans under two separate entities),3 for people who don’t have access to Medicaid, Medicare, or employer-sponsored health insurance. This includes:

- Self-employed people

- Early retirees needing coverage until Medicare

- Workers at small businesses without health benefits

Connecticut is among the states where state-funded subsidies are available in addition to federal subsidies. In Connecticut, this is known as the Covered Connecticut program, and it’s available to adults with household incomes up to 175% of the poverty level.4

Frequently asked questions about health insurance in Connecticut

Who can buy Marketplace health insurance?

To qualify for Marketplace coverage in Connecticut, you must:5

- Live in Connecticut

- Be a U.S. citizen, national, or lawfully present in the U.S.

- Not be incarcerated

- Not be enrolled in Medicare

Although that makes most people in Connecticut eligible to use the Marketplace, eligibility for financial assistance (premium subsidies and cost-sharing reductions) also depends on income. In addition, to be eligible for financial assistance through Access Health CT, you must:

- Not be eligible for employer-sponsored coverage that’s considered affordable and provides minimum value.

- Not be eligible for HUSKY (Medicaid/CHIP)

- Not be eligible for premium-free Medicare Part A.6

- If married, file a joint tax return with your spouse7 (with very limited exceptions)8

- Not be able to be claimed by someone else as a tax dependent.9

When can I enroll in an ACA-compliant plan in Connecticut?

Connecticut’s open enrollment period for individual and family health plans runs from November 1 to January 15.10

- Enroll by December 15 for coverage to start January 1.

- Enroll between December 16 and January 15 for coverage to begin February 1.

Outside of open enrollment, you generally need a qualifying life event, such as losing coverage, getting married, or permanently moving to enroll or make changes. And Connecticut is among a handful of states where pregnancy is considered a qualifying event.11

The qualifying event will trigger a special enrollment period (SEP) that will allow you to sign up for coverage or switch to a different plan.

But some people can sign up without a qualifying life event. For example:

Native Americans can enroll year-round.12

People eligible for the Covered Connecticut program can enroll anytime.13

Anyone eligible for HUSKY (Medicaid/CHIP) in Connecticut can also enroll year-round.

How do I enroll in a Marketplace plan in Connecticut?

There are multiple ways to enroll in an ACA Marketplace plan in Connecticut:14

- Online: Go to AccessHealthCT.com to create an account and apply.

- Phone: Contact the Call Center at 855-805-4325.

- Get help from a navigator, certified application counselor, or agent/broker certified with Access Health CT. These individuals can provide help over the phone, in-person, or online.

How can I find affordable health insurance in Connecticut?

You can find affordable individual and family health plans in Connecticut through AccessHealthCT.com, the state’s ACA exchange.

Access Health CT is where you can:

- Shop, compare, and sign up for health and dental plans

- Qualify for financial help to lower your costs

- Enroll in HUSKY (Medicaid/CHIP) or the Covered Connecticut Program if eligible

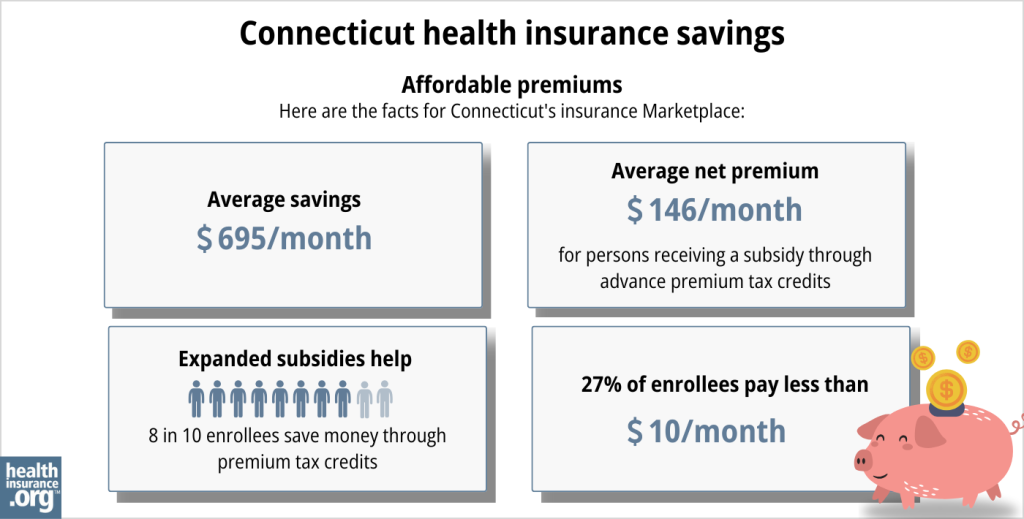

Eighty-seven percent of Access Health CT enrollees receive subsidies, saving an average of $766 each month on their 2024 premiums.15 These subsidies are called Advance Premium Tax Credits (APTC). Subsidy-eligible Connecticut Marketplace enrollees pay an average of $233/month in after-subsidy premiums in 2024.15

If your income is no more than 250% of the federal poverty level, you may qualify for cost-sharing reductions (CSR) to lower your deductibles and out-of-pocket costs.16

If you qualify for Covered Connecticut, the state will cover your portion of the monthly premiums and any expenses related to cost-sharing, such as your deductibles, copays, and co-insurance.

Covered Connecticut is available to enrollees with household income up to 175% of the poverty level (they must also not be eligible for Medicaid, which is available up to 138% of the poverty level).

Under the Covered Connecticut program, eligible enrollees must select a silver plan through Access Health CT and accept all of the federal subsidies available to them. Covered Connecticut then pays any remaining premiums and cost-sharing, resulting in a plan that has a $0 premium and $0 cost-sharing.4

Legislation was considered in 2024 to extend Covered Connecticut to 200% of the poverty level, and also create a second reduced-benefit tier of the program, available to enrollees with income between 200% and 300% of the poverty level. But the bill did not advance.17

Source: CMS.gov18

How many insurers offer Marketplace coverage in Connecticut?

Are Marketplace health insurance premiums increasing in Connecticut?

For 2025, the following average rate increases have been approved for the insurers that offer individual/family health coverage via Access Health CT, amounting to an overall average rate increase of 5.9%3 (this was lower than the average increase of 8.3% that the insurers had proposed).

Connecticut’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Anthem | 6.4% |

| ConnectiCare Benefits | 5.1% |

| ConnectiCare Insurance Company | 11.8% |

Source: Connecticut Insurance Department3

Although the overall average rate increase is 5.9% for 2024, most enrollees — 87% in 202420 — get premium subsidies that cover some of their premium costs. These subsidies are designed to keep pace with the cost of the benchmark plan (second-lowest-cost Silver plan), so if the benchmark price increases in 2025, average subsidies will also increase.

For perspective, here’s an overview of how average unsubsidized premiums have changed in Connecticut’s individual/family market over the years:

- 2015: Average decrease of 1%.21

- 2016: Average increase of 3.5%.22

- 2017: Average increase of 24.8%.23

- 2018: Average increase of 28.4%.24

- 2019: Average insurance of 2.72%.25

- 2020: Average increase of 3.65%.26

- 2021: Average increase of 0.01%.27

- 2022: Average increase of 5.6%.28

- 2023: Average increase of 12.9%.29

- 2024: Average increase of 9.4%30

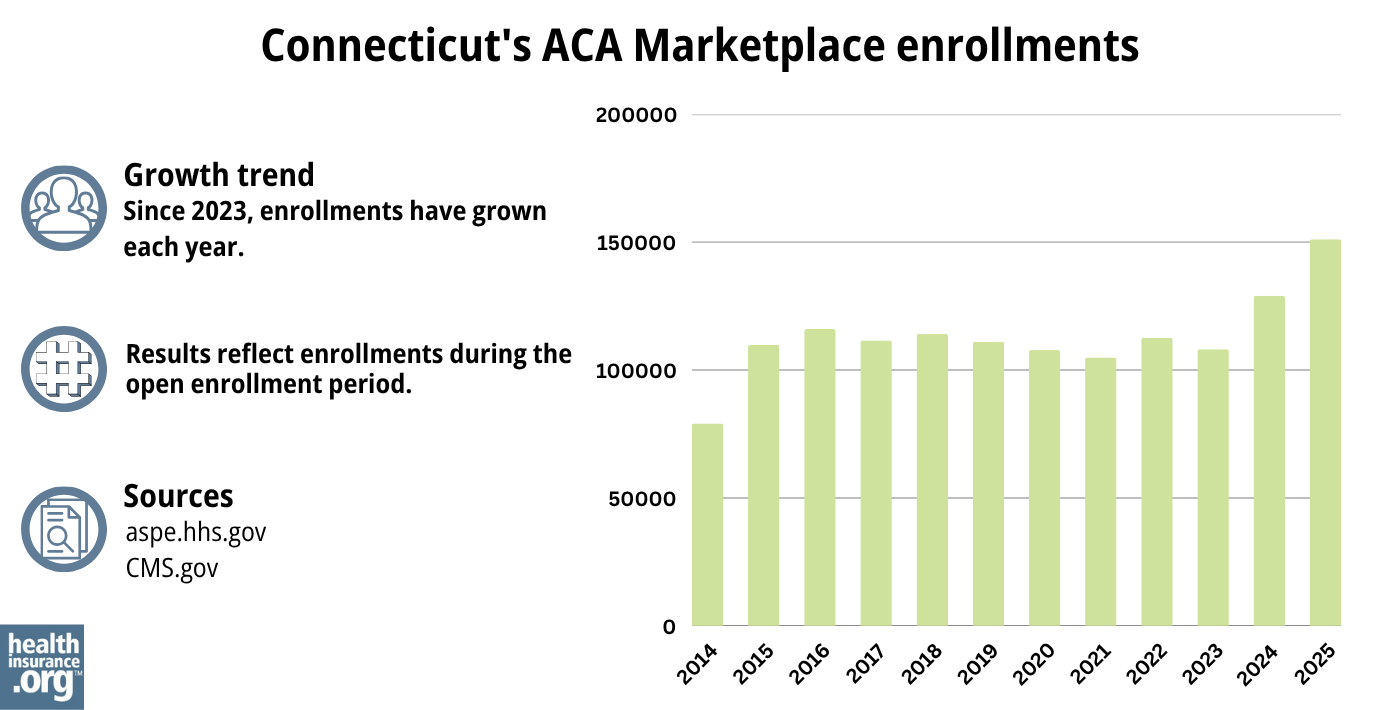

How many people are insured through Connecticut’s Marketplace?

A record-high 129,000 people enrolled in private plans through the Connecticut exchange during the open enrollment period for 2024 coverage.31

The enrollment growth was driven in part by the continued subsidy enhancements under the American Rescue Plan and Inflation Reduction Act, as well as the “unwinding” of the pandemic-era Medicaid continuous coverage rule, with some people transitioning from Medicaid to a Marketplace plan. Access Health CT also noted that the enrollment growth was partially due to additional outreach and enrollment efforts by the Marketplace and local brokers.32

Source: 2014,33 2015,34 2016,35 2017,36 2018,37 2019,38 2020,39 2021,40 2022,41 2023,42 2024,43 202544

What health insurance resources are available to Connecticut residents?

Access Health CT

This website is used by Connecticut residents to sign up for private individual market or small-group coverage and income-based Medicaid/CHIP coverage.

Connecticut CHOICES Program

Offers free enrollment counseling and assistance for older adults, people with disabilities, and their caregivers.

Connecticut Insurance Department

Regulates and licenses the state’s health insurance companies, brokers, and agents. They also address inquiries and complaints from consumers about entities under their regulation.

Husky Healthcare

Provides health coverage for Connecticut residents with lower and moderate incomes.

Medicare Rights Center

This nationwide service offers help and information to Medicare beneficiaries and their caregivers.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Connecticut?

Explore more resources for options in Connecticut including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Health Insurance Rates for 2025”

Connecticut Insurance Department. Sep. 6, 2024 ⤶ - ”Health Insurance Rates for 2025” Connecticut Insurance Department. Sep. 6, 2024 ⤶ ⤶ ⤶ ⤶

- Covered Connecticut Program. Access Health CT. Accessed November 2023. ⤶ ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed January 12, 2024. ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- Special Enrollment Periods. Access Health CT. Accessed November 2023. ⤶

- “Who doesn’t need a special enrollment period?“ healthinsurance.org, Accessed August 2023 ⤶

- Covered Connecticut Program. Connecticut.gov. Accessed November 2023. ⤶

- “Get Help with Your Health Insurance” Access Health CT, Accessed September 2023 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶ ⤶

- “Federal Poverty Level (FPL)” HealthCare.gov, 2023 ⤶

- ”Connecticut SB317” BillTrack50. Accessed June 20, 2024. ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- On-Exchange Plans, 2024 Rates. Connecticut Insurance Department. Accessed November 8, 2023. ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- Connecticut: *Approved* 2016 Weighted Avg. Rate Hikes: +3.5%, -2.9% Sm. Group. ACA Signups. September 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- Health Insurance Rates for 2020. Connecticut Insurance Department. September 2018. ⤶

- Health Insurance Rates for 2020. Connecticut Insurance Department. September 2019. ⤶

- Health Insurance Rates for 2021. Connecticut Insurance Department. September 2020. ⤶

- Health Insurance Rates for 2022. Connecticut Insurance Department. September 2021. ⤶

- Many CT health insurance plans will see double-digit rate hikes in 2023. Connecticut Mirror. September 2022. ⤶

- “Health Insurance Rates for 2024” Connecticut Insurance Department, Accessed September 2023 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶

- ”Record Number 0f Connecticut Residents Enroll in Health Insurance Plans Through Access Health CT for 2024” Access Health CT. January 18, 2024. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶