What are Small Business Health Care Tax Credits?

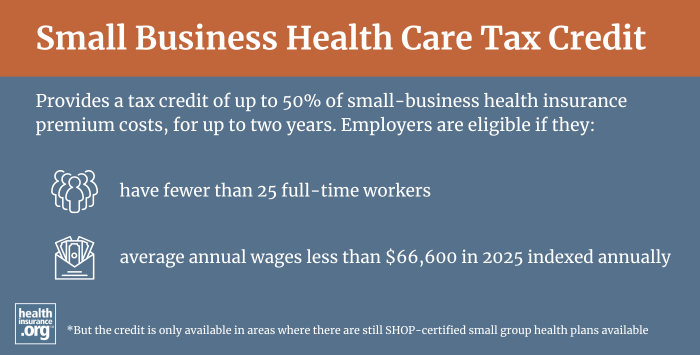

Small Business Health Care Tax Credits provide a tax credit of up to 50% of small-business health insurance premium costs, for up to two years. Employers are eligible if they have fewer than 25 full-time workers and average annual wages less than $66,600 in 20251 (this is indexed for inflation each year2).

However, the credit is only available in areas where there are still SHOP-certified small group health plans available, and that does not include most of the country. Read more about the credit.

Footnotes

- "IRS Releases 2025 Cost-of-Living Adjustments for Health FSAs, Transportation Benefits, Adoption Assistance, and More" Thompson Reuters. Oct. 23, 2024 ⤶

- "Small Business Health Care Tax Credit and the SHOP Marketplace" Internal Revenue Service. Accessed Oct. 22, 2024 ⤶