Home > Health insurance Marketplace > Utah

Utah Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Utah health insurance Marketplace guide

If you need health insurance in Utah, this guide, including the FAQs below, is for you. You may find that an Affordable Care Act (ACA) Marketplace plan – commonly referred to as an Obamacare plan or an exchange plan – may be an affordable choice.

In Utah, the exchange (Marketplace) is operated at the federal level, meaning individuals and families enroll in health plans through HealthCare.gov or authorized enhanced direct enrollment entities.3

The Marketplace serves individuals and families who need to purchase their own health insurance. This includes self-employed individuals, people who have retired early and are not yet eligible for Medicare, and employees of small businesses that do not provide health benefits. Enrolling in a plan on the exchange is the only way Utah residents can access financial assistance for their individual market plan coverage.

For the 2024 plan year, two new insurers joined Utah’s marketplace: Imperial Health Plan of the Southwest, Inc. and Aetna Health of Utah, Inc. And enrollment reached a significant new record high, with nearly 367,000 people selecting 2024 Marketplace plans during the open enrollment period.4

Most of Utah’s Marketplace insurers will continue to offer coverage in 2025, but Cigna is exiting the Utah market at the end of 20245 (details below).

Frequently asked questions about health insurance in Utah

Who can buy Marketplace health insurance?

Most people in Utah can buy health insurance through the exchange. Marketplace health coverage is available if you meet the following criteria:6

- You must be a resident of Utah.

- You must be lawfully present in the U.S.

- You can’t be incarcerated.

- You must not be enrolled in Medicare.

Whether or not you qualify for financial assistance with your premium, deductible, or out-of-pocket costs depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area.

Additionally, to qualify for financial assistance, you must:

- Not have access to affordable health coverage through an employer. If you think your employer-sponsored health plan is too expensive, use our Employer Health Plan Affordability Calculator to check if you qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP in Utah, or for premium-free Medicare Part A.7

- If married, file a joint tax return.8

- Not be able to be claimed by someone else as a tax dependent.8

When can I enroll in an ACA-compliant plan in Utah?

In Utah, the open enrollment window to sign up for ACA Marketplace individual and family health plans runs from November 1 to January 15.9

For coverage to start on January 1, enroll by December 15. Enrolling between December 16 and January 15 will push your coverage start date to February 1.

Outside of open enrollment, you can only sign up for coverage (through the exchange or directly through an insurance company) if you have a special enrollment period (SEP). In most cases, this means you need to have a qualifying life event, but there are some SEPs that don’t require specific qualifying events, such as:

- Your income is more than 138% of the poverty level but no more than 150% of the poverty level, and you’re eligible for premium tax credits. In this scenario, you can enroll anytime (note that if your income isn’t more than 138% of the poverty level you’ll likely qualify for Utah Medicaid, which accepts enrollments year-round).

- American Indians and Alaska Natives can enroll whenever necessary.

How do I enroll in a Marketplace plan in Utah?

You have a few ways to enroll in a Marketplace health plan in Utah:

- Online: Go to HealthCare.gov. This is the federal Marketplace website that also lets you shop around for plans. You can also enroll in a Utah Marketplace plan via an EDE entity approved to offer coverage in Utah.10

- By Phone: Call 1-800-318-2596 (TTY: 1-855-889-4325) to talk to a representative over the phone. The call center is available 24 hours a day, seven days a week, except holidays.

- In-person: Get help from a licensed insurance agent, navigator, or certified application counselor in your area. Look for assistance at localhelp.HealthCare.gov. Call 2-1-1 or visit takecareutah.org.11

No matter which of the above methods you use, you’ll still purchase your health plan through HealthCare.gov (or an approved EDE) since Utah uses the federally-facilitated Marketplace. The website will walk you through the application process and determine your eligibility for financial assistance.

How can I find affordable health insurance in Utah?

People in Utah who enroll in a Marketplace plan (accessed at HealthCare.gov) can be eligible for two different types of financial assistance, depending on their household income:

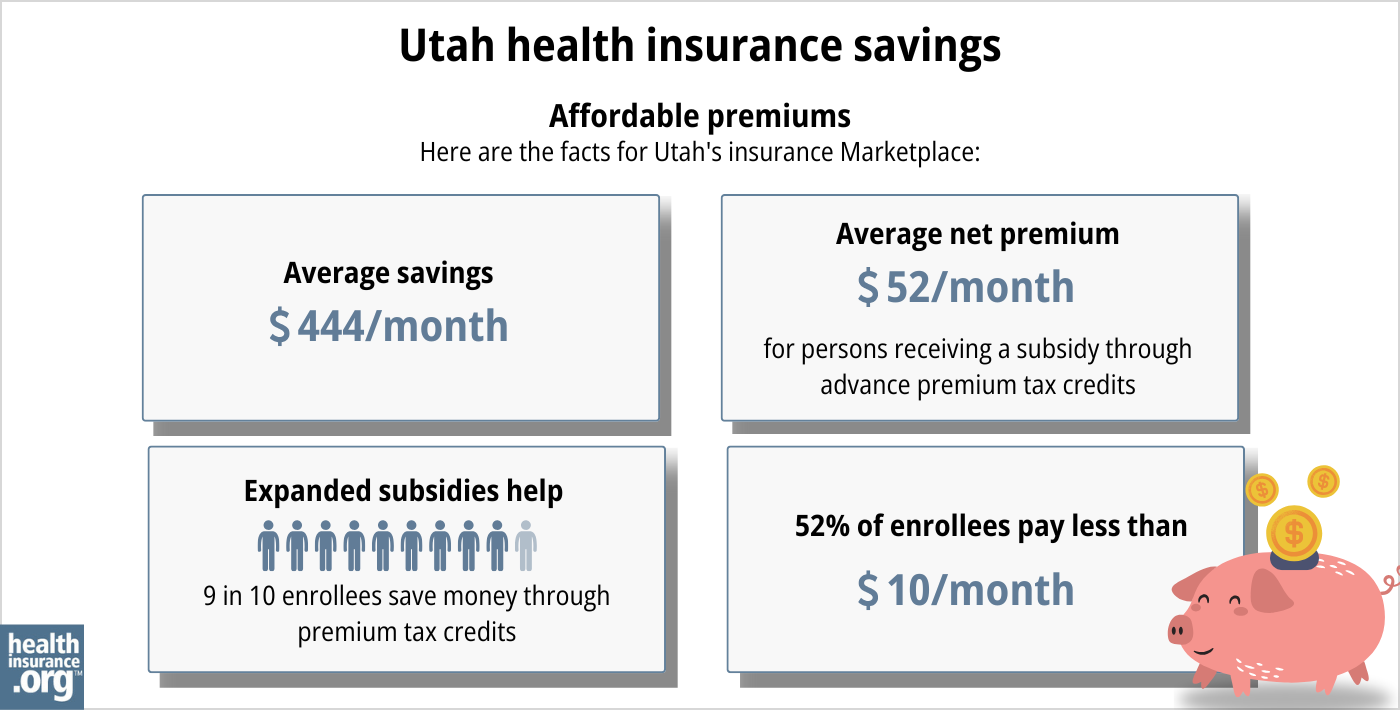

- Premium tax credits (premium subsidies): If you sign up on HealthCare.gov, you may qualify for financial assistance called Advance Premium Tax Credits (APTC) to lower your monthly premiums. Ninety-six percent of Utah Marketplace enrollees were receiving premium subsidies in early 2024, which reduced average net premiums to about $63/month.12 (These numbers are based on effectuated enrollment; the chart below shows some different metrics and uses data from all applications submitted during open enrollment.)

- Cost-sharing reductions (CSR): If your household income is no more than 250% of the federal poverty level, you can also receive cost-sharing reductions (CSR) assistance, as long as you select a Silver-level plan. CSRs reduce your deductible and out-of-pocket expenses, which means you can get the care you need at an affordable cost.

Source: CMS.gov 13

Medicaid: Check if you’re eligible for Medicaid by going online to HealthCare.gov or through medicaid.utah.gov.14

Short-term health insurance: Short-term health insurance is a lower-cost option in Utah, and several insurers offer short-term plans. Short-term health insurance is generally only a reasonable option if you’re not eligible for any financial assistance through the exchange, or if you’re trying to enroll outside of open enrollment and don’t have a SEP. And for plans effective in September 2024 or later, policy duration is limited to no more than four months, so these policies are also only suitable to fill a short gap between other plans. Short-term policies do not cover pre-existing medical conditions.

How many insurers offer Marketplace coverage in Utah?

For 2025, seven insurers offer Marketplace coverage in Utah, with varying coverage areas.15

There were eight participating insurers in 2024, but Cigna is exiting the Utah individual market at the end of 2024.5 Enrollees with 2024 coverage from Cigna need to select a new plan during the open enrollment period that began in November 2024.

Are Marketplace health insurance premiums increasing in Utah?

Tthe following average rate changes were approved for 2025 for Utah’s individual market insurers, applicable to pre-subsidy premiums:16

Utah’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| BridgeSpan Health Company | 18.41% |

| Cigna Health | exiting the market |

| Molina Healthcare of Utah | 5.2% |

| Regence BlueCross BlueShield of Utah | 18.51% |

| SelectHealth | 9.09% |

| University of Utah Health Plans | 6.8% |

| Imperial Health Plan of the Southwest | 11.39% |

| Aetna Health of Utah | 14.3% |

Source: Federal Rate Review Database16

The Utah Health Insurance Transparency website indicates how many policyholders each carrier has,17 although the number of members isn’t specified for some enrollees (a policy can cover multiple family members). But the weighted average rate increase based on the number of policyholders is about 10.2% (calculated before any subsidies are applied; subsidies change to keep pace with the cost of the second-lowest-cost Silver plan in each area).

For perspective, here’s how average full-price premiums have changed in Utah’s individual/family market in previous years:

- 2015: Average increase of 5%18

- 2016: Average increase of 25%19

- 2017: Average increase of 31.7%20

- 2018: Average increase of 39.5%21

- 2019: Average increase of 0.5%22

- 2020: Average decrease of 2.3%%23

- 2021: Average rate changes ranged from -7% to +3%24

- 2022: Average increase of 1%25

- 2023: Average increase of 6%26

- 2024: Average increase of 11.4%27

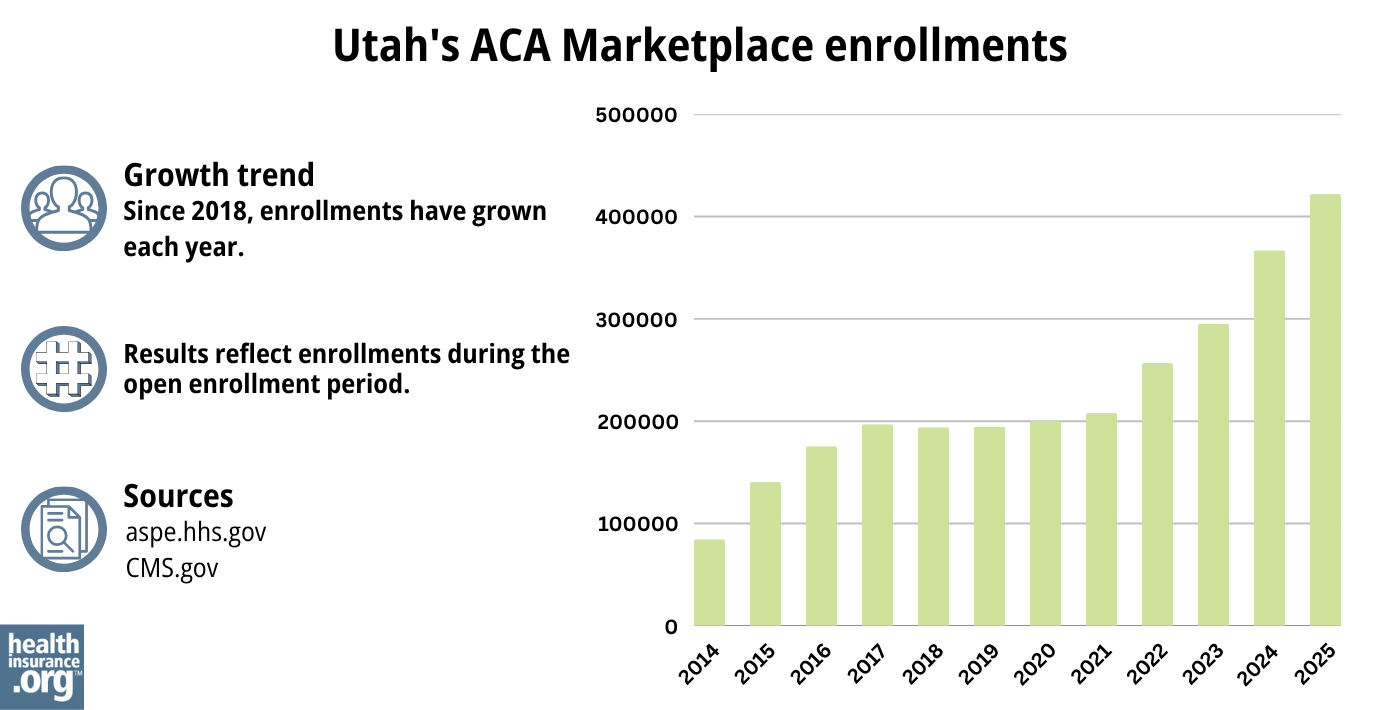

How many people are insured through Utah’s Marketplace?

During the open enrollment period for 2024 coverage, 366,939 people enrolled in private plans through Utah’s health insurance Marketplace.28

This was a substantial record high, far exceeding the previous record high when 295,196 people enrolled for 2023.29

The chart below shows enrollment over time in Utah’s exchange. The sharp increase in enrollment in recent years has been driven in large part by the subsidy enhancements under the American Rescue Plan and Inflation Reduction Act, which made Marketplace plans more affordable. The enrollment increase for 2024 is also partially driven by Medicaid disenrollments, which resumed in 2023. Some people who are no longer eligible for Medicaid have obtained coverage in the Marketplace instead.

Source: 2014,30 2015,31 2016,32 2017,33 2018,34 2019,35 2020,36 2021,37 2022,38 2023,29 2024,39 202540

What health insurance resources are available to Utah residents?

HealthCare.gov

The official federal website where you can sign up for health insurance plans through the ACA Marketplace.

Utah Insurance Department

Oversees and licenses health insurance companies, brokers, and agents, offering information and help for various health insurance concerns.

Utah Health Insurance Transparency; Latest Rate Changes

Shows rate and plan filings that insurers have submitted for review by state regulators.

Utah Senior Services

Supports Medicare beneficiaries by providing assistance, information, and valuable resources.

Take Care Utah

An initiative aimed at helping Utah residents understand and access health insurance options, including the ACA Marketplace and Medicaid.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Utah?

Explore more resources for options in Utah including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- “Entities Approved to be Used Enhanced Direct Enrollment” Centers for Medicare and Medicaid Services. Aug. 9, 2024 ⤶

- Marketplace 2024 Open Enrollment Period Report: Final National Snapshot. Centers for Medicare and Medicaid Services. January 2024. ⤶

- ”Health Insurance Plans in Utah” Cigna. Accessed Aug. 19, 2024 ⤶ ⤶

- “A quick guide to the Health Insurance Marketplace” HealthCare.gov, Accessed September 2023 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed May 10, 2024 ⤶ ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- ”Entities Approved to Use Enhanced Direct Enrollment” Centers for Medicare & Medicaid Services. Aug. 9, 2024 ⤶

- “Applying for Health Insurance” Utah Department of Health & Human Services, Accessed Dec. 4, 2024 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- “Utah Medicaid” Utah Department of Health and Human Services, medicaid.utah.gov, Accessed September 2023 ⤶

- ”2025 Insurers” Utah Insurance Department. Accessed Dec. 4, 2024 ⤶

- ”Utah Rate Review Submissions” RateReview.HealthCare.gov. Accessed Dec. 4, 2024 ⤶ ⤶

- Latest Rate Changes. Utah Health Insurance Rate Transparency, Accessed Aug. 19, 2024 ⤶

- “Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums” Commonwealth Fund. December 2014 ⤶

- “FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally*” ACA Signups. October 2015 ⤶

- “Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups. August 2016 ⤶

- “2018 Rate Hikes” ACA Signups. October 2017 ⤶

- “2019 Rate Hikes” ACA Signups. October 2018 ⤶

- “2020 Rate Changes” ACA Signups. October 2019 ⤶

- “2021 Premium Changes on ACA Exchanges and the Impact of COVID-19 on Rates” KFF. October 2020 ⤶

- “2022 Rate Changes” ACA Signups. October 2021 ⤶

- “Utah: (Updated) Final Avg. Unsubsidized 2023 #ACA Premiums: +6.0%” ACA Signups. August 2022 ⤶

- Utah: *Final* Avg. Unsubsidized 2024 #ACA Rate Changes: +11.4%; Aetna & Imperial Joining Indy Market. ACA Signups. October 2023. ⤶

- Marketplace 2024 Open Enrollment Period Report: Final National Snapshot. Centers for Medicare and Medicaid Services. January 2024. ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶ ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶