Medicare in Minnesota

Original Medicare, Medicare Advantage, Part D prescription drug, and Medigap coverage in Minnesota

Key takeaways

- More than 1.1 million people are enrolled in Medicare in Minnesota.1

- More than 685,000 of Minnesota Medicare plan beneficiaries have private Medicare coverage, including Medicare Advantage.1

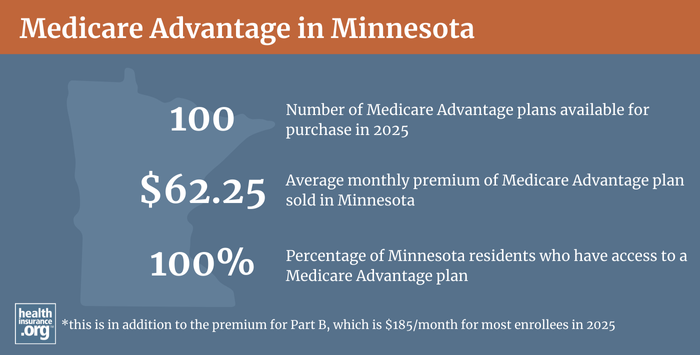

- 2025 Medicare Advantage availability in Minnesota ranges from fewer than 10 to over 40 plans, depending on the county.2

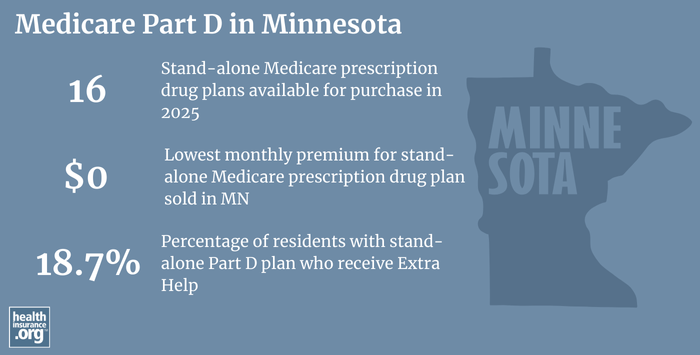

- There are 16 stand-alone Medicare Part D prescription drug plans available in Minnesota in 2025.3

Medicare enrollment in Minnesota

As of September 2024, 1,153,108 Minnesota residents were enrolled in Medicare coverage,1 which amounted to about 18% of the state’s population.4

Most individuals become eligible for Medicare when they turn 65. But people may become eligible for Medicare if they have been receiving certain disability benefits for 24 months,5 or have amyotrophic lateral sclerosis (ALS) or end-stage renal disease. In the US, about 11% of all Medicare beneficiaries — just over 7 million people — are under age 65.6 It’s a little lower in Minnesota, where only about 9% of Medicare beneficiaries are under age 65 and eligible due to a disability.1

- Read about Medicare’s open enrollment period and other important enrollment deadlines.

- Learn about how Minnesota’s Medicaid program can provide assistance to Medicare beneficiaries with limited income and assets.

Learn about Medicare plan options in Minnesota by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Minnesota

The ACA Marketplace allows individuals and families to shop for and enroll in ACA-compliant health insurance plans. Subsidies may be available based on household income to help lower costs.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Minnesota.

Learn about Minnesota’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Minnesota.

Frequently asked questions about Medicare in Minnesota

What is Medicare Advantage?

Private Medicare Advantage plans are an alternative to Original Medicare (Medicare Part A, hospital coverage, and Medicare Part B, outpatient/medical coverage). Medicare Advantage plans include all of the covered benefits of Original Medicare7 (although there can be significant differences in the out-of-pocket costs), and most Medicare Advantage plans also include Medicare Part D prescription drug coverage and may offer extra benefits like dental and vision coverage, a nurse hotline service, and fitness.

But Medicare Advantage plans tend to have limited provider networks, and out-of-pocket costs may be higher than they would be with Original Medicare plus a Medigap plan and Medicare Part D prescription drug plan. There are pros and cons to either option, and the right solution is different for each person.

Plan availability varies by county, but Minnesota’s Medicare Advantage market is strong: Residents throughout the state can select from among at least 8 Medicare Advantage plans for 2025, and some counties have more than 40 different plan options for sale.2

The Annual Enrollment Period (October 15 – December 7) allows Medicare beneficiaries the opportunity to change their Medicare Advantage coverage if they choose to do so.

About 60% of all Minnesota Medicare enrollees were enrolled in Medicare Advantage plans as of September 2024,1 as opposed to a national average of about 50%.6

(Note that these numbers refer to people who are enrolled in a private plan to replace Original Medicare, as opposed to a plan to supplement it — so stand-alone Medicare Part D prescription drug plans and Medigap policies are not counted when we talk about more than half of Minnesota’s Medicare beneficiaries being enrolled in private plans.)

Private plan enrollment already accounted for well over half of Minnesota’s Medicare beneficiaries several years ago, but it dropped in 2019 and has climbed again since then in line with Medicare Advantage growth nationwide. But the percentage of Minnesota Medicare beneficiaries with private coverage has been climbing again since then, with nearly 58% of the state’s beneficiaries enrolled in private plans by 2023.

Minnesota was the first to participate in a demonstration program to pilot Medicare Cost plans in the 1970s, and the plans remained popular over the decades. They didn’t catch on in many other states, however, and Medicare + Choice came on the national scene in the 1990s, replaced by Medicare Advantage in 2003.

Are Medicare Cost plans available in Minnesota?

The legislation that introduced Medicare Advantage also created a competition clause that banned Medicare Cost plans from operating in areas where they faced substantial competition from Medicare Advantage plans, but the implementation of the competition clause was delayed for many years. In 2015, legislation (MACRA) called for the competition clause to be implemented in 2019.

As a result, Medicare Cost Plans were discontinued in 66 Minnesota counties.8 These Medicare Cost Plans include Medicare Part A and Part B coverage, but with the flexibility to see non-network providers. A Medicare Cost Plan may also include the option of obtaining separate Medicare Part D prescription drug coverage.8 In 2011, 24% of Minnesotans were enrolled in Medicare Cost Plans. As of December 2020, about 6% of state residents had Medicare Cost plans.9

One of the reasons Medicare Cost has been so popular in Minnesota is that the state has a large population of “snowbirds” — retirees who live in Minnesota during the summer, but head south to warmer climes in the winter. With Medicare Cost plans, the enrollee still has Original Medicare — including the large nationwide network of providers who work with Medicare — in addition to the Medicare Cost coverage. Medicare Advantage plans, in contrast, tend to have localized networks that might not be suitable for a senior who lives in two different states during the year. A Medigap plan plus Original Medicare will allow a person in that situation to have access to health providers in both locations, although Medigap tends to be more expensive than Medicare Advantage. There are pros and cons to both options, and no one-size-fits-all solution.

As of 2023, there were still Medicare Cost plans available in 21 counties in Minnesota. Medicare Cost plans in the state are offered by Blue Cross Blue Shield of Minnesota and Medica (as of 2022, there were also Cost plans offered by Health Partners, but their policies are no longer available in Minnesota as of 2023)

Medigap enrollment and regulations in Minnesota

Thirteen insurers offer Medigap policies in Minnesota as of 2025.10

According to AHIP, 206,932 Minnesota Medicare beneficiaries were enrolled in Medigap plans (also known as Medicare Supplement insurance) in 2023,11 to supplement their Original Medicare coverage.

Learn how Medigap plans are regulated and standardized.

Medigap plan standardization is different in Minnesota

In all but three states, Medigap policies are standardized under federal rules.12 But Minnesota is one of three states that have federal waivers that allow the state to do its own Medigap standardization.13

So instead of the ten Medigap plans (A through N) that are marketed in most states, Minnesota Medigap plans include: Basic, Basic with riders, Extended Basic, Medicare SELECT (policies that require enrollees to stay within their provider network), and Medigap policies with limited coverage.14

Efforts to create an annual Medigap enrollment window

Under federal rules, there’s no annual guaranteed-issue enrollment opportunity for Medigap. But Minnesota enacted legislation in 2023 to create a Medigap guaranteed issue window each fall, during the October 15 – December enrollment window that applies to other private Medicare plans (Part D and Medicare Advantage). The new law was scheduled to take effect in August 2025, but that has been delayed to August 2026.15

Some stakeholders, including the insurer that holds the majority of the Medigap market share in Minnesota, have asked lawmakers to repeal the new guaranteed-issue open enrollment period before it takes effect.16 The stakeholders have said that premiums will be higher if there’s an annual guaranteed-issue enrollment window for Medigap plans. To address this, additional legislation was enacted in 2025, calling for higher premiums for people utilizing the new guaranteed-issue enrollment window to sign up for Medigap for the first time.17

Medigap for people under age 65

Federal rules do not guarantee access to Medigap plans for people who are under 65, but the majority of the states – including Minnesota – have implemented rules to ensure that disabled Medicare beneficiaries have at least some access to Medigap plans. Minnesota law grants a six-month open enrollment period to anyone who enrolls in Medicare Part B, regardless of age18 (federal rules only grant this window to people who enroll in Part B and are also at least 65 years old).

Other consumer protections

Minnesota prohibits Medigap insurers from basing premiums on an enrollee’s age. Premiums for Medigap plans in Minnesota only vary based on tobacco use and where the enrollee lives.10

Minnesota law also prevents Medigap insurers from imposing pre-existing condition waiting periods if the beneficiary enrolls during their initial six-month open enrollment window. For those who apply after that, Medigap insurers are not allowed to impose pre-existing condition waiting periods if the enrollee wasn’t diagnosed or treated for the condition in the 90 days before enrolling in the Medigap policies.18

What is Medicare Part D?

Original Medicare does not provide coverage for outpatient prescription drugs. About 47% of Original Medicare beneficiaries nationwide have supplemental coverage via an employer-sponsored plan (from a current or former employer or spouse’s employer) or Medicaid, and these plans often include prescription coverage.19 Some Medigap plans that were sold prior to 2006 included coverage for prescription drugs, but sales of those plans ceased as of 2006, when Medicare Part D became available. Medicare prescription drug Part D was created under the Medicare Modernization Act of 2003, which was signed into law by President George W. Bush.20

For people who have enrolled in Medicare since 2006 and who don’t have prescription drug coverage through Medicaid or an employer-sponsored plan, Medicare Part D prescription drug plan enrollment is essential in order to have coverage for prescriptions. Medicare Part D prescription drug is optional, and can be purchased as a stand-alone plan, or integrated with a Medicare Advantage plan.

There are 16 stand-alone Medicare Part D prescription drug plans for sale in Minnesota for 2025, with premiums starting at $0 per month.3 The same open enrollment period that applies to Medicare Advantage plans (October 15 to December 7) also applies to Part D plans. During this period, Medicare beneficiaries can change their Medicare Part D prescription drug coverage, with the new plan taking effect January 1.

In Minnesota, as of September 2024, there were 347,302 people with stand-alone Medicare Part D prescription drug coverage. Another 612,520 Medicare beneficiaries in Minnesota had Medicare Part D prescription drug coverage as part of their Medicare Advantage plans.1

What additional resources are available for Medicare beneficiaries and their caregivers in Minnesota?

You may contact Minnesota’s Health Insurance Counseling Program with questions related to Medicare coverage in the state, or for assistance with eligibility or enrollment.

This overview of how Minnesota’s Medicaid program can help Medicare beneficiaries with limited financial means is a useful resource.

The Minnesota Commerce Department has a Medicare resource and information page on their website. They also regulate and license the health insurance companies that offer policies in the state, as well as the agents and brokers who sell those policies, and can address consumers’ questions and complaints.

The Medicare Rights Center is a nationwide service that can answer questions and provide information about Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Minnesota?

Explore more resources for options in MN including ACA coverage, short-term health insurance, dental and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – Minnesota.” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (71) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶

- “U.S. Census Bureau Quick Facts: United States; Minnesota.” U.S. Census Bureau, July 1, 2024. ⤶

- “Medicare Information.” Social Security Administration. Accessed August 14, 2023. ⤶

- “Medicare Monthly Enrollment – US” Centers for Medicare & Medicaid Services Data. Accessed January, 2o25. ⤶ ⤶

- “Medicare Advantage Plans Cover All Medicare Services.” Medicare.gov. Accessed November 3, 2023. ⤶

- “Medicare Basics.” Minnesota Department of Commerce – Insurance, March 8, 2023. ⤶ ⤶

- “Public Health Insurance Programs.” MN Department of Health, January 9, 2023. ⤶

- “Annual Premium Guide: Medicare Supplement. Basic, Extended Basic, other plans and optional riders currently marketed in Minnesota” Minnesota Commerce Department. Accessed Oct. 3, 2025 ⤶ ⤶

- “The State of Medicare Supplement Coverage” AHIP. May 2025. Accessed Oct. 3, 2025 ⤶

- “Medigap: Background and Statistics – CRS Reports.” Congress.gov. Accessed Oct. 3, 2025 ⤶

- “Medigap in Minnesota” Medicare.gov. Accessed Oct. 3, 2025 ⤶

- “Minnesota Medigap insurance policy options” Minnesota Commerce Department. Accessed Oct. 3, 2025 ⤶

- ”Medicare Supplement Open Enrollment Impact Study” Minnesota Commerce Department. Accessed Oct. 1, 2025 ⤶

- ”Letters from stakeholders regarding Minnesota’s new Medigap annual enrollment period” Accessed Oct. 1, 2025 ⤶

- ”Minnesota HF4” BillTrack50. Enacted June 15, 2025 ⤶

- “Sec. 62A.31 MN Statutes.” Office of the Revisor of Statutes. Accessed Oct. 3, 2025 ⤶ ⤶

- Ochieng, Nancy, Gabrielle Clerveau, and Tricia Neuman. “A Snapshot of Sources of Coverage among Medicare Beneficiaries.” Kaiser Family Foundation, August 14, 2023. ⤶

- “Fact Sheet: Medicare Prescription Drug, Improvement, and Modernization Act of 2003.” National Archives and Records Administration. Accessed August 26, 2023. ⤶