Home > Health insurance Marketplace > Mississippi

Mississippi Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Mississippi health insurance Marketplace guide

Use this guide, including the FAQs below, to help you find the right health plan in Mississippi. Many people find an ACA Marketplace (exchange) plan, also known as Obamacare, to be a cost-effective choice.

Mississippi uses the federally-facilitated health insurance Marketplace, Healthcare.gov, for residents to purchase ACA-compliant plans. In May 2024, Mississippi enacted legislation (HB1647, which became law without the governor’s signature) that authorizes the Mississippi Commissioner of Insurance to create a state-based health insurance exchange platform.3 But nothing has come of that yet.

Mississippi Insurance Commissioner Mike Chaney has long advocated for the state to run its own exchange.4 But he also noted that he won’t proceed without Governor Reeves’s support.5 In a phone discussion, Chaney noted that if Gov. Reeves were to agree to a state-based exchange, Mississippi has the infrastructure in place to potentially have an operational state-based exchange quite soon. But under rules that CMS recently finalized, a state has to operate a state-based exchange using the federal platform (HealthCare.gov) for at least one year before the state can transition to a fully state-based platform.6 Under that rule, the fall of 2026 (for 2027 coverage) would be the soonest that Mississippi could be enrolling people via a state-based Marketplace platform, as Mississippi is still using HealthCare.gov for the 2025 plan year.

The Mississippi Marketplace provides access to health insurance products from five private insurers. Coverage areas vary, but residents in all Mississippi counties have access to Marketplace plans from at least three insurers as of 2025.7

Depending on your income and other circumstances, you may also get help to lower your monthly insurance premium (the amount you pay to enroll in the coverage) and possibly your out-of-pocket expenses. As of early 2024, 99% of Mississippi Marketplace enrollees were receiving premium subsidies, and 71% were receiving cost-sharing reductions.8

Frequently asked questions about health insurance in Mississippi

Who can buy Marketplace health insurance?

To qualify for health coverage through the Marketplace in Mississippi, you must:9

- Live in Mississippi.

- Be lawfully present in the United States

- Not be incarcerated.

- Not be enrolled in Medicare

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your household income. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage from an employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.10

- If married, file a joint tax return11 (with very limited exceptions)12

- Not be able to be claimed by someone else as a tax dependent.13

When can I enroll in an ACA-compliant plan in Mississippi?

In Mississippi, the open enrollment period for individual/family health coverage runs from November 1 to January 15.14

Enrollments must be submitted by December 15 in order to have coverage effective January 1. Enrollments submitted in the final month of the open enrollment window have an effective date of February 1 instead.9

Outside of open enrollment, a special enrollment period (usually triggered by a specific qualifying life event) is necessary to enroll or make changes to your coverage.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

How do I enroll in a Mississippi Marketplace plan?

There are several ways to enroll in an ACA Marketplace plan in Mississippi:

- Online through HealthCare.gov

- By phone at (800) 318-2596

- With the help of a broker, Navigator, or certified application counselors (these individuals can provide help online, over the phone, or in person, depending on your needs)

- Via an approved enhanced direct enrollment entity.15

How can I find affordable health insurance in Mississippi?

Under the Affordable Care Act (ACA), there are income-based subsidies that can help lower your premium payments each month. These subsidies are available to Mississippi residents who meet the eligibility requirements and enroll in Marketplace coverage.

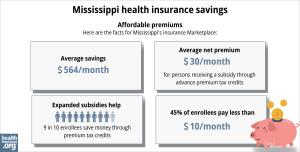

Almost all of Mississippi’s exchange enrollees – 98% – qualified for premium subsidies (advance premium tax credits, or APTC) during the open enrollment period for 2024, with an average savings of $592/month. These subsidies reduced the average subsidy-eligible enrollee’s premium to about $25/month.16

In addition to premium subsidies, the Affordable Care Act provides cost-sharing reductions (CSR) to people whose household income isn’t more than 250% of the poverty level, as long as they select a Silver-level plan through the Marketplace.17

Between the premium subsidies and cost-sharing reductions, you may find that an ACA Marketplace plan in Mississippi provides the best value for your family’s health coverage.

Source: CMS.gov18

Mississippi has not yet expanded Medicaid under the ACA, so there is still a coverage gap in the state. Adults under age 65 who are not disabled and who don’t have minor children are not eligible for Mississippi Medicaid, regardless of how low their income is. And Marketplace subsidies are not available if your income is below the poverty level. Roughly 74,000 low-income adults in Mississippi are in the coverage gap due to the state’s refusal to implement Medicaid expansion.19

How many insurers offer Marketplace coverage in Mississippi?

Are Marketplace health insurance premiums increasing in Mississippi?

The following average premium changes for 2025 were aproved for the insurers that offer plans through the Mississippi Marketplace, applicable to full-price (pre-subsidy) premiums:22

Mississippi’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Ambetter/Magnolia | 1.3% |

| Cigna | 4% |

| Primewell Health Services (formerly Vantage Health Plan) | 6.64% |

| Molina | -2.05% |

| UnitedHealthcare | -1.01% |

Source: RateReview.HealthCare.gov22

(Blue Cross Blue Shield of Mississippi’s approved average increase is 2.5% for 2025. But their individual/family plans are not available through the marketplace in Mississippi, and can only be purchased off-exchange, without any subsidies.)22

Mississippi continues to be one of just two states (the other is Indiana) where the cost of cost-sharing reductions is spread across plans at all metal levels (broad loading), instead of being added only to Silver plan rates (Silver loading). West Virginia also took that approach through 2021, but transitioned to a Silver loading approach as of 2022. A review of rate filing memos for 2025 indicates that the broad loading approach continues to be used in Mississippi.23

Silver loading makes coverage more affordable in many cases, because it increases the price of Silver-level plans, and subsidy amounts are based on the cost of the second-lowest-cost Silver plan. But Mississippi regulators have not yet taken advantage of this approach, even though it’s being used in nearly every other state.

For perspective, here’s an overview of how average full-price (pre-subsidy) premiums have changed over time in Mississippi’s individual/family market (note that these averages include BCBS of MS, which only offers coverage outside the Marketplace):

- 2015: Average decrease of 19%.24

- 2016: Average increase of 14.9%.25

- 2017: Average increase of 15.8%.26

- 2018: Average increase of 38%.27

- 2019: Average increase of 0.2%.28

- 2020: Average increase of 0.3%.29

- 2021: Average increase of 2.7%.30

- 2022: Average increase of 3.8%.31

- 2023: Average increase of 5.3%.32

- 2024: Average increase of 2.3%33

How many people are insured through Mississippi’s Marketplace?

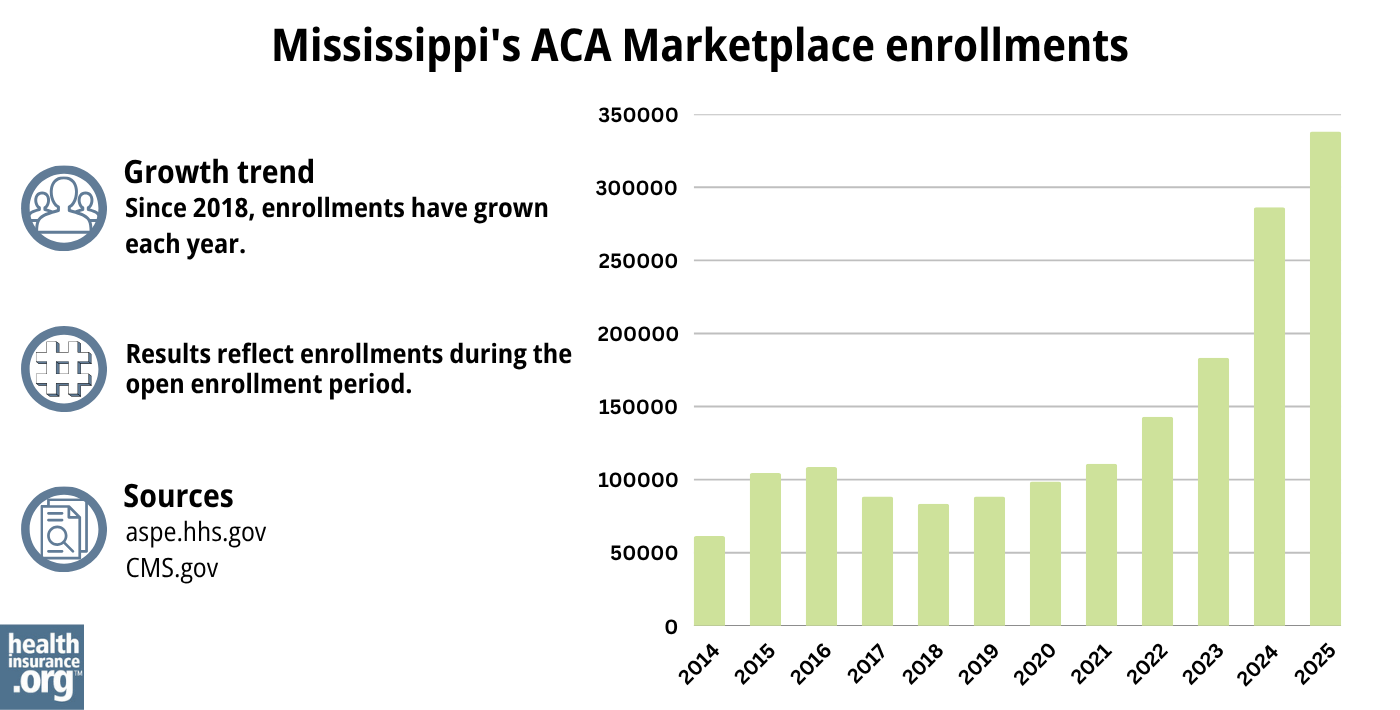

In Mississippi, 286,410 people enrolled in private plans through the Mississippi Marketplace during the open enrollment period for 2024, setting a significant new record high for the state (see chart below).34

This increase in enrollment is thanks in part to the American Rescue Plan (ARP). Under the ARP, the ACA’s premium subsidies are larger and more widely available. The ARP subsidy enhancements have been extended through 2025 by the Inflation Reduction Act.35

The enrollment spike was also due to the “unwinding” of the pandemic-era Medicaid continuous coverage rule. For three years, states didn’t disenroll anyone from Medicaid, but disenrollments resumed in the spring of 2023, and some people who lost Medicaid subsequently enrolled in Marketplace coverage. CMS reported that by April 2024, more than 70,000 Mississippi residents had transitioned from Medicaid to a Marketplace plan during the unwinding period.36

Source: 2014,37 2015,38 2016,39 2017,40 2018,41 2019,42 2020,43 2021,44 2022,45 2023,35 2024,46 202547

What health insurance resources are available to Mississippi residents?

HealthCare.gov

800-318-2596

State Exchange Profile: Mississippi

The Henry J. Kaiser Family Foundation overview of Mississippi’s progress toward creating a state health insurance exchange.

Health Help Mississippi

Assists people insured by private health plans, Medicaid, or other plans in resolving problems pertaining to their health coverage; assists uninsured residents with access to care.

(877) 314-3843 / [email protected]

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Mississippi?

Explore more resources for options in Mississippi including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- ”Mississippi HB1647” BillTrack50. Enacted May 14, 2024 ⤶

- ”Legislature considering creating a state-based healthcare exchange” WLBT3. April 15, 2024 ⤶

- ”Commissioner won’t create Mississippi health insurance exchange unless governor approves” SunHerald. June 20, 2024 ⤶

- Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2025; Updating Section 1332 Waiver Public Notice Procedures; Medicaid; Consumer Operated and Oriented Plan (CO-OP) Program; and Basic Health Program. U.S. Department of the Treasury; U.S. Department of Health and Human Services. April 2, 2024. ⤶

- ”Plan Year 2025 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces” Centers for Medicare and Medicaid Services. October 25, 2024 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶

- “A quick guide to the Health Insurance Marketplace®” HealthCare.gov, Accessed August, 2023 ⤶ ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed January 12, 2024. ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, Aug. 9, 2024 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶

- APTC and CSR Basics. Centers for Medicare and Medicaid Services. June 2023. ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- How Many Uninsured Are in the Coverage Gap and How Many Could be Eligible if All States Adopted the Medicaid Expansion? KFF. Feb. 26, 2024 ⤶

- “Mississippi Rate Review Submissions” RateReview.Healthcare.gov. Accessed Aug. 2, 2024 ⤶

- Plan Year 2025 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces. Centers for Medicare and Medicaid Services. October 25, 2024 ⤶

- “Mississippi Rate Review Submissions” RateReview.Healthcare.gov. Accessed Nov. 12, 2024 ⤶ ⤶ ⤶

- “Mississippi Rate Review Submissions” RateReview.Healthcare.gov. Accessed Aug. 2, 2024 ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- 2021 Rate Changes. ACA Signups. October 2020. ⤶

- 2022 Rate Changes. ACA Signups. October 2021. ⤶

- UPDATED: FINAL Unsubsidized 2023 Premiums: +6.2% Across All 50 States +DC. ACA Signups. Accessed November 2023. ⤶

- ”Mississippi: *Final* Avg. Unsubsidized 2024 #ACA Rate Changes: +2.3% (Unweighted; Updated)” ACA Signups. Nov. 7, 2023 ⤶

- ”Health Insurance Marketplaces 2024 Open Enrollment Period Report” CMS.gov. March 22, 2024 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶ ⤶

- ”HealthCare.gov Marketplace Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024; Accessed Aug. 2, 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶