Medicare in New Jersey

New Jersey ensures access to Medigap Plan D for beneficiaries under age 65

Key Takeaways

- Over 1.7 million residents are covered by Medicare in New Jersey.1

- More than a third of New Jersey Medicare beneficiaries select Medicare Advantage plans.1

- More than half of New Jersey’s Medicare beneficiaries have stand-alone Part D plans; 16 plans are available in 2025 with premiums starting at $2.30/month.12

Medicare enrollment in New Jersey

As of September 2024, Medicare enrollment in New Jersey stood at more than 1.7 million residents.1 Most of them — about 91% — are eligible for Medicare due to their age (i.e., being at least 65). But roughly 9% are eligible for Medicare coverage due to a disability that lasts at least 24 months, or a diagnosis of ALS or end-stage renal disease.1 Nationwide, about 89% of enrollees use Medicare benefits due to age, while 11% are eligible due to disability.3

Medicare options

Medicare beneficiaries have some choices to make in terms of how they access Medicare coverage and the benefits they want to have. The first choice is between Medicare Advantage, where an individual enrolls with a private health plan that is under contract with the federal government to provide Medicare coverage, or Original Medicare, where coverage is paid for directly by the federal government. Medicare beneficiaries also have options around Medigap policies and Medicare Part D (prescription drug) coverage.

The regulation of Medicare Advantage and Part D plans mostly lies with the federal government, although states are responsible for licensing the insurers and ensuring financial solvency. Medigap plans must comply with federal rules for standardization, but states have more direct oversight over these plans.

Original Medicare includes Part A (also called hospital insurance, which helps pay for inpatient stays at a hospital, skilled nursing facility, or hospice center) and Part B (also called medical insurance, which helps pay for outpatient care like a doctor appointment or a preventive healthcare service, such as most vaccinations). Medicare Advantage plans bundle Parts A and B under a single private plan and often include other services like prescription drugs and vision coverage. Beneficiaries still pay for Part B, but many Advantage plans have no additional premiums.

When it comes to Original Medicare versus Medicare Advantage, there are pros and cons to either option, and the right solution is different for each person.

Learn about Medicare plan options in New Jersey by contacting a licensed agent.

Explore our other comprehensive guides to coverage in New Jersey

We’ve created this guide to help you understand the New Jersey health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Learn about health insurance coverage options in New Jersey.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in New Jersey.

Learn about New Jersey’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in New Jersey.

Frequently asked questions about Medicare in New Jersey

What is Medicare Advantage?

The majority of New Jersey Medicare beneficiaries are enrolled in Original Medicare, but Medicare Advantage enrollment has been steadily growing since 2004.

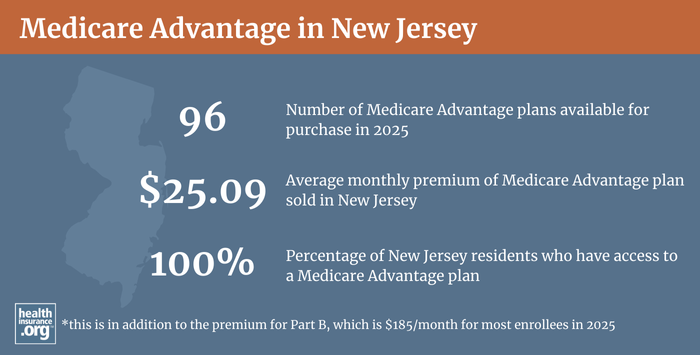

As of September 2024, about 41% of Medicare beneficiaries in New Jersey had coverage under Medicare Advantage plans.1 Nationwide, the average is 50%.3 The other 59 percent of New Jersey’s Medicare beneficiaries opted instead for coverage under Original Medicare.1

There are 21 counties in New Jersey, and the availability of Medicare Advantage plans for 2025 ranges from 30 plans to 50+ plans.4

The average Medicare Advantage premium in 2025 is $25.09/month (in addition to the premium for Medicare Part B). But all Medicare beneficiaries in New Jersey have access to Medicare Advantage plans with $0 premiums (meaning the enrollee only has to pay the premium for Medicare Part B).5

Medicare beneficiaries can enroll in Medicare Advantage plans when they’re first eligible for Medicare or during the annual open enrollment period in the fall, which runs from October 15 to December 7 each year. There is also a Medicare Advantage open enrollment period each year (January 1 to March 31) during which people who are already enrolled in Medicare Advantage plans can change to a different Medicare Advantage plan or drop their Medicare Advantage plan and enroll in Original Medicare instead.

What are Medigap plans?

Medigap plans are used to supplement Original Medicare, covering some or all of the out-of-pocket costs (for coinsurance and deductibles) that people would otherwise incur if they only had Original Medicare on its own.

Twenty-three insurers offer Medigap plans in New Jersey.6

Medigap plans are standardized under federal rules, and people are granted a six-month window, when they are at least 65 and enrolled in both Medicare Part A and Part B, during which coverage is guaranteed issue for Medigap plans. However, federal rules do not guarantee access to a Medigap plan if you’re under 65 and eligible for Medicare as a result of a disability.

But New Jersey is among the majority of the states that have adopted rules to ensure at least some access to Medigap plans for enrollees under the age of 65. And New Jersey goes further than many other states by also ensuring that people under age 65 don’t pay higher premiums for their Medigap coverage (in many states where Medigap plans are guaranteed issue for those under 65, the premiums are still higher because insurers know that disabled enrollees are likely to incur higher costs).

New Jersey’s consumer protections for disabled Medigap enrollees include provisions for those under age 50, and for those age 50-64. In both cases, as long as the person applies for a Medigap plan (Medigap Plan D, as of 2020) within six months of enrolling in Medicare Part B, the coverage is guaranteed issue and the price won’t be more than the insurer charges for enrollees who are eligible for Medicare due to their age (as opposed to a disability). But younger applicants only have one insurer option, while older applicants can select from any Medigap insurer in their area:

- For Medicare beneficiaries who are under age 50, coverage is guaranteed issue only with the state’s contracted carrier (Horizon Blue Cross Blue Shield of New Jersey)7 and the available plan is Medigap Plan D (it was Plan C prior to 2020). The state runs a program so that all carriers that offer health benefits in New Jersey share in the Medigap losses incurred by the contracted carrier for these enrollees. As of 2024, the monthly premium for Horizon’s Plan D for Medicare beneficiaries under age 50 was about $166/month for men and $154/month for women.7

- For Medicare beneficiaries who become eligible between the ages of 50 and 64, coverage for Plan D (it was Plan C prior to 2020) is guaranteed issue with any insurer in New Jersey that offers Medigap plans.8 And insurers must maintain loss ratios of at least 65% for individual policies and 75% for group policies.

Under federal law (MACRA) that was enacted in 2015, Medigap Plans C and F can no longer be sold to people who become eligible for Medicare on or after January 1, 2020. So New Jersey enacted legislation (S.3651) in 2019 to align the state’s existing law with the new federal requirements. As of 2020, Plan D is the guaranteed-issue Medigap plan for disabled Medicare beneficiaries in New Jersey, instead of Plan C.

In 2019, lawmakers in New Jersey also considered legislation (A.4834 and S.2895) to provide continuous guaranteed-issue Medigap rights to Medicare beneficiaries who are at least 65 years old, but neither bill advanced in the legislature. Similar legislation was introduced in 2023 (S.1162), but did not advance. The current rules (which mirror federal requirements and have not yet been changed in New Jersey) only grant people a one-time six-month window during which they can pick a Medigap plan with guaranteed-issue rights. People who miss that window or pick a less-than-ideal Medigap plan are often unable to pick a different plan later on, because insurers can use medical underwriting to determine eligibility for coverage after that one-time enrollment window closes.

What is Medicare Part D?

While not a covered benefit under Original Medicare, coverage for outpatient prescription drugs can be provided via a Medicare Advantage plan with integrated Part D coverage (MA-PD), an employer-sponsored plan (offered by a current or former employer), or a stand-alone prescription drug plan (PDP).

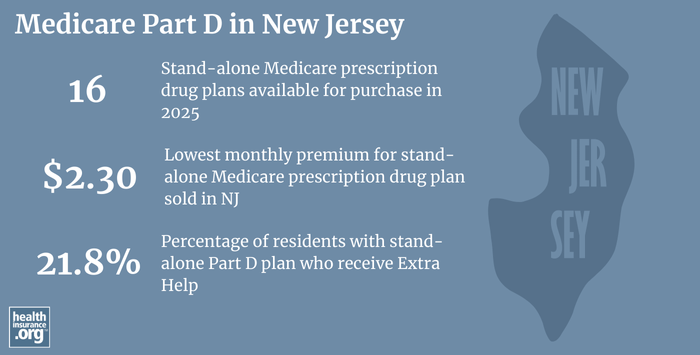

As of September 2024, there were 897,329 Medicare beneficiaries in New Jersey who were enrolled in stand-alone Part D prescription drug plans. In addition, another 518,776 New Jersey Medicare beneficiaries had Part D coverage integrated with a Medicare Advantage plan.9

Total enrollment in Medicare Part D in New Jersey, including stand-alone plans as well as Part D coverage integrated with Medicare Advantage plans, stood at 1,416,105 as of September 2024, and that number has been steadily increasing along with the overall increase in Medicare enrollment.1

New Jersey does still have higher than average enrollment in stand-alone Medicare Part D plans, with about 63% of the state’s total Medicare population enrolled in stand-alone Part D plans, versus about 36% nationwide.13

For 2025 coverage, there are 16 stand-alone Part D plans available in New Jersey, with premiums starting at $2.30/month.10

Medicare Part D enrollment is available when a person is first eligible for Medicare and during the annual open enrollment period in the fall (October 15 to December 7, with coverage effective January 1).

How does Medicaid provide financial assistance to Medicare beneficiaries in New Jersey?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in New Jersey includes overviews of these programs, including long-term care coverage, Medicare Savings Programs, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in New Jersey?

These resources provide free assistance and information about Medicare programs and availability in New Jersey.

- The New Jersey State Health Insurance Assistance Program can help with questions related to Medicare coverage in New Jersey.

- New Jersey’s Senior Services website has a variety of resources that are helpful for people with Medicare in New Jersey.

- The New Jersey State Library has a website page devoted to social services for seniors in New Jersey.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in New Jersey?

Explore more resources for options in New Jersey including ACA coverage, short-term health insurance, dental insurance and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – New Jersey.” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (PAGE NUMBER FOR APPLICABLE STATE) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶

- “Medicare Monthly Enrollment – US” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶

- ”Medicare Open Enrollment Fact Sheet” (New Jersey, Page 92). Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶

- ”Medicare Supplement (Medigap) Insurance Companies Offering Policies in New Jersey as of February 2024” NJ.gov. Revised Feb. 1, 2024 ⤶

- ”Medicare Supplement Coverage Sold in New Jersey

for those Under Age 50″ NJ.gov. Oct. 30, 2023 ⤶ ⤶ - ”NJ Medicare Supplement Coverage for People Between Ages 50 and 65 on Medicare Due to Disability January 2025” NJ.gov. Accessed Jan. 22, 2025 ⤶

- “September 2024 Medicare Monthly Enrollment – New Jersey.” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (92) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶