Home > Health insurance Marketplace > Vermont

Vermont Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Vermont health insurance Marketplace guide

This Vermont health insurance guide, including the FAQs below, will help you understand the coverage options and potential financial assistance available to you and your family.

Vermont runs its own health insurance exchange (Marketplace), which is called Vermont Health Connect. The Vermont Health Connect platform allows residents to shop for individual and family health plans offered by two private health insurance carriers. These plans are used by people who aren’t eligible for Medicare, Medicaid, or an affordable employer-sponsored health plan. Vermont Health Connect can also be used to enroll in Medicaid or Dr. Dynasaur.

Vermont is among the states that offer state-funded subsidies in addition to the federal subsidies provided under the ACA. Vermont is also among the states that have individual mandates, but unlike the other states that have individual mandates, Vermont does not have a financial penalty for going without coverage.3

As explained in more detail below, premium subsidies in Vermont were expected to be “much larger” in 2025 than they were in 2024,4 due to the state’s new approach for setting Silver plan rates. For most enrollees, these higher premium subsidies more than offset the overall weighted average rate increase of 18.1% that was approved for Vermont’s individual market plans. So it’s not surprising that enrollment in 2025 coverage was the highest it had been in the last decade (see details below).

Vermont’s individual and small-group health insurance markets were merged (unlike most other states) through 2021, but were separated as of January 2022.5 Without additional legislation, they would have re-merged starting in 2026,6 but legislation was enacted in 2025 that permanently keeps the markets unmerged.7 As a result, carriers in Vermont will continue to calculate separate premiums for individual plans and small-group plans.

Frequently asked questions about health insurance in Vermont

Who can buy Marketplace health insurance in Vermont?

To be eligible to enroll in private health coverage through Vermont Health Connect, you must:

- Be a resident of Vermont and lawfully residing in the United States

- Not be incarcerated

- Not be enrolled in Medicare

So most people in Vermont are eligible to enroll in a health plan through Vermont Health Connect. But there are some additional parameters must be met in order to qualify for state and federal subsidies through Vermont Health Connect.

To qualify for income-based federal Advance Premium Tax Credits (APTC), federal cost-sharing reductions (CSR), or Vermont’s state-funded financial assistance you must:

- Not have access to an affordable plan offered by an employer. If you are eligible to sign up for an employer’s plan and aren’t sure whether it’s considered affordable, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies via beWellnm.

- Not be eligible to enroll in Vermont Medicaid or Dr. Dynasaur coverage, or premium-free Medicare Part A.

- File a joint tax return with your spouse, if you’re married.8 (with very limited exceptions)9

- Not be able to be claimed by someone else as a tax dependent.10

In addition to those basic parameters, Vermont Health Connect premium subsidy eligibility will depend on your household’s income and how it compares with the premium for the second-lowest-cost Silver plan in your area (unlike most states, premiums do not vary by age or location within the state of Vermont).

When can I enroll in an ACA-compliant plan in Vermont?

The open enrollment period in Vermont begins November 1 and continues through January 15.11

Enrollments must be completed by December 15 to have coverage effective January 1. Enrollments completed between December 16 and January 15 will have a February 1 effective date.12

Outside of the annual open enrollment period, you may still be able to enroll or make a plan change if you experience a qualifying life event, such as giving birth or losing other health coverage.

Some people can enroll year-round even without a specific qualifying life event. This includes the low-income special enrollment period, which is available to Vermont applicants with household income up to 200% of the poverty level.13 (The household income cutoff for this SEP is 150% in most states.)

Enrollment in Vermont Medicaid and Dr. Dynasaur is available year-round for eligible applicants.

How do I enroll in a Marketplace plan in Vermont?

To enroll in an ACA Marketplace/exchange plan in Vermont, you can:

- Visit Vermont Health Connect – the state’s health insurance exchange/Marketplace – to compare the health plans that are available in your area, determine whether you’re eligible for financial assistance, and enroll in coverage during open enrollment or during a special enrollment period. You can reach Vermont Health Connect’s call center at 855-899-9600.

- Enroll in a Vermont Health Connect plan with the help of an insurance agent or broker, or a certified enrollment assister.14

How can I find affordable health insurance in Vermont?

You may find that you’re eligible for financial assistance through Vermont Health Connect, which can make your coverage and medical care more affordable. And the assistance may be more robust than it is in many other states, as both federal and state subsidy programs are available in Vermont.

The Affordable Care Act (ACA) created federal premium subsidies (advance premium tax credits, or APTC), which are available depending on your income. Nearly nine out of ten Vermont Health Connect enrollees (89%) were receiving APTC as of early 2024. These subsidies covered an average of $702/month, reducing the average enrollee’s premium to about $243/month.15

Vermont also offers state-funded premium subsidies for applicants with household income up to 300% of the federal poverty level. The additional subsidies stack on top of the federal APTC, and reduce (by 1.5 percentage points) the percentage of income that applicants have to pay to purchase the second-lowest-cost Silver plan.16

Federal cost-sharing reductions (CSR) are available to applicants with household income up to 250% of the poverty level, and Vermont offers additional cost-sharing reductions to bring eligibility for this program up to 300% of the poverty level in Vermont.17

Cost-sharing reductions reduce the deductible and other out-of-pocket expenses for Silver-level plans. Nearly 28% of Vermont Health Connect enrollees were receiving CSR benefits as of 2024.18

Depending on your income and circumstances, you may be able to enroll in free or low cost health coverage through Vermont Medicaid or Dr. Dynasaur. Learn more about whether you might be eligible for these programs in Vermont.

Source: CMS.gov19

How many insurers offer Marketplace coverage in Vermont?

Two insurance companies offer health plans through Vermont Health Connect.20

Are Marketplace health insurance premiums increasing in Vermont?

Approved 2025 rate changes for Vermont’s insurers are shown below, but it’s important to note that Vermont’s premium subsidies were expected to be significantly larger in 2025 due to a new state requirement for how Silver plan premiums are set. According to the Green Mountain Care Board, “despite significant increases in the gross premiums of individual plans, for most people, the net premiums, after accounting for premium subsidies, are expected to decrease.”4

Starting with the 2025 plan year, Vermont joined Texas and New Mexico in requiring carriers to add a specific and significant load to Silver plan rates to account for the fact that the federal government no longer funds cost-sharing reductions (that has been the case since 2018, but carriers have set their own CSR loads until now).21

Specifically, the carriers have to add a 41.9% load to Silver plan rates to account for the cost of CSR (for reference, New Mexico requires a 44% load and Texas requires a 35% load; Pennsylvania also has a state-mandated protocol for this, but the load is only 22%-26%,22 so it’s not as significant).

This results in Vermont Health Connect’s Gold plans being priced lower than Silver plans. It increases premium subsidies for everyone who qualifies for them, and makes non-Silver plans tend to be the more attractive option for people who aren’t eligible for cost-sharing reductions.23

The following table shows Vermont’s Marketplace insurers’ approved rate changes for 2025 individual/family health plans,4 amounting to a weighted average rate increase of 18.1% before any subsidies are applied.24

As noted above, however, subsidies are larger in 2025 for subsidy-eligible enrollees, resulting in lower net premiums for many enrollees.

Vermont’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Blue Cross Blue Shield of Vermont | 19.8% |

| MVP | 14.2% |

Source: Green Mountain Care Board20

The approved rates are larger than the carriers initially proposed, but smaller than the revised proposals the carriers submitted. Green Mountain Care Board noted that they “had limited latitude this year to require further reductions to the proposed premiums” due to concerns about a carrier’s financial viability.4

Ninety-one percent of Vermont Health Connect enrollees receive premium subsidies,25 which will grow disproportionately to overall premiums in 2025, making net premium lower for many enrollees. But for the 9% of enrollees who don’t get subsidies, plus anyone enrolled outside the exchange (as well as businesses with small group health plans), the regulators noted that the approved rates for 2025 were “painfully high.”20

For perspective, here’s a summary of how average pre-subsidy rates have changed in previous years in Vermont’s individual/family market:

- 2015: Average increase of 7.8%26

- 2016: Average increase of 5.5%27

- 2017: Average increase of 7%28

- 2018*: Average increase of 8.5%29

- 2019: Average increase of 6.1%30

- 2020: Average increase of 11.5%31

- 2021: Average increase of 3.5%32

- 2022: Average increase of 8.6%33

- 2023: Average increase of 15.2%34

- 2024: Average increase of 13%35

*For both insurers, the approved rates for 2018 were based on the assumption that federal funding for cost-sharing reductions (CSR) would continue. But on October 12, 2018 (less than three weeks before the start of open enrollment) the Trump administration announced that funding for cost-sharing reductions (CSR) would end immediately. Insurers in many states had already prepared for this eventuality in their rate filings, although some states scrambled in the subsequent days to revise rate filings to add the cost of CSR to 2018 premiums. Vermont, however, stuck with the rates that had been approved in August — which were based on the assumption that the federal government would continue to fund CSR.

But even if Vermont’s insurers had been allowed to add the cost of CSR to premiums for 2018, the impact would have been smaller than it was in most states. This is due in large part to the fact that the individual and small group risk pools were combined in the state (until 2022), meaning that an increased cost situation that impacted rates for the individual market was spread across the small group market too, resulting in a more stable rate situation.

In 2019, Vermont’s insurers were allowed to start adding the cost of CSR to silver plan premiums under the terms of S.19, as is the protocol used in most states. As explained above, the state has begun requiring carriers to add a 41.9% CSR load to silver plan rates starting with the 2025 plan year.

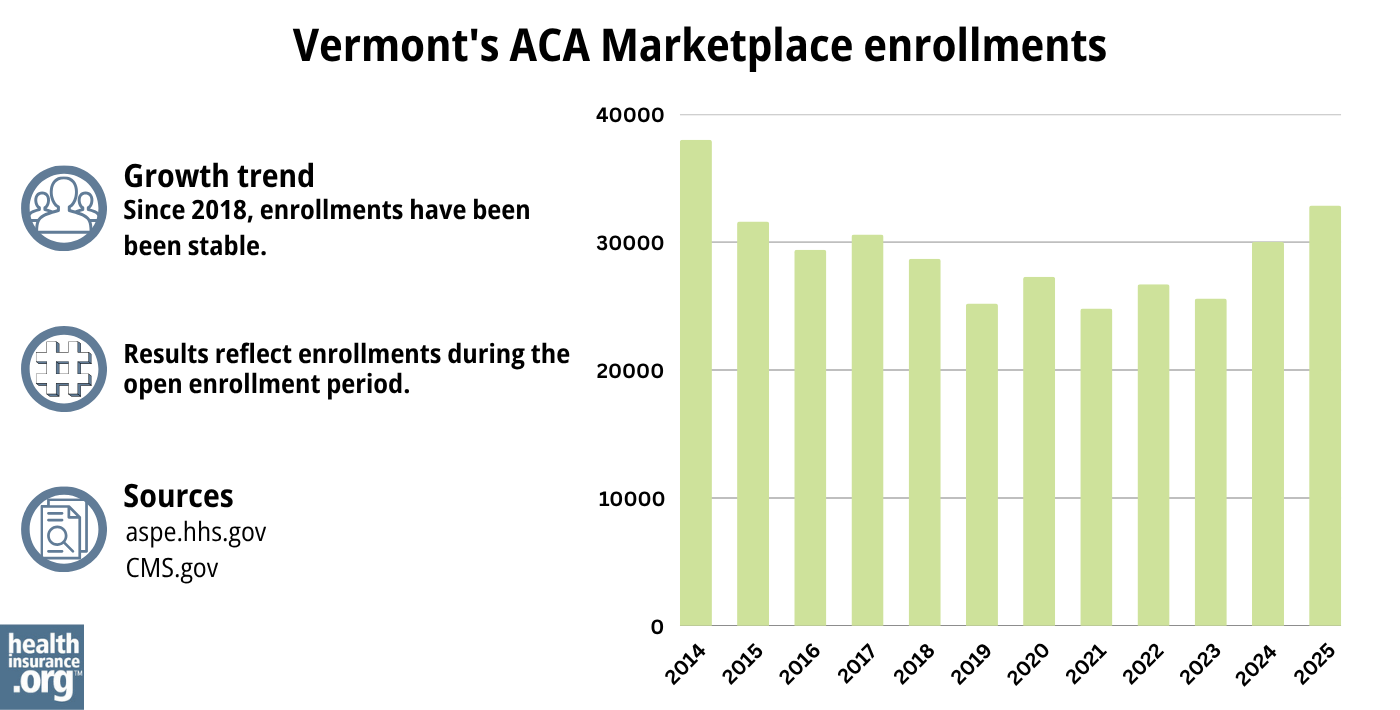

How many people are insured through Vermont’s Marketplace?

During the open enrollment period for 2025 coverage, 32,800 people selected private plans through Vermont Health Connect.36 This was the highest enrollment had been since 2014 (see chart below for details).

As noted above, premium subsidies grew substantially in Vermont in 2025, helping to make coverage more affordable for many enrollees than it had been in prior years. This likely played a role in Vermont seeing its highest enrollment total in the last decade.

Source: 2014,37 2015,38 2016,39 2017,40 2018,41 2019,42 2020,43 2021,44 2022,45 2023,46 2024,47 202548

What health insurance resources are available to Vermont residents?

Vermont Health Connect

The state-based health insurance Marketplace/exchange. Individuals and families use the Marketplace to obtain health coverage, with financial assistance based on income. Vermont Health Connect can also be used to enroll in Medicaid and Dr. Dynasaur.

Vermont Insurance Division

Consumer assistance with insurance questions and complaints.

Green Mountain Care Board

An independent five-member board, created by Vermont’s 2011 health care reform legislation and tasked with improving health care transparency, advancing innovation in health care payment and delivery, and regulating various aspects of health care in the state. The Green Mountain Care Board is also responsible for reviewing and approving health insurance rates.

Vermont State Health Insurance Program

A local service that provides enrollment counseling and assistance for Medicare beneficiaries.

Vermont Medicaid and Dr. Dynasaur

Health coverage for low-income Vermont residents.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Vermont?

Explore more resources for options in Vermont including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”GMCB Sets Adjustments for 2025 Health Insurance Premiums” Green Mountain Care Board. Aug. 14, 2024 ⤶

- “Individual Mandate FAQ” Vermont Health Connect ⤶

- ”GMCB Sets Adjustments for 2025 Health Insurance Premiums” Green Mountain Care Board. Aug. 14, 2024 ⤶ ⤶ ⤶ ⤶

- ”Market Rating Reforms” CMS.gov. Accessed May 7, 2024 ⤶

- ”Green Mountain Care Board, 2023 Annual Report” Green Mountain Care Board. January 16, 2024 ⤶

- ”Vermont H35” BillTrack50. Enacted Feb. 19, 2025 ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed January 12, 2024. ⤶

- “Vermont Communications Toolkit for 2023 Open Enrollment” Vermont Health Connect. ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “Special enrollment period offers lower costs for thousands of Vermont households” Department of Vermont Health Access, July 2022. ⤶

- “Find an Assister” Vermont Health Connect ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶

- “2021-2025 Applicable Percentages” Vermont Health Connect, Accessed September 28, 2023 ⤶

- “Financial Help” Department of Vermont Health Access. Accessed September 28, 2023 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”GMCB Sets Adjustments for 2025 Health Insurance Premiums” Green Mountain Care Board. Aug. 14, 2024 ⤶ ⤶ ⤶

- ”Cost Sharing Reductions and Silver Loads” Lewis & Ellis. Feb 14, 2024 ⤶

- ”2024 ACA-Compliant Health Insurance Rate Filing Guidance” Pennsylvania Insurance Department. Mar. 21, 2023 ⤶

- ”Vermont: (Preliminary) Avg. Unsubsidized 2025 #ACA Rate Change: +14.9%, But Say Hello To Premium Alignment!” ACA Signups. May 16, 2024 ⤶

- ”GMCB Sets Adjustments for 2025 Health Insurance Premiums” Green Mountain Care Board. Aug. 14, 2024 And (for market share information to calculate weighted average) “Vermont: (Preliminary) Avg. Unsubsidized 2025 #ACA Rate Change: +14.9%, But Say Hello To Premium Alignment!” ACA Signups. May 16, 2024 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶

- “Vermont: 2015 Rates To Increase 7.8% Avg (Weighted)” ACA Signups. September 7, 2014 ⤶

- “VERMONT: Approved 2016 Rate Hikes: 5.5% Individual, 5.7% Small Group (Vs. 8.0-8.3% Requested)” ACA Signups. August 14, 2015 ⤶

- “Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups. October 2016 ⤶

- “2018 Rate Hikes” ACA Signups. October 2017 ⤶

- “Vermont: APPROVED 2019 ACA Rate Increases Drop From 8.6% To 6.1%; Would Be Just 1.7% W/Out #ACASabotage” ACA Signups. August 16, 2018 ⤶

- “Vermont: APPROVED Avg. 2020 #ACA Premiums: +11.5% (Down From +13%)” ACA Signups. August 13, 2019 ⤶

- “Regulators reduce health insurers’ premium requests” VT Digger. August 17, 2020 and “Vermont: Carriers Request 6.8% Avg. Rate Hikes For 2021; #COVID19 Impact Is A Big Ol’ ¯|_(ツ)_|¯” (to show market share). ACA Signups. May 15, 2020 ⤶

- “2022 Rate Changes” ACA Signups. October 2021 ⤶

- “Vermont: Final Avg. Unsubsidized 2023 #ACA Rate Change: +15.2%” ACA Signups. October 13, 2022 ⤶

- ”Vermont: Final Avg. Unsubsidized 2024 #ACA Rate Change: +13.0%” ACA Signups. Aug. 28, 2023 ⤶

- “Marketplace 2025 Open Enrollment Period Report: National Snapshot” CMS.gov, Jan. 17, 2025 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶