Home > Health insurance Marketplace > Wyoming

Wyoming Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Wyoming health insurance Marketplace guide

We created this guide, including the FAQs below, to help you understand the health coverage options and possible financial assistance available to you and your family in Wyoming.

Wyoming uses the federally-facilitated health insurance exchange enrollment platform, HealthCare.gov, commonly known as the Marketplace, for enrollment in Affordable Care Act (ACA) plans.

The Wyoming Marketplace provides access to health insurance products from three private insurers for 2025, including UnitedHealthcare, which is new to Wyoming’s individual market for 2025.3 (See more details below about insurer participation and rate changes for 2025.)

Depending on your income and other circumstances, you may qualify for financial assistance when you buy your coverage through the Wyoming Marketplace. Most enrollees in Wyoming qualify for advance premium tax credits (premium subsidies), and some also qualify for cost-sharing reductions that lower their out-of-pocket medical costs.4

Frequently asked questions about health insurance in Wyoming

Who can buy health insurance through the Marketplace in Wyoming?

To qualify for health coverage through the Marketplace in Wyoming, you must:5

- Live in Wyoming

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for financial assistance in the form of premium subsidies and cost-sharing reductions (CSR) depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area – which depends on your age and location. (See more details below about premium subsidies and CSR benefits.). In addition, to qualify for financial assistance with your ACA plan you must:

- Not have access to affordable health coverage through your employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.6

- If married, file a joint tax return with your spouse.7

- Not be able to be claimed by someone else as a tax dependent.7

When can I enroll in an ACA-compliant plan in Wyoming?

In Wyoming, you can sign up for an ACA-compliant individual or family health plan from November 1 to January 15, which is the annual open enrollment period.8

If you need your coverage to start on January 1, you must apply by December 15. If you apply between December 16 and January 15, your coverage will begin on February 1.8

Outside of open enrollment, a special enrollment period is necessary to enroll or make changes to your coverage.

Most special enrollment periods are triggered by a qualifying life event, such as giving birth or losing other health coverage. But some special enrollment periods don’t require a specific qualifying life event.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

How do I enroll in a Marketplace plan in Wyoming?

To enroll in an ACA Marketplace plan in Wyoming, you can:

- Visit HealthCare.gov – the federally-facilitated health insurance Marketplace that’s used in Wyoming. Here you will find an online platform to compare plans, determine whether you’re eligible for financial assistance, and enroll in the plan that best meets your needs.

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator or certified application counselor, or an approved enhanced direct enrollment entity.9

You can also call HealthCare.gov’s contact center by dialing 1-800-318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, seven days a week, but it’s closed on holidays.

How can I find affordable health insurance in Wyoming?

Wyoming residents can use the federally-facilitated enrollment platform – HealthCare.gov – to shop for individual and family health plans.

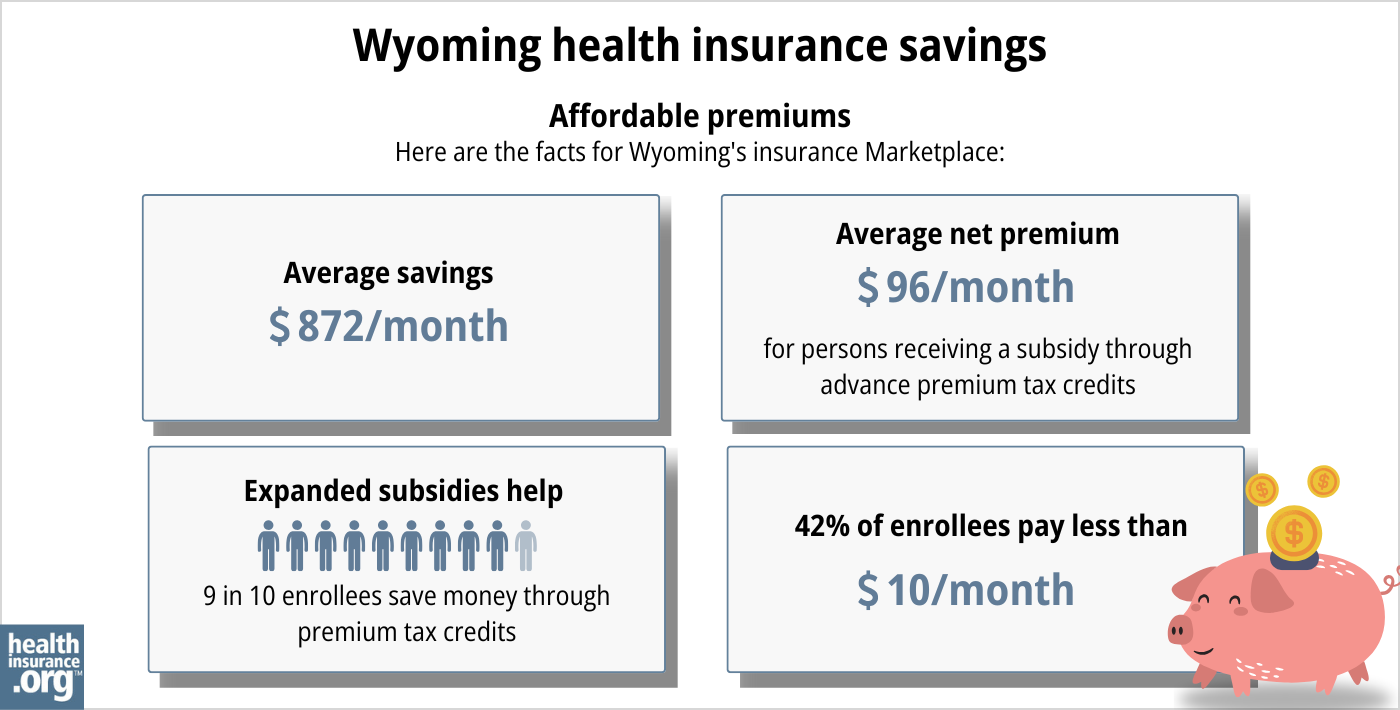

As of early 2024, about 96% of the people enrolled in plans through the Wyoming Marketplace were saving money on their premiums as a result of premium subsidies. The average subsidy savings was $864/month, which brought the average net premium — including the 4% of enrollees who paid full price — down to just $108/month.4

In addition to the premium subsidies, Marketplace enrollees with household incomes up to 250%of the federal poverty level also qualify for cost-sharing reductions (CSR) that reduce the out-of-pocket expenses on Silver-level plans.10

Between the premium subsidies and cost-sharing reductions, you may find that an ACA plan is the cheapest health insurance option for you.

Source: CMS.gov11

Wyoming has not yet expanded Medicaid eligibility under the ACA. The state legislature has considered Medicaid expansion numerous times over the years, but the legislation has never been successful.

As a result, there is a coverage gap in the state: Non-disabled adults under age 65 who don’t have children are ineligible for both Medicaid and Marketplace subsidies if their income is below the poverty level.

How many insurers offer Marketplace coverage in Wyoming?

Three insurers offer 2025 exchange (Marketplace) plans in Wyoming.12 Two of them already offered coverage in 2024, and they were joined by UnitedHealthcare for 2025.3

In most Wyoming counties, residents can choose from among plans offered by all three insurers for 2025, but three counties along the western edge of the state have just two participating Marketplace insurers,12 as UnitedHealthcare doesn’t offer coverage in those counties.

Are Marketplace health insurance premiums increasing in Wyoming?

Wyoming’s Marketplace insurers proposed the following average rate changes for 2025, before subsidies were applied.13

(Note that in Wyoming, the federal government is responsible for reviewing and approving Marketplace plans and rates. The rates were likely approved as filed, but the federal rate review website wasn’t updated with final 2025 rates for Wyoming — although it was updated with final rates in the rest of the country.13 The Wyoming Department of Insurance told us they do not publicize or comment on the federally-reviewed rates. So while we assume the proposed rates shown below were approved as filed, we cannot guarantee that’s the case.)

Wyoming’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Blue Cross Blue Shield of Wyoming | 9.91% |

| Mountain Health CO-OP/Montana Health CO-OP | 10.11% |

| UnitedHealthcare | new for 2025 |

Source: RateReview.HealthCare.gov14

Wyoming is one of three states that does not have an effective rate review program, so the proposed rates and plans are reviewed by the federal government (CMS) instead of state regulators.15 Rates were finalized in the fall of 2024, but as noted above, the federal rate review website (ratereview.healthcare.gov) was never updated with the approved 2025 rates for Wyoming.

When we talk about overall average rate changes, keep in mind that they only reflect how full-price premiums change from one year to the next. They don’t account for subsidies or for the fact that a person’s rates will increase each year based on their age, even if their insurer doesn’t change its average premiums at all.

Most enrollees in Wyoming’s exchange receive premium subsidies, which offset the majority of the cost of their coverage.4

Here’s a summary of how average pre-subsidy premiums have changed over the years in Wyoming’s individual/family health insurance market (note that these numbers are unweighted averages for years with multiple carriers, as enrollment numbers were often redacted):

- 2015: Average increase of 5%16

- 2016: Average increase of 6%17 (only one participating insurer)

- 2017: Average increase of 7.4%18

- 2018: Average increase of 55%19 (Largely due to elimination of federal funding for CSR)

- 2019: Average decrease of 0.25%20

- 2020: Average increase of 1.6%21

- 2021: Average decrease of 10%22 (second insurer joined the exchange)

- 2022: Average decrease of 4%23

- 2023: Average increase of 18.5%24

- 2024: Average increase of 0.3%25

How many people in Wyoming are insured through the Marketplace?

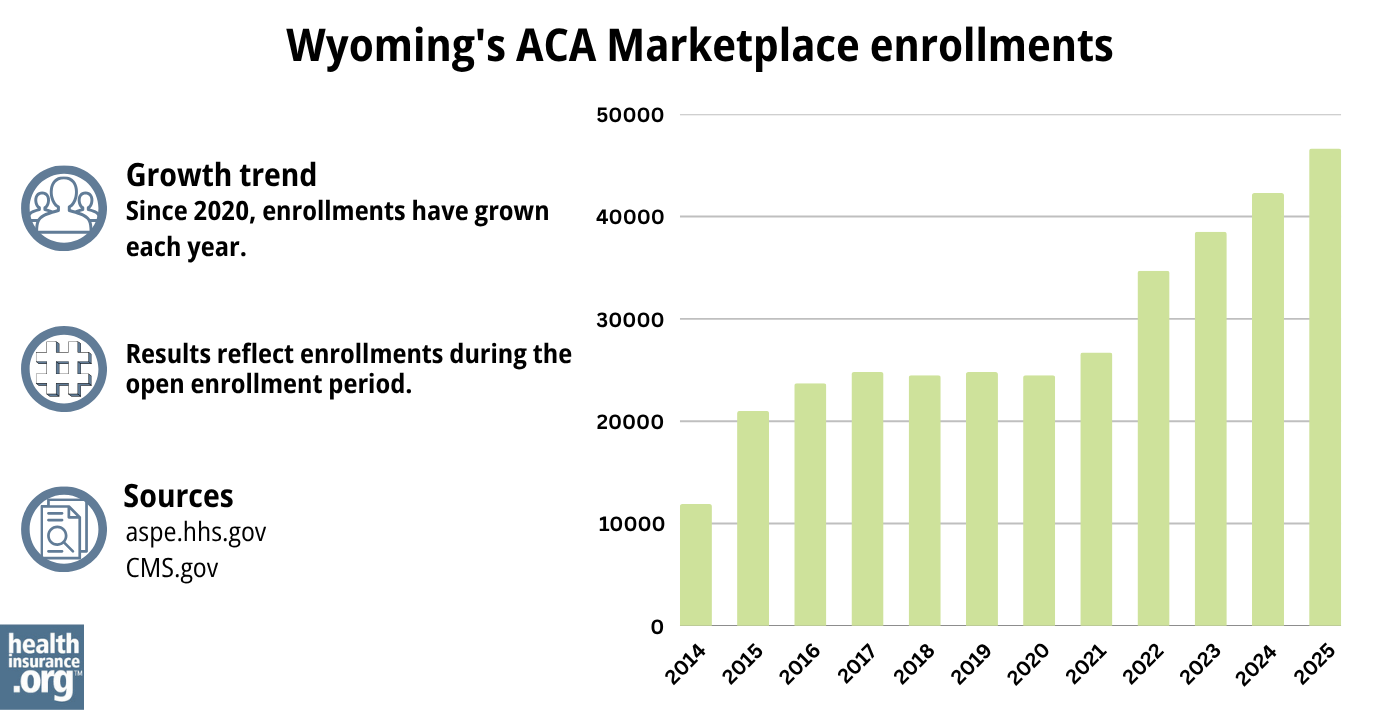

During the open enrollment period for 2025 coverage, 46,643 people enrolled in private plans through the Wyoming ACA Marketplace.26

This was a new record high in Wyoming, and marked the fifth year in a row of new record-high enrollment in Wyoming’s Marketplace (see chart below for prior year enrollment totals). Overall nationwide Marketplace enrollment also set a new record high in 2025.27

The surge in enrollment in recent years was due in part to the American Rescue Plan (ARP) which made ACA’s premium subsidies more substantial. Under the ARP’s rules – extended through 2025 by the Inflation Reduction Act – subsidies are larger and more widely available than they used to be.28

The enrollment increase in 2024 and 2025 was also driven partly by the “unwinding” of the pandemic-era Medicaid continuous coverage rule. CMS reported that 5,864 Wyoming residents transitioned from Medicaid to a Marketplace plan during the year-long unwinding period.29

Source: 2014,30 2015,31 2016,32 2017,33 2018,34 2019,35 2020,36 2021,37 2022,38 2023,39 2024,40 202541

What health insurance resources are available to Wyoming residents?

HealthCare.gov

800-318-2596

Wyoming Insurance Department

Provides consumer protection and support to Wyoming residents by investigating consumer complaints and resolving issues on insurance matters.

(307) 777-7401 / Toll Free: 1-800-438-5768 / [email protected]

State Exchange Profile: Wyoming

The Henry J. Kaiser Family Foundation overview of Wyoming’s progress toward creating a state health insurance exchange.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org..

Looking for more information about other options in your state?

Need help navigating health insurance options in Wyoming?

Explore more resources for options in Wyoming including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- ”New 2025 Individual Exchange plans and prior authorization information” UnitedHealthcare. Oct. 1, 2024 ⤶ ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶ ⤶

- “A quick guide to the Health Insurance Marketplace®” HealthCare.gov, Accessed July, 2024 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed May 10, 2024 ⤶ ⤶

- “When can you get health insurance?” HealthCare.gov. Accessed July 8, 2024 ⤶ ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- ”APTC and CSR Basics” Centers for Medicare & Medicaid Services. June 2023. ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- “Plan Year 2025 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces.” Centers for Medicare and Medicaid Services. October 25, 2024 ⤶ ⤶

- ”Wyoming Rate Review Submissions” RateReview.HealthCare.gov, Accessed Aug. 3, 2024 ⤶ ⤶

- ”Wyoming Rate Review Submissions” RateReview.HealthCare.gov. Accessed Aug. 3, 2024 ⤶

- ”State Effective Rate Review Programs” CMS.gov. Accessed Aug. 3, 2024 ⤶

- ”Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums” The Commonwealth Fund. December 2014. ⤶

- ”UPDATE: Wyoming: Requested 2016 Avg. Rate Hikes: 10.2%” ACA Signups. Sept. 15, 2015; However, WINhealth and Time Insurance exited the market at the end of 2015 and only BCBSWY plans continued into 2015 ⤶

- ”Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups. October 2016. ⤶

- ”Alabama, Hawaii, Missouri, Wyoming: Wrapping Up The 2018 Rate Hike Project W/An Assist From Avalere” ACA Signups. Oct 27, 2017 ⤶

- ”2019 Rate Hikes” ACA Signups. October 2018. ⤶

- ”2020 Rate Changes” ACA Signups. October 2019. ⤶

- ”Wyoming: Preliminary Avg. 2021 #ACA Rates: 10.0% *Decrease*” ACA Signups. Oct. 14, 2020 ⤶

- ”Wyoming: Preliminary Avg. 2022 #ACA Rate Changes (Unweighted): -4.1% Indy Market; +1.0% Sm. Group” ACA Signups. Oct. 13, 2021 ⤶

- ”Wyoming: (Preliminary) Avg. Unsubsidized 2023 #ACA Rate Changes: +18.5%” ACA Signups. Aug. 3, 2022 ⤶

- ”Wyoming: *Final* Avg. Unsubsidized 2024 #ACA Rate Changes: +0.3% (Unweighted; Updated)” ACA Signups. Nov. 8, 2023 ⤶

- ”Marketplace 2025 Open Enrollment Period Report: National Snapshot” Centers for Medicare & Medicaid Services. Jan. 17, 2025 ⤶

- ”Over 24 Million Consumers Selected Affordable Health Coverage in ACA Marketplace for 2025” Centers for Medicare & Medicaid Services. Jan. 17, 2025 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, Accessed August 2023 ⤶

- ”HealthCare.gov Marketplace Medicaid Unwinding Report” CMS.gov. Data through April 2024. Accessed Jan. 31, 2025 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶