What is a dependent?

A dependent is a person who is eligible to be added to a policyholder’s health insurance coverage.

The policyholder is the individual who has primary eligibility for coverage – for example, an employee whose employer offers health insurance benefits.

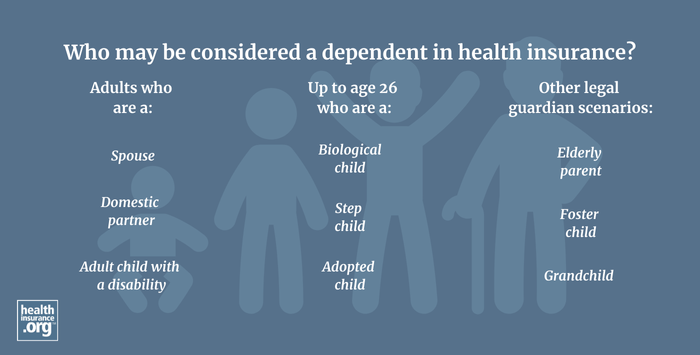

A dependent may be a spouse, domestic partner, or child (some plans refer to "spouse and dependents" meaning that they differentiate between the spouse and the children).

You can cover your biological, adopted, and stepchildren. In some cases, you may also be able to cover a grandchild, an adult child with a disability, a foster child or someone for whom you are the legal guardian.

In most states, you cannot add your parents to your health plan as dependents. But California does allow people with individual/family health coverage to add their parents as dependents.1

How long can I cover my child?

In general, you can cover your child up to age 26. Their coverage may end the month they turn 26 or the end of the year they turn 26, depending on the type of coverage.

Note that you can cover your adult child on your health insurance policy up to age 26 even if you don’t claim them as a dependent on your tax return. The U.S. Department of Labor website has a helpful FAQ page related to health coverage for young adult dependents.

If your child is disabled, you may be able to continue covering them after age 26.

Does Medicare cover dependents?

No, Medicare does not provide dependent coverage.2 Each person with Medicare has their own policy, and the coverage is only for that individual.

If you enroll in Medicare and you have a spouse and/or children who need coverage, they will need to obtain it elsewhere. Depending on the circumstances, this can be via COBRA/employer coverage, the Marketplace, or Medicaid.

How does COBRA work for dependents?

If you have been getting group insurance coverage through an employer and experience a qualifying life event (like if you change jobs, get married or divorced, retire, become eligible for Medicare, etc.), your previously enrolled dependents are eligible for continuation of health insurance coverage through the Consolidated Omnibus Budget Reconciliation Act (COBRA).

COBRA lets your dependents continue to be part of the same group health plan that they previously had through you. However, your previous employer will likely require you to pay the full premium cost (i.e., both your share and whatever your employer was previously paying).

Marketplace coverage is available as an alternative to COBRA, and income-based subsidies may be available. The loss of access to the employer-sponsored plan is a qualifying life event that will allow your dependents to enroll in a Marketplace plan, even if COBRA is available to them.

Footnotes

- Parent Healthcare Act (AB 570) Allows Californians To Add Parents To Their Healthcare. California Health Advocates. October 2021. ⤶

- Young Adults and the Affordable Care Act: Protecting Young Adults and Eliminating Burdens on Businesses and Families. Centers for Medicare and Medicaid Services. Accessed January 2024. ⤶