Home > Health insurance Marketplace > Minnesota

Minnesota Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Minnesota health insurance Marketplace guide

We’ve compiled this guide, including the FAQs below, to help you choose the right health insurance plan for you and your family. An ACA Marketplace/exchange plan – or Obamacare – is a good option for many people who don’t have access to Medicare, Medicaid, or employer-sponsored health insurance. We’re here to walk you through the choices available.

In Minnesota, you can sign up for ACA Marketplace coverage through MNsure, the state’s health insurance exchange/Marketplace, where five private insurers offer health insurance policies. If eligible, you may also get help to lower your monthly insurance cost (premium) and your out-of-pocket expenses through MNsure.

People in Minnesota can also sign up for MinnesotaCare – Minnesota’s Basic Health Program – or income-based Medical Assistance (Medicaid) through MNsure.1

Frequently asked questions about health insurance in Minnesota

Who can buy Marketplace health insurance?

To be eligible to enroll in private health coverage through the Marketplace in Minnesota (MNsure), you must:

- Be a Minnesota resident

- Be either a United States citizen or national, or be lawfully present

- Not be incarcerated

- Not have Medicare coverage

While most Minnesota residents are eligible to enroll in individual/family coverage through MNsure, eligibility for financial assistance (premium subsidies and cost-sharing reductions) is different. It depends on your income, and to qualify for financial assistance with your Marketplace plan you must:

- Not be eligible to enroll in an affordable employer-sponsored health insurance plan. If your employer (or your spouse’s employer) offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medical Assistance (Minnesota Medicaid) or MinnesotaCare.

- Not be eligible for premium-free Medicare Part A.4

- If married, file a joint tax return with your spouse.5 (with very limited exceptions)6

- Not be able to be claimed by someone else as a tax dependent.7

When can I enroll in an ACA-compliant plan in Minnesota?

In Minnesota, you can sign up for an ACA-compliant individual or family health plan from November 1 to January 15 during open enrollment.8

If you want your coverage to start on January 1, you must apply by December 15. If you apply between December 16 and January 15, your coverage will begin on February 1.

Outside of open enrollment time, you may be eligible to enroll if you experience a qualifying life event, such as giving birth or losing employer-sponsored insurance.

How do I enroll in a Marketplace plan in Minnesota?

To enroll in an ACA Marketplace plan in Minnesota, you can:

- Visit MNsure – Minnesota’s health insurance marketplace. MNsure provides an online platform to shop, compare, and choose the best health plans.

- Purchase individual and family health coverage through insurance agents or brokers, or with help from an MNsure Navigator.9

You can also call MNsure’s contact center by dialing 651-539-2099 (or 855-366-7873 if you’re outside the Twin Cities). The contact center operates from 8 a.m. to 4 p.m. from Monday to Friday.

How can I find affordable health insurance in Minnesota?

You may find affordable health insurance options in Minnesota by signing up through MNsure.

Under the Affordable Care Act, there are income-based subsidies – a type of financial assistance – called Advance Premium Tax Credits (APTC). APTCs can help lower your premium payments and reduce your overall expenses.

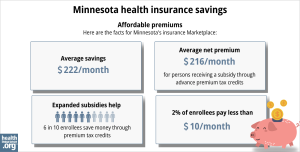

Heading into the open enrollment period for 2024 coverage, MNsure projected that families eligible for APTC in Minnesota would see an average total premium savings of $6,750 on 2024 coverage due to tax credits.10

By the end of open enrollment for 2024 coverage, more than half (58%) of MNsure’s private plan enrollees were saving an average of $351 per person per month on their 2024 premium expenses – those who qualified for subsidies pay an average monthly net premium of $297.11

(Although MNsure’s average premium subsidy amount is quite a bit lower than the $536/month national average subsidy, that’s because Minnesota has a Basic Health Program. for people earning up to 200% of the federal poverty level. So while individuals with income under 200% of FPL qualify for large premium subsidies in other states, they instead qualify for premium-free or very low-cost Basic Health Program coverage in Minnesota.)

If your household income is no more than 250% of the federal poverty level, you may also qualify for cost-sharing reductions (CSR). These reductions can lower your deductibles and out-of-pocket expenses. Combining APTCs and CSRs might make an ACA plan the most budget-friendly health insurance choice for you.

You can also find inexpensive health insurance through Medicaid (called Medical Assistance in Minnesota). Check to see if you meet the criteria for Medicaid in Minnesota.

If your income is too high for Medical Assistance but not more than 200% of the poverty level, you may find that you’re eligible for MinnesotaCare. This is the state’s Basic Health Program, which we referenced above as a reason for MNsure’s smaller-than-average premium subsidies.

Minnesota also has a reinsurance program, which helps to keep premiums lower than they would otherwise be for people whose income is too high to qualify for premium subsidies.12

Source: CMS.gov 13

How many insurers offer Marketplace coverage in Minnesota?

There are five insurers that offer exchange plans in Minnesota:14 All five will continue to offer coverage in 2025.15

PreferredOne, which has only offered coverage outside the exchange for the last several years, exited Minnesota’s individual/family market altogether at the end of 2023. People enrolled in PreferredOne’s individual plans in 2023 had to select a new plan from a different insurer to have coverage in 2024.16

The availability of plans varies by location. For 2024, most counties in Minnesota offer exchange plans from at least three different insurers, and every county has at least two insurers offering plans through MNsure.17

Are Marketplace health insurance premiums increasing in Minnesota?

For 2025, the following average rate changes have been approved by the Minnesota Department of Commerce for the insurers that offer individual/family coverage through MNsure,15 amounting to an overall average increase of about 8.8%,18 before subsidies are applied:

Minnesota’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Blue Plus | 11.56% |

| Health Partners, Inc. | 9.71% |

| Medica | 1.95% |

| UCare | 8.8% |

| Quartz | 9.43% |

Source: Minnesota Commerce Department15

Keep in mind that these average proposed rate increases are for full-price plans. However, more than half of the people who enroll through MNsure get premium tax credits that help reduce costs.11

These subsidies are adjusted each year to match changes in the benchmark plan (the second-lowest-cost Silver plan) in each area. As a result of the American Rescue Plan and the Inflation Reduction Act, the subsidies are larger and more widely available than they were in the past.

If the cost of your current plan increases, you may find that a different MNsure plan might be a better fit for your needs and budget.

For perspective, here’s an overview of how average full-price premiums have changed over time in Minnesota’s individual/family health insurance market:

- 2015: Average increase of 4.5%19

- 2016: Average increase of 41.4%20

- 2017: Average increase of 56.6%21

- 2018: Average decrease of 5.3%22

- 2019: Average decrease of 12.4%23

- 2020: Average decrease of 1%24

- 2021: Average increase of 2%25

- 2022: Average increase of 9.5%26

- 2023: Average increase of 1.5%27

- 2024: Average increase of about 4.5%28

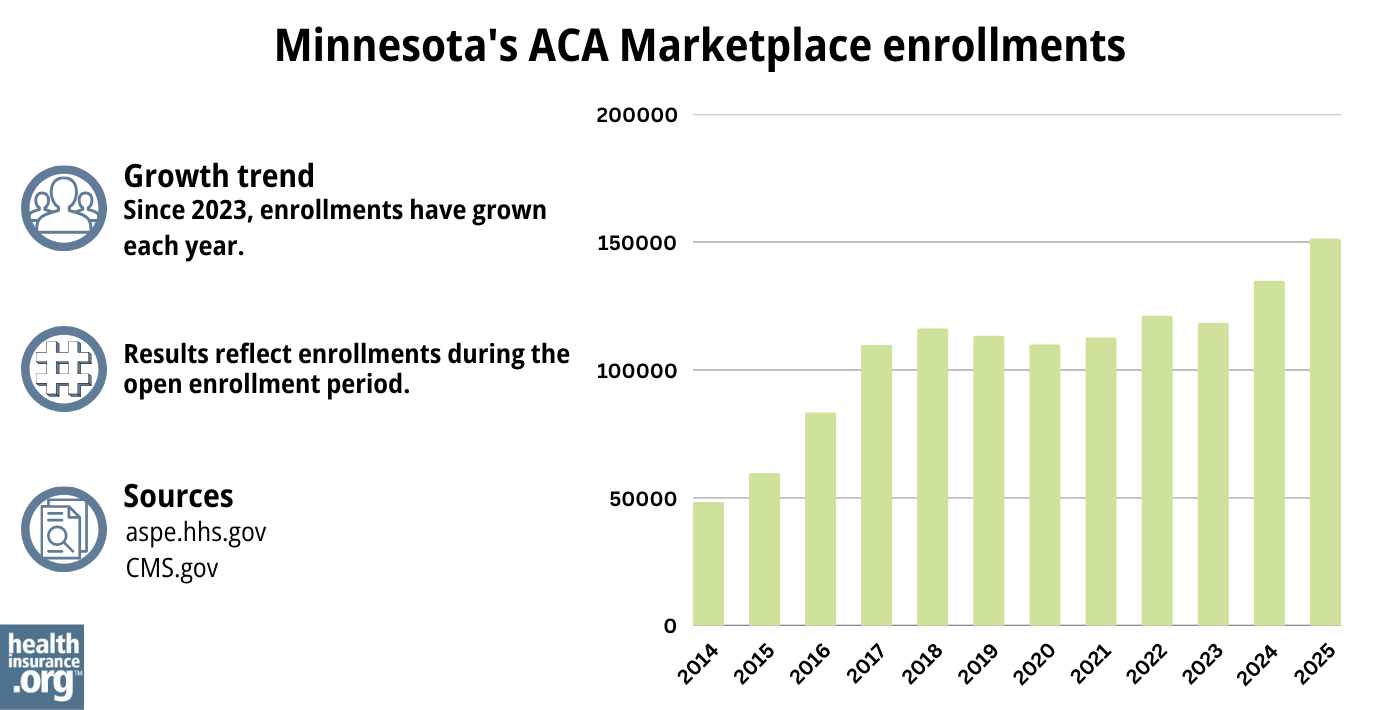

How many people are insured through Minnesota’s Marketplace?

During the open enrollment period for 2024 coverage, a record-high 135,001 people enrolled in private health coverage through the Minnesota exchange (MNsure).29 This doesn’t include people enrolled in MinnesotaCare and Medical Assistance.

Source: 2014,30 2015,31 2016,32 2017,33 2018,34 2019,35 2020,36 2021,37 2022,38 2023,39 2024,40 202541

What health insurance resources are available to Minnesota residents?

MNsure: Minnesota’s health insurance marketplace provides financial help for individual plan premiums exclusively to state residents. To reach MNsure for more information, dial (651) 539-2099 or (855) 366-7873 if outside the Twin Cities.

Minnesota Department of Human Services: The Minnesota Department of Human Services offers health care coverage programs and resources. You can call their customer service at 651-297-3862 or 800-657-3672 for assistance.

Local tribal or county health care office: To receive assistance with health care programs, you can contact your local tribal or county health care office.

Minnesota State Health Insurance Assistance Program: You can find information and resources for Minnesota’s Medicare beneficiaries.

Medical Assistance: Minnesota’s Medical Assistance (Medicaid) program helps low-income individuals and families with medical coverage. This program has eligibility requirements, and more information is available on the Minnesota Department of Health website.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Minnesota?

Explore more resources for options in Minnesota including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- Applying for Medical Assistance (MA) and MinnesotaCare. Minnesota Department of Human Services. Accessed November 2023. ⤶

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”2025 Health Insurance Rates” Minnesota Commerce Department. Accessed Oct. 2, 2024 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed January 12, 2024. ⤶

- “Open Enrollment Period” MNsure.org, Accessed Nov. 16, 2023 ⤶

- Navigators. MNsure. Accessed November 2023. ⤶

- MNsure’s Annual Health Insurance Open Enrollment Window Starts Today. MNsure. November 2023. ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶ ⤶

- 2023 Health Insurance Rates. Minnesota Commerce Department. Accessed November 2023. ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- 2024 Health Insurance Rates. Minnesota Commerce Department. Accessed November 2023. ⤶

- ”2025 Health Insurance Rates” Minnesota Commerce Department. Accessed Oct. 2, 2024 ⤶ ⤶ ⤶

- Individual Plans. PreferredOne. Accessed November 2023. ⤶

- MN Dept of Commerce approves 2024 rates for individual and small group health insurance in Minnesota. Minnesota Commerce Department, September 2023. ⤶

- ”Minnesota: *Final* avg. unsubsidized 2025 #ACA rate change: +8.8% (updated)” ACA Signups. June 18, 2024. ⤶

- ”With 4.5% average increase, MNsure rates to remain lowest in nation” MinnPost. Oct. 1, 2014 ⤶

- ”FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally*” ACA Signups. October 2015. ⤶

- ”Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups. October 2016. ⤶

- ”UPDATE: Minnesota: Avg. Rate DROP In 2018 Thanks To (Troubled) Reinsurance Program” ACA Signups. Oct. 2, 2017 ⤶

- ”Minnesota: APPROVED 2019 #ACA Rates: 12.4% Lower, But Would Have Dropped 18.9% W/Out #ACASabotage” ACA Signups. Oct. 2, 2018 ⤶

- ”Minnesota: *Final* 2020 ACA Premiums: 1.0% *Decrease*” ACA Signups. Oct 1, 2019 ⤶

- ”Minnesota: APPROVED Avg. 2021 #ACA Premiums: +2.0% Indy, +2.8% Sm. Group” ACA Signups. Oct. 6, 2020 ⤶

- ”Minnesota: Approved Avg. 2022 #ACA Rate Changes: +9.5% Individual Market; +2.7% Sm. Group; Families Will Save $684/Yr On Average Thanks To The #AmRescuePlan” ACA Signups. Oct. 11, 2021 ⤶

- ”Minnesota: Final Avg. Unsubsidized 2023 #ACA Rate Changes: +1.5%” ACA Signups. Sep. 30, 2022 ⤶

- ”MN Dept of Commerce approves 2024 rates for individual and small group health insurance in Minnesota” Minnesota Commerce Department, September 2023. and “Minnesota: *Final* Avg. Unsubsidized 2024 #ACA Rate Change: +4.5%” ACA Signups. October 2023. ⤶

- ”Health Insurance Marketplaces 2024 Open Enrollment Period Report” CMS.gov. March 22, 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶