Home > Health insurance Marketplace > Hawaii

Hawaii Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Hawaii health insurance Marketplace guide

Hawaii utilizes a federally-facilitated health insurance Marketplace, which means residents enroll through HealthCare.gov, where two private insurers offer individual/family health plans for Hawaii residents. The Hawaii Insurance Division oversees the plans sold in the exchange.

The approved rates for 2025 amounted to an overall weighted average increase of about 6.7%, before subsidies were applied (details below). However, most enrollees get subsidies that offset a significant portion of their premiums, and the subsidy amounts change each year to keep pace with the cost of the benchmark Silver plan.

For many people, an Affordable Care Act (ACA) Marketplace plan – called Obamacare or an exchange plan – may be a cost-effective choice. This guide, including the FAQs below, is designed to help you understand how Hawaii health insurance options work, including the financial assistance that may be available to you through Hawaii’s health insurance Marketplace.

(In 2014 and 2015, Hawaii ran its own exchange, but transitioned to HealthCare.gov in the fall of 2015 and has continued to use the federally-facilitated platform ever since.)

Frequently asked questions about health insurance in Hawaii

Who can buy Marketplace health insurance?

Virtually all residents of Hawaii are eligible to buy Marketplace health insurance with the following exceptions:3

- People who are not legally in the U.S.

- People already enrolled in Medicare

- People who are incarcerated

But eligibility for financial assistance in the Marketplace is a bit more involved. Eligibility for premium subsidies depends on how the cost of coverage in your area compares with your household income.

And to be eligible for subsidies you must not be eligible for Med-QUEST (Medicaid/CHIP), premium-free Medicare Part A,4 or an employer’s plan that’s considered affordable and comprehensive.

Most Marketplace enrollees do qualify for premium subsidies. As of early 2024, subsidies were being paid on behalf of 84% of Hawaii Marketplace enrollees.5

When can I enroll in an ACA-compliant plan in Hawaii?

Hawaii’s open enrollment period for individual and family health coverage is from November 1 to January 15. This is set by the federal government since Hawaii uses the federally-facilitated exchange.

Here are some key dates to remember:6

- November 1: Open enrollment starts! This is when you can first sign up for or change plans for the following year. If you enroll by December 15, your coverage will begin on January 1.

- December 15: Last day to change plans or enroll for coverage to begin on January 1. After this date, any changes or new plans will start on February 1.

- January 15: Open enrollment ends.

After open enrollment, you can sign up for or make changes to individual market coverage if you qualify for a special enrollment period (SEP). To be eligible for a SEP, you’ll usually need a qualifying life event.

Some SEPs don’t depend on a qualifying life event. For example:

- If you’re a Native American, you can enroll anytime.

- If you’re eligible for premium tax credits and your income is not more than 150% of the poverty level, you can enroll anytime.

- People eligible for Medicaid/CHIP (Med-QUEST in Hawaii) can enroll in that coverage anytime.

How do I enroll in a Marketplace plan in Hawaii?

If you qualify for an ACA Marketplace plan, there are a variety of ways you can sign up, either during open enrollment or during a special enrollment period:

- Enroll online via HealthCare.gov.

- Enroll by phone at (800) 318-2596.

- Enroll in person, over the phone, or online with the help of an agent/broker, Navigator, certified application counselor, or an approved enhanced direct enrollment entity.7

How can I find affordable health insurance in Hawaii?

Hawaii’s uninsured rate has long been lower than the national average, due in large part to the state’s Prepaid Health Care Law, which has been in effect for nearly half a century.

Under this law, Hawaii’s employers must provide coverage to employees who work at least 20 hours per week, and the employee’s portion of the premiums can’t be more than 1.5% of their gross wages. So employer-sponsored health coverage is more accessible in Hawaii than it is in most of the rest of the country.

(A note about small group health insurance: Hawaii was the first state to receive approval for a 1332 waiver, which allowed Hawaii to no longer have a SHOP exchange.8 Small businesses in Hawaii purchase small group health plans directly from the insurers that sell these plans.)

But for those who aren’t eligible for an employer’s health plan or Medicare, coverage is available through the Marketplace (HealthCare.gov) or Med-QUEST (Medicaid/CHIP).

ACA Marketplace plans (on HealthCare.gov)

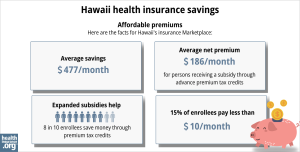

- 84% of Hawaii Marketplace enrollees were receiving premium subsidies (advance premium tax credits, or APTC) as of early 2024, meaning they didn’t have the pay the full cost of their coverage.

- The average premium subsidy in Hawaii’s Marketplace in early 2024 was $549/month. Even accounting for the enrollees who paid full price, the average net premium paid by enrollees was $244/month. 5

If your income is no more than 250% of the federal poverty level, you may qualify for cost-sharing reductions (CSR) to reduce your deductibles and out-of-pocket expenses, as long as you select a silver plan through the Marketplace.9

- As of early 2024, more than a quarter of Hawaii Marketplace enrollees were receiving premium subsidies.5

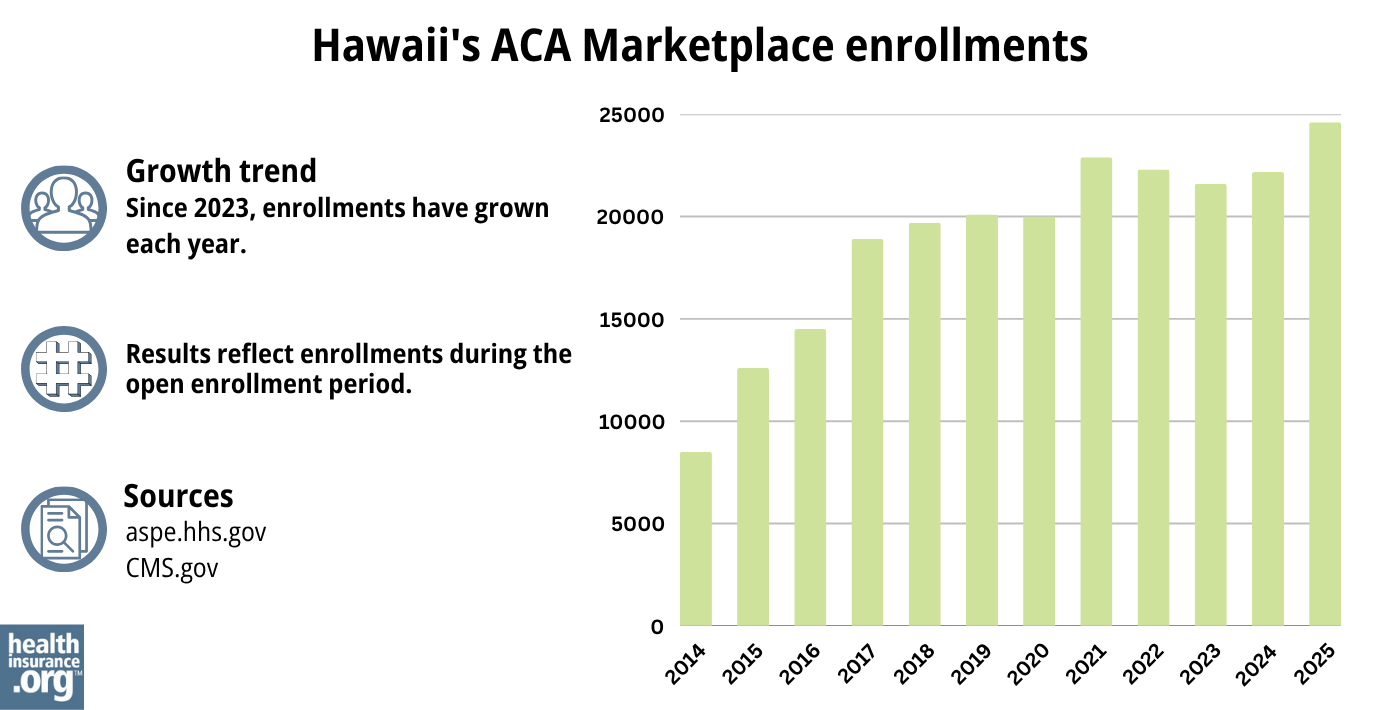

Source: CMS.gov10 (Note that the graphic is based on total enrollment during the open enrollment period and includes different metrics than the bullets above, which are based on effectuated enrollment in early 2024.)

Medicaid

Hawaiians may find affordable coverage through Medicaid (Med-QUEST) if eligible.

How many insurers offer Marketplace coverage in Hawaii?

Two private insurance companies offer individual/family health coverage through Hawaii’s health insurance Marketplace.11

Are Marketplace health insurance premiums increasing in Hawaii?

According to Hawaii SERFF filings, the following average pre-subsidy rate changes were approved for 2025:12

Hawaii’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Hawaii Medical Service Association (HMSA) | 8% |

| Kaiser Foundation Health Plan, Inc. | 4% |

Source: Hawaii SERFF12

According to the approved filings, HMSA had 21,605 enrollees in 2024, and Kaiser had 10,996. So the weighted average rate increase for 2025 was about 6.7%.12

As is always the case, these average premium changes are based on full-price premiums, but most enrollees are eligible for subsidies and thus do not pay full price. The subsidies are designed to keep pace with the cost of the benchmark plan in each area, so they grow when average benchmark premiums grow.

For perspective, here’s a summary of how average pre-subsidy premiums for ACA-compliant individual/family plans have changed each year in Hawaii:

- 2015: 7.8% increase13

- 2016: 30% increase14

- 2017: 30.7% increase15

- 2018: 32.8% increase16

- 2019: 5.3% increase17

- 2020: 4% decrease18

- 2021: 2.4% decrease19

- 2022: 1.6% increase20

- 2023: 2% increase21

- 2024: 8.8% increase22

How many people are insured through Hawaii’s Marketplace?

During the open enrollment period for 2025 coverage, 24,606 people enrolled in private health insurance plans through the Hawaii Marketplace.23 This was a new record high for Hawaii.

Although nationwide Marketplace enrollment had reached new record highs in 2022, 2023, 2024,24 and again in 2025, Hawaii didn’t exceed its 2021 enrollment until 2025.

Here’s a summary of how enrollment has changed over time in Hawaii’s Marketplace:

Source: 2014,25 2015,26 2016,27 2017,28 2018,29 2019,30 2020,31 2021,32 2022,33 2023,34 2024,35 202536

What health insurance resources are available to Hawaii residents?

HealthCare.gov

This is the ACA Marketplace, where you can enroll in a health insurance plan online. You may also get help by calling (800) 318-2596.

Hawaii’s Insurance Division of the Department of Commerce and Consumer Affairs

Licenses and regulates health insurers, agents, and brokers. They also handle consumer questions and complaints about insurance.

Legal Aid Society of Hawaii

The Navigator organization funded by the federal government in Hawaii.

Hawaii Medicaid (Med-QUEST)

This program provides health coverage for eligible residents.

Hawaii Prepaid Health Care Law information

This law helps ensure that many workers in Hawaii have access to health coverage through their jobs.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Hawaii?

Explore more resources for options in Hawaii including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶ ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, Aug. 9, 2024 ⤶

- ”Hawaii Section 1332 Waiver Extension” Centers for Medicare and Medicaid Services. December 10, 2021. ⤶

- “Federal Poverty Level (FPL)” HealthCare.gov, 2023 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”Hawaii Rate Review Submissions” HealthCare.gov, Accessed Aug. 15, 2024 ⤶

- ”Hawaii SERFF Filings” Accessed Aug. 15, 2024 ⤶ ⤶ ⤶

- ”Hawaii: Final 2015 QHP Rate Increase: 7.8%; SHOP Plans *Drop* 3.5%” ACA Signups. November 13, 2024 ⤶

- ”FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally” ACA Signups. October 15, 2015. ⤶

- ”Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups. August 14, 2016. ⤶

- ”2018 Rate Hikes” ACA Signups. ⤶

- ”Release: HAWAII 2019 Affordable Care Act Individual Rates” Hawaii Department of Commerce and Consumer Affairs. October 2018 ⤶

- ”2020 Rate Changes” ACA Signups ⤶

- ”Hawaii SERFF Filings” Accessed September 2023 ⤶

- ”2022 Rate Changes” ACA Signups. ⤶

- ”UPDATED: FINAL Unsubsidized 2023 Premiums: +6.2% Across All 50 States +DC” ACA Signups. ⤶

- ”Hawaii: *Final* avg. unsubsidized 2024 #ACA rate changes: +8.8% (updated)” ACA Signups. Nov. 2, 2023 ⤶

- ”Marketplace 2025 Open Enrollment Period Report: National Snapshot” Centers for Medicare & Medicaid Services. Jan. 17, 2025 ⤶

- ”Another Year of Record ACA Marketplace Signups, Driven in Part by Medicaid Unwinding and Enhanced Subsidies” KFF.org. Jan. 24, 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶