If I don't enroll in a health insurance plan by the end of open enrollment (January 15 in most states), what options do I have?

In general, your options for coverage are very limited if you don't enroll in a plan by the end of open enrollment. In most states, open enrollment for 2025 coverage ends on January 15, 2025, although Idaho's open enrollment period will end in mid-December and some states opt to extend enrollment into the latter half of January. The open enrollment period applies outside of the exchange as well.

Thanks to the American Rescue Plan, premium subsidies are larger and available to more people consumers.

But there may be exceptions that will allow you to enroll outside of open enrollment:

Medicaid/CHIP

Medicaid/CHIP enrollment is available year-round for those who qualify. If your income drops to a Medicaid-eligible level later in the year, you'll be able to enroll at that point. Similarly, if you're on Medicaid and your income increases to a level that makes you ineligible for Medicaid, you'll have an opportunity to switch to a private plan at that point if you wish to do so.

State-run programs with year-round enrollment

There are also some states where other types of coverage can be obtained outside of open enrollment:

- Basic Health Programs in New York, Minnesota, and Oregon.

- The ConnectorCare program in Massachusetts (for people who are newly eligible or who haven’t enrolled before).

- The Covered Connecticut program allows eligible applicants to enroll anytime.

American Indians and Alaska Natives

American Indians and Alaska Natives can enroll in plans through the exchange year-round. Here's more about special provisions in the ACA that apply to American Indians and Alaska Natives.

Low-income applicants

In most states, subsidy-eligible applicants with income up to 150% of the poverty level can enroll year-round. Some state-run exchanges that offer additional state-funded subsidies have made the year-round low-income enrollment opportunity available at higher income levels.

Special enrollment period

If you have a qualifying life event during the year, you'll have access to a special enrollment period. Qualifying events include things like marriage (assuming at least one spouse already had coverage before the marriage), the birth or adoption of a child, loss of other minimum essential coverage, or a permanent move to a new geographical area where the available health plans are different from what was available in your prior location (assuming you already had coverage before your move).

Our guide to special enrollment periods in the individual health insurance market explains all of the qualifying life events and the rules that apply to each one. In general, if you're enrolling mid-year, be prepared to provide proof of the qualifying event that triggered your special enrollment period.

(If you're uncertain about your eligibility for a special enrollment period, call (800) 436-1566 to discuss your situation with a licensed insurance professional.)

If you do not have a qualifying life event (or qualify for one of the general enrollment opportunities described above), there is no way to enroll in an ACA-qualified individual health insurance policy outside of normal open enrollment, either on or off-exchange. This is very different from the pre-2014 individual health insurance market, where people could apply for coverage at any time. But of course, approval used to be contingent on health status, which is no longer the case.

Other plans – and their limits

Unless you qualify for a special enrollment period or become eligible for Medicaid, Medicare, or employer-sponsored coverage, the only plans you can purchase outside of open enrollment are those that are not deemed minimum essential coverage.

Unless you qualify for a special enrollment period or become eligible for Medicaid, Medicare, or employer-sponsored coverage, the only plans you can purchase outside of open enrollment are those that are not deemed minimum essential coverage.

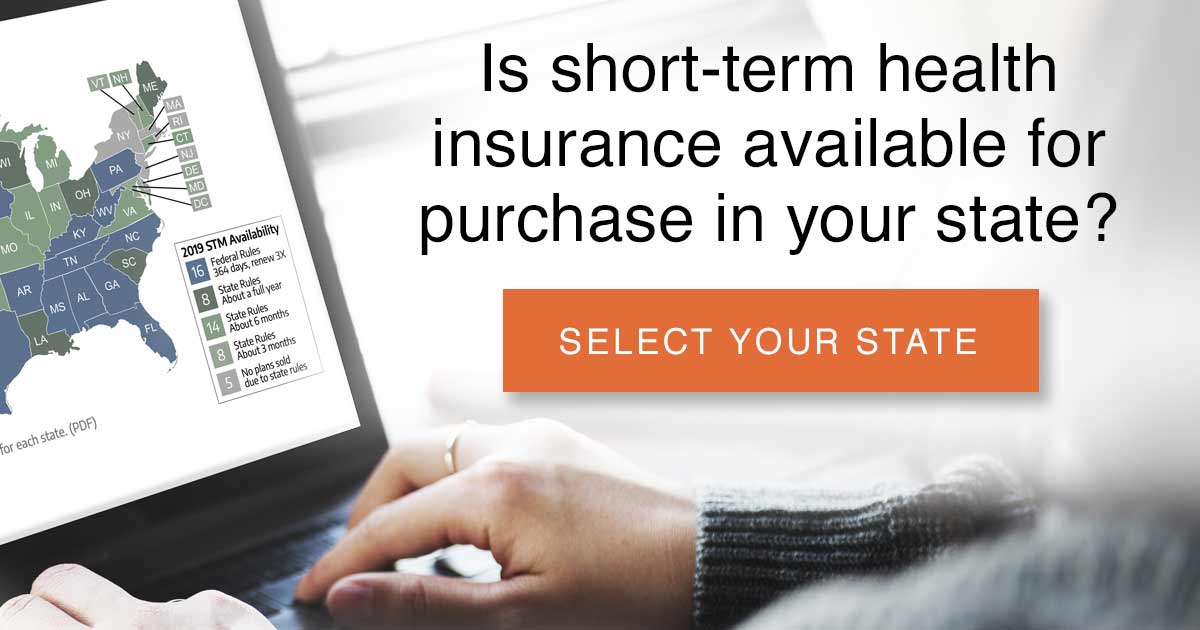

This includes discount plans, critical illness insurance, dental and vision plans, health care sharing ministry plans, accident supplements, Farm Bureau plans available in several states, and short-term medical insurance policies — which are now limited to total durations of no more than four months, including renewals. But none of these coverage options can considered a good substitute for an ACA-qualified plan.

It's important to understand that short-term plans are, by definition, temporary health insurance policies, and they have set expiration dates. And while the loss of other health insurance that is considered minimum essential coverage is a qualifying event that triggers a special open enrollment period for ACA-compliant individual market plans, short-term policies are not minimum essential coverage. So you will not be able to purchase an ACA-compliant plan outside of open enrollment when your short-term policy expires (you would, however, be able to join your employer's plan when your short-term plan ends, as the termination of a short-term plan is a qualifying event for employer-sponsored coverage; HHS clarified that point in the 2018 rules for short-term plans).

The plans available outside of open enrollment (without a special enrollment period) will provide meager coverage compared with the ACA-qualified plans that are sold on and off-exchange. And purchasing them will not satisfy the individual mandate in states that still impose a penalty for not having health insurance coverage (New Jersey, Massachusetts, California, Rhode Island, and the District of Columbia; short-term plans aren't available in most of those areas, but other types of non-ACA-compliant coverage, such as fixed indemnity plans, tend to be available. They will not, however, fulfill the state-based individual mandates).

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.