What is a health care sharing ministry?

Health care sharing ministries (HCSMs) are non-insurance entities in which members "share a common set of ethical or religious beliefs and share medical expenses among members in accordance with those beliefs."

According to recent data published by regulators in Colorado, there are at least 1.7 million people in the U.S. who use HCSMs.

Although HCSMs are not health insurance and do not count as minimum essential coverage under the ACA, the Affordable Care Act (ACA) granted HCSM members an exemption from the requirement that people maintain minimum essential coverage. The ACA's rules regarding HSCMs are outlined in Section 1501/5000A(d)(2)(B) of the ACA (starting on page 148).

To qualify for the exemption under the ACA, the HCSM had to have been continually sharing members' health care costs since the end of 1999 or earlier. As of 2024, 107 health care sharing ministries were certified by the federal Department of Health and Human Services and their members were eligible for an exemption from the ACA's individual mandate penalty

Exemptions from the individual mandate penalty are no longer necessary, because the ACA's penalty for not having insurance coverage was reduced to $0 as of 2019.

But HCSM enrollment has soared since the ACA took effect, and the plans remain popular, due in large part to monthly membership dues that tend to be lower than full-price health insurance premiums for people who don't qualify for the ACA's premium subsidies.

However, it's important to note that most exchange enrollees do qualify for subsidies (93% in 2024),1 especially with the subsidy enhancements that are in effect through at least 2025. For subsidy-eligible people, a plan obtained through the exchange (Marketplace) could be significantly less expensive than an HCSM membership, while also providing real health insurance coverage.

What are the pros and cons of health care sharing ministry plans?

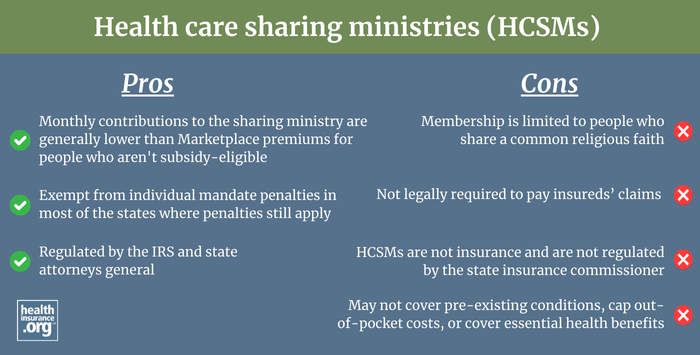

Health care sharing ministry plans can have pros and cons, depending on the enrollee's circumstances and coverage expectations:

Pros:

- The monthly amount that members pay is typically much less than the full-price premiums for individual major medical coverage. So for people who don't get ACA premium subsidies, HCSMs are generally less expensive in terms of the monthly cost of the membership (but as noted above, subsidies are available to most people who need to obtain their own health coverage).

- HCSM members were exempt from the ACA's individual mandate penalty, which applied from 2014 through 2018. This is different from most of the other alternatives to ACA-compliant coverage. (If you had short-term coverage or a limited-benefit plan, for example, you were still on the hook for the individual mandate penalty). The penalty no longer applies after the end of 2018 unless you're in a state that has implemented its own penalty, most of which do offer exemptions for HCSM members).

- HCSMs are 501(c)(3) charities, so they are regulated by the IRS and by state attorneys general.

- If you're not eligible for ACA premium subsidies and are facing the possibility of being uninsured altogether, HCSM coverage is better than being uninsured.

Cons:

- HCSMs are not regulated by the ACA. The coverage you get will vary from one HCSM to another, but they are not required to cover pre-existing conditions, cap out-of-pocket costs, or cover essential health benefits. And they can still have annual and lifetime benefit caps.

- Membership is limited to people who share a common religious faith, and who agree to a variety of rules for a "Godly lifestyle" including avoiding tobacco, extramarital sex, alcohol abuse, etc. For some, these rules are too restrictive.

- HCSMs are not insurance, and are not regulated by state insurance commissioners (Colorado now requires HCSMs to submit various information to the state's Division of Insurance, but this does not affect the benefits that HCSMs provide).

- While health insurance plans have a legal obligation to pay insureds' claims according to the terms of the contract, HCSMs do not have the same type of legally binding requirements, and members cannot rely on their state insurance commissioner to handle grievances. Even if you combine a health care sharing ministry plan with a direct primary care membership, you still don't have actual health insurance coverage.

- When healthy people leave the ACA-compliant market and switch to HCSMs, it results in a sicker, less stable risk pool for ACA-compliant plans. Since HCSMs often don't cover pre-existing conditions, it's typically only healthy people who join them. But those same people sometimes find themselves wanting to switch back to ACA-compliant coverage if they become seriously ill. This dynamic (healthy people leaving, sick people joining) is not conducive to the long-term stability of real health insurance products. So it's essential for people who can remain in the ACA-compliant market to do so (including everyone who gets premium subsidies to make doing so more affordable).

Footnotes

- "Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average" CMS.gov, July 2, 2024 ⤶