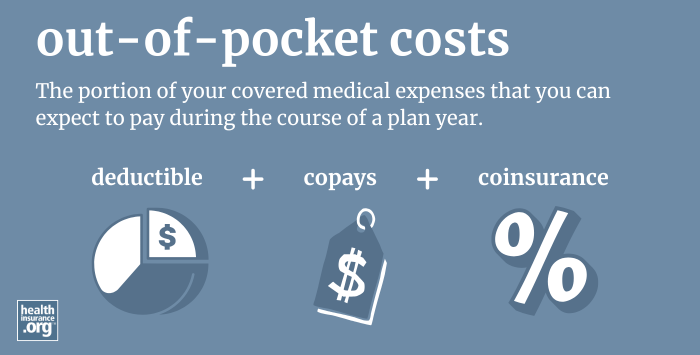

What are out-of-pocket costs?

Out-of-pocket costs refer to the portion of your covered medical expenses that you can expect to pay during the course of a plan year, although they typically only refer to in-network costs for essential health benefits, as there are no regulations in place to cap how much people spend on out-of-network care, and insurers are not required to cover services that aren't considered essential health benefits.

What expenses are included in out-of-pocket costs?

Your out-of-pocket costs can include a combination of your health plan's deductible, copays, and coinsurance, for any covered, in-network services.

The monthly premiums you pay in order to have coverage are not included in out-of-pocket costs. Out-of-pocket costs are only incurred if and when you need medical care, whereas premiums have to be paid every month, regardless of whether you need medical care or not.

If you receive medical care that's not covered by your health plan, you'll have to pay the full cost of the treatment, but it won't count towards your policy's out-of-pocket limit (an example would be the cost of dental care, assuming your plan does not include dental coverage).

Are out-of-pocket costs capped?

Yes. One of the Affordable Care Act’s notable improvements for consumers is a limit on out-of-pocket costs. For 2024, the maximum out-of-pocket for an individual is $9,450, and for a family, it's $18,900.1 The out-of-pocket caps change each year. In 2025, these amounts will decrease for the first time, dropping to $9,200 and $18,400, respectively.2

Health plans can cap out-of-pocket spending below the maximum allowable limits, so the limits vary from one plan to another. And the ACA's cost-sharing subsidies also result in lower out-of-pocket limits for eligible enrollees who select silver-level plans.

Under the ACA, family plans can have total out-of-pocket limits that are double the individual out-of-pocket limit, but no individual can be expected to pay more in out-of-pocket costs than the individual limit, even if he or she is covered under a family plan. (This rule was implemented in 2016.)

The ACA's out-of-pocket limits do not apply to grandmothered plans or grandfathered plans.

Is there a limit on out-of-pocket costs if you don't stay in-network?

If you use out-of-network providers, your out-of-pocket costs can be considerably higher than the limits stated above. On some plans, they're double the in-network limits, but on other plans, out-of-pocket costs can be unlimited if patients receive care from doctors or hospitals that aren't in the health plan's network.

And it's increasingly common to see plans that simply don't cover out-of-network care at all, unless it's an emergency situation. HMOs and EPOs use that model, and they are quite common, especially in the individual/family health insurance market.

Footnotes

- ”Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2024 Benefit Year” Centers for Medicare & Medicaid Services. Dec. 12, 2022. ⤶

- ”Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year” Centers for Medicare & Medicaid Services. November 15, 2023. ⤶