Expert analysis of health reform issues

ACA open enrollment: what’s new for 2025

October 16, 2024 – Open enrollment for 2025 ACA (Affordable Care Act)-compliant health insurance is just around the corner. Let’s take a look at the various…

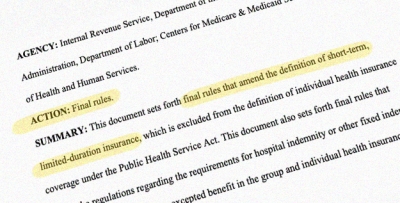

Finalized federal rule reduces total duration of short-term health plans to 4 months

September 20, 2024 – A finalized federal rule will impose new nationwide duration limits on short-term limited duration insurance (STLDI) plans. The rule…

Georgia switches to state-run health insurance Marketplace for 2025 coverage

September 17, 2024 – Starting Nov. 1, 2024, Georgia residents will use a state-run health insurance enrollment platform, Georgia Access, to shop for and enroll…

DACA news: 100,000 Dreamers become eligible for Marketplace health insurance

August 21, 2024 – Starting in November, DACA health insurance options will include exchange enrollment and eligibility for income-based premium subsidies.…

Domestic partner health insurance: a coverage option for unmarried couples

June 20, 2024 – If you’re in a relationship deemed a domestic partnership, access to your domestic partner’s health insurance, or their access to…

What consumers need to know about unauthorized Marketplace plan changes

May 20, 2024 – In recent weeks, we’ve seen news reports of Marketplace enrollees’ coverage being switched without their knowledge. Here's what…

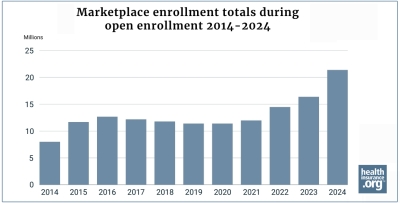

Enrollment in 2024 Marketplace health plans during open enrollment reaches record high

April 30, 2024 – During the open enrollment period for 2024 health coverage, more than 21.4 million people enrolled in private qualified health plans (QHPs)…

Health insurance for the unemployed

April 26, 2024 – When it comes to obtaining health insurance for the self employed, consumers have several coverage options to consider, including ACA…

Six ways federal rule changes might affect Marketplace enrollees

April 23, 2024 – Federal health insurance rule changes that take effect for coverage in 2025 (and beyond) could affect Marketplace enrollment, essential…

Where Medicaid unwinding and disenrollments stand at the one-year mark

April 22, 2024 – Here’s a look at what’s been happening with disenrollments that resulted from Medicaid unwinding – and also a look at the…

6 lessons Mary Lou Retton’s health scare can teach us about coverage

January 23, 2024 – Mary Lou Retton’s health scare story included some important lessons for consumers, many of whom may assume that the celebrity’s health…

HMO vs PPO vs POS vs EPO: What’s the difference?

January 3, 2024 – The type of managed care your health plan falls under affects your healthcare costs and plan benefits – including access to medical…