Expert analysis of health reform issues

Foes use scare tactics on health care penalty

September 12, 2012 – ACA opponents are using scare tactics to convince Americans that a mandate to buy comprehensive health insurance represents a tax on the…

GOP duo’s fuzzy math catches up to them

September 10, 2012 – "For 30 years, Republicans have been getting away, politically, with providing fuzzy numbers about so many things. The Romney campaign has…

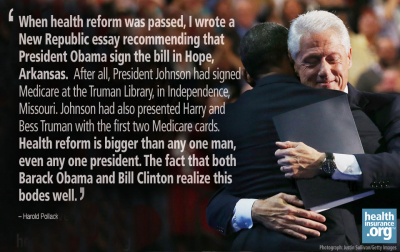

We’re better off for Obama’s health reform

September 6, 2012 – Harold Pollack: Clinton delivered the best speech of the 2012 campaign. "No one in American politics can rival Clinton's ability to weave…

Dems fall in love with Obamacare — at last

September 5, 2012 – From the explicit mention in the Democratic platform of the Affordable Care Act to the embrace of the term “Obamacare”, Democrats…

Kennedy’s 1980 message perfect in 2012

September 4, 2012 – "Ted Kennedy’s speech at the 1980 Democratic convention still echoes in my mind. It remains the finest, most inspiring political oration…

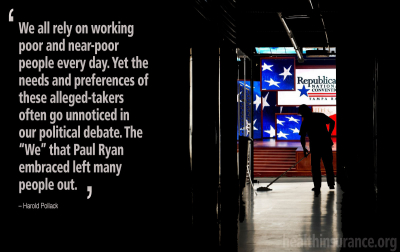

Makers, takers, and health reform

September 3, 2012 – Romney running mate Paul Ryan's speech last week criticized President Obama for enacting "a new entitlement we didn't even ask for." But…

‘It’s a floor wax. No, it’s a dessert topping.’

August 31, 2012 – Mitt Romney and Paul Ryan are peddling a magical Medicare concoction that's appetizing to seniors – promised protection from $716 in…

Convention’s pants on fire over Obamacare

August 30, 2012 – Perhaps conventions are not where you expect truth to be told. But should they at least be places where lies are not so…

A GOP victory and women’s health?

August 26, 2012 – On the eve of the Republican Convention, blogger Maggie Mahar wonders, "What would a Republican victory in November mean for women's…

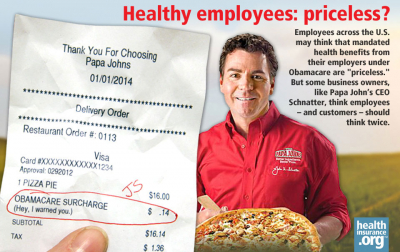

Health reform: it’s having each other’s back

August 17, 2012 – Alleged Obamacare-related increase in price of Papa John's pizza ? 11 cents. Ensuring working Americans have a health care safety net?…

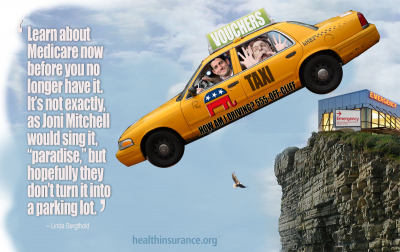

Ryan’s Medicare plan would ‘pave Paradise’

August 16, 2012 – It's not particularly helpful to either demonize or lionize Paul Ryan. Medicare needs to change and he has certainly made it a major point…

Massachusetts still leads way on reform

August 9, 2012 – In colonial times, Massachusetts was considered the "Cradle of Liberty" as the center of the fight for American Independence. That spirit…