Medicaid eligibility and enrollment in Florida

Florida is one of just 10 states that have refused to expand Medicaid, leaving hundreds of thousands without access to coverage

Who is eligible for Medicaid in Florida?

To qualify for federal funding, state Medicaid programs are required to cover certain populations, such as low-income children and pregnant women. States can also choose to cover optional coverage groups, like low-income adults without dependents. Each state sets its own income limits for qualification, and can exceed minimum levels set by the federal government. Florida’s Medicaid/CHIP eligibility standards (including a built-in 5% income disregard) are as follows:

- Children up to 1-year-old: 211% of the federal poverty level (FPL)

- Children ages 1-18: 138% of FPL

- Children under age 19 can qualify for Florida Healthy Kids (CHIP), with modest monthly premiums, if household income is between 138% and 200% of FPL (The cap was supposed to be increased to 300% as of January 2024, under legislation Florida enacted in 2023.1 But Florida officials did not submit a timely 1115 waiver amendment proposal to CMS to obtain approval for this change, so the implementation has been delayed.2)

- Pregnant women: 196% of FPL (this coverage continues for 12 months after the baby is born)

- Adults with minor children: 26% of FPL (note that this percentage changes as the federal poverty level changes, because Florida uses a flat dollar limit for Medicaid eligibility for parents, so it doesn’t keep pace with the poverty level)

- Adults under 65 who aren’t disabled or caring for minor children are not eligible for Medicaid regardless of how low their income is, because Florida hasn’t expanded Medicaid under the ACA.

People who qualify for Supplemental Security Income (SSI) automatically qualify for Medicaid in Florida. See more information in the SSI-Related Programs Financial Eligibility Standards.

Apply for Medicaid in Florida

Online at ACCESS Florida, or submit a paper application by mail, fax or in person to a local service center. For help with the application process, call 866-762-2237.

Eligibility: Children up to 1 year old with family income up to 206% of FPL; children 1-5 with family income up to 140% of FPL; children 6-18 with family income up to 133% of FPL; pregnant women with family income up to 191% of FPL; young adults 19-20 with family income up to 30% of FPL; adults with dependents with family income up to 30% of FPL. People who qualify for Supplemental Security Income automatically qualify for Medicaid. For information: SSI-Related Programs Financial Eligibility Standards

Has Florida expanded Medicaid for low-income adults?

No. As of 2024, Florida is one of ten states where the ACA’s expansion of Medicaid for low-income adults has not been implemented. Democrats in the Florida legislature have been pushing for Medicaid expansion for years, but have consistently been blocked by Republicans, who control both chambers of the legislature. On the first day of the 2024 legislative session in Florida, Senate President Kathleen Passidomo noted “We have had the debate several times over the last decade. Medicaid expansion is not going to happen.”1

The ACA doesn’t provide subsidies for people with income below the poverty level, because the law called for them to have Medicaid instead. But in states that have refused Medicaid expansion people who aren’t eligible for Medicaid and whose income is too low for exchange subsidies are in what’s called the coverage gap, with no realistic access to affordable health coverage. An estimated 388,000 Florida residents are in the Medicaid coverage gap. Only Texas has more people in the coverage gap.2

Medicaid expansion advocates are working to get a Medicaid expansion ballot measure on the 2026 Florida state ballot. But it would have some high bars to clear both in terms of getting on the ballot and being successful. Under Florida rules, nearly a million voters would have to sign the petition, and then the Florida Supreme Court would have to certify that the amendment is eligible to be added to the ballot. If it makes it that far, it would need at least 60% of voters supporting it to pass.3

Several other states have implemented Medicaid expansion via ballot measure, but only one (Idaho) passed by more than 60%. The rest were all between 50.5% and 59%, but they were in states where only a simple majority was needed.4

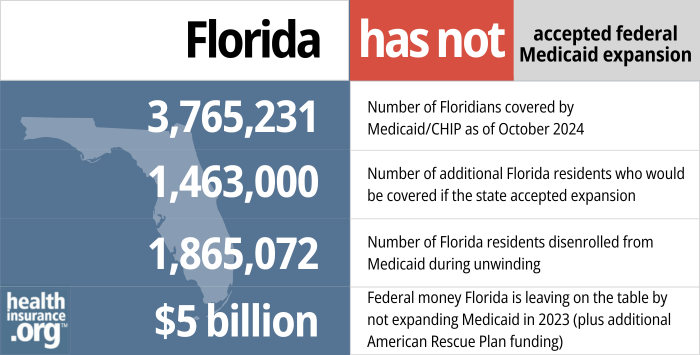

- 3,765,231 – Number of Floridians covered by Medicaid/CHIP as of October 20245

- 1,463,000 – Number of additional Florida residents who would be covered if the state accepted expansion6

- 1,865,072 – Number of Florida residents disenrolled from Medicaid during unwinding7

- $5 billion – Federal money Florida left on the table by not expanding Medicaid in 2023 (plus additional American Rescue Plan funding)8

Explore our other comprehensive guides to coverage in Florida

This guide will help you understand the Florida health insurance options available to you and your family. Many people find that an Affordable Care Act (ACA) Marketplace plan – or Obamacare – helps them save money on health insurance expenses.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Florida.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Florida as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage.

Frequently asked questions about Florida Medicaid eligibility and enrollment

How do I enroll in Medicaid in Florida?

Review Florida’s eligibility criteria, and if you believe you are eligible to enroll in Medicaid you have several options:

- Apply online at ACCESS Florida, or fill out a paper form. Use this application for low-income children, pregnant women, families, and aged or disabled individuals who are not currently receiving Supplemental Security Income (SSI).

- Use this application to apply for food or cash assistance in addition to Medicaid. You should also use this form if you currently receive SSI or if you are applying for home-based and community services, hospice care, or nursing home care.

- Submit a paper application submitted by mail, fax or in person to a local service center.

For help with the application process, call 1-866-762-2237.

How does Medicaid provide financial help to Medicare beneficiaries in Florida?

Many Medicare beneficiaries receive Medicaid financial assistance that can help them with Medicare premiums, lower prescription drug costs, and pay for expenses not covered by Medicare – including long-term care.

Our guide to financial assistance for Medicare enrollees in Florida includes overviews of these programs, including Medicaid nursing home benefits, Extra Help, and eligibility guidelines for assistance.

How is Florida handling post-pandemic Medicaid renewals?

Medicaid disenrollments were paused nationwide throughout the COVID pandemic. But that ended in April 2023, and states resumed regular eligibility redeterminations, disenrolling people who were no longer eligible for Medicaid (as well as those who fail to respond to renewal information requests).

During the pandemic, Medicaid enrollment in Florida grew from 3.8 million in March 2020 (when the pause on Medicaid disenrollments began) to nearly 5.8 million by April 2023. Eligibility redeterminations must be conducted for all of these enrollees during a 12-month window referred to as the “unwinding” period.

Florida resumed disenrollments in April 2023. By December 2023, more than 1.2 million people had been disenrolled from Florida Medicaid,9 mostly for “procedural” reasons — meaning the state didn’t have enough information to determine whether they were still eligible.

But coverage had been renewed for another 2.4 million enrollees9 who still met the eligibility criteria and completed their renewal paperwork, if necessary (in many cases, eligibility can be automatically redetermined using data the state has on file and integrated systems that work with SNAP and TANF eligibility).

Florida continued to process renewals and eligibility redeterminations throughout the pandemic. But if a person was found to be ineligible or didn’t reply to a request for information, their coverage did not end. As of late 2022, Florida Medicaid estimated that they had 900,000 cases in which at least one person in the household was no longer eligible for Medicaid, and 850,000 cases in which the enrollee didn’t respond to eligibility redetermination information requests during the pandemic. But these individuals were still enrolled at that point, due to the pandemic-related rules.

Starting in April 2023, Florida began prioritizing eligibility redeterminations for enrollees who were already flagged in the system as likely ineligible, and who had not used Medicaid services in the past 12 months (indicating that they may already have other coverage in place). After that, the state began processing eligibility redeterminations for the rest of the people who had been flagged as likely ineligible. Vulnerable populations, including those under 21 with complex medical conditions and low-income people who are institutionalized or in hospice care will have their eligibility redetermined towards the end of the 12-month “unwinding” period.

If a person is no longer eligible for Medicaid, they should understand what their coverage options are once their Medicaid coverage terminates. Other coverage options might include an employer-sponsored plan, Medicare, or a plan purchased through the exchange/marketplace. Florida’s integrated eligibility system will also be able to determine whether a person might now be eligible for Florida KidCare (CHIP) or a subsidy in the exchange/marketplace (HealthCare.gov), and will transfer the enrollee’s application to those resources when applicable.

For people who end up needing to purchase their own replacement coverage (ie, they aren’t eligible for Medicare or an employer’s plan), HealthCare.gov is offering an extended enrollment opportunity, through July 31, 2024, for anyone who loses Medicaid at any time during the “unwinding” process. Since Florida does still have a coverage gap due to the state’s refusal to expand Medicaid under the ACA, low-income residents need to be aware of how to avoid this coverage gap.

People who are eligible for Medicare will have a special enrollment window during which they can sign up for Medicare without a late enrollment penalty it continues for six months after the person’s Medicaid ends. People who are eligible for an employer’s plan will generally only have 60 days to sign up for that plan after their Medicaid ends (enrollments can also be submitted before the termination of Medicaid, and that’s generally necessary to avoid a gap in coverage).

How many people are enrolled in Florida Medicaid?

Although Florida has not expanded Medicaid under the ACA, enrollment in the state’s program continued to grow over the years. But it began to decline in 2023, due to the end of the pandemic-era pause on disenrollments. Enrollment stood at 3.7 million by late 2013. By April 2023, total Florida Medicaid and CHIP enrollment stood at nearly 5.8 million people, but it had dropped to 4.2 million by October 2023, after several months of “unwinding” disenrollments.10

Legislation impacting Florida Medicaid

History of Florida’s Medicaid program

Florida was one of the later states to implement Medicaid, not adopting the program until January of 1970 (the first states to implement Medicaid did so in early 1966).

Florida Medicaid spending grew 13.5% on average every year between 1980 and 2004. In an effort to slow that trend, Florida applied for and received approval for an 1115 waiver for its Medicaid Reform pilot. The pilot implemented managed care in two counties in 2006 and added three more counties in 2007; the waiver was extended several times.

In 2013, the federal government approved an amendment for statewide expansion of managed care; the amendment also renamed Medicaid Reform as Managed Medical Assistance (MMA). Almost nine out of ten Florida Medicaid beneficiaries are now enrolled in managed care plans, like health maintenance organizations (HMOs). The state hopes to improve quality through better coordination of care and save money through smaller networks of providers.

As originally written, the Affordable Care Act included Medicaid expansion as a key strategy to reduce the number of uninsured people in the U.S. The ACA allowed the federal government to reduce funding for states’ existing Medicaid programs if they did not expand Medicaid to cover adults with household income up to 138% of the federal poverty level.

However, the U.S. Supreme Court ruled in 2012 that the withholding of funds for existing Medicaid programs was unconstitutional. Medicaid expansion was left as an option for states, and Florida has not implemented it. As of mid-2023, Florida is one of 11 states that have not expanded Medicaid.

Florida’s decision not to expand Medicaid leaves nearly 400,000 people in the state in the coverage gap — ineligible for Medicaid and also ineligible for tax subsidies to help them afford private health insurance (people with income over 100% of the poverty level are currently eligible for premium subsidies in the exchange, but those with income between 100% and 138% of the poverty level would switch to Medicaid eligibility if Florida were to expand coverage).

Florida’s economy is negatively impacted by not expanding Medicaid. According to an analysis by the Florida Policy Institute, Florida could save $200 million per year by expanding Medicaid. And that was before the American Rescue Plan created a provision to give states additional Medicaid funding for two years if they newly expand Medicaid. Florida could choose to start receiving that funding at any time, by opting to expand Medicaid.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Florida?

Explore more resources for options in Florida including ACA coverage, short-term health insurance, dental insurance and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- FL Senate president shuts down Medicaid expansion in Florida. The Florida Phoenix. January 2024. ⤶

- How Many Uninsured Are in the Coverage Gap and How Many Could be Eligible if All States Adopted the Medicaid Expansion? KFF. March 2023. ⤶

- Florida group seeks to put Medicaid expansion on the 2026 ballot. Tampa Bay Times. February 2024. ⤶

- Maine Question 2; Utah Proposition 3; Nebraska Initiative 427; Oklahoma State Question 802; Missouri Amendment 2; South Dakota Constitutional Amendment D. Ballotpedia. Accessed February 2024. ⤶

- October 2024 Medicaid & CHIP Enrollment Data Highlights, Medicaid.gov, Accessed February 2025 ⤶

- “3.7 Million People Would Gain Health Coverage in 2023 If the Remaining 12 States Were to Expand Medicaid Eligibility” , urban.org, Accessed July 2022 ⤶

- “Medicaid Enrollment and Unwinding Tracker” , KFF.org, Accessed February 2025 ⤶

- “Last 11 States Should Expand Medicaid to Maximize Coverage and Protect Against Funding Drop as Continuous Coverage Ends” , cbpp.org, Accessed January 2023 ⤶

- Florida Unwinding Monthly Reports: April through December 2023. Florida Health Justice Project. Accessed February 2024 ⤶ ⤶

- October 2023 Medicaid & CHIP Enrollment Data Highlights, Medicaid.gov, Accessed February 2024 ⤶